The Public Islamic Opportunities Fund (PIOF) is a unit trust managed by Public Mutual Malaysia.

It is a moderately large fund with an estimated value exceeding MYR1 billion or US$222 million based on an exchange rate of USD1 to MYR4.5.

The PIOF primarily invests in Shariah-compliant equities traded on the Malaysian stock market.

The unit trust is suitable for investors looking for growth but can stomach the risk that comes with the volatility of the fund.

The Public Islamic Opportunities Fund’s unit price can fluctuate significantly in a short time.

In addition, it does not pay cash distributions on a consistent basis.

Therefore, investors seeking regular income may not find PIOF attractive, as distributions are incidental and subject to fund performance.

Apart from the irregular cash distribution, the fund mainly invests in small-cap companies. This makes the fund highly risky, as small-cap equities are usually volatile.

Although the PIOF’s primary objective is investing in small-cap companies, it may remain invested in counters which have moved above certain market capitalization range stated in the fund’s investment policy and strategy.

Let’s look at more details, starting with the table of contents below.

Enjoy!

Table Of Contents

Overview

A1. Fund Summary

Performance

B1. Annual Total Return

B2. Average Annual Return

B3. Capital And Income Growth

B4. Other Performance Data

Distribution And Income Received

C1. Cash Distribution And Unit Split

C2. Income And Yield

Asset Allocation

D1. Equity

D2. Non-Equity

D3. Total

Liquidity

Top Holdings

F1. Top 10 Equities – Malaysia

F2. Top 10 Equities – Foreign

Number Of Shares Held

G1. Malaysian Equities

G2. Foreign Equities

Correlation With Benchmark

H1. Unit Price Vs Benchmark

H2. Positive Correlation With Benchmark

H3. Negative Correlation With Benchmark

Conclusion And Reference

S1. Review Summary

– S11. Advantages

– S12. Disadvantages

S2. References and Credits

S3. Disclosure

Fund Summary

The following summary is obtained from the annual report for the financial year ended 31 July 2023, unless stated otherwise.

Category

Equity

Investment Objective

To achieve capital growth through investments in companies with small market capitalization which comply with Shariah principles.

Launch Date

28 Jun 2005

Distribution Policy

INCIDENTAL

Risk Level

Very High – 5 (on a scale of 1 – 5)

3-Year Volatility

High – 13.1 By Lipper Analytics (10 Sept 2023)

Size

MYR1.2 billion (USD333 million based on an exchange rate of USD1 = MYR4.5) as of 19 Sept 2023.

Shariah Compliant

Yes

Sales Charge

Up To 5%

Expenses

1.57% Of Fund NAV On Average From 2020 To 2023

Performance

Annual Total Return

Annual total return for the financial year ended 31 July.

| Years | PIOF Annualized Return (%) | Benchmark Return (%) |

|---|---|---|

| 2023 | 3.73 | 6.93 |

| 2022 | -15.31 | -7.34 |

| 2021 | 15.98 | 19.36 |

| 2020 | 51.91 | 1.17 |

| 2019 | -7.05 | -9.72 |

| 2018 | -4.29 | -17.47 |

The volatility of the unit trust is reflected in the performance table above.

As seen, the fund registered an exceptional return of 51.9% in 2020 but suffered a massive setback of -15.3% in 2022.

In fiscal 2023 (ended on 31 July), the PIOF registered a return of 3.73% and is lower than its benchmark’s return of 6.93%.

The fund’s Shariah-compliant equity portfolio contributed a return of +5.93% while its Islamic money market portfolio contributed a return of +2.83% for the period ended on 31 July 2023.

The PIOF had an 81.4% equity exposure and an 18.6% exposure in the money market portfolio for fiscal 2023. This produced an attributed return of 4.83% and 0.53% for the equity and money market, respectively.

Adjusted for an expense ratio of 1.62%, the total return of the unit trust topped +3.73% for the financial year ended on 31 July 2023.

In 2023, the PIOF’s technology stocks underperformed due to global interest rate concerns, resulting in the fund’s underperformance compared to the benchmark.

