Vape. Pexels Image.

Altria (NYSE:MO), a Fortune 200 company, is on a mission to help cigarette smokers to transition to a smokeless future.

To do that, Altria has made several acquisitions and investments in recent years to expand its non-combustible or smokeless tobacco portfolio.

As of 2023, Altria, directly and indirectly, owns several businesses, including the following subsidiaries as well as agreements with others that Altria believes, will turn the company around from a stagnant to a growth-driven non-combustible focused conglomerate:

- New owner of NJOY Holdings, Inc. (NJOY) – a retailer of various e-vapor products which include the popular NJOY ACE,

- Completely acquired Helix Innovations LLC – maker of on! oral nicotine pouches,

- Owner of certain of JUUL’s heated tobacco intellectual property in JUUL LABS – the nation-leading e-vapor company,

- Exclusive U.S. license to commercialize Philips Morris International Inc’s IQOS products – the only heated tobacco product authorized by the U.S FDA.

- A significant stake in Cronos – a leading Canadian cannabinoid company

- A significant stake in Anheuser-Busch InBev – the world’s largest brewer

But just how successful has the company been in its transition to a smokeless tobacco endeavor?

To find out, in this article, we will look at Altria’s oral tobacco segment (previously known as the smokeless tobacco product segment).

This article covers the revenue excluding excise taxes, sales volumes, growth rates, and market share of Altria’s smokeless products shipped under the oral tobacco segment.

Let’s look at the numbers!

Investors interested in Altria’s cigarette and cigar sales and market share may find more resources on this page – Altria Marlboro and cigar sales volume and market share.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Altria Expand The Sales And Market Share Of Its Oral Tobacco Products?

Consolidated Revenue

A1. Oral Tobacco Product Revenue

A2. YoY Growth Rates Of Oral Tobacco Product Revenue

Consolidated Sales Volume

B1. Oral Tobacco Product Sales Volumes

B2. YoY Growth Rates Of Oral Tobacco Product Sales Volumes

Sales Volume By Product Type

C1. Copenhagen, Skoal, And on! Sales Volumes

C2. Percentage Of Copenhagen, Skoal, And on! Sales Volumes

C3. YoY Growth Rates Of Copenhagen, Skoal, And on! Sales Volumes

Total Market Share And Market Share Breakdown

D1. Oral Tobacco Segment Total Market Share

D2. Market Share Of Copenhagen, Skoal, And on!

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Oral Tobacco Segment: Altria’s oral tobacco segment primarily focuses on manufacturing, distributing, and selling smokeless tobacco products, including snus and moist snuff.

These products are marketed as alternatives to traditional cigarettes. They are consumed by placing them in the mouth, either under the lip or between the gum and cheek, rather than being smoked.

This segment includes popular brands like Copenhagen and Skoal. The company promotes these products within legal and regulatory frameworks, focusing on adult tobacco consumers.

This segment represents a significant part of Altria’s broader strategy to diversify its product portfolio beyond traditional combustible cigarettes in response to changing consumer preferences and a growing emphasis on harm reduction in the tobacco industry.

Retail Share: In the context of a specific product, retail share refers to the percentage of sales or volume that the product holds within a particular retail market or category.

This metric significantly indicates the product’s market position, competitiveness, and appeal to consumers within retail environments. It’s calculated by dividing the product’s sales by the total sales of all similar products in the same category, then multiplying by 100 to get a percentage.

Retail share offers insights into the product’s performance, helps understand consumer preferences, and aids in strategic decision-making for marketing, distribution, and product development.

According to Altria’s 2023 annual report, its oral tobacco products segment’s retail share results exclude international volume. Retail share results for oral tobacco products are based on data from Circana, a tracking service that uses a sample of stores to project market share and depict share trends.

This service tracks sales in the food, drug, mass merchandisers, convenience, military, dollar store and club trade classes on the number of cans and packs sold.

Oral tobacco products are defined by Circana as moist smokeless, snus and oral nicotine pouches. New types of oral tobacco products, as well as new packaging configurations of existing oral tobacco products, may or may not be equivalent to existing MST products on a can-for-can basis.

