Tesla battery. Source: Flickr Image.

This article covers Tesla’s energy segment revenue, profit, and margins.

Tesla’s energy segment holds the potential to surpass its automotive segment in the future, driven by significant advancements and growing demand for sustainable energy solutions.

Tesla envisions a future where its entire network of supercharger stations will be fully powered by solar energy generation and storage systems.

Achieving this goal would significantly reduce the company’s carbon footprint and further its mission of promoting sustainable energy solutions.

You may find related statistic of Tesla on these pages:

- Tesla solar and energy storage deployments,

- Tesla revenue breakdown and profit margin, and

- Tesla solar vs automotive.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Tesla Energy Business Strategy

O3. How Does Tesla Energy Make Money

Energy Revenue

A1. Energy Generation And Storage Revenue

A2. YoY Growth Rates Of Energy Generation And Storage Revenue

Energy Profit And Margin

B1. Energy Generation And Storage Gross Profit

B2. Energy Generation And Storage Gross Margin

Ratio To Total Revenue

C1. Energy To Total Revenue Ratio

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Power Purchase Agreement: A power purchase agreement (PPA) is a legal contract between an electricity generator and a buyer, typically a utility or a corporation.

In this agreement, the generator agrees to sell a certain amount of electricity at a pre-determined price over a specified period. PPAs are commonly used in the renewable energy industry to facilitate the financing and development of new renewable energy projects.

Tesla Energy Business Strategy

Tesla’s energy business strategy encompasses several key components aimed at reinventing and leading the global shift towards sustainable energy. The strategy can be dissected into the following critical aspects:

1. **Integration of Energy Solutions**: Tesla is not just an electric vehicle (EV) manufacturer; it’s also focused on creating a fully integrated clean energy ecosystem. This includes solar energy products, like solar panels and solar roofs, as well as energy storage solutions, such as the Powerwall, Powerpack, and Megapack. By offering a comprehensive range of products, Tesla aims to enable homes, businesses, and utilities to generate, store, and manage renewable energy efficiently.

2. **Innovation in Energy Storage**: A cornerstone of Tesla’s energy strategy is its emphasis on advanced battery technology. The company continuously innovates in this area, aiming to reduce energy storage costs and increase its batteries’ efficiency and reliability. This is crucial for the viability of renewable energy, as it addresses the issue of intermittency by storing excess energy generated during peak conditions for use when generation is low.

3. **Scaling Production**: Tesla’s Gigafactories are central to its strategy, enabling the mass production of batteries and electric vehicles. By scaling up production, Tesla aims to drive down costs through economies of scale, making sustainable energy products more affordable and accessible to a broader market.

4. **Synergy Between Electric Vehicles and Energy Products**: Tesla’s energy strategy is closely tied to its electric vehicle business. The company envisions a future where homes and businesses generate their own clean energy, store it, and use it to power their everyday needs and their Tesla vehicles. This holistic approach encourages the adoption of both EVs and renewable energy products.

5. **Deployment of Software and Services**: Beyond hardware, Tesla is leveraging software to enhance the value of its energy products. This includes smart management systems that optimize energy use and storage based on real-time data and user preferences. Additionally, Tesla aims to create a virtual power plant by linking distributed energy resources to provide grid services, further stabilizing the grid and reducing the need for fossil fuel-based peak power plants.

6. **Market Expansion and Policy Advocacy**: Tesla is actively working to expand into new markets around the world while also engaging in policy advocacy to support the transition to renewable energy. The company recognizes the importance of favorable regulations and incentives in accelerating the adoption of sustainable energy solutions.

In summary, Tesla’s energy business strategy is multifaceted, aiming to lead in the transition to sustainable transportation and fundamentally change how energy is generated, stored, and consumed. Tesla seeks to drive the world toward a cleaner, more sustainable energy future through innovation, integration, and advocacy.

