Electric cars. Pixabay Image.

Nio Inc. (NYSE:NIO) is a Chinese startup that designs and develops what the company calls premium smart electric vehicles.

The company differentiates itself from other EV startups through technological breakthroughs and innovation which include its industry-leading battery swapping technologies, Battery as a Service, or BaaS, as well as its proprietary autonomous driving technologies and Autonomous Driving as a Service, or ADaaS.

While Nio derives its revenue primarily from China, it has sales offices in other countries around the world, particularly in the U.S. and Europe.

Nio’s vehicle portfolio consists of mainly large and mid-size SUVs and sedans.

That said, this article presents the total revenue and segment revenue of Nio Inc.

Apart from revenue, we also will explore the company’s profit and margins.

Keep in mind that this article presents only the sales revenue of Nio Inc.

Investors who are interested in Nio’s vehicle sales volume may visit this article – Nio Vehicle Sales Volume.

Without further ado, let’s start with the following topics!

Table Of Contents

Consolidated Results

A1. Total Revenue By Year

A2. Total Revenue By TTM

Results By Segment

B1. Vehicle Sales And Other Revenues

B2. Percentage Of Vehicle Sales And Other Revenues

B3. Revenue Growth Rates

Profitability By Segment

C1. Gross Profit

C2. Gross Margin

Operating Efficiency

D1. Operating Profit

D2. Operating Margin

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

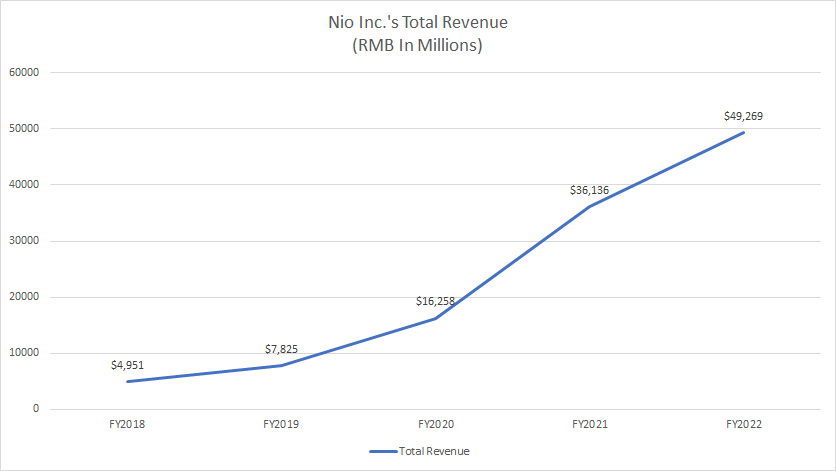

Nio’s Total Revenue By Year

Nio total revenue by year

(click image to enlarge)

On a yearly basis, Nio’s revenue reached a record high of nearly RMB 50 billion (USD 7 billion) as of 2022, representing a rise of 36% over 2021.

Over the past 5 years, Nio’s total revenue has been on an exponential rise and the figures have increased by more than 10-fold since 2018, driven primarily by the growing vehicle volumes.

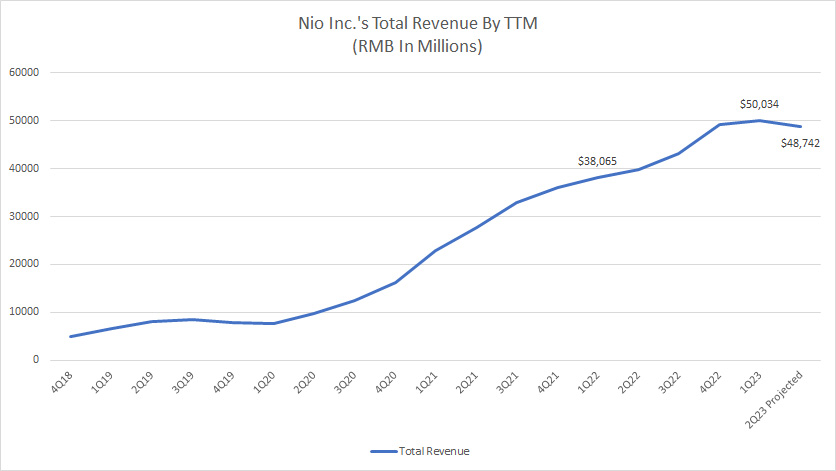

Nio’s Total Revenue By TTM

Nio total revenue by TTM

(click image to enlarge)

The TTM plot shows Nio’s incredible revenue growth over the years.

On a TTM basis, Nio’s total revenue reached RMB 50 billion (USD 7 billion) as of 1Q 2023 and is expected to come slightly lower to RMB 49 billion (USD 6.9 billion) in 2Q 2023, according to the outlook given by the company during the latest earnings release.