For example, one pack of snus or one can of oral nicotine pouches, irrespective of the number of pouches in the pack, is assumed to be equivalent to one can of MST.

Because this service represents retail share performance only in key trade channels, it should not be considered a precise measurement of actual retail share. It is retail services’ standard practice to periodically refresh their retail scan services, which could restate retail share results that were previously released in these services.

Copenhagen: Altria’s Copenhagen refers to a brand of smokeless tobacco products, specifically moist snuff, produced and marketed by Altria Group, Inc.

Copenhagen is one of the oldest brands in the smokeless tobacco market, having been introduced in the United States in the early 19th century. It offers a range of flavors and cuts, catering to a variety of preferences among adult consumers.

As a mature product category, smokeless tobacco, like Copenhagen, is subject to regulatory and health considerations, with its use and sale regulated in many jurisdictions due to health risks associated with tobacco consumption.

Skoal: Skoal is a moist smokeless tobacco product, also known as dipping tobacco. It is produced by the Altria Group (previously known as Philip Morris Companies, Inc.) through its subsidiary, U.S. Smokeless Tobacco Company.

Skoal was first introduced in the United States in 1934 and is known for its wide range of flavours and formats, such as pouches and fine cuts. The product is placed in the user’s lip, typically under the lip or between the lip and gum, allowing nicotine to be absorbed through the mouth’s tissues

Skoal, like other smokeless tobacco products, is often marketed as an alternative to smoking cigarettes, although it carries its health risks and warnings.

on!: “On!” is a brand of nicotine pouches produced by Altria Group, a leading producer and marketer of tobacco products.

These pouches are designed to offer adult tobacco consumers an alternative to traditional cigarettes and vaping products. They are smoke-free and spit-free and come in a variety of flavors and nicotine strengths, allowing users to consume nicotine discreetly without the need for smoking or vaping.

Altria’s introduction of “on!” is part of its strategy to diversify its product offerings beyond conventional tobacco products and adapt to the evolving preferences of adult tobacco consumers seeking alternative nicotine delivery systems.

How Does Altria Expand The Sales And Market Share Of Its Oral Tobacco Products?

Altria Group, Inc. has implemented several strategies to expand its sales and market share in the oral tobacco products sector. These strategies include:

1. **Innovation and Product Development**: Altria has focused on developing and launching new, innovative oral tobacco products to attract consumers. This includes introducing snus and moist smokeless tobacco (MST) products with varied flavors, nicotine strengths, and packaging options to cater to a wide range of consumer preferences.

2. **Strategic Acquisitions**: Altria has expanded its oral tobacco product portfolio through strategic acquisitions. For instance, the acquisition of UST Inc. – the maker of Skoal and Copenhagen, NJOY Holdings, Inc. – the maker and retailer of NJOY ACE, and Helix Innovations LLC – the maker of on! oral nicotine pouches, has greatly enhanced Altria’s presence in the smokeless tobacco market.

3. **Marketing and Distribution**: Altria employs targeted marketing strategies to promote its oral tobacco products. This includes point-of-sale advertising, digital marketing, and direct mail campaigns to educate adult consumers about product offerings. Additionally, Altria leverages a broad distribution network to ensure its products are widely available across various retail channels.

4. **Consumer Engagement**: Altria focuses on building strong consumer relationships through loyalty programs and consumer engagement initiatives. These programs offer rewards and exclusive offers to consumers, encouraging repeat purchases and fostering brand loyalty.

5. **Regulatory Compliance and Harm Reduction**: Recognizing the regulatory landscape’s impact on tobacco products, Altria actively engages in regulatory advocacy to influence policy decisions. It invests in research and development of potentially less harmful alternatives to traditional cigarettes and communicates the potential reduced-risk profile of its oral tobacco products, aligning with consumer interest in harm reduction.

6. **Expansion of Distribution Channels**: To reach a broader audience, Altria seeks to expand the availability of its oral tobacco products beyond traditional retail outlets through alternative channels, such as e-commerce platforms and specialized tobacco shops.