How Does Tesla Energy Make Money

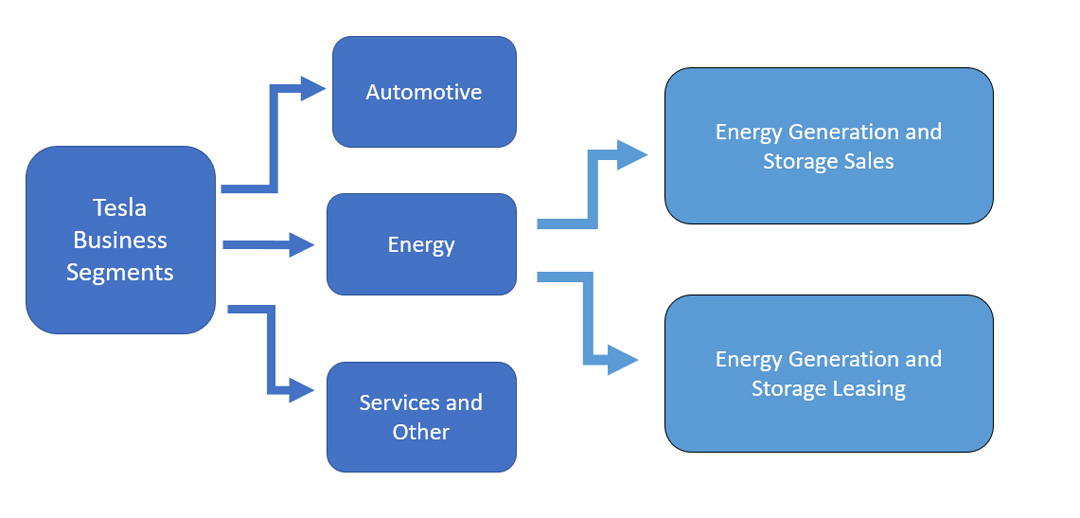

Tesla energy

(click image to expand)

Tesla’s energy gets its revenue primarily from two sources:

- 1. Energy generation and storage sales

- 2. Energy generation and storage leasing

Tesla’s energy generation and storage sales revenue is derived from sales of solar energy systems and energy storage products to residential, small commercial, and large commercial and utility grade customers.

On the other hand, Tesla’s energy generation and storage leasing revenue is derived from leasing solar energy systems and electricity to commercial and retail customers.

In the case of leasing, Tesla is the lessor who owns the assets, while its customers are the lessees.

Apart from leasing the entire solar energy generation systems, Tesla also leases electricity to retail and commercial customers under a power purchase agreement (PPA).

Tesla earns recurring income from customers leasing electricity under a power purchase arrangement.

Energy Generation And Storage Revenue

tesla-energy-generation-and-storage-revenue

(click image to expand)

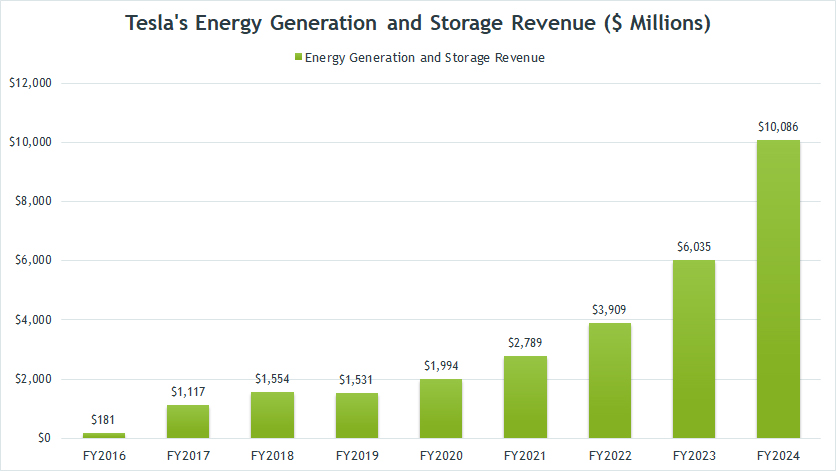

Tesla’s energy generation and storage revenue reached an unprecedented $10.1 billion in fiscal year 2024, setting a new all-time high. This remarkable figure represents a 67% increase from the $6 billion recorded in fiscal year 2023.

