Crypto asset. Pixabay image.

This article presents the trading volume of Coinbase Global, Inc. (NASDAQ: COIN).

The trading volume is one of the key business metrics of Coinbase, which it uses to evaluate its business performance, identify trends, and make strategic decisions.

For other key statistics of Coinbase Global, you may find more information on these pages:

- Coinbase verified users and monthly transacting users,

- Coinbase crypto investment and bitcoin holdings, and

- Coinbase revenue breakdown and profit margin.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Coinbase Boost Its Trading Volume?

Consolidated Results

B1. Trading Volume

B2. YoY Growth Rates Of Trading Volume

Results By Segment

C1. Consumer And Institutional Trading Volumes

C2. Consumer And Institutional Trading Volumes In Percentage

C3. YoY Growth Rates Of Consumer And Institutional Trading Volumes

Results By Crypto Asset

D1. Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes

D2. Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes In Percentage

D3. YoY Growth Rates Of Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Traving Volume: Coinbase defines trading volume as the total U.S. dollar equivalent value of spot-matched trades transacted between a buyer and seller through its platform during the period of measurement.

In addition, according to the company’s annual reports, Coinbase’s trading volume also represents the product of the quantity of assets transacted and the trade price at the time the transaction was executed. Coinbase believes the trading volume reflects liquidity on its order books, trading health, and the underlying growth of the cryptoeconomy.

For the twelve-month period ended on Dec 31, 2024, no crypto assets other than Bitcoin, Ethereum, and USDT individually represented more than 10% of Coinbase’s Trading Volume and no crypto assets other than Bitcoin and Ethereum individually represented more than 10% of Coinbase’s transaction revenue, according to the 2024 annual report.

USDT: USDT, which stands for Tether, is a type of cryptocurrency known as a stablecoin. Its value is meant to mirror that of the U.S. dollar, offering the benefits of digital currency without the same level of volatility found in other cryptocurrencies like Bitcoin or Ethereum.

Essentially, 1 USDT is designed to be equivalent to 1 USD, aiming to maintain a 1:1 value ratio with the dollar. This stability is achieved by backing USDT with equivalent reserves of traditional fiat currencies, such as dollars, held by the issuing company, Tether Limited.

USDT operates on various blockchain networks, providing a bridge between fiat currencies and cryptocurrencies and offering a more stable means of transaction and value storage in the digital currency space.

Crypto Asset Volatility: Crypto Asset Volatility represents Coinbase’s internal measure of crypto asset volatility in the market relative to prior periods. The volatility is based on intraday returns of a volume-weighted basket of all assets listed on Coinbase’s trading platform.

These returns are used to compute the basket’s intraday volatility which is then scaled to a daily window. These daily volatility values are then averaged over the applicable time period as needed.

Consumer Trading Volume: Consumer trading volume in the crypto market refers to the total quantity of cryptocurrency trades executed by retail investors over a specific timeframe. This includes individual traders’ buying and selling activities across various cryptocurrencies and trading platforms.

Consumer trading volume is an important metric in the crypto space as it provides insights into the level of retail participation, market liquidity, and investor sentiment within the cryptocurrency market. High trading volumes often indicate strong interest or activity among individual investors, which can lead to increased market movements and volatility.

Conversely, low trading volumes might suggest reduced retail participation or caution among individual traders. This metric is crucial for understanding the crypto market dynamics from the perspective of the general public or retail investors.

Institutional Trading Volume: Institutional trading volume in the crypto market refers to the total quantity of cryptocurrency transactions executed by institutional investors. These investors include hedge funds, pension funds, mutual funds, and insurance companies, among others, who trade large quantities of cryptocurrencies either for investment purposes or as part of their asset management strategies.

Unlike retail investors, who typically trade smaller amounts, institutional investors have the capacity to move the market with their trades due to the large volumes they handle. Their activity is closely watched as it can provide insights into market trends and potential shifts in the crypto landscape.

