Maserati Granturismo. Pixabay image.

Maserati is an Italian luxury car manufacturer that produces high-performance sports cars and grand tourers. The company was founded in 1914 in Bologna, Italy, and has a long history of producing some of the world’s most iconic and sought-after vehicles.

Maserati’s cars are known for their distinctive style, advanced engineering, and powerful engines, making them a favorite among car enthusiasts and collectors alike.

This article presents Maseratis’ worldwide vehicle sales and vehicle sales by country and region. In addition to the sales numbers, we also explore the growth rates of Maserati’s global and regional sales.

Keep in mind that the sale figures presented are of retail basis. For a definition of how Stellantis measures its retail volume, you may find more information here: new vehicle sales.

Let’s take a look!

Investors looking for other sales statistics of Stellantis may find more resources on these pages:

- Stellantis global sales,

- Stellantis North America,

- Stellantis Europe,

- Stellantis South America,

- Stellantis China, India & Asia Pacific, and

- Stellantis Middle East & Africa

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why are Maserati’s sales on the decline globally?

Global

Global Sales Growth

A2. Growth Rates Of Global Vehicle Sales

Sales By Country And Region

B1. Vehicle Sales In The U.S., Europe, China, and Japan

B2. Percentage Of Vehicle Sales In The U.S., Europe, China, and Japan

Regional Sales Growth

B3. YoY Growth Rates Of Vehicle Sales By Country And Region

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants, manufactured by joint ventures and third-party contract manufacturers, and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis vehicle wholesale.

Why are Maserati’s sales on the decline globally?

Maserati’s global sales have been declining due to several key factors:

- Weak Brand Positioning: Stellantis CEO Carlos Tavares has repeatedly criticized Maserati’s marketing strategy, stating that the brand’s positioning is unclear and the storytelling is not effective. This has led to a diluted brand image, making it difficult for Maserati to stand out in the competitive luxury car market.

- Aggressive Dealer Discounting: Dealers, especially in China, have been offering significant discounts on Maserati models. This practice has tarnished the brand’s premium allure and has been a major factor in the sales decline.

- Reduced Model Lineup: Maserati has been working with a significantly reduced product portfolio. Three models ended production at the end of 2023, leaving the brand with fewer options to attract customers.

- Cost-Cutting Measures: Stellantis has implemented cost-cutting measures to refocus Maserati on profitability. While necessary, these measures have impacted the brand’s ability to innovate and attract customers.

- Competition: Maserati faces stiff competition from other luxury brands like Ferrari and Lamborghini, which have managed to maintain or even grow their sales. For instance, Ferrari delivered 13,752 vehicles in 2024, registering a slight growth of 0.7%, while Lamborghini sold 10,112 vehicles in 2023, marking an increase of 10%.

- Market-Specific Challenges: Maserati’s sales have declined significantly in key markets such as North America and Italy. In the United States, sales fell by 39%, while in Europe, the decline was 38%. Other European markets, such as Germany and the UK, also saw significant drops in sales.

- Production Issues: Maserati’s Italian factories have seen a dramatic reduction in production volumes. For example, the historic plant that used to produce models like the Ghibli, Quattroporte, and Levante now manufactures only GranTurismo and Grancabrio, with volumes dramatically reduced.

These factors combined have led to a significant decline in Maserati’s sales, with a 45% drop in 2024 compared to the previous year.

Global Vehicle Sales

Maserati-global-vehicle-sales

(click image to expand)

A definition of Maserati’s vehicle sales is available here: new vehicle sales.