The growth trajectory has been nothing short of impressive. Since fiscal year 2017, Tesla’s energy generation and storage revenue has surged by over 800%, climbing from $1.1 billion to $10.1 billion by the end of fiscal year 2024. This exponential growth underscores Tesla’s successful expansion in the energy sector.

Several factors have contributed to this outstanding performance. The continued ramp-up of the Megapack factory (Megafactory) in Lathrop, CA, has significantly boosted production capacity, allowing Tesla to meet the escalating demand for its energy storage solutions.

Besides, the increasing adoption of Tesla’s energy products, such as the Powerwall, Powerpack, and Megapack, by residential, commercial, and utility customers has further driven revenue growth.

Moreover, the global shift towards renewable energy sources and the need for reliable energy storage solutions have positioned Tesla as a key player in the energy market.

By providing innovative and scalable energy solutions, Tesla is helping to stabilize the grid and support the integration of intermittent renewable energy sources like solar and wind.

Looking ahead, Tesla’s energy division is poised for continued growth, with ongoing investments in technology and infrastructure.

As the world transitions to sustainable energy, Tesla’s energy generation and storage business has the potential to become a major revenue driver, contributing significantly to the company’s overall mission of accelerating the world’s transition to sustainable energy.

YoY Growth Rates Of Energy Generation And Storage Revenue

tesla-energy-generation-and-storage-revenue-yoy-growth-rates

(click image to expand)

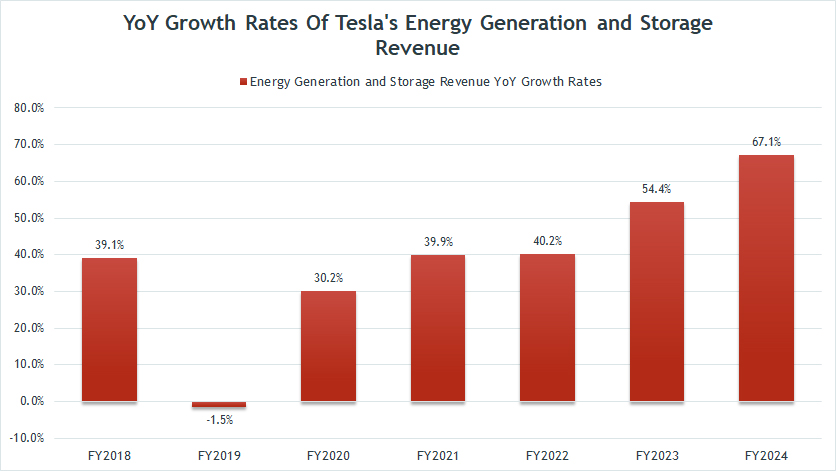

Tesla has consistently maintained steady growth in its energy revenue over the past eight years since fiscal year 2018, as illustrated in the chart above. The company has hardly recorded any dips in this segment, showcasing its resilience and strategic focus on expanding its energy solutions.

In fiscal year 2024, Tesla’s energy generation and storage revenue reached a record high, growing by an impressive 67% compared to the previous year. This milestone reflects the increasing demand for Tesla’s energy products and the company’s ability to scale its operations effectively.

On average, Tesla has recorded an annual growth rate of 54% in its energy revenue over the past three years, from fiscal year 2022 to 2024. This consistent growth trajectory underscores Tesla’s success in diversifying its revenue streams beyond automotive sales and establishing a strong presence in the renewable energy market.

