Meta’s Family Of Apps. Pixabay Image.

This article provides a breakdown of the revenue segments for Meta Platforms, Inc. (NASDAQ: META). Meta’s revenue segments consist of two primary divisions: Family of Apps and Reality Labs.

Let’s find out!

You may find related statistic of Meta Platforms, Inc., in the following pages:

Sales

Costs and Expenses

- Meta total costs and expenses breakdown: cost of sales and operating expense,

- Meta advertising expenditure analysis,

- Meta operating costs breakdown: R&D, marketing, and administrative,

Comparison With Peers

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Meta Business Strategy

O3. How Does Meta Earn Revenue

Insight & Summary of Observed Trends

Z1. Insight & Summary of Meta’s Revenue Breakdown By Segment

Segment Revenue Statistics

A1. Revenue Breakdown: FoA and RL

A2. Revenue Breakdown In Percentage: FoA and RL

A3. Revenue YoY Growth: FoA and RL

Reference, Credits, and Disclosure

S1. References and Credits

S2. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Family Of Apps: Meta’s Family of Apps (FoA) refers to the suite of social media and communication platforms owned by Meta Platforms (formerly Facebook Inc.).

This segment includes widely-used apps such as Facebook, Instagram, Messenger, WhatsApp, and Threads. These apps generate revenue primarily through advertising, connecting billions of users globally and offering various functionalities like photo and video sharing, messaging, and social networking.

Reality Labs: Meta’s Reality Labs (RL) is a division of Meta Platforms (formerly Facebook Inc.) focusing on developing virtual reality (VR) and augmented reality (AR) hardware and software.

Formerly known as Oculus VR, Reality Labs produces products like the Meta Quest VR headsets and the Ray-Ban Stories smart glasses. The division is also involved in research and development efforts aimed at advancing technologies related to the metaverse and artificial intelligence (AI).

Meta Business Strategy

Meta aims to invest based on its priorities, focusing on six key investment areas: AI, the metaverse, discovery engine, monetization of products and services, regulatory readiness, and enhancing developer efficiency.

The company’s AI investments support initiatives across its products and services, helping power the systems that rank content in its apps, recommending relevant content, developing new generative AI experiences, and enhancing developer productivity.

Most of Meta’s investments are directed toward developing its family of apps, with significant investments in its metaverse efforts, including developing virtual and augmented reality devices, software for social platforms, neural interfaces, and other foundational technologies.

Despite operating at a loss for the foreseeable future in the Reality Labs segment, Meta believes investing in the metaverse will unlock monetization opportunities for businesses, developers, and creators, including advertising, hardware, and digital goods.

How Does Meta Earn Revenue

Meta revenue streams

(click image to expand)

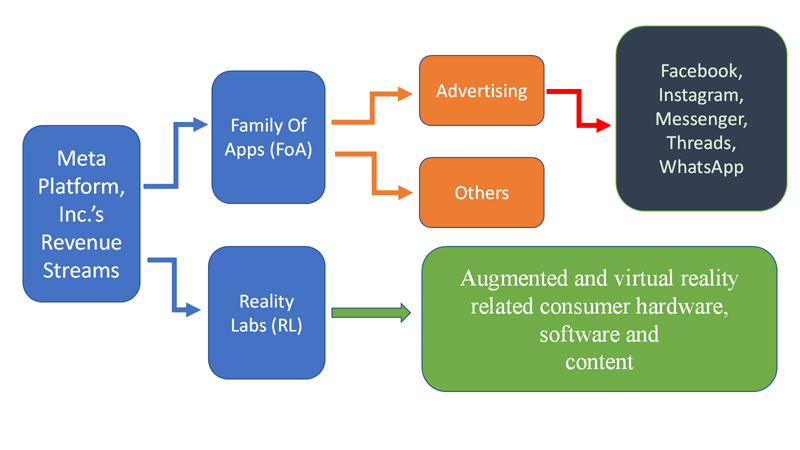

Meta Platforms, Inc.’s (META) revenue streams consist of two segments: Family Of Apps (FoA) and Reaility Labs (RL).

The definitions of Meta’s segments are available here: Family Of Apps and Reality Labs.

Meta’s Family of Apps generates revenue primarily from selling advertising placements to marketers. These marketers purchase ads that can appear across various platforms, including Facebook, Instagram, Messenger, Threads, and third-party applications and websites.