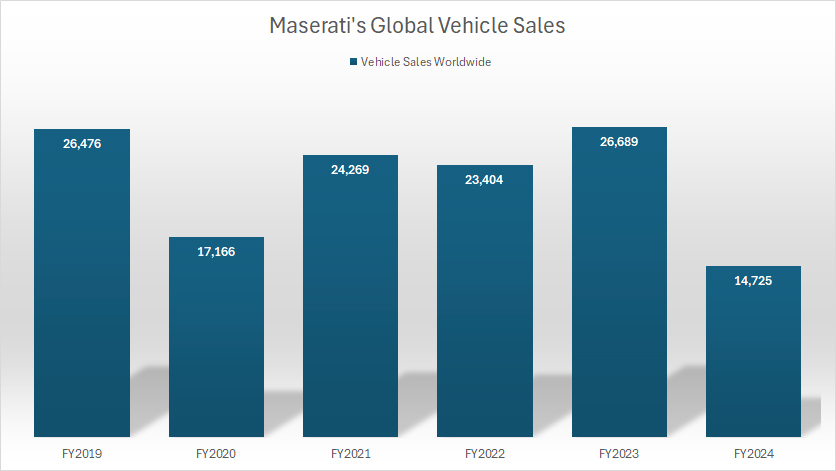

Maserati experienced a sharp decline in global vehicle sales, with figures falling to just 14,700 units in fiscal year 2024. This marked a significant decrease of more than 40% compared to the 26,700 vehicles sold in 2023. The drop not only underscores a dramatic shift in Maserati’s recent performance but also signifies one of the steepest year-over-year sales contractions in the company’s history.

From 2019 onwards, Maserati’s annual vehicle deliveries have shown a relative consistency, maintaining a baseline of at least 20,000 vehicles per year. This stability had given the brand a semblance of resilience, even in the face of fierce competition and evolving market dynamics. However, the sudden and unexpected plunge in 2024 disrupted this trend, setting a worrying precedent for the luxury automaker.

The 2024 sales performance represents a historic low for Maserati, raising critical questions about the effectiveness of its current strategies. Contributing factors such as an unclear brand positioning, reduced product lineup, aggressive dealer discounting practices, and intensified competition in the luxury automobile segment have compounded the challenges faced by the company.

This performance highlights the urgent need for Maserati to recalibrate its approach, from refining its marketing narrative to expanding its model offerings, in order to regain traction in a highly competitive market. Such an unprecedented sales dip underscores the gravity of Maserati’s current predicament.

Growth Rates Of Global Vehicle Sales

Maserati-global-vehicle-sales-growth-rates

(click image to expand)

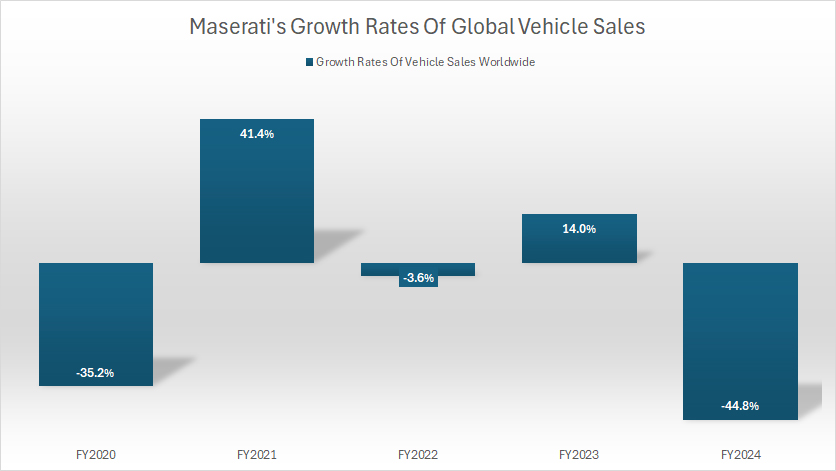

In fiscal year 2024, Maserati’s global sales growth plummeted to an unprecedented -44%, marking the steepest decline since 2019 and one of the worst performances in the brand’s recent history. This sharp downturn reflects a significant disruption in the company’s trajectory, as Maserati faced mounting challenges in maintaining its foothold in the luxury automobile market.

Between fiscal years 2022 and 2024, Maserati’s annual sales growth averaged -12%, highlighting a troubling trend of consistent decline. However, the dramatic -44% contraction in 2024 far exceeded the average downturn, signaling a culmination of underlying issues that had been gradually eroding the brand’s market position.