Energy Generation And Storage Gross Profit

tesla-energy-generation-and-storage-gross-profit

(click image to expand)

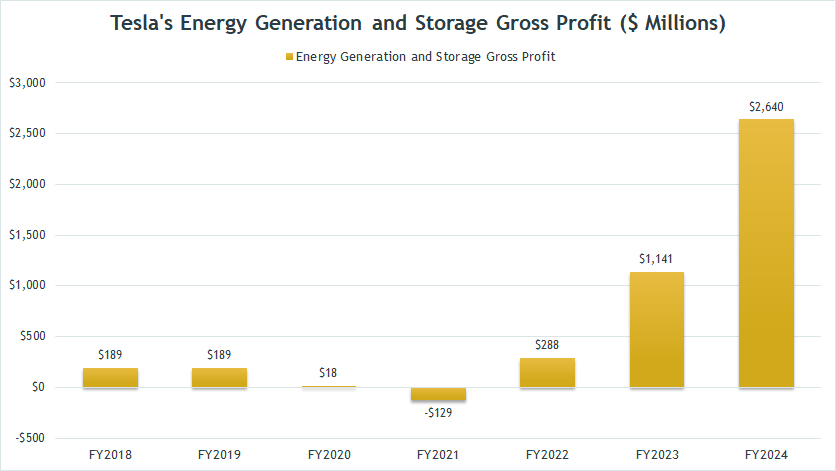

In fiscal year 2024, Tesla achieved a record gross profit of $2.6 billion from its energy segment, marking a substantial increase from the $1.1 billion recorded in fiscal year 2023. This remarkable growth underscores the successful expansion and profitability of Tesla’s energy business.

The impressive gross profit is a testament to the increasing demand for Tesla’s energy products, including the Powerwall, Powerpack, and Megapack.

The continued ramp-up of the Megapack factory (Megafactory) in Lathrop, CA, has played a pivotal role in meeting this growing demand, enabling Tesla to produce and deliver energy storage solutions at scale.

Tesla’s energy segment has become a significant contributor to the company’s overall financial performance.

The substantial increase in gross profit reflects not only the company’s ability to scale its operations but also the growing market adoption of renewable energy and energy storage solutions.

As the world transitions to sustainable energy sources, Tesla’s energy products are gaining traction among residential, commercial, and utility customers.

Looking ahead, Tesla’s energy business is poised for further growth, driven by ongoing innovations and investments in technology and infrastructure.

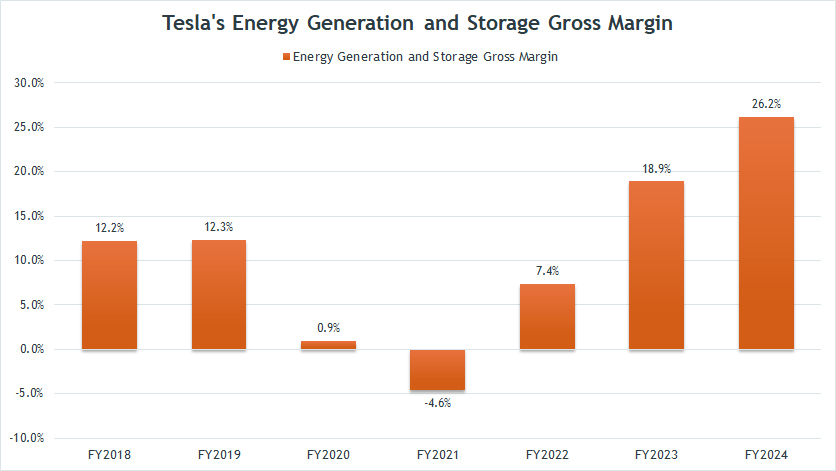

Energy Generation And Storage Gross Margin

tesla-energy-generation-and-storage-gross-margin

(click image to expand)

Tesla’s energy gross margin has shown remarkable improvement over the past several years, reaching an all-time high of 26% in fiscal year 2024. This milestone marks a significant achievement for the company, reflecting its growing efficiency and profitability in the energy segment.

In fiscal year 2023, Tesla’s energy gross margin stood at 19%, which was already a substantial jump from the 7% recorded in fiscal year 2022.

Despite these impressive gains, Tesla experienced a challenging period between fiscal year 2020 and 2021. During this time, the company’s energy gross margin saw a significant drop, culminating in a negative 5% in fiscal year 2021.

This decline was likely due to various factors, such as supply chain disruptions, increased production costs, and broader economic impacts related to the COVID-19 pandemic.

The recovery and subsequent growth in Tesla’s energy gross margin demonstrate the company’s resilience and strategic adjustments.

