Going vege with Beyond Meat. Source: Flickr

Beyond Meat (NASDAQ:BYND) has never paid a dividend and will probably remain so in the foreseeable future.

This article uncovers some of the factors why Beyond Meat does not pay cash dividends.

For your information, Beyond Meat had its IPO in May 2019 but has never been a dividend-paying stock.

Here is an excerpt of Beyond Meat’s dividend policy extracted from the latest annual report:

- “The Company has not issued regular dividends on common shares in the past nor does the Company expect to issue dividends in the future.”

Most of Beyond Meat’s peers such as Kellogg and Conagra Brands are regular dividend payers but Beyond Meat seems to be unable to do so.

In this article, we will dive into Beyond Meat’s financials and find out what has been going on with the company.

Without further ado, let’s start with the following topics.

Beyond Meat Cash Dividend Topics

Factors That Do Not Support Dividends

A1. Declining Revenue

A2. Weakening Pricing And Soaring Cost

A3. Unprofitable Operations

A4. A Tumbling Gross Margin

A5. Negative Cash Flow

A6. High Debt Levels

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Beyond Meat’s Declining Revenue

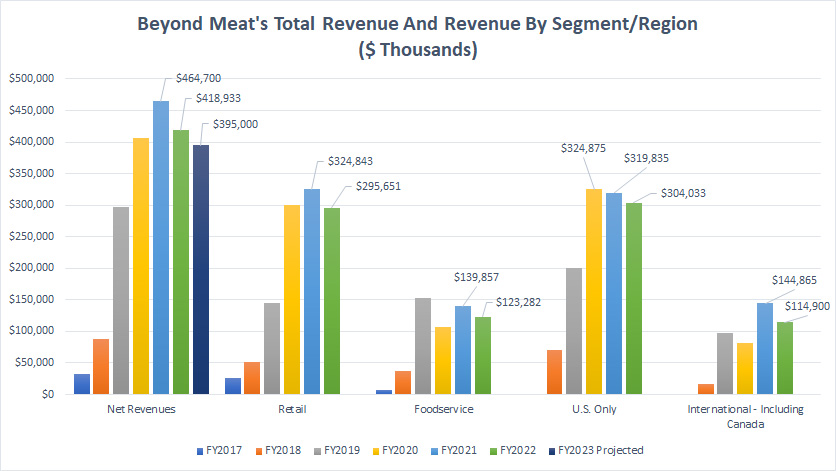

Beyond Meat net revenue and revenue by region and segment

(click image to enlarge)

The first reason that Beyond Meat is not a dividend-paying stock has to do with its revenue growth.

As seen in the chart above, Beyond Meat used to be a high flyer in terms of revenue growth.

However, since the pandemic began in 2020, Beyond Meat’s revenue growth has been in reverse, meaning that it has actually been declining.

For example, on a consolidated basis, Beyond Meat’s net revenue declined by 10% in 2022 over 2021 and guided for an even lower revenue figure for fiscal 2023.

By the end of fiscal 2023, Beyond Meat’s net revenue is expected to reach only $395 million on average, a record low since 2020.

To make matters worse, Beyond Meat’s revenue decline actually happened across all segments and regions as shown in the chart and the decline is not a corner case.

For example, Beyond Meat’s revenue in both retail and foodservice segments reached record lows as of 2022 and the same downtrend applies to the company’s U.S. and international regions.

As seen in the chart, Beyond Meat’s revenue generated from its U.S. and international regions also has reached record lows as of 2022 since the beginning of the pandemic.

In short, Beyond Meat seems to be unable to grow its revenue in post-pandemic periods, whether it’s in the U.S. or on a global basis.

Moreover, the company also has failed to reignite the growth engine in both the retail and foodservice segments.