Average Annual Return

Average annual return for the following years ended 31 July 2022.

| Years | PIOF Average Return (%) | Benchmark Average Return (%) |

|---|---|---|

| 1 Year | -15.31 | -7.34 |

| 3 Years | 16.42 | 3.97 |

| 5 Years | 6.55 | -3.33 |

| 10 Years | 12.81 | 2.30 |

| Since Commencement | 27.52 | 7.40 |

Note that the fund’s fiscal 2023 performance and benchmark return data has not been updated in its PRODUCT HIGHLIGHTS SHEET. Therefore, we are using the 2022 performance data in this discussion.

The performance of the Public Islamic Opportunities Fund looks much better than its benchmark, particularly on a long-term basis.

For example, the PIOF registered an average annual return of 16.42%, 6.55%, and 12.81% in 3, 5, and 10 years ended on 31 July 2022, respectively.

These returns were much better than the benchmark’s returns.

Since commencement (12 July 2005), the unit trust’s performance was even better, at 27.52% compared to its benchmark’s return of only 7.4% on average.

Therefore, the longer you are invested in the PIOF, the better the return is.

Capital And Income Growth

Capital And Income Growth

| As at 31 July | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Capital Growth (%) | 0.24 | -16.21 | 15.43 | 50.97 |

| Income Growth (%) | 3.48 | 1.07 | 0.48 | 0.62 |

Another performance metric to keep an eye on for the unit trust is the capital and income growth of the fund.

The PIOF boasts decent capital growth, which averaged about 12.6% between fiscal 2020 and 2023, as presented in the table above.

However, the PIOF lacks income growth. On average, income payable to the fund has grown by only +1.4% over the past four years.

The poor performance of the income aspect of the fund is tolerable as the fund’s objective is to seek capital appreciation, not income.

Other Performance Data

Other performance data for the financial year ended 31 July.

Unit Prices (MYR) => prices quoted are ex-distribution

| As at 31 July | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Highest NAV per unit for the year | 0.5571 | 0.7140 | 0.6677 | 0.5741 |

| Lowest NAV per unit for the year | 0.4964 | 0.5022 | 0.5108 | 0.2623 |

Net Asset Value (NAV) and Units In Circulation (UIC) as at the end of the financial year

| As at 31 July | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total NAV (MYR’000) | 1,134,028 | 999,452 | 1,023,671 | 1,083,206 |

| UIC (in ’000) | 2,123,323 | 1,906,167 | 1,593,212 | 1,892,252 |

| NAV per unit (MYR) | 0.5341 | 0.5243 | 0.6425 | 0.5724 |

An important feature to look at when buying a unit trust such as the Public Islamic Opportunities Fund (PIOF) is to look at the size of the fund, ie. the NAV or net asset value of the fund.

On a long-term basis, the NAV of the fund should always be on the rise.

However, the PIOF has barely grown in terms of the NAV since 2020.

The NAV per unit may not be an accurate indicator of the performance of the fund due to cash distribution and/or unit split which can significantly affect the value of the NAV per unit.

The unit trust’s NAV has remained stagnant for four years, raising a red flag for investors.

The stagnant NAV may indicate poor fund performance, lack of interest from new investors, or fleeing of existing unit holders.

Total Expense Ratio

| As at 31 July | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total Expense Ratio (%) | 1.56 | 1.57 | 1.57 | 1.57 |

A lower ratio is preferable as it indicates lower expenses of the unit trust fund.

Portfolio Turnover Ratio

| As at 31 July | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Portfolio Turnover Ratio (time) | 0.10 | 0.14 | 0.25 | 0.25 |

A lower ratio is prefered as it indicates lower trading activities and thus, lower expenses and more money for unit holders.