7. **Environmental, Social, and Governance (ESG) Initiatives**: Altria has also committed to various ESG initiatives, aiming to operate sustainably and responsibly. Although not directly related to sales, these initiatives help improve brand image and loyalty among consumers who prioritize corporate responsibility.

Through these comprehensive strategies, Altria aims to sustain and grow its market share in the increasingly competitive oral tobacco products market, addressing consumer demands and regulatory challenges.

Oral Tobacco Product Revenue

Altria oral tobacco product revenue by year

(click image to expand)

Altria’s oral tobacco segment revenue made up roughly 12% of the company’s total revenue in 2023, according to this article – Altria revenue by segment and profit margin.

While this ratio may be small, it has been increasing, according to the same article, and so is the revenue, as depicted in the chart above.

As shown in the chart, Altria’s oral tobacco segment revenue reached $2.6 billion as of the end of fiscal year 2023, up 4% over 2022 and more than 50% over 2014.

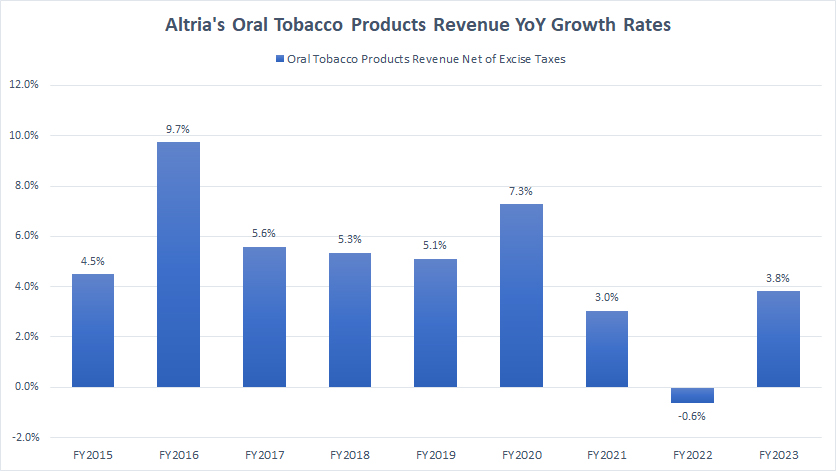

YoY Growth Rates Of Oral Tobacco Product Revenue

altria-oral-tobacco-product-revenue-yoy-growth-rates

(click image to expand)

The growth of Altria’s revenue generated within the oral tobacco segment has been mostly positive, as shown in the chart above.

On average, Altria’s revenue in the oral tobacco segment has grown by 4% annually over the last five years.

A noticeable trend is the significant growth in the oral tobacco segment revenue in fiscal year 2020, notably at 7.3% over the prior year.

This is the period during the height of the COVID-19 pademic. In this period, consumers tend to increase the consumption of tobacco products.

The reason is that with lockdowns and social distancing measures in place, many individuals found themselves with more discretionary time. The lack of usual social activities or the transition to working from home for some meant that there were more opportunities for smoking.

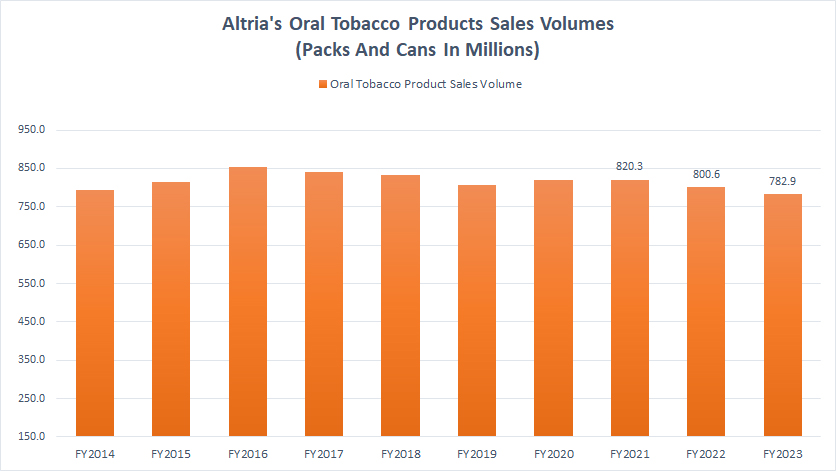

Oral Tobacco Product Sales Volumes

Altria oral tobacco product sales volumes by year

(click image to expand)

