Jack In The Box’s store. Source: Flickr Image

Jack In The Box (NASDAQ:JACK) has only started paying cash dividends since fiscal 2014.

The company pays cash dividends on a quarterly basis.

Therefore, Jack In The Box’s common stock shareholders will receive the cash dividend payment on a quarterly basis.

Since fiscal 2014, Jack In The Box has suspended its cash dividend only once and it was in fiscal 2020 Q3 when the COVID-19 crisis hit.

Although the dividend was suspended in 3Q 2020, Jack In The Box resumed the dividend payments in the following quarter as soon as the company found it unnecessary to suspend the dividends given the high earnings power and the free cash flow being generated during the COVID periods.

Therefore, Jack In The Box’s dividend payments was only minimally impacted in 2020.

At the same time, the company also resumed the stock buyback in fiscal 2021 2Q after being suspended for 4 consecutive quarters starting in fiscal 2020.

In this article, we will find out why Jack In The Box is still a good and pretty much safe dividend stock.

Let’s start out with the following topics!

Jack In The Box Cash Dividend Topics

Factors That Support The Dividend

A1. Acquisition Of Del Taco

A2. Rising Revenue And Profitability

A3. A Highly Profitable Company

A4. Impressive Same-Store Sales

A5. Reliable Dividend Payments

A6. Strong Capital Returns

A7. Solid Cash Flow

Factors That Do Not Support The Dividend

B1. High Debt Levels But Low On Cash

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Jack In The Box’s Del Taco Acquisition

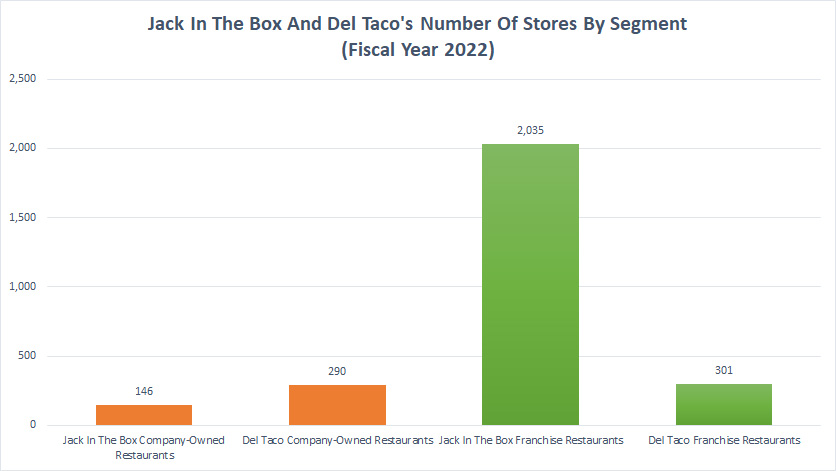

Jack In The Box and Del Taco number of stores (click image to enlarge)

For your information, Jack In The Box acquired Del Taco, a fast-food restaurant chain specializing in Mexican cuisine, and the deal was completed in 2Q 2022.

Since then, Jack In The Box has added roughly 600 more stores from Del Taco which comprise an almost equal number of company-owned and franchise restaurants as shown in the chart above.

The acquisition of Del Taco represents an opportunity for Jack In The Box to significantly boost its future profitability and cash flow, and thereby your cash dividends.

As seen in the chart above, the majority of Del Taco’s restaurants are company-owned and operated.

In this aspect, Del Taco’s numbers are more than double that of Jack In The Box, notably at 290 stores as opposed to only 146 stores for Jack In The Box.

In the future, these stores are expected to be steadily converted to franchise restaurants under the company’s re-franchising strategy as stated in the annual reports.

The ratio could be 90% or more for franchise restaurants and 10% or less for company-owned restaurants based on the existing results shown in this article – Jack In The Box Total Stores.

Jack In The Box intends to run an asset-light operation by having these company-operated stores to be fully converted into franchise restaurants.