The steep decline in 2024 underscores the compounded impact of several critical factors, including unclear brand positioning, a reduced model lineup, aggressive dealer discounting practices, and heightened competition from rivals such as Ferrari, Lamborghini, and Porsche. Additionally, Maserati’s limited ability to innovate and expand its offerings in a rapidly evolving market has left the brand increasingly vulnerable.

The 2024 fiscal year serves as a stark reminder of the urgent need for Maserati to reassess its strategies. Without immediate and effective action to address these persistent challenges, the brand risks further eroding its presence in the competitive luxury automotive sector. This sharp contraction underscores the necessity for Maserati to evolve and adapt swiftly to market demands.

Vehicle Sales In The U.S., Europe, China, and Japan

Maserati-vehicle-sales-by-country-and-region

(click image to expand)

The definition of Stellantis’ vehicle sales is available here: new vehicle sales.

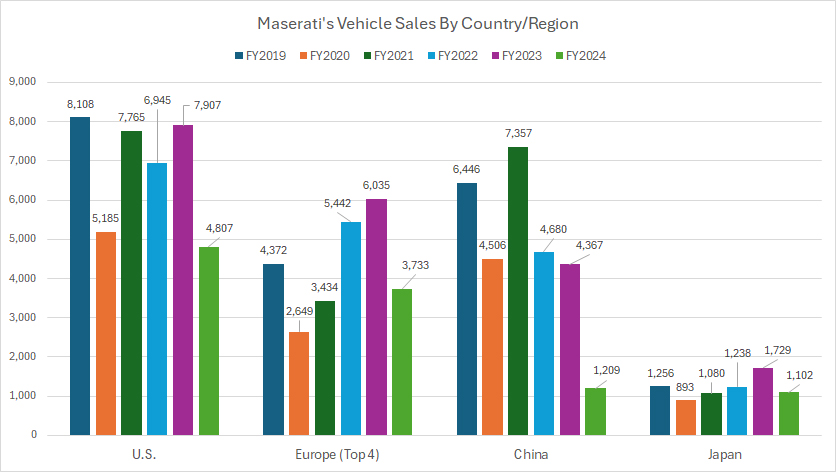

Maserati’s top four largest markets by sales volumes are the United States, Europe, China, and Japan, each representing critical regions for the brand’s global presence. However, 2024 marked a year of significant challenges across all these markets, culminating in one of the worst global sales results for Maserati in recent history.

- United States: The U.S. remains Maserati’s largest market by sales volume. However, the brand faced a substantial decline in new vehicle sales in 2024, delivering only 4,800 units — a sharp drop from the 7,900 units sold in 2023. Over the three-year period from 2022 to 2024, Maserati’s average annual sales in the U.S. amounted to approximately 6,500 vehicles. This declining trend reflects increased competition from luxury car brands and a weakening foothold in a historically strong market for Maserati.

- Europe: Europe ranks as Maserati’s second-largest market, but sales have been under pressure in recent years. On average, Maserati has sold around 5,000 vehicles annually in the region. In fiscal year 2024, sales in key European countries, including Italy, the United Kingdom, Germany, and Switzerland, totaled only 3,700 units — a stark contrast to the 6,000 vehicles sold in 2023. This represents a significant year-over-year decline and underscores the brand’s struggle to maintain its appeal among European luxury car buyers.

- China: China, Maserati’s third-largest market, has been a major area of concern. In fiscal year 2023, the company sold 4,400 vehicles in the region. However, over the past five years, Maserati’s sales in China have plunged dramatically — from 6,400 units in 2019 to just 1,200 units in 2024, marking an over 80% decrease over the period. The 2024 fiscal year was especially devastating, with sales falling by more than 70% compared to 2023. On average, Maserati sold 3,400 vehicles annually in China from 2022 to 2024, but the recent downturn reflects intensifying competition and challenges in the Chinese luxury market.

- Japan: Japan ranks as Maserati’s fourth-largest market by sales volumes, with retail sales averaging over 1,300 vehicles annually. Interestingly, Maserati’s sales in Japan had shown notable growth since 2019, climbing from 1,200 units that year to 1,700 units in 2023 — a rise of more than 40%. However, 2024 saw a significant reversal of this trend, with sales plummeting by 36% to just 1,100 units, marking one of the poorest results for Maserati in the Japanese market.