In terms of shipment volumes, Altria shipped slightly fewer oral tobacco products in fiscal 2023 than in 2022, notably at 783 million cans and packs compared to 800 million packs and cans in the previous year.

In addition, Altria’s sales of oral tobacco products have remained relatively flat over the last several years, as shown in the chart above.

Moreover, Altria’s oral tobacco product shipment volume peaked at roughly 850 million cans and packs reported in fiscal 2016. Since then, Altria shipped considerably fewer smokeless tobacco products in subsequent years.

Compared to the peak figure reported in 2016, Altria’s 2023 sales volume represents a decline of 8%.

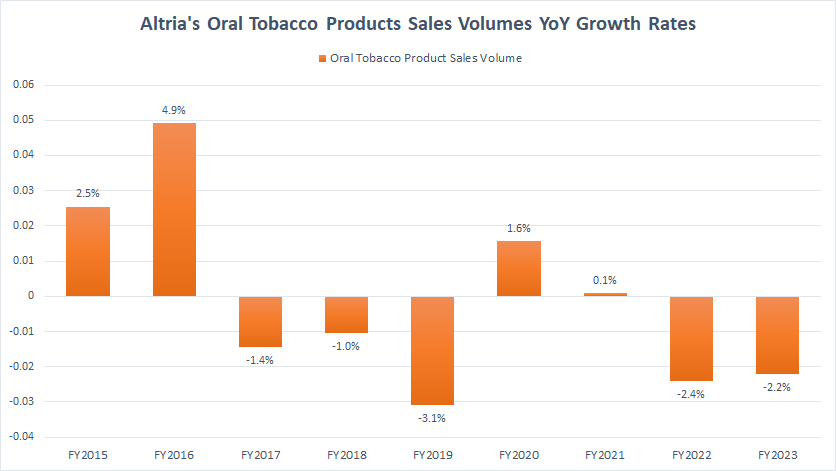

YoY Growth Rates Of Oral Tobacco Product Sales Volumes

altria-oral-tobacco-product-shipment-volumes-yoy-growth-rates

(click image to expand)

The growth of Altria’s sales generated within the oral tobacco segment has been mostly negative, as shown in the chart above.

On average, Altria’s sales volumes in the oral tobacco segment have declined by 1% annually over the last five years.

Although Altria’s sales volumes have decreased, its revenue has increased, as illustrated in prior discussions, implying that the tobacco maker has implemented price increases on its products.

Tobacco companies such as Altria and Philip Morris International often have strong brand loyalty among their consumer base, allowing for some elasticity in pricing. If the price increase per unit outweighs the decline in volume, then revenue can indeed increase.

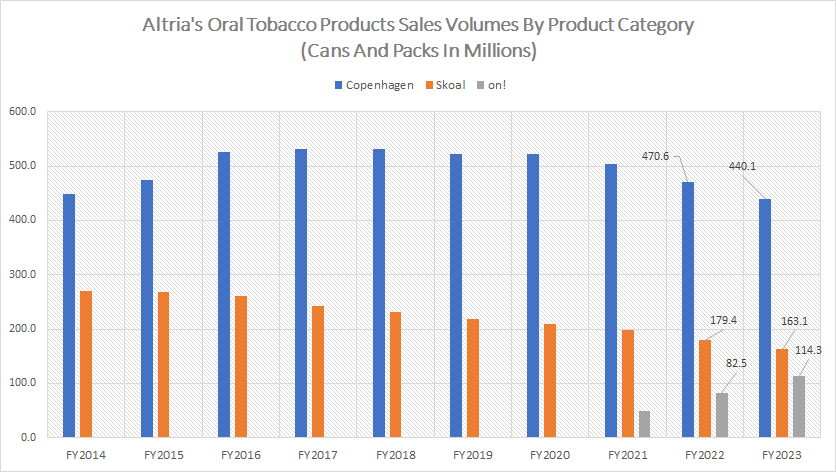

Copenhagen, Skoal, And on! Sales Volumes

Altria Copenhagen Skoal and On! sales volumes by year

(click image to expand)