Cash Distribution And Unit Split

| Declaration Date | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| 07-31 | 07-29 | 07-29 | 07-31 | |

| Net Distribution Per Unit (Cent In MYR) | 1.00 | 2.00 | 2.00 | – |

| Average Yield (%) | 1.8 – 2.0 | 2.8 – 4.0 | 3.0 – 3.9 | – |

| Distribution In Cash Amount (MYR In Millions) | 21.2 | 38.1 | 31.9 | – |

| Unit Split | – | – | – | – |

The Public Islamic Opportunities Fund (PIOF) has declared a cash distribution of 1.00 cent for fiscal year 2023, resulting in a yield of 1.8% to 2.0% depending on the purchase price of the unit trust.

The PIOF has declared cash distributions in 3 out of the 4 years between 2020 and 2023.

The cash distribution of 1 cent in fiscal 2023 was only half the amount declared in 2022.

The cash distribution yields for 2023 ranged from 1.8% to 2.0%, significantly lower than in 2022.

The unit trust has never initiated a unit split from 2020 to 2023.

Income And Yield

| As at 31 July (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Profit From Shariah‑Based Placements | 3,855 | 1,215 | 706 |

| Distribution Income | 2,103 | 1,896 | 2,109 |

| Dividend Income | 50,989 | 25,243 | 18,474 |

| Total Income | 56,947 | 28,354 | 21,289 |

| Average NAV | 1,066,740 | 1,011,562 | – |

| Average Yield % | 5.3 | 2.8 | – |

The table above shows the breakdown of income earned by the fund.

The Public Islamic Opportunities Fund (PIOF) earned income from various streams such as profit from Shariah‑based placements, distribution income, and dividend income.

The PIOF earned a total income of MYR57 million in 2023 compared to a total income of MYR28 million in 2022, representing year-on-year growth of 104%.

The average income yield for the financial year 2023 reached 5.3%, and was nearly double the yield in 2022.

This yield is relatively good in my opinion, considering that the primary objective of fund is about seeking long-term capital appreciation and not income.

The earned income can potentially cover expenses and contribute to the distributions for the investors.

Equity

| As at 31 July (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Malaysia | ||||

| Basic Materials | 0.2 | 0.3 | 0.3 | 0.4 |

| Communications | 4.2 | 5.1 | 6.6 | 4.6 |

| Consumer Cyclical | 4.9 | 5.1 | 1.7 | 1.8 |

| Consumer Non-Cyclical | 5.4 | 3.7 | 2.4 | 2.7 |

| Energy | 3.5 | – | – | 1.4 |

| Financial | 6.0 | 4.5 | 3.2 | 3.9 |

| Industrial | 34.1 | 39.7 | 39.3 | 50.2 |

| Technology | 14.9 | 16.7 | 20.7 | 9.6 |

| TOTAL MALAYSIA | 73.2 | 75.1 | 74.2 | 74.6 |

| Japan | ||||

| Industrial | 4.1 | 0.7 | 2.2 | 1.1 |

| Korea | ||||

| Basic Materials | – | – | – | 0.4 |

| Industrial | 2.3 | 2.0 | 1.7 | – |

| Technology | 1.4 | – | 1.4 | – |

| Sub Total | 3.7 | 2.0 | 3.1 | 0.4 |

| Singapore | ||||

| Industrial | – | – | – | 5.6 |

| Taiwan | ||||

| Industrial | – | 2.8 | 4.4 | 2.6 |

| Technology | 0.2 | 0.1 | 2.2 | 3.5 |

| Sub Total | 0.2 | 2.9 | 6.6 | 6.1 |

| United States | ||||

| Consumer Non-Cyclical | – | – | – | 1.7 |

| Technology | 2.8 | 1.7 | 7.9 | 2.8 |

| Sub Total | 2.8 | 1.7 | 7.0 | 4.5 |

| TOTAL FOREIGN | 10.8 | 7.3 | 19.8 | 17.7 |

| TOTAL EQUITY | 84.0 | 82.4 | 94.0 | 92.3 |

The Public Islamic Opportunities Fund (PIOF)’s equity portfolio primarily consists of Malaysian stocks, totaling 73.2% of NAV as of the end of the financial year 2023.

This ratio has remained roughly the same between 2020 and 2023.