By ramping up production at the Megapack factory (Megafactory) in Lathrop, CA, Tesla has been able to optimize its manufacturing processes and meet the increasing demand for energy storage solutions.

The continued adoption of Tesla’s energy products, including the Powerwall, Powerpack, and Megapack, has further contributed to the improved margins.

As Tesla continues to innovate and expand its energy offerings, the company is well-positioned to capitalize on the growing demand for renewable energy and energy storage solutions.

The significant improvement in the energy gross margin underscores Tesla’s potential to drive profitability and success in this rapidly evolving market.

On a side note, Tesla generates much better profitability in its automotive segment compared to the energy segment.

For example, Tesla’s automotive segments, such as car sales and automotive leasing, generate gross margins ranging from 20% to 40%.

These margins are significantly higher than those in the energy segment, reflecting the robust demand and efficient production processes within the automotive sector.

While Tesla’s energy segment continues to evolve and expand, the automotive segment remains a key driver of the company’s financial success.

The impressive gross margins in the automotive sector highlight Tesla’s ability to navigate the competitive landscape and deliver strong financial performance.

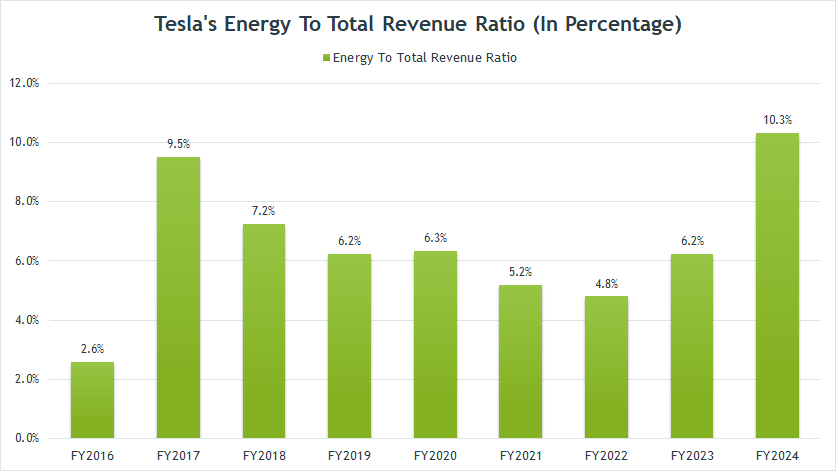

Energy To Total Revenue Ratio

tesla-energy-revenue-to-total-revenue-ratio

(click image to expand)

Over the past several years, Tesla’s energy revenue has increasingly contributed a significant portion of the company’s total revenue, as depicted in the graph above.

In fiscal year 2024, the energy segment accounted for 10% of Tesla’s total revenue, marking an all-time high since 2016. This growth is particularly notable considering that the energy segment’s revenue contribution bottomed out at 4.8% in fiscal year 2022.

The subsequent years have seen a remarkable rebound, with the ratio steadily climbing and reaching a record level by fiscal year 2024. This resurgence highlights the growing importance and success of Tesla’s energy business in the company’s overall financial performance.

Overall, Tesla’s energy is expected to play an increasingly vital role in the company’s mission of accelerating the world’s transition to sustainable energy.

Conclusion

In summary, Tesla’s energy has shown remarkable growth and profitability over the past several years, despite facing some challenges in its solar deployments.

Tesla’s energy has become a significant contributor to the company’s overall financial performance. In fiscal year 2024, the energy segment accounted for 10% of Tesla’s total revenue, up from a low of 4.8% in fiscal year 2022.

Tesla’s energy gross margin has also improved significantly, reaching a record high of 26% in fiscal year 2024. The improvement in gross margins reflects Tesla’s ability to optimize its manufacturing processes and meet the growing demand for its energy storage solutions.

Overall, Tesla’s energy has demonstrated exceptional growth and profitability, contributing significantly to the company’s financial success.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s annual reports published on the company’s investor relations page: Tesla Update Letters and Presentations.

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.