How Does Coinbase Boost Its Trading Volume?

Coinbase employs several strategies to boost its trading volume. These strategies include:

1. **Expanding the range of products and services**: Coinbase continuously explores and adds new cryptocurrencies and financial products, such as Coinbase Earn, staking rewards, and more sophisticated trading tools. This attracts both new and experienced traders looking for diverse trading opportunities.

2. **Improving user experience**: By focusing on a user-friendly interface, mobile app availability, and customer support, Coinbase makes it easier for new users to start trading and for existing users to trade more efficiently. A positive user experience encourages higher trading activity.

3. **Marketing and partnerships**: Engaging marketing campaigns and strategic partnerships help Coinbase to expand its user base. By collaborating with other fintech companies and leveraging social media, Coinbase can attract new users, which in turn increases its trading volume.

4. **Educational resources**: Providing educational materials and resources about cryptocurrency trading and investment encourages new traders to start trading and helps existing traders to make more informed decisions, potentially leading to increased trading activity.

5. **Security measures**: Ensuring a high level of security builds trust among users. By investing in advanced security technologies and protocols, Coinbase reassures users that their assets are safe, which is crucial for encouraging trading on the platform.

6. **Regulatory compliance**: By adhering to regulatory requirements and seeking licenses in various jurisdictions, Coinbase can access new markets and attract users who are cautious about regulatory compliance, thus boosting its trading volume.

7. **Liquidity improvement**: Coinbase works on providing high liquidity, which allows users to execute trades quickly and at desired prices. High liquidity attracts high-frequency traders and institutional investors, significantly increasing trading volume.

By combining these strategies, Coinbase aims to enhance its platform’s appeal to a broad range of users, from novices to professionals, thereby increasing its trading volume.

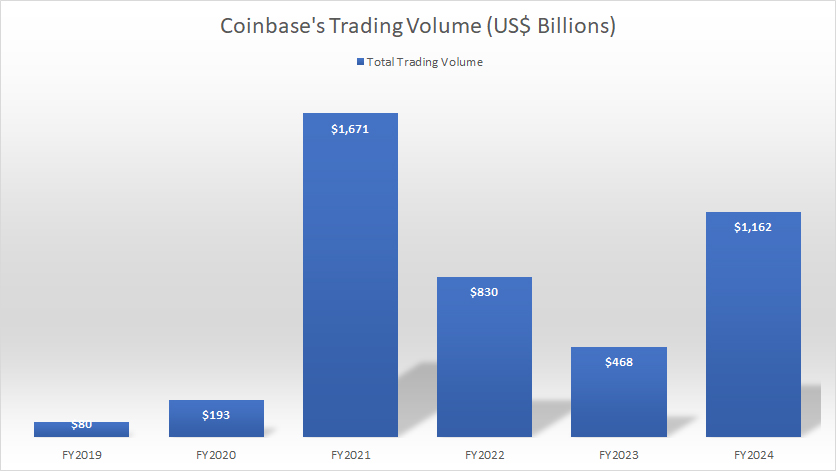

Trading Volume

Coinbase-trading-volume-by-year

(click image to expand)

The definition of Coinbase’s trading volume is available here: trading volume.

In fiscal year 2022, Coinbase’s trading volume stood at $830 billion. However, this figure experienced a significant decline of over 40% in 2023, dropping to $468 billion. Despite this downturn, Coinbase’s trading volume made a remarkable recovery in fiscal year 2024, surging to $1.2 trillion — an impressive increase of 140% compared to 2023.

Although the trading volume rebounded substantially in 2024, it remained 30% below the peak figure of $1.7 trillion achieved in fiscal year 2021. Coinbase attributed the rise in trading volume in 2024 to the significant growth in Crypto Asset Volatility. According to the company, Crypto Asset Volatility increased by 37% compared to the prior period, which played a pivotal role in driving trading activity.