The definitions of Altria’s Copenhagen, Skoal, and “on!” are available here: Copenhagen, Skoal, and “on!”.

Altria’s Copenhagen has made up the majority of the company’s oral tobacco sales volumes, notably at nearly 500 million cans and packs on an annual basis. In fiscal year 2023, Altria shipped just 440 million cans and packs of Copenhagen, down 7% compared to the result a year ago.

Altria’s Copenhagen sales volumes seem to have peaked at 531 million cans and packs reported between fiscal 2016 and 2017. Since then, Altria’s Copenhagen shipment volumes have been declining.

Altria’s Skoal comes in second in terms of sales volume, at slightly fewer than 200 million cans and packs per year. However, in fiscal 203, Altria shipped only 163 million cans and packs of Skoal, considerably fewer from a year ago.

Also, Altria’s Skoal shipment volumes have been declining since 2014. The 163 million shipment volume recorded in 2023 represents a decrease of 40% from 2014, a significant drop in ten years.

The third smallest product in terms of sales volume is Altria’s latest add-on, on!, a nicotine pouch. While the shipment volumes have declined for both Copenhagen and Skoal, Altria’s on! seems to have defied the downtrend.

As seen, Altria’s on! sales volumes have considerably increased since 2021, reaching a record figure of 114 million cans and packs as of 2023.

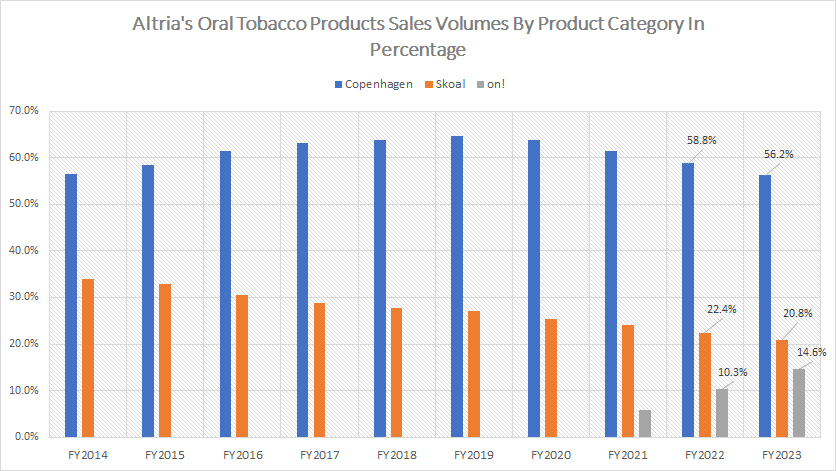

Percentage Of Copenhagen, Skoal, And on! Sales Volumes

Altria percentage of Copenhagen, Skoal and On! sales volumes

(click image to expand)

The definitions of Altria’s Copenhagen, Skoal, and “on!” are available here: Copenhagen, Skoal, and “on!”.

Altria’s Copenhagen has contributed the biggest portion of sales volume, notably at more than 60% of the company’s total volume within the oral tobacco sector. However, this figure seems to have peaked at 65% recorded in fiscal 2019 and has since been on the decline.

As of 2023, Altria’s Copenhagen sales volume made up only 56% of the company’s oral tobacco sales volume, still a sizable figure despite being lower from the previous year.

A similar trend applies to the sales contribution from Altria’s Skoal. As seen, the percentage of Altria’s Skoal to total volume has continued to slide, reaching only 20.8% as of 2023, also a record low.