In Summary: Maserati’s performance in 2024 was marred by steep declines across all its major markets, culminating in the worst global sales results in the past five years. The sharp downturn in China was particularly catastrophic, with sales volumes almost obliterated. These challenges reflect not only regional difficulties but also broader issues in Maserati’s global strategy, including unclear brand positioning, a limited product lineup, and the inability to effectively compete in an increasingly dynamic luxury automotive market. Addressing these challenges will be critical for Maserati to restore its footing on the global stage.

Percentage Of Vehicle Sales In The U.S., Europe, China, and Japan

Maserati-vehicle-sales-by-country-and-region-in-percentage

(click image to expand)

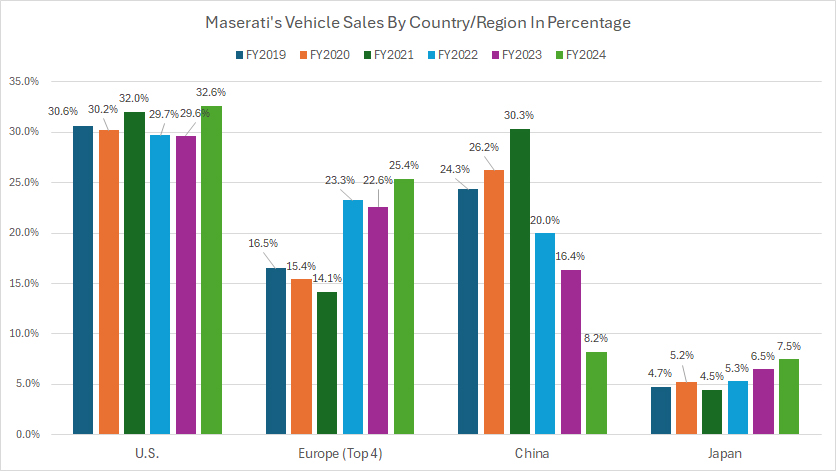

Maserati’s top four largest markets by sales volumes are the United States, Europe, China, and Japan, each representing critical regions for the brand’s global presence.

- United States: In fiscal year 2024, despite Maserati’s vehicle sales in the United States declining significantly, the U.S. market still represented 33% of the brand’s global sales volume. This was an increase from 30% in 2023, marking a surprising trend given the overall downturn in sales. Ironically, the U.S. share of global sales in 2024 was the highest in the last six years and among the top compared to other markets. This underscores that Maserati’s sales in the U.S. declined at a much slower pace relative to the sharp drops seen in other countries, highlighting the region’s relatively stronger resilience.

- Europe: Similarly, Maserati experienced an increase in its sales ratio in Europe, with the region accounting for 25% of the global volume in 2024. This was despite the absolute sales figures falling by nearly 40% year-over-year. The increased contribution from Europe can be attributed to steeper declines in other key markets, particularly China, which shifted the balance in favor of Europe in terms of sales distribution.

- China: China, historically a powerhouse market for Maserati, saw its sales contribution shrink dramatically in 2024. The country accounted for just 8% of Maserati’s global sales volume, a sharp decline from 16% in 2023. This represents a halving of its share and reflects a broader, long-term downward trend. At its peak, China contributed 30% to Maserati’s global volume, a figure that once rivaled the U.S. and far exceeded Europe. However, these levels are no longer the norm, as China’s luxury market has become increasingly challenging for Maserati to compete in.

- Japan: Japan, Maserati’s fourth-largest market, accounted for 7.5% of global sales in 2024, up slightly from 6.5% in 2023. Similar to the trends observed in the U.S. and Europe, Japan’s increased contribution to the global sales ratio contrasts with its declining absolute sales figures. In 2024, Japan’s sales volumes fell significantly; however, the decline was much slower compared to other markets, particularly China, which saw a severe contraction. This resilience in Japan, though modest, has helped the region maintain a steady presence in Maserati’s global distribution.