From a year ago, the 1Q 2023 figure rose by 32%.

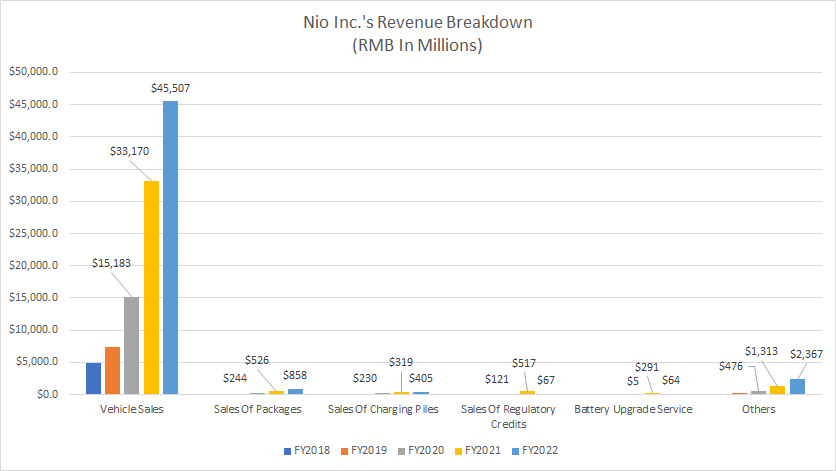

Nio’s Vehicle Sales And Other Revenue Segments

Nio revenue breakdown by segment

(click image to enlarge)

Nio’s revenue comes from several sources or segments as shown in the chart above.

Nio’s primary revenue source comes from vehicle sales, topping RMB 45.5 billion (USD 6.4 billion) as of 2022, a rise of 37% over 2021.

Nio’s other revenue sources are negligible compared to vehicle sales revenue.

Apart from vehicle sales, Nio also generates revenue from sales of packages, charging piles, and regulatory credits as well as battery upgrade service.

While these revenue segments are small, they have grown significantly over the years and can add up to quite a remarkable number.

For example, Nio’s sales of packages alone totaled more than RMB 1.6 billion (USD 228 million) between fiscal 2020 and 2022.

Similarly, Nio earned roughly RMB 700 million (USD 100 million) from the sales of regulatory credits over the last 3 years.

In addition, Nio also earned significant revenue from charging and battery service-related sales.

This segment alone generated more than RMB 1.3 billion (USD 184 million) from fiscal 2020 to 2022.

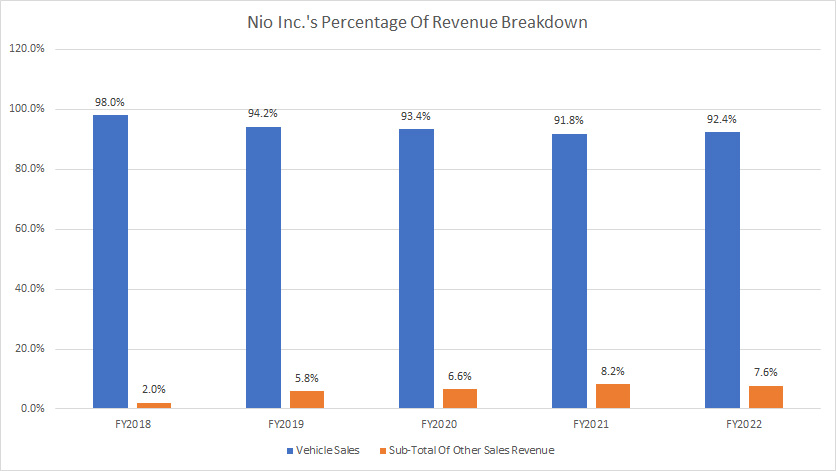

Nio’s Percentage Of Vehicle Sales And Other Revenues

Nio’s percentage of revenue by segment

(click image to enlarge)

From a percentage perspective, Nio’s vehicle sales represent more than 90% of the company’s total revenue and the ratio reached 92% as of 2022.

However, since 2018, the percentage of Nio’s vehicle sales has been on the decline and reached one of the new lows as of 2022.

On the other hand, the percentage of Nio’s other revenue sources grew to 7.6% as of 2022, one of the new highs since 2018.

The rising percentage of other revenue segments illustrates the growing importance of Nio’s other sales channels, particularly the battery and charging-related services.