Beyond Meat’s Weakening Pricing And Soaring Cost

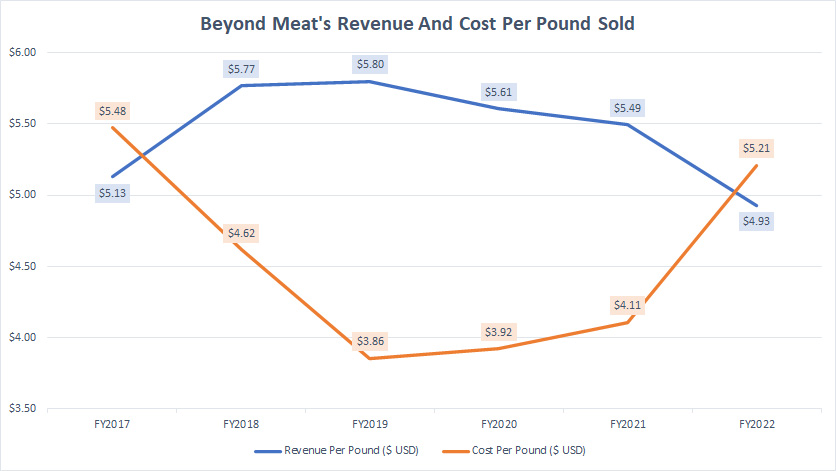

Beyond Meat price and cost per pound

(click image to enlarge)

Apart from the declining revenue, Beyond Meat also is having another issue related to revenue which is weakening pricing.

As shown in the chart above, Beyond Meat’s average realized price per pound or revenue per pound sold has been on a decline.

The decline seems to be having nothing to do with the pandemic as it actually has occurred since fiscal 2018 which was way before the pandemic hit.

For example, since 2018, Beyond Meat’s average realized price per pound or revenue per pound sold has steadily declined and reached only $4.93 USD per pound as of 2022, the lowest figure that the company has ever recorded.

Therefore, Beyond Meat’s weakening pricing seems to be occurring on an organic basis and has nothing to do with any external factors.

To make matters worse, Beyond Meat not only is facing a declining pricing phenomenon but also a soaring cost per pound sold for its products.

As seen in the chart, Beyond Meat’s cost per pound sold has significantly increased since 2019 and hit a new high of $5.21 USD as of 2022 which was even higher than the revenue per pound sold.

While this figure was much higher when Beyond Meat was just starting out, it came back haunting the company again since the beginning of the pandemic.

However, this time around, the soaring cost per pound sold had actually been driven by a high inflationary environment instead of low volumes.

Therefore, Beyond Meat seems to be unable to control the cost per pound sold and the higher cost has actually affected its profitability as reflected in the much higher cost per pound than the respective revenue per pound.

In short, Beyond Meat has been unable to stay profitable, let alone declare a cash dividend due primarily to the declining revenue per pound sold and the soaring cost per pound sold.

Beyond Meat Is Unprofitable

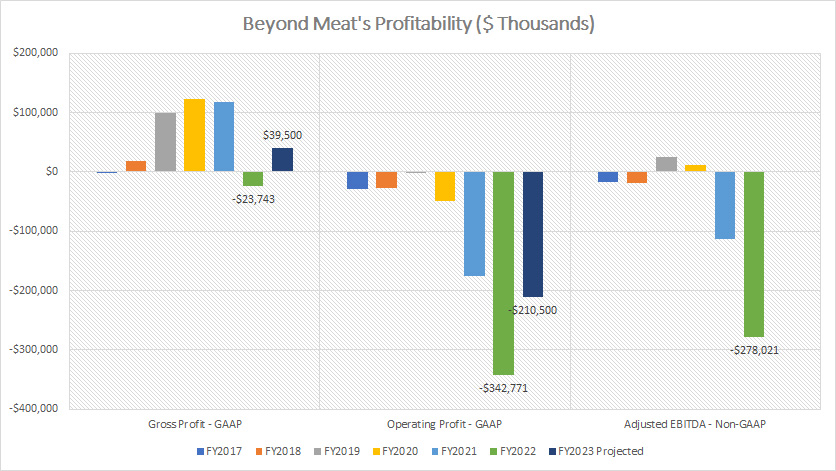

Beyond Meat profitability

(click image to enlarge)

Beyond Meat’s declining net revenue and revenue per pound sold coupled with the soaring costs have rendered the company unprofitable for so many years.