Franchise restaurants are more profitable operations compared to company-operated stores as the earnings and cash flow provided by franchisees are not only recurring but also predictable to the parent company.

Also, franchise restaurants’ gross margin is more than twice the number of company-owned restaurants while operating margin is more than 3X higher as shown in this article – Jack In The Box Profit And Margin By Segment.

Therefore, by having Del Taco’s company-owned stores slowly re-franchised to more profitable operations, Jack In The Box could significantly boost its earnings and cash flow, and of course the steady stream of dividend income to stockholders.

Jack In The Box Rising Revenue And Profitability

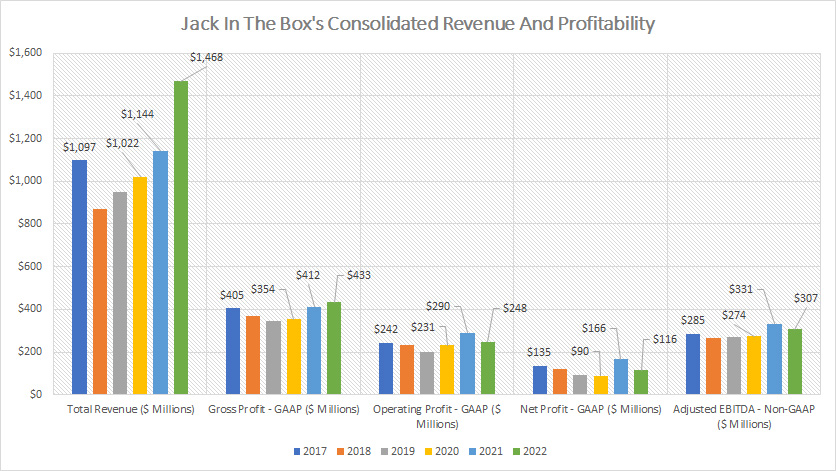

Jack In The Box consolidated revenue and profit (click image to enlarge)

Jack In The Box’s rising revenue and profitability also help to provide a safe and stable dividend income to shareholders.

As seen in the chart above, Jack In The Box’s revenue has been on a steady rise and reached a record high of $1.5 billion as of 2022.

Similarly, most of Jack In The Box’s profitability metrics also have been on the rise and soared to one of the new highs as of 2022.

More importantly, Jack In The Box not only has been profitable but also has been able to make a consistent profit in the past 6 years, irrespective of what has happened around the world.

For example, Jack In The Box managed to produce consistent, if not growing, revenue and profits even during the height of the COVID-19 crisis which occurred between 2020 and 2021.

Moreover, Jack In The Box’s revenue and profits in fiscal 20222 also came in reasonably well despite having one of the toughest years around when labor and raw material costs hit record highs.

Therefore, Jack In The Box is running not only a durable but also a thriving business, all thanks to the re-franchising strategy which helps to provide a steady and stable income stream to the company, no matter what is going on around.

In short, Jack In The Box’s rising and stable revenue and profitability makes the case for a strong and safe dividend extremely compelling.

Jack In The Box Runs A Highly Profitable Operation

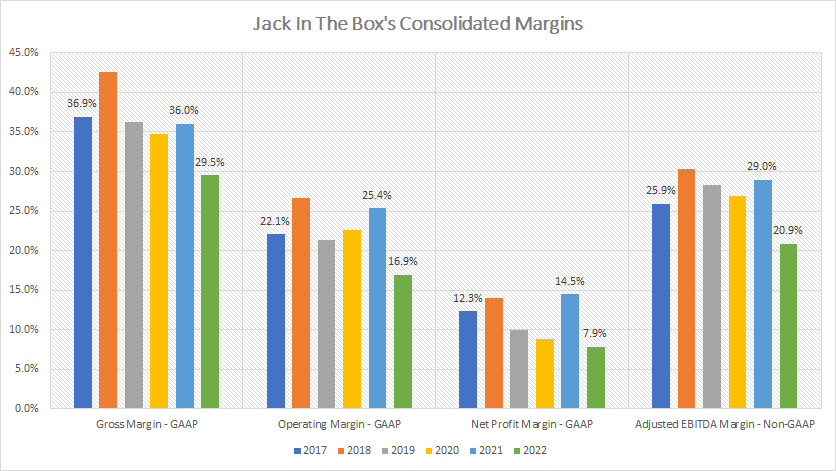

Jack In The Box consolidated margins (click image to enlarge)

Jack In the Box is not just profitable but a highly profitable one.