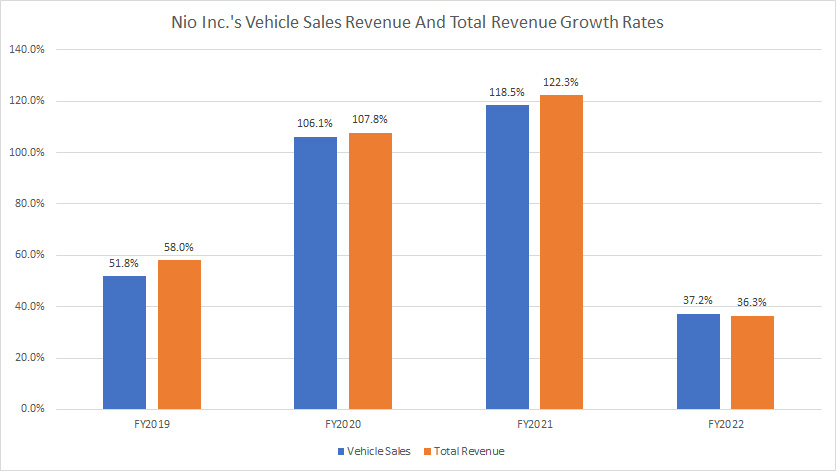

Nio’s Revenue Growth Rates

Nio revenue growth rates

(click image to enlarge)

Nio’s revenue grew the slowest in 2022 over the past 4 years.

As seen in the chart above, Nio’s revenue growth came in at only 36% in 2022 over 2021 while vehicle sales revenue rose 37% in the same period, also a record low since 2019.

Nio’s revenue growth seems to have peaked in 2021 after topping more than 100% for both vehicle sales and total revenue.

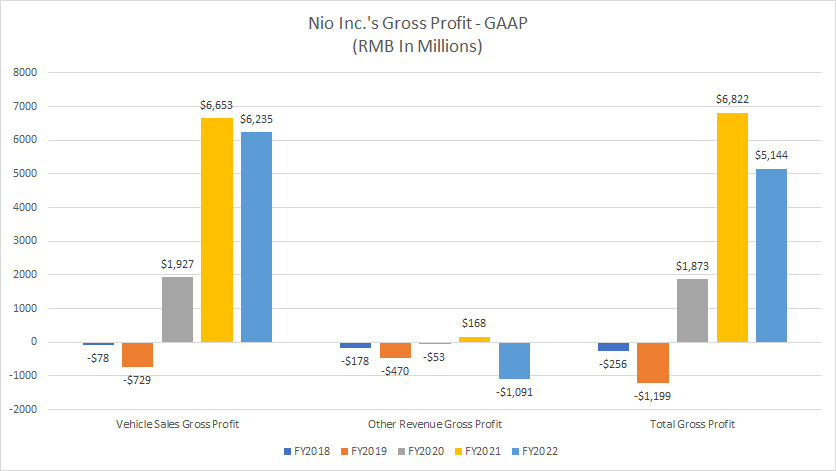

Nio’s Gross Profit

Nio gross and vehicle profit

(click image to enlarge)

Nio’s vehicle sales generate the largest profit for the company, topping RMB 6.2 billion (USD 0.9 billion) in gross profit in fiscal 2022.

This figure was slightly lower in 2022 over 2021, illustrating the declining profitability of the vehicle sales segment.

Also worth mentioning is that Nio only started to make a profit in 2020 and the profitability applied to only the vehicle sales segment.

For other revenue segments, Nio had been incurring losses and the loss in other segments rose to more than RMB 1 billion (USD 140 million) in 2022, the steepest figure the company has ever reported.

On a cumulative basis, Nio’s total gross profit came in at only RMB 5 billion (USD 700 million)as of 2022, down significantly from a year ago.

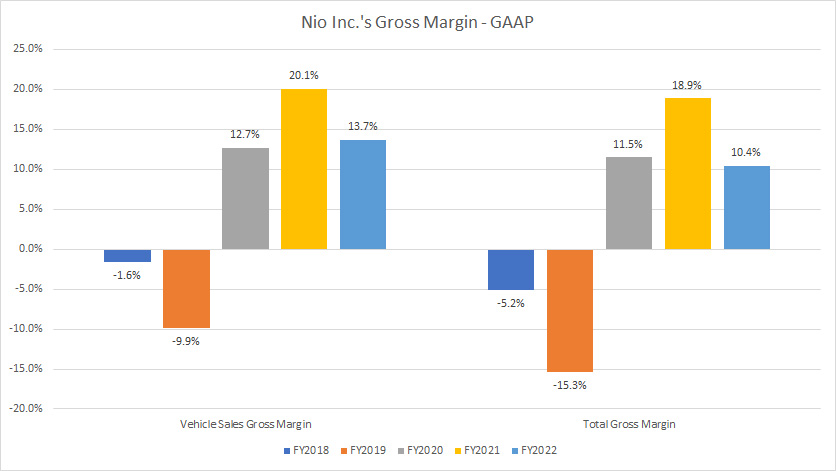

Nio’s Gross Margin

Nio gross and vehicle margin

(click image to enlarge)

From the perspective of margin, Nio’s vehicle sales gross margin topped 13.7% as of 2022, down significantly from the 20% reported in 2021.