Furthermore, the 2024 annual report revealed that Coinbase’s trading volume growth significantly outpaced the 105% growth in the overall U.S. spot market. This achievement underscored Coinbase’s ability to capture a larger portion of the trading activity due to its competitive position and strategic product offerings.

Coinbase’s success in regaining momentum can be attributed to several key factors. The company’s robust platform, user-friendly interface, and advanced trading features have positioned it as a preferred choice among traders. Additionally, Coinbase’s commitment to security and regulatory compliance has built trust and confidence among its users.

Moreover, Coinbase has continuously expanded its range of supported cryptocurrencies, offering a diverse portfolio that caters to the evolving preferences of investors. The company’s strategic partnerships and integrations with other financial institutions have further enhanced its market presence and accessibility.

As the crypto market continues to evolve, Coinbase’s ability to adapt and innovate will be crucial in maintaining its competitive edge. Investors and stakeholders will be closely watching how the company navigates future market dynamics and capitalizes on emerging opportunities to sustain its growth trajectory.

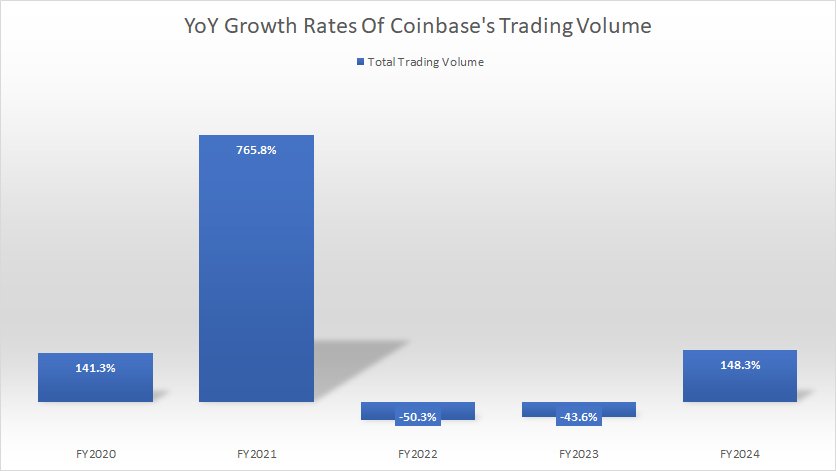

YoY Growth Rates Of Trading Volume

Coinbase-growth-rates-of-trading-volume-by-year

(click image to expand)

The definition of Coinbase’s trading volume is available here: trading volume.

In fiscal year 2021, Coinbase’s trading volume experienced a remarkable surge, increasing by over 700% year-over-year, marking the most significant growth since 2020. However, this peak in trading volume was followed by a notable decline in the subsequent years.

In 2022, Coinbase’s trading volume decreased by 50% year-over-year, marking the first such substantial decrease in three years. This decline continued into 2023, with trading volume falling by an additional 44% compared to 2022.

Despite these challenges, Coinbase’s trading volume made a significant recovery in fiscal year 2024, surging by 148% year-over-year from 2023. This recovery highlights the company’s resilience and ability to bounce back from previous setbacks.

Several factors may have contributed to this recovery in trading volume. The increased volatility in the cryptocurrency market during 2024 likely played a crucial role in driving trading activity. Additionally, Coinbase’s strategic initiatives to enhance its platform and expand its range of supported cryptocurrencies could have attracted more users and traders.

However, it’s important to note that while the trading volume rebounded significantly in 2024, it remained 30% below the peak figure of $1.7 trillion achieved in fiscal year 2021. This indicates that there is still room for growth and improvement.

As Coinbase continues to navigate the dynamic and rapidly evolving cryptocurrency market, its ability to innovate, maintain user trust, and adapt to market trends will be crucial in sustaining its growth trajectory. Investors and stakeholders will be closely monitoring the company’s performance and strategic initiatives to assess its potential for long-term success.