On the other hand, the PIOF’s foreign equity made up 10.8% of NAV as of 2023, up 3 percentage points over 2022 but down significantly over 2021.

The industrial sector contributed 34% to the unit trust’s NAV, making it the largest holding in Malaysia’s portfolio.

The technology sector came in at 14.9% of NAV as of 2022, the second biggest holding after the industrial sector within the fund.

These 2 sectors alone made up nearly 50% of PIOF’s NAV as of 2023. However, this ratio was down significantly compared to 2020.

It’s possible that the fund manager had a less optimistic view of the industrial sector in Malaysia.

Of all sectors in the fund, the Consumer Cyclical and Consumer Non-Cyclical saw the biggest percentage growth between 2020 and 2023.

On the other hand, the PIOF’s technology holding was down considerably since 2021.

Despite considerable rebalancing activities, the NAV percentage for Malaysian equities remained relatively stable between 2020 and 2022.

The PIOF’s foreign equity holding fell to only 10.8% of NAV as of 2023 compared to 2020, down nearly half in just 4 years.

The biggest decline was Taiwan equity; the fund had nearly exited this country as of 2023.

Non-Equity

| As at 31 July (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Collective Investment Funds – Malaysia | 3.7 | 3.4 | 3.3 | 3.9 |

| Warrants – Malaysia | 0.5 | 0.7 | 0.6 | – |

| Shariah-Based Placements With Financial Institutions | 10.0 | 9.4 | 3.9 | 3.7 |

| TOTAL NON-EQUITY | 14.2 | 13.5 | 7.8 | 7.6 |

| Other Assets & Liabilities | 1.8 | 4.1 | -1.8 | 0.1 |

The Public Islamic Opportunities Fund (PIOF)’s non-equity portfolio had signficantly grown and reached as much as 14.2% of NAV as of 2023, more than double the figure in 2020.

The most significant growth in non-equity portfolio was the Shariah-Based placements with financial institutions.

The percentage of NAV for Shariah-Based placements with financial institutions had increased from 3.7% to 10.0% between 2020 and 2023.

It is possible that the fund manager had a less favorable view of the equity market; the equity portfolio had decreased from 92.3% of NAV in 2020 to only 84% of NAV as of 2023.

Asset Allocation – Total

Change In Portfolio Exposures

| As at 31 July | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Investment Type | |||

| Shariah-Compliant Equity And Equity-Related Securities | 86.6 | 83.3 | 95.0 |

| Islamic Money Market | 13.4 | 16.7 | 5.0 |

Adjusted for other assets and liabilities, the Public Islamic Opportunities Fund (PIOF)’s equity portfolio had an exposure of 86.6% as of the end of the financial year 2023 while the exposure of the Islamic money market reached 13.4% for the same period.

The PIOF’s equity exposure has declined from as much as 95% in 2021 to the latest ratio of 86.6%.

On the other hand, the fund’s money market exposure has increased from 5% in 2021 to 13.4% as of 2023.

Therefore, the PIOF had a significantly higher amount of cash in 2023 compared to two years ago.

Again, the increase in cash position may imply a less favorable equity market.

Cash And Deposits

| As at 31 July (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Deposits And Cash | |||

| Shariah‑Based Placements With Financial Institutions | 112,908 | 93,590 | 40,157 |

| Cash At Banks | 44,936 | 83,718 | 16,174 |

| Total Deposit And Cash | 157,844 | 177,308 | 56,331 |

| Total Net Assets | |||

| Net Asset Value (“NAV”) | 1,134,028 | 999,452 | 1,023,671 |

| Ratio Of Liquid Assets To NAV (%) | 13.9 | 17.7 | 5.5 |

The PIOF’s liquid assets primarily consist of deposits and cash at bank.

Total deposits and cash reached MYR158 million as of 2023, a decrease of 11% over 2022 but a rise of 182% over 2021.

With respect to NAV, the ratio came in at 13.9% as of 2023 compared to 17.7% and 5.5% in 2022 and 2021, respectively.