Altria’s Skoal contribution has declined by more than 10 percentage points over the 10-year period, making Skoal a product with the worst performance within the smokeless tobacco sector.

On the flipped side, Altria’s latest product, on!, has emerged as a winner, with sales volume in 2023 accounting for 14% of the company’s total volume within the oral tobacco product segment, up considerably from the 10% in 2022. The 2023 ratio has nearly doubled over the 6% reported in 2021.

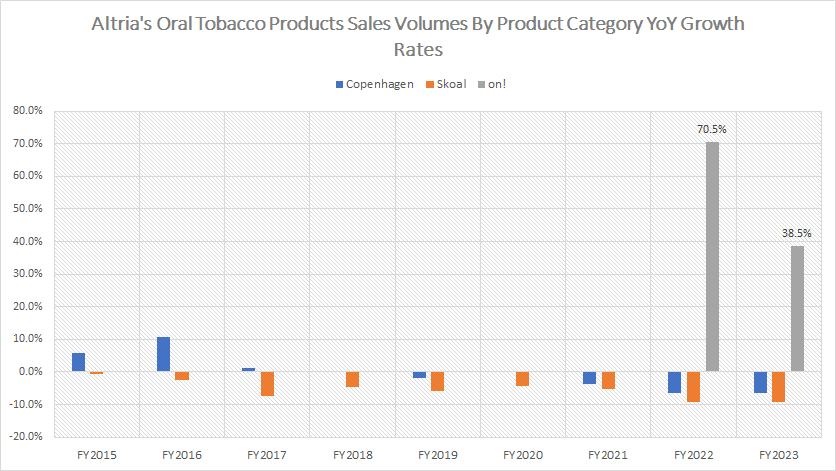

YoY Growth Rates Of Copenhagen, Skoal, And on! Sales Volumes

altria-copenhagen-skoal-and-on-shipment-volumes-yoy-growth-rates

(click image to expand)

The definitions of Altria’s Copenhagen, Skoal, and “on!” are available here: Copenhagen, Skoal, and “on!”.

The sales growth of Altria’s Copenhagen and Skoal has been downright mediocre over the last several years, as illustrated in the chart above. In most fiscal years, Altria has recorded negative growth rates for Copenhagen and Skoal.

That said, Altria’s Copenhagen and Skoal have declined at an average YoY growth rate of 3.7% and 6.7%, respectively, for the past five years.

On the contrary, Altria’s sales of “on!” has grown relatively well, with YoY growth rates reaching 70% and 38% in fiscal year 2022 and 2023, respectively.

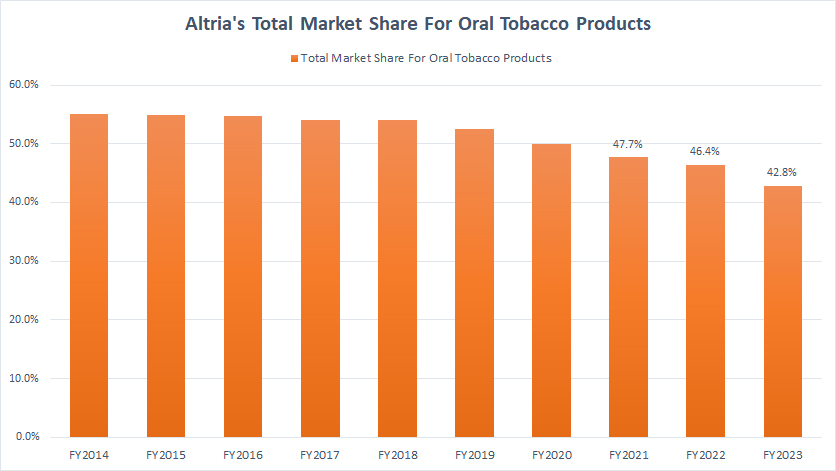

Oral Tobacco Segment Total Market Share

altria-oral-tobacco-segment-market-share

(click image to expand)

The definition of Altria’s market share is available here: market share.