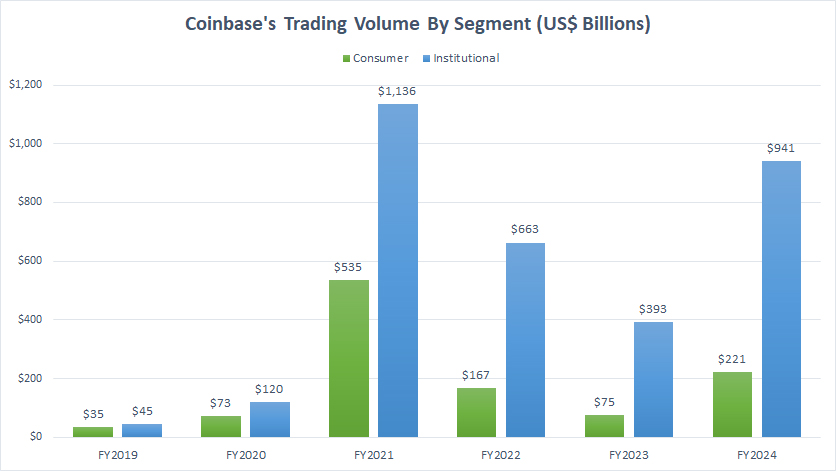

Consumer And Institutional Trading Volumes

Coinbase-consumer-and-institutional-trading-volume

(click image to expand)

Coinbase’s trading volume can be classified into two main categories: consumer and institutional. The definitions of consumer and institutional trading volume are available here: consumer trading volume and institutional trading volume.

The retail market, also known as the consumer segment, consists of individual investors who trade independently. On the other hand, the institutional market includes large investment funds, pension funds, and other financial institutions that invest money on behalf of their clients.

As depicted in the chart above, Coinbase’s trading volume from the consumer segment is significantly smaller compared to the institutional segment. Institutional investors, which include hedge funds, asset managers, and other large financial institutions, typically trade in much larger volumes than individual retail investors, as shown in the chart.

It is important to note that there has been a significant decline in the trading volumes of both consumer and institutional segments since 2021. During fiscal year 2022, Coinbase recorded trading volumes of $167 billion and $663 billion in the consumer and institutional segments, respectively. These figures dropped drastically in 2023, reaching just $75 billion for the consumer segment and $393 billion for the institutional segment.

Coinbase’s trading volumes peaked in fiscal year 2021, with the consumer segment achieving $535 billion and the institutional segment reaching $1.1 trillion. However, in fiscal year 2024, Coinbase’s trading volumes in both segments saw a significant recovery, with the consumer segment reaching $221 billion and the institutional segment reaching $941 billion.

Despite the recovery, it is evident that both the consumer and institutional segments still have room for growth to reach their peak levels. As Coinbase continues to navigate the dynamic cryptocurrency market, its ability to innovate, maintain user trust, and adapt to market trends will be crucial in sustaining its growth trajectory

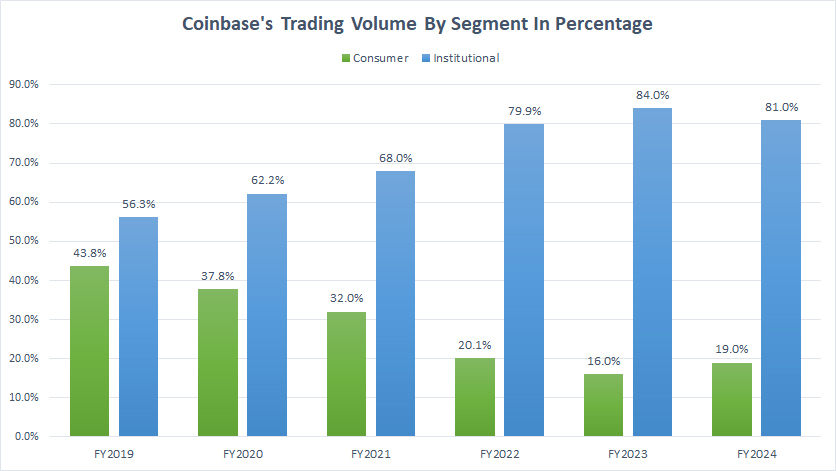

Consumer And Institutional Trading Volumes In Percentage

Coinbase-consumer-and-institutional-trading-volume-in-percentage

(click image to expand)

The definitions of consumer and institutional trading volume are available here: consumer trading volume and institutional trading volume.