Even for fiscal 2023, the company has guided for a significantly low gross profit and a remarkably large operating loss.

Therefore, Beyond Meat has not even been able to stay afloat, let alone declare a cash dividend.

Beyond Meat’s Tumbling Gross Margin

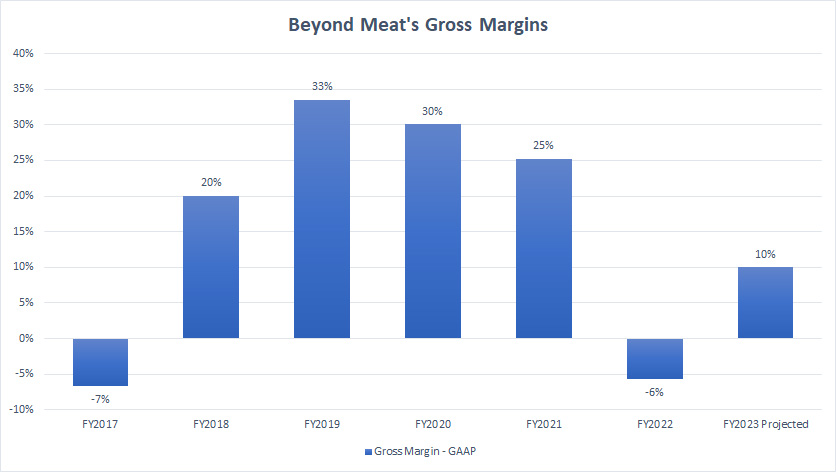

Beyond Meat gross margin

(click image to enlarge)

Beyond Meat suffers not only from an unprofitable operation but also a tumbling gross margin as shown in the chart above.

As seen, Beyond Meat’s gross margin has been on a decline after peaking at 33% in fiscal 2019.

As of 2022, Beyond Meat’s gross margin reached a record low of -6%.

This figure is expected to recover to 10% in fiscal 2023.

While Beyond Meat expects to recover in gross margin in 2023, the guided figure will be far from profitable after accounting for operating expenses.

Again, the unprofitable nature and declining gross margin have rendered Beyond Meat’s ability to declare cash dividends all these years.

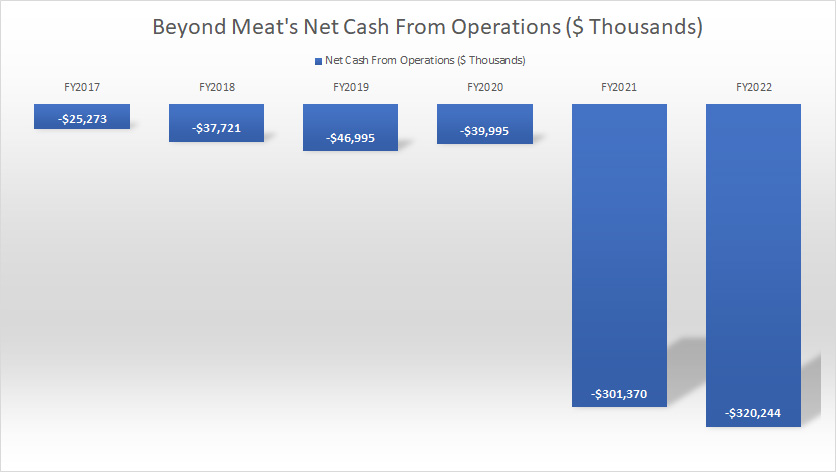

Beyond Meat’s Negative Cash Flow

Beyond Meat net cash from operations

(click image to enlarge)

I am sure you have heard the saying that goes like this, cash is king.

It’s no exception for Beyond Meat when it comes to cash, especially net cash from operations which is the cash produced by business operations.

Cash is still the king from Beyond Meat’s business perspective and it is the single most important factor in deciding whether a company can afford a dividend or not.

As you can see in the chart above, Beyond Meat’s net cash from operations has actually been negative and is getting worse.

Instead of producing cash, Beyond Meat’s business operations are consuming cash.