Altria’s total market share for oral tobacco category in the U.S. topped 42.8% as of fiscal year 2023, down significantly from 46.4% reported in fiscal 2022.

In addition, Altria’s oral tobacco category market share in the U.S. has considerably decreased since fiscal year 2014, down more than 10 percentage points over the last ten years, reportedly from 55% in 2014 to 42.8% as of 2023.

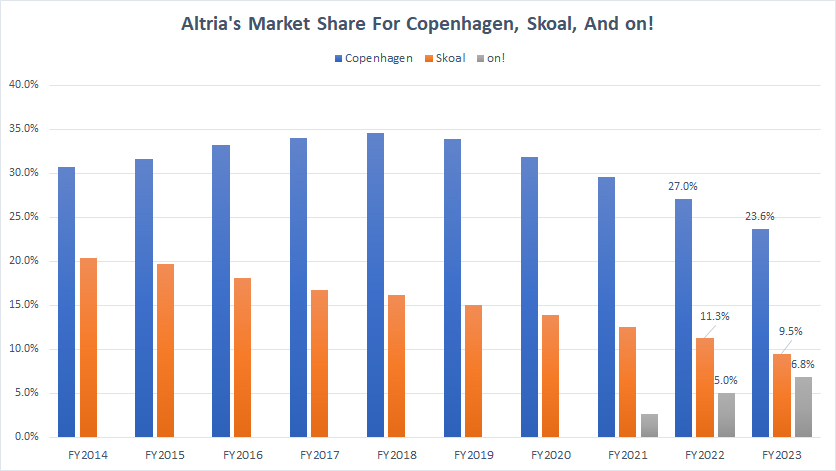

Market Share Of Copenhagen, Skoal, And on!

Altria market share for Copenhagen, Skoal and On! in the U.S.

(click image to expand)

The definitions of Altria’s market share and oral tobacco products are available here: market share, Copenhagen, Skoal, and “on!”.

Altria’s Copenhagen, its largest product by sales volume within the oral tobacco segment, has a market share of roughly 23.6% in the U.S. oral tobacco category as of 2023.

However, this figure appears to have reached its peak figure of 34.5% in 2018. The market share figure has been in decline since 2018.

Altria’s Skoal came next after Copenhagen at a market share of 9.5% in the U.S. oral tobacco category in 2023. A similar downtrend applies to Skoal whose market share also has been declining. As of 2023, Altria’s market share for Skoal reached just 9.5%, an all-time low over the last decade.

In contrast, Altria’s market share for “on!” in the U.S. oral tobacco category has increased from 2.6% reported in 2021 to 6.8% as of 2023. Altria’s “on!” is the only oral tobacco product that has seen an increase in market share in the U.S.

Summary

Despite a shrinking shipment volume in the oral tobacco product segment, Altria’s revenue in this product category has continued to climb, driven primarily by higher pricing. Altria has most likely been raising prices across all oral tobacco products all these years.

Also, Altria’s ambition to transition to a smokeless tobacco company may still be a long way to go, considering that the revenue of the oral tobacco product segment represents just 12% of the company’s total volume as of 2023, according to this article – Altria revenue breandown and profit margin.

Moreover, sales volumes under the oral tobacco segment have been relatively flat in recent years and have even gone lower for two of its most prominent smokeless tobacco products, Copenhagen and Skoal.

Altria has only started selling on! (its latest product add-on in the oral tobacco products segment) in fiscal 2021. Altria’s sales of “on!” comprised only 15% of total sales volume under the oral tobacco segment as of 2023.

Other than sales volumes, Altria’s market share in the U.S. for Copenhagen and Skoal (two of its flagship oral tobacco products) have gone down considerably over the years.

Therefore, Altria still has a lot work to do. I believe its latest acquisition of NJOY Holdings, Inc. (NJOY) is the right direction toward a smokeless future for the company.

References and Credits

1. All data presented in this article were referenced and obtained from Altria’s SEC filings, earnings releases, quarterly and annual reports, press releases, webcast, etc., which are available in Altria Investors Relations.

2. Pexels Images

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!