Therefore, there has been a significant rise in liquidity within the Public Islamic Opportunities Fund in the past 3 years.

Again, the fund manager may not have been very optimistic about equity.

Top 10 Equities – Malaysia

| As at 31 July 2023 | ||||

|---|---|---|---|---|

| Average Purchased Price (MYR) | Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | |||

| Frontken Corporation Berhad | Industrial | 0.64 | 87,761 | 7.7 |

| Uchi Technologies Berhad | Industrial | 1.49 | 62,887 | 5.5 |

| Inari Amertron Berhad | Technology | 0.79 | 57,694 | 5.1 |

| D&O Green Technologies Berhad | Technology | 3.18 | 49,222 | 4.3 |

| Kelington Group Berhad | Industrial | 0.66 | 43,543 | 3.8 |

| SAM Engineering & Equipment (M) Berhad | Industrial | 3.24 | 34,368 | 3.0 |

| MBM Resources Berhad | Consumer Cyclical | 3.13 | 33,732 | 3.0 |

| V.S. Industry Berhad | Industrial | 0.54 | 32,576 | 2.9 |

| Globetronics Technology Berhad | Technology | 1.85 | 32,400 | 2.8 |

| TIME dotCom Berhad | Communications | 0.55 | 29,864 | 2.6 |

| Total | – | – | 464,047 | 40.7 |

All Malaysian equities held by The Public Islamic Opportunities Fund (PIOF) are traded on the Kuala Lumpur Stock Exchange.

That said, Frontken Corporation Berhad, an engineering firm that services the semiconductor industry, topped the chart at 7.7% of NAV or MYR88 million as of 2023.

At 5.5% of NAV or MYR63 million, Uchi Technologies Berhad, also an engineering firm, claimed the 2nd spot as one of the largest positions within the unit trust fund.

Inari Amertron Berhad, a manufacturer of electrical and electronic components, was ranked 3rd place as of 2023 with 5.1% of NAV or MYR58 million.

Of all the top 10 equities within the PIOF, 5 are from the industrial sector while 3 are from the technology sector.

On a cumulative basis, all top 10 Malaysian equities in the fund contributed 41% of NAV or MYR464 million as of 2023.

The top 10 equity composition is concentrated on the industrial and technology sectors and is in line with what we saw in the prior discussion.

Another trend worth mentioning is that the top 10 equity holdings in the unit trust are small capitalization companies which the fund has held for quite some time.

In addition, you can find out from the average purchased price located in the table above and most of the stocks have been winning counters as of Oct 2023.

Some of the stocks have gone up several times their average purchased price as of Oct 2023.

While the portfolio capitalizes on the growth of small capitalization companies, the unit trust fund will likely depend on the growth of the Malaysian economy and more specifically, the growth of the export sector.

Therefore, if the growth of the Malaysian economy comes to a standstill, especially in the export sector, the Public Islamic Opportunities Fund (PIOF) will likely be negatively impacted.

All in all, the Public Islamic Opportunities Fund (PIOF) captures primarily on the growth of the technology and industrial sectors in Malaysia as most counters within these sectors are engineering firms and manufacturers that not only service but also supply products to local as well as oversea markets.

Top 10 Equities – Foreign

| As at 31 July 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | ||

| Fujimi Incorporated (Japan) | Industrial | 27,720 | 2.4 |

| Daejoo Electronic Materials Co., Ltd (Korea) | Industrial | 25,594 | 2.3 |

| Ambarella, Inc (U.S) | Technology | 16,891 | 1.5 |

| LEENO Industrial Inc (Korea) | Industrial | 15,922 | 1.4 |

| Marvell Technology, Inc (U.S.) | Technology | 14,738 | 1.3 |

| Toyo Tanso Co., Ltd (Japan) | Industrial | 13,806 | 1.2 |

| Jeol Ltd (Japan) | Industrial | 5,265 | 0.5 |

| Visual Photonics Epitaxy Co., Ltd (Taiwan) | Technology | 1,824 | 0.2 |

| Boshiwa International Holding Ltd (HK) | Consumer Cyclical | – | – |

| TOTAL EQUITY – FOREIGN | – | 121,760 | 10.8 |

The Public Islamic Opportunities Fund (PIOF) held only 9 foreign equities as of 31 July 2023.