In fiscal year 2024, Coinbase’s institutional clients accounted for a substantial 81% of the company’s total trading volume. While this represents a slight decrease from the 84% recorded in 2023, it still marks one of the highest ratios ever observed.

Since 2019, the percentage of institutional trading volume has significantly increased and continued to rise even amidst the decrease in overall trading volumes during the post-pandemic periods.

On the other hand, the consumer segment’s contribution to Coinbase’s total trading volume was significantly smaller. In fiscal year 2024, the consumer segment accounted for only 19% of the total trading volume, a notable decline from the 43.6% achieved in fiscal year 2019.

This trend of declining contribution from the consumer segment has been evident since 2019, with the ratio decreasing from 43.8% in 2019 to an all-time low of 16% in 2023. However, in fiscal year 2024, there was a rebound, with the consumer segment’s ratio increasing to 19%.

The significant rise in institutional trading volume can be attributed to several factors. Institutional clients, including hedge funds, asset managers, and other large financial institutions, tend to trade in much larger volumes compared to individual retail investors. This increased activity has bolstered the overall trading volume for Coinbase, even as the company faced challenges in other areas.

Additionally, the growing interest in cryptocurrencies from institutional investors has played a crucial role in driving the increase in institutional trading volume. These investors are seeking to diversify their portfolios and capitalize on the opportunities presented by the volatile and rapidly evolving cryptocurrency market.

In contrast, the decline in the consumer segment’s trading volume reflects the challenges faced by individual retail investors. Factors such as market volatility, regulatory uncertainties, and economic conditions may have deterred retail investors from engaging in cryptocurrency trading at the same levels as before.

Despite these trends, the rebound in the consumer segment’s trading volume in fiscal year 2024 is a positive sign. It indicates a renewed interest and engagement from individual investors, which could contribute to the overall growth of Coinbase’s trading activity in the future.

As Coinbase continues to navigate the dynamic cryptocurrency landscape, its ability to cater to both institutional and retail clients will be crucial for sustained growth. By leveraging its competitive position, enhancing its platform, and adapting to market trends, Coinbase can potentially capture a larger share of the trading activity and achieve long-term success.

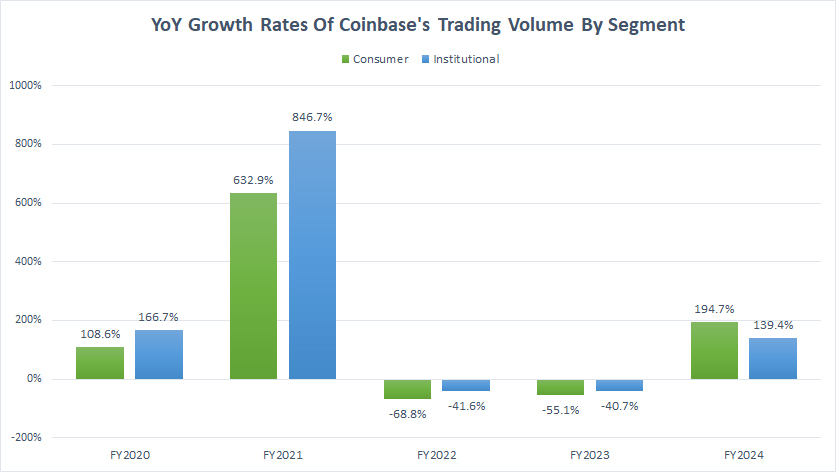

YoY Growth Rates Of Consumer And Institutional Trading Volumes

Coinbase-growth-rates-of-consumer-and-institutional-trading-volume

(click image to expand)

The definitions of consumer and institutional trading volume are available here: consumer trading volume and institutional trading volume.