In summary, the U.S., Europe, and Japan are the only regions that experienced a relative increase in sales contribution in fiscal year 2024. This is in stark contrast to China, whose sales volumes and contribution to Maserati’s global figures have deteriorated significantly. These shifts reflect both the changing dynamics in Maserati’s key markets and the brand’s ongoing challenges in maintaining its position in the global luxury automotive sector.

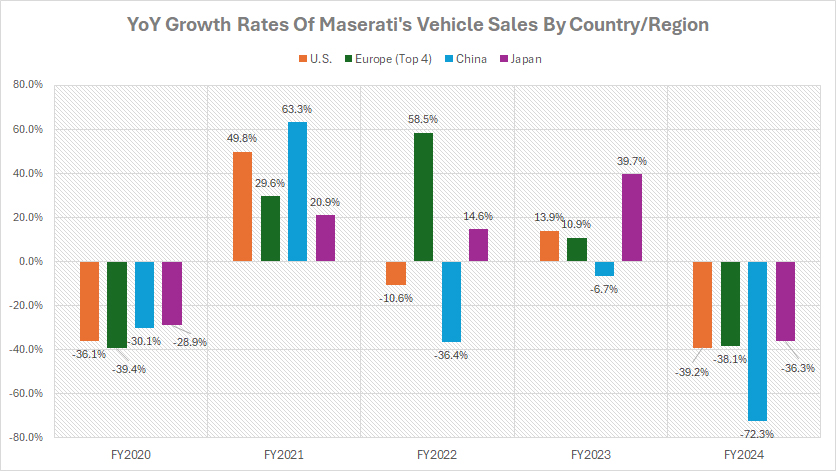

YoY Growth Rates Of Vehicle Sales By Country And Region

Maserati-growth-rates-of-vehicle-sales-by-country-and-region

(click image to expand)

Maserati’s top four largest markets by sales volumes are the United States, Europe, China, and Japan, each representing critical regions for the brand’s global presence.

Maserati faced an unprecedented downturn in fiscal year 2024, experiencing its worst sales growth in recent history, as highlighted in the accompanying chart. Sales across all countries fell by more than 30% year-over-year, a significant blow to the brand’s global presence. The decline was particularly severe in China, where vehicle sales tumbled by over 70%, marking a catastrophic year for Maserati in one of its historically strong markets.

This sharp decline stands in stark contrast to Maserati’s relatively modest but steady growth seen prior to 2024. For instance, in fiscal year 2023, Japan demonstrated remarkable momentum, with Maserati’s sales growth reaching nearly 40% year-over-year—the highest among its key markets. The United States also performed well, with sales growth of 14% during the same year, underscoring its continued importance as Maserati’s largest single market. Meanwhile, Europe saw an 11% year-over-year increase in vehicle sales, reflecting stable demand in key countries such as Italy, Germany, and the United Kingdom.

China, however, had already shown signs of slowing in 2023, with sales declining by 7% year-over-year. This drop, though modest compared to 2024, foreshadowed the deeper struggles Maserati would face in the region. Once a market where Maserati’s sales peaked at 30% of its global volume, China’s sharp contraction has highlighted the growing challenges in maintaining competitiveness in this critical region.

In summary, while Maserati achieved moderate growth in key markets like Japan, the U.S., and Europe in 2023, fiscal year 2024 marked a dramatic reversal. The brand’s global sales were heavily impacted, with China bearing the brunt of the collapse. This downward trend has underscored the need for Maserati to reassess its global strategies and address regional challenges to stabilize its market presence moving forward.

Conclusion

Maserati’s fiscal year 2024 results are a wake-up call for the brand to reassess its strategies. With China no longer a cornerstone of global sales, Maserati needs to double down on its core markets — such as the U.S. and Europe — while also modernizing its product lineup to better appeal to evolving consumer tastes. A clear and compelling brand narrative, combined with innovative models and competitive pricing, will be critical for Maserati to regain momentum and stabilize its global presence.

References and Credits

1. All financial figures presented were obtained and referenced from Stellantis’ quarterly and annual reports published on the company’s investor relations page: Stellantis Investor Relation.

2. Pixabay images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.