The majority of foreign equities are from the Industrial sector and are traded on Japan.

At the top of the chart, Fujimi Incorporated from the Japan. comprised 2.4% NAV or MYR28 million as of 31 July 2023, making it the largest foreign equity holding in the fund.

Daejoo Electronic from Korea took the 2nd spot at 2.3% NAV or MYR26 million.

Ambarella from the U.S. claimed the 3rd place at 1.5% NAV or MYR17 million.

At the bottom of the chart is Boshiwa International Holding Ltd which has gone bankrupt and has been delisted from the Hong Kong Stock Exchange in 2020.

All foreign equities held by the unit trust fund comprised 10.8% of NAV or MYR122 million as of 2023.

Therefore, the foreign equity position within the PIOF was small and was concentrated mainly in the Industrial sector, similar to the Malaysian equity portfolio which was also concentrated in the same sector.

In short, the Public Islamic Opportunities Fund (PIOF) was moderately exposed to foreign equity as of 2023.

Malaysian Equities

| Number Of Shares Held As At 31 July (In ‘000) | ||

|---|---|---|

| 2023 | 2022 | |

| Basic Materials | ||

| NTPM Holdings | 6,343 | 6,843 |

| Communications | ||

| GHL Systems | 22,106 | 22,106 |

| TIME dotCom | 5,561 | 5,561 |

| Consumer, Cyclical | ||

| AEON Co. (M) Bhd | 10,731 | 10,731 |

| MBM Resources | 9,749 | 8,853 |

| Padini Holdings | 2,271 | 2,271 |

| Consumer, Non-Cyclical | ||

| Apex Healthcare | 7,271 | 4,848 |

| Kawan Food | 2,654 | 779 |

| KPJ Healthcare | 14,039 | 14,039 |

| TSH Resources | 21,395 | 8,495 |

| Energy | ||

| Dayang Enterprise | 19,312 | – |

| Hibiscus Petroleum | 13,600 | – |

| Financial | ||

| Eco World Development | 6,977 | 3,144 |

| Lagenda Properties | 11,076 | 8,713 |

| RCE Capital | 9,711 | 4,256 |

| Syarikat Takaful Malaysia | 7,673 | 7,673 |

| Industrial | ||

| AME Elite Consortium | 16,658 | 16,658 |

| Frontken Corporation | 27,087 | 27,087 |

| Kelington Group | 30,238 | 29,138 |

| Lingkaran Trans Kota | 1,002 | 1,002 |

| Magni-Tech Industries | 5,709 | 5,273 |

| SAM Engineering & Equipment (M) | 6,874 | 6,874 |

| SCGM Bhd | – | 7,224 |

| Scientex Packaging (Ayer Keroh) | 13,256 | 13,256 |

| SKP Resources | 22,341 | 21,963 |

| Sunway Construction | 1,602 | 1,602 |

| Supercomnet Technologies | 8,858 | 7,523 |

| Thong Guan Industries | 7,088 | 7,088 |

| Uchi Technologies | 18,281 | 18,281 |

| UWC Berhad | 3,154 | 3,154 |

| V.S. Industry | 36,398 | 36,398 |

| Technology | ||

| D & O Green Technologies | 12,525 | 12,525 |

| Dufu Technology Corp. | 9,896 | 9,896 |

| Genetec Technology | 410 | – |

| Globetronics Technology | 22,500 | 16,450 |

| Inari Amertron | 19,104 | 19,104 |

| KESM Industries | 1,347 | 1,347 |

The table above tracks the numbers of shares held of Malaysian equities within the PIOF.

The numbers of shares held for most Malaysian equities in the fund have remained nearly the same between 2022 and 2023.

The PIOF acquired 19.3 million shares of Dayang Enterprise and 12.6 million shares of Hibiscus Petroleum to establish new positions in the energy sector in 2023.