In fiscal year 2021, Coinbase experienced extraordinary growth in trading volumes, with the consumer segment increasing by 633% year-over-year (YoY) and the institutional segment surging by 847% YoY. This marked a significant milestone for the company, reflecting heightened activity and interest in cryptocurrency trading.

However, the trading volume took a sharp downturn in fiscal year 2022. The consumer segment experienced a dramatic decline of 69% YoY, while the institutional segment saw a decrease of 42% YoY. This decline came after a period of substantial growth in the previous fiscal year, indicating volatility in the market.

The downward trend continued into fiscal year 2023, with further reductions in trading volumes for both segments. The consumer segment recorded a decrease of 55%, while the institutional segment declined by 40.7%. These figures underscored the challenges faced by Coinbase during this period of market fluctuation.

Despite these setbacks, fiscal year 2024 brought a significant recovery for Coinbase. Both the consumer and institutional segments experienced notable rebounds. The consumer segment’s trading volume surged by 195% YoY, while the institutional segment saw an increase of 129% YoY. This recovery highlighted the resilience of Coinbase and its ability to regain momentum after periods of decline.

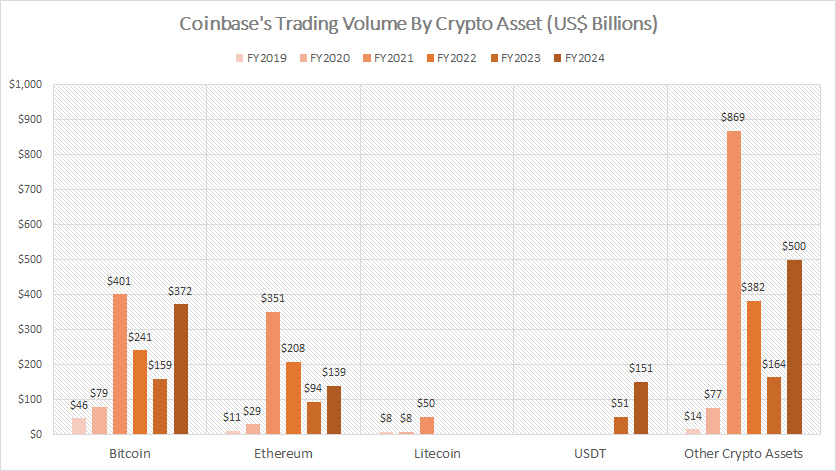

Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes

Coinbase-trading-volume-by-crypto-asset

(click image to expand)

The definition of Coinbase’s USDT is available here: USDT.

In addition to being divided into consumer and institutional categories, Coinbase’s trading volume can be further classified based on the different types of cryptocurrencies traded on the platform.

The major cryptocurrencies traded on Coinbase’s platforms with a minimum of 10% of total volumes are Bitcoin, Ethereum, Litecoin, and USDT, as shown in the chart above.

In fiscal year 2022, Bitcoin trading volume on Coinbase’s platform totaled $241 billion, down from $401 billion the previous year. This figure further decreased to $159 billion in fiscal year 2023. However, in fiscal year 2024, Bitcoin trading volume surged to $372 billion, roughly doubling the volume from the prior year.

Ethereum provides the second-largest trading volume for the company, only slightly behind Bitcoin. In fiscal years 2022, 2023, and 2024, Ethereum trading volumes were $208 billion, $94 billion, and $139 billion, respectively. Since fiscal year 2021, Ethereum results have significantly decreased but recovered modestly in fiscal year 2024.