On a cumulative basis, Nio’s total gross margin came in at 10.4% in 2022, also down significantly over 2021.

Nio’s lower gross margin in 2022 illustrates the company’s declining profitability compared to a year ago.

Again, Nio only started to make a profit in 2020 in vehicle sales as seen in the positive gross margin reported in the same year.

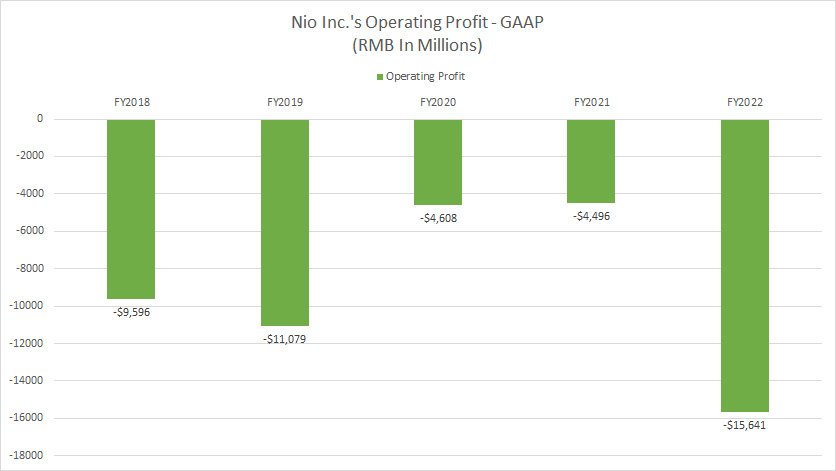

Nio’s Operating Profit

Nio operating profit

(click image to enlarge)

Nio’s operating profit had been in the negative values between 2018 and 2022 as shown in the chart above, illustrating the unprofitable nature of the company’s operations.

While Nio’s operating loss had narrowed significantly between 2020 and 2021, it got worse in 2022 and reached RMB -15.6 billion (US -2.2 billion), the largest operating loss the company had ever reported.

Since 2018, Nio has never made a profit from the perspective of operations.

Despite revenue surging to nearly RMB 50 billion in 2022, Nio was still unable to generate an operating profit.

Instead, Nio’s operating loss worsened to a record figure, illustrating the massive challenges and huge expenses that tend to exist for automotive companies like Nio which designs and develops its own products.

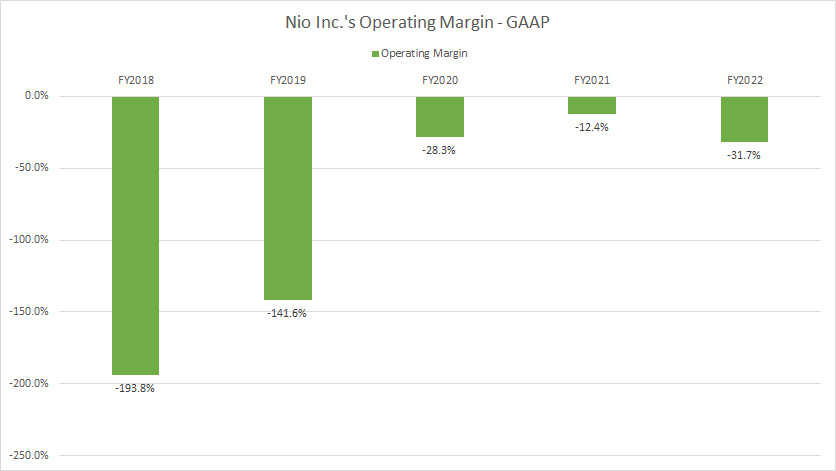

Nio’s Operating Margin

Nio operating margin

(click image to enlarge)

While Nio’s operating profit reached a record loss in 2022, its operating margin narrowed significantly to only -32% in the same fiscal year.

Since 2018, Nio’s operating margin had improved significantly.

Despite the remarkable improvement in operating margin, Nio’s figures were still negative, indicating that the company had been unprofitable and incurred massive operating losses all these years.

Conclusion

To recap, Nio’s revenue was at a record high of RMB 50 billion as of 2022.

Despite the record revenue and the revenue growth since 2018, Nio had not been able to generate positive operating profit and was only able to generate a gross margin that peaked at 19% in 2021.

As of 2022, Nio’s gross margin topped only 10% while vehicle margin came in at 14% in the same fiscal year.

The worse thing is that Nio guided for a dimmer outlook in 2023 where revenue will decline.

What do you think of Nio?

Please leave your comments below.

References and Credits

1. All financial figures in this article were obtained and referenced from Nio Inc.’s SEC filings, earnings reports, financial statements, etc, which are available in Nio’s Financial Filings.

2. Featured images in this article are used under creative commons licenses and sourced from Pixabay.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!