Apart from that, the fund also had significantly increased its positions in the financial sector.

For example, numbers of shares held in Eco World Development and RCE Capital have more than doubled since 2022.

The PIOF totally exited its position in SCGM Berhad as of 2023.

In the technology sector, the unit trust initiated a new position in Genetec Technology in 2023 by acquiring 410,000 shares and further acquired 6 million shares in Globetronics Technology in the same year.

Foreign Equities

| Number Of Shares Held As At 31 July (In ‘000) | ||

|---|---|---|

| 2023 | 2022 | |

| Consumer, Cyclical | ||

| Boshiwa International Holding Ltd (HK) | 1,898 | 1,898 |

| Industrial | ||

| Fujimi Incorporated (Japan) | 254 | – |

| Jeol Ltd (Japan) | 34 | 34 |

| Toyo Tanso Co., Ltd (Japan) | 77 | – |

| Daejoo Electronic Materials Co., Ltd (Korea) | 72 | 32 |

| LEENO Industrial Inc (Korea) | 27 | 27 |

| Gold Circuit Electronics Ltd (Taiwan) | – | 430 |

| LOTES Co., Ltd (Taiwan) | – | 62 |

| Speed Tech Corp (Taiwan) | – | 734 |

| TXC Corporation (Taiwan) | – | 769 |

| Technology | ||

| Ambarella, Inc (U.S) | 45 | – |

| Marvell Technology, Inc (U.S.) | 50 | 68 |

| Visual Photonics Epitaxy Co., Ltd (Taiwan) | 96 | – |

The table above tracks the numbers of shares held of foreign equities within the PIOF.

The most significant change in foreign equities between 2022 and 2023 was that the fund completely divested from its Taiwanese equity holdings within the industrial sector.

Unit Price Vs Benchmark

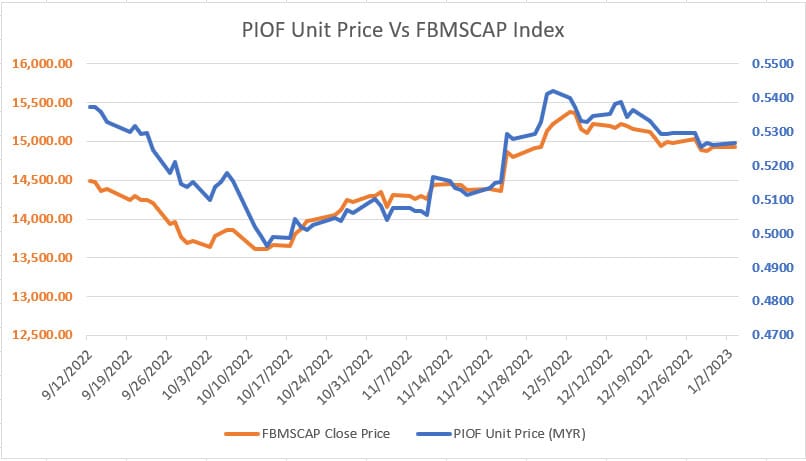

PIOF Unit Price Vs FBMSCAP Index

(click image to expand)

The FTSE Bursa Malaysia Small Cap Shariah Index (FBMSCSM) is the selected Benchmark for the Public Islamic Opportunities Fund (PIOF).

Constituents are screened according to the Malaysian Securities Commission’s Shariah Advisory Council (SAC) screening methodology.

That being said, this correlation was performed back in 2022 over 3 months.

The results above show that the unit price of the PIOF tracks closely the volatility of the FBMSCSM index.

Positive Correlation With Benchmark

Positive Correlation

| Positive Changes | |||

|---|---|---|---|

| FBMSCSM Index Changes | PIOF Unit Price Changes In MYR | Rise Ratio | |

| Date | |||

| 01/03/2022 | 8.68000 | 0.0006 | 0.000069 |

| 12/30/2022 | 42.21000 | -0.0007 | -0.000017 |

| 12/27/2022 | 43.76000 | 0.0000 | 0.000000 |

| 12/22/2022 | 58.69000 | -0.0002 | -0.000003 |

| 12/14/2022 | 51.14000 | 0.0007 | 0.000014 |

| 12/09/2022 | 123.94000 | 0.0016 | 0.000013 |

| 12/05/2022 | 151.92000 | -0.0020 | -0.000013 |

| Average | – | – | 0.000023 |

The table above shows the correlation between the FBMSCSM index and the PIOF unit prices in a positive direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000023.