In contrast, Reality Labs reflects Meta’s efforts to develop the metaverse and derives its revenue from sales of consumer hardware products, software, and content.

These offerings encompass augmented and virtual reality-related consumer hardware, software, and content designed to help people stay connected anytime, anywhere.

The Meta Quest is a prime example of such products and services, enabling friends and families to stay connected and share meaningful moments through state-of-the-art VR hardware, software, and content.

With its advanced technology, Meta Quest offers an immersive experience that enhances communication and interaction, making it easier for users to connect and engage with loved ones in new and exciting ways.

Insight & Summary of Meta’s Revenue Breakdown By Segment

The following analysis consolidates the trends observed for Meta’s revenue by breakdown product segment, revenue mix, and YoY growth rates for the 2019–2025 period.

-

Throughout this timeframe, Meta has demonstrated robust long-term topline expansion, climbing from $70.70 billion in 2019 to $200.97 billion by 2025.

-

The fundamental driver of this growth remains the Family of Apps (FoA) segment, which consistently forms the bedrock of the company’s financial profile.

-

FoA revenues exhibited strong resilience; after a brief cyclical contraction in 2022 (-1.0% YoY), the segment sharply re-accelerated, delivering back-to-back growth exceeding 22% in 2024 and 2025.

-

Consequently, FoA continues to monopolize the revenue mix, structurally accounting for 98% to 99% of total revenue across all observed years.

-

Conversely, the Reality Labs (RL) segment has experienced high volatility and structural stagnation following an initial burst of hyper-growth (127.3% YoY in 2020 and 99.6% in 2021).

-

RL revenue peaked at $2.27 billion in 2021 and has essentially flatlined since, concluding 2025 at $2.21 billion with a muted 2.8% YoY growth rate.

-

As the core FoA business has scaled massively while Reality Labs has stalled, RL’s overall contribution to the revenue mix has steadily diluted from its peak of 1.9% in 2021/2022 down to just 1.1% by 2025.

-

This dynamic underscores that despite strategic investments in immersive technologies, Meta’s revenue engine remains overwhelmingly anchored to its advertising ecosystem.

The table below combines all key revenue metrics, revenue mix, and growth rates into a single view for the latest three fiscal years.

Consolidated Revenue by Segment 3-Year Averages (2023–2025)

| Metric | 3-Year Avg. Value |

|---|---|

| Revenue by Segment ($ Millions) | |

| Family Of Apps ($ Millions) | $164,706.33 |

| Reality Labs ($ Millions) | $2,083.00 |

| Total Revenue ($ Millions) | $166,789.33 |

| Revenue Mix (%) | |

| Family Of Apps Mix (%) | 98.73% |

| Reality Labs Mix (%) | 1.27% |

| YoY Growth Rates (%) | |

| Family Of Apps Growth (%) | 20.23% |

| Reality Labs Growth (%) | 1.27% |

| Total Revenue Growth (%) | 19.93% |

Revenue Breakdown: FoA and RL

Meta’s operating segments are made up of FoA and RL. The definitions of these segments is available here: Family Of Apps and Reality Labs.

Revenue by Segment 3-Year Averages (2023–2025)

| Metric | 3-Year Avg. Value |

|---|---|

| Family Of Apps ($ Millions) | $164,706.33 |

| Reality Labs ($ Millions) | $2,083.00 |

| Total Revenue ($ Millions) | $166,789.33 |

Revenue Breakdown In Percentage: FoA and RL

Meta’s operating segments are made up of FoA and RL. The definitions of these segments is available here: Family Of Apps and Reality Labs.

Revenue Mix 3-Year Averages (2023–2025)

| Metric | 3-Year Avg. Value |

|---|---|

| Family Of Apps Mix (%) | 98.73% |

| Reality Labs Mix (%) | 1.27% |

Revenue YoY Growth: FoA and RL

Meta’s operating segments are made up of FoA and RL. The definitions of these segments is available here: Family Of Apps and Reality Labs.

Revenue YoY Growth Rates 3-Year Averages (2023–2025)

| Metric | 3-Year Avg. Value |

|---|---|

| Family Of Apps Growth (%) | 20.23% |

| Reality Labs Growth (%) | 1.27% |

| Total Revenue Growth (%) | 19.93% |

References and Credits

1. Meta Platform, Inc., financial figures are obtained from the company’s annual reports published on the company’s investor relations page: Meta Investor Relations.

2. Pixabay Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.