As of fiscal 2022, Beyond Meat’s operating cash flow consumption totaled $320 million, the largest figure the company has ever reported.

Therefore, if Beyond Meat is constantly running a cash flow deficit, how the company can ever be able to afford a cash dividend?

From the operating cash flow results, Beyond Meat is still far from self-sufficient in terms of cash flow generation.

For this reason, Beyond Meat is heavily relying on external capital injections such as debt financing and equity issuance to fund its business operations.

As such, a cash dividend by Beyond Meat is definitely out of the question for now.

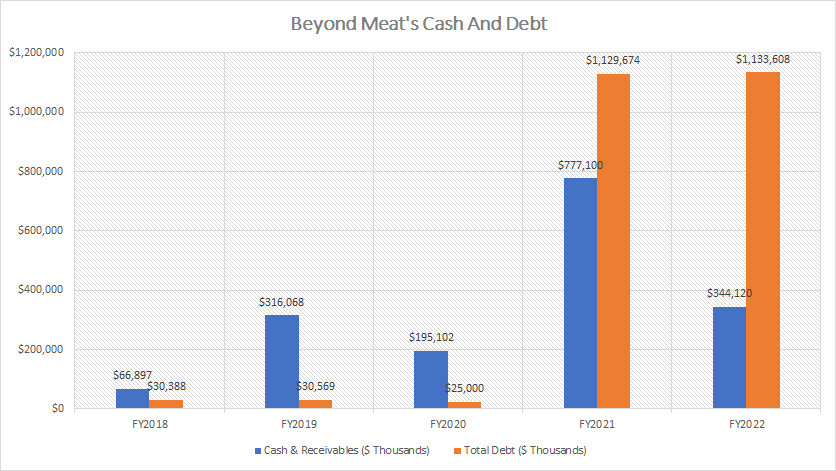

Beyond Meat Has High Debt Levels

Beyond Meat cash and debt

(click image to enlarge)

Beyond Meat used to have a much higher cash position than debt levels as shown in the chart above.

However, these trends have gone in the opposite direction in recent years.

As of 2022, Beyond Meat’s debt levels were much higher than its total liquidity which consists primarily of cash on hand and receivables.

The reason is that Beyond Meat had used up nearly all of its cash on hand by fiscal 2020 and had no choice but to take on more debt in 2021.

As seen in the chart above, Beyond Meat’s total debt levels soared significantly to more than $1 billion due to an external capital injection which came in the form of long-term debt.

Despite the rising cash on hand in fiscal 2021 after the external cash injection, the figure dwindled to only $344 million as of 2022 from the $777 million reported in fiscal 2021, driven primarily by the worsening cash consumption which we saw in prior discussions.

Eventually, Beyond Meat still owed the same amount of debt but its cash position had considerably dived.

If Beyond Meat’s cash flow position has not improved in the foreseeable future, it is a certain fact that the company will take on more debt again to raise cash.

Therefore, a cash dividend coming from Beyond Meat is certainly out of the question in a situation like this.

Conclusion

In summary, why doesn’t Beyond Meat’s stock pay dividends?

The obvious reason is that the company has neither a profit nor the necessary cash flow to pay a dividend.

The company does not even generate sufficient cash to support its own operations, let alone a dividend.

All in all, Beyond Meat, simply does not have the financial means to pay a dividend now.

Additionally, Beyond Meat also is expected to be unprofitable in the foreseeable future.

For now, Beyond Meat needs to retain all profits and cash, if there are any, to sustain itself and keep the company afloat.

While revenue growth had been phenomenal in the past, Beyond Meat had not been able to translate the success into profitability and positive cash flow.

Moreover, the company had even taken on more debt to sustain itself.

In short, the case of a cash dividend coming from Beyond Meat will not happen for the time being.

Credits and References

1. All financial figures in this article were obtained and referenced from BYND’s SEC filings, financial statements, earnings releases, presentations, etc. which are available in this location – Beyond Meat’s Earnings Releases.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Stacy Spensley and Mike Kniec.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!