At this ratio, a 1-point index increment in the FBMSCSM index will result in an MYR0.000023 increase in the PIOF unit price.

For a 100-point index increment, the PIOF unit trust fund will increase by MYR0.0023 or MYR0.23 cents on average.

Negative Correlation With Benchmark

Negative Correlation

| Negative Correlation | |||

|---|---|---|---|

| FBMSCSM Index Changes | PIOF Unit Price Changes In MYR | Fall Ratio | |

| Date | |||

| 12/29/2022 | -12.21000 | 0.0013 | -0.000106 |

| 12/28/2022 | -134.84000 | -0.0042 | 0.000031 |

| 12/23/2022 | -11.44000 | 0.0005 | -0.000044 |

| 12/21/2022 | -109.33000 | -0.0021 | 0.000019 |

| 12/20/2022 | -73.28000 | -0.0018 | 0.000025 |

| 12/19/2022 | -38.21000 | -0.0030 | 0.000079 |

| 12/16/2022 | -42.14000 | 0.0019 | -0.000045 |

| Average | – | – | 0.000011 |

The table above shows the correlation between the FBMSCSM index and PIOF unit prices in a negative direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000011.

The average ratio indicates that when the FBMSCSM index falls by 1 index point, the PIOF unit price will fall by about MYR0.000011 on average.

From a 100-point perspective, the PIOF unit price will fall by about MYR0.0011 or MYR0.11 cents on average.

The Public Islamic Opportunities Fund (PIOF) unit price is more sensitive to an index rise than an index drop.

As the FBMSCSM index moves, the PIOF unit trust will rise faster than it drops.

This trend is good for the unit trust as it will be more resilient and less volatile in market downturns.

Review Summary

Advantages (Results Were Up To 31 July 2023, unless stated otherwise)

1. The Public Islamic Opportunities Fund (PIOF) capitalizes on the growth of small-cap companies which can offer investors exceptional returns.

2. For 3 years ended on 31 July 2022, the PIOF returned an average of 16.42% per annum while the 5-year return for the same period totaled 6.55% per annum on average. The 10-year return was even better, at 12.81% per annum on average.

3. Since commencement in 2005, the PIOF returned an average of 27.52% per annum on average for the period ended on 31 July 2022. And it beats its benchmark by a large margin.

4. Although the fund does not intend to provide income consistently, it does declare a cash distribution incidentally. More importantly, the yield was quite good in the past as seen in one of the tables above.

Disadvantages (Results Were Up To 31 July 2023, unless stated otherwise)

1. The fund is concentrated on the Malaysian equity market with a NAV ratio of 73.2% as of 2023 while foreign equity made up only 10.8% of NAV. Therefore, the fund had minimal foreign equity exposure as of 2023.

2. If the growth of the Malaysian economy comes to a standstill, the PIOF will most likely be negatively impacted.

3. The unit trust does not distribute cash dividends on a regular basis. For example, it failed to declare a cash distribution in 2020.

4. The NAV of the PIOF has remained stagnant since 2020, possibly due to poor performance, excess payment of cash distribution, lack of interest from new investors, and the exit of existing unit holders.

References and Credits

1. All financial information in this article was obtained and referenced from the following links:

a) Public Mutual Unit Trust Fund

b) FBMSCAP index

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor advice to purchase a security. The Public Islamic Opportunities Fund (PIOF) is not in any way sponsored, endorsed, sold, or promoted by StockDividendScreener.com.

Therefore, StockDividendScreener.com shall not be liable (whether in negligence or otherwise) to any person for any error in this article.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!