Litecoin’s trading volume surged to $50 billion in fiscal year 2021, marking a significant rise from 2020. However, Coinbase stopped providing Litecoin’s trading data for 2022 and beyond, possibly due to the fact that it decreased to a much smaller volume.

The trading volume of USDT surged to $51 billion in 2023 and more than tripled in fiscal year 2024, reaching $151 billion. Coinbase attributed this soar to de-pegging events, which drove higher activity in secondary markets.

A noticeable trend is the decrease in trading volume of major cryptocurrencies on Coinbase’s platforms since fiscal year 2021. In fiscal year 2023, Coinbase recorded a considerable decline in trading volumes for Bitcoin, Ethereum, and other major cryptocurrencies.

However, the results in fiscal year 2024 mark a significant recovery for Coinbase’s cryptocurrency trading activities. This rebound can be attributed to several factors, including renewed market interest, increased volatility, and Coinbase’s strategic initiatives to enhance its platform and expand its range of supported cryptocurrencies.

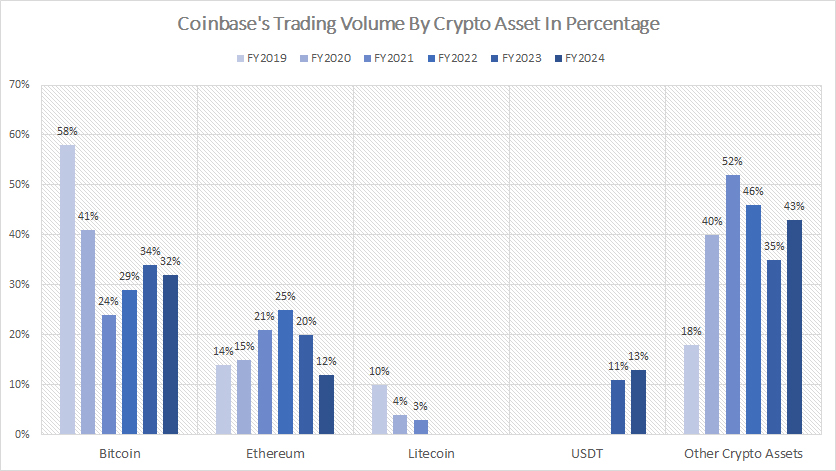

Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes In Percentage

Coinbase-trading-volume-by-crypto-asset-in-percentage

(click image to expand)

The definition of Coinbase’s USDT is available here: USDT.

Bitcoin dominated Coinbase’s total trading volume, constituting 29% in fiscal year 2022, rising to 34% in 2023, and maintaining a strong 32% in 2024. This solidified Bitcoin’s position as the cryptocurrency with the largest trading volume on the platform.

In contrast, Ethereum accounted for a smaller share, making up 25% of Coinbase’s total trading volume in 2022, decreasing to 20% in 2023, and further dropping to 12% in fiscal year 2024. This decline highlights that other cryptocurrencies have been growing at a faster pace compared to Ethereum.

Litecoin, despite its significant surge to $50 billion in trading volume in 2021, accounted for only 3% of Coinbase’s total volume. This was a notable decline from the 10% share it held in 2019. Subsequently, Coinbase ceased providing Litecoin’s trading data for 2022 and beyond, possibly due to its reduced trading volume.

USDT (Tether) showed an upward trend in its trading volume, contributing 11% of Coinbase’s total volume in fiscal year 2023. This percentage further increased to 13% in fiscal year 2024, demonstrating the growing significance of this crypto asset on the platform.

Examining these trends reveals a shift in the trading landscape on Coinbase’s platform. Bitcoin’s resilience and substantial trading volume underscore its continued dominance among cryptocurrencies. Meanwhile, Ethereum’s declining share indicates increased competition from other emerging crypto assets.

The growth in USDT’s trading volume reflects a heightened interest in stablecoins, which offer a semblance of stability in the volatile cryptocurrency market. The increased activity surrounding USDT can be attributed to various market events, such as de-pegging occurrences that drove higher trading activity in secondary markets.

Overall, these shifts in trading volumes among different cryptocurrencies on Coinbase’s platform illustrate the dynamic nature of the cryptocurrency market.

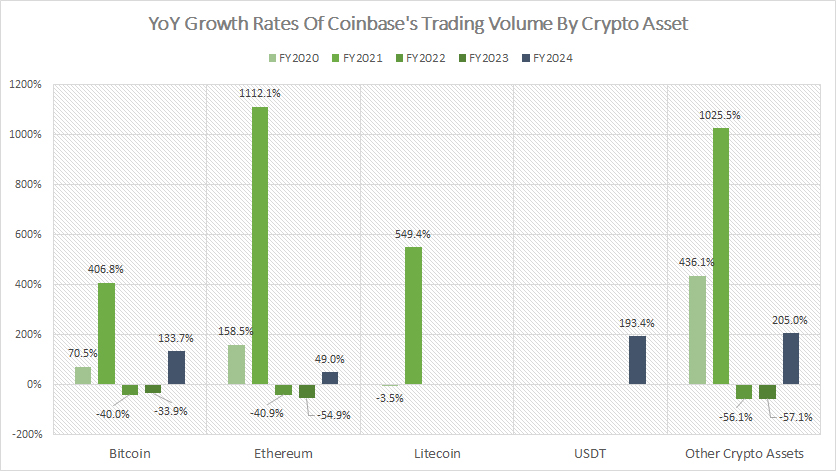

YoY Growth Rates Of Bitcoin, Ethereum, Litecoin, And USDT Trading Volumes

Coinbase-growth-rates-of-trading-volume-by-crypto-asset

(click image to expand)

The definition of Coinbase’s USDT is available here: USDT.

Coinbase experienced a remarkable surge in trading volumes for all cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, in 2021. However, this explosive growth was short-lived as all cryptocurrencies’ trading volume growth rates plummeted a year later.

For instance, Bitcoin trading volume declined by 40% in 2022, following the previous year’s surge. The downward trend continued into 2023, with a further decrease of 34%. Similarly, Ethereum’s trading volume dipped by 41% in 2022 and dropped even further by 55% in 2023.

The decline in trading volumes was not limited to these major cryptocurrencies. Overall trading volume across all crypto assets on Coinbase’s platform saw a significant downturn during this period.

However, fiscal year 2024 marked a significant recovery for most of the crypto assets traded on Coinbase’s platforms. Bitcoin trading volume increased by 134% year-over-year (YoY), showcasing a robust rebound. Ethereum trading volume surged by 49% YoY, indicating a notable recovery.

USDT (Tether) experienced an impressive growth of 193% over the prior year, making it the crypto asset with the highest growth rate in fiscal year 2024. Other cryptocurrencies also showed signs of recovery:

In fiscal years 2022 and 2023, the trading volumes of these other crypto assets declined by 56% and 57%, respectively. However, in fiscal year 2024, their trading volumes grew by more than 200% over the prior year, highlighting a strong resurgence.

Conclusion

Coinbase’s crypto asset trading volume peaked in 2021 but significantly declined in 2022 and 2023. The same goes for the trading volume of Coinbase’s consumer and institutional segments.

Despite the recent turbulence in the cryptocurrency market, Coinbase may still be able to reach its previous trading volume high. The prices of most crypto assets have experienced significant recovery, offering renewed hope for Coinbase and its investors.

For example, Coinbase saw significant recovery in fiscal year 2024 across all segments and cryptocurrencies.

With the market showing signs of stabilization, Coinbase may have the opportunity to regain its momentum and continue to grow its trading volume.

Credits and References

1. All financial figures presented were obtained and referenced from Coinbase Global, Inc.’s annual reports published on the company’s investor relations page: Coinbase Investor Relations.

2. Pixabay images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.