As seen in the chart above, Jack In The Box’s businesses produce solid margins.

In this aspect, Jack In The Box’s gross margin averaged about 36% between 2017 and 2022 while its operating margin came in at 23% on average for the same period.

More importantly, Jack In The Box’s net profit margin had been consistently above 10% on average in the past 6 years.

Keep in mind that some of these margins were produced in some of the toughest years that we have seen and they include crises such as the COVID-19 pandemic, an ongoing war in Ukraine, a major disruption in labor and costs of materials, and a high inflationary environment.

Despite all of these challenges, Jack In the Box not only managed to overcome the obstacles but also thrived and produced strong results in the end.

In short, Jack In The Box’s solid margins delivers consistent and reliable dividend payments to shareholders.

Jack In The Box Impressive Same-Store Sales

Same-Store Sales As At The End Of The Financial Year

| FY | Jack In The Box | Del Taco | ||||

|---|---|---|---|---|---|---|

| Company Stores | Franchise Stores | System Wide | Company Stores | Franchise Stores | System Wide | |

| 2014 | 2.0% | 2.0% | 2.0% | 5.3% | 5.2% | 5.2% |

| 2015 | 5.1% | 7.0% | 6.5% | 6.4% | 6.2% | 6.3% |

| 2016 | 0.0% | 1.6% | 1.2% | 4.7% | 4.9% | 4.8% |

| 2017 | -1.3% | 0.9% | 0.5% | 4.0% | 4.6% | 4.3% |

| 2018 | 0.6% | 0.1% | 0.1% | 1.5% | 3.8% | 2.5% |

| 2019 | 1.7% | 1.3% | 1.3% | 0.5% | 1.3% | 0.9% |

| 2020 | 3.1% | 4.0% | 4.0% | -2.9% | 1.4% | -0.9% |

| 2021 | 6.1% | 10.7% | 10.3% | 6.5% | 8.9% | 7.7% |

| 2022 | 3.7% | 0.6% | 0.9% | na | na | 3.9% |

| – | ||||||

| Average | 2.3% | 3.1% | 3.0% | 3.3 | 4.5 | 3.9% |

| Total | 21.0% | 28.2% | 26.8% | 26.0 | 36.3 | 34.7% |

Jack In The Box’s same-store sales has everything to do with the cash dividend declared.

The reason is that the company’s financial results are pretty much tied to the sales revenue generated by company-owned and franchise restaurants.

Therefore, if the same-store sales increase, Jack In The Box’s bottom lines also will follow suit.

As seen in the table above, same-store sales for Jack In The Box and Del Taco’s stores may not be the best in the industry but they have been mostly positive, and could sometimes even be in high single-digits, illustrating that sales revenue from both company and franchise stores have been on the rise steadily.

On average, Jack In The Box’s sales grew 3% between 2014 and 2022 while that of Del Taco grew nearly 4% for the same period.

Cumulatively, Jack In The Box’s sales grew nearly 27% while that of Del Taco came in at 35% for the past 9 years.

These numbers are significant as they represent sales that have grown positively and consecutively for stores that have operated for more than 1 year.

Jack In The Box’s positive same-store sales all these years have indirectly translated to the growing dividends which we will see in the next discussions.

In short, Jack In The Box’s positive same-store sales is another reason that the cash dividends are sound and safe.

Jack In The Box’s Reliable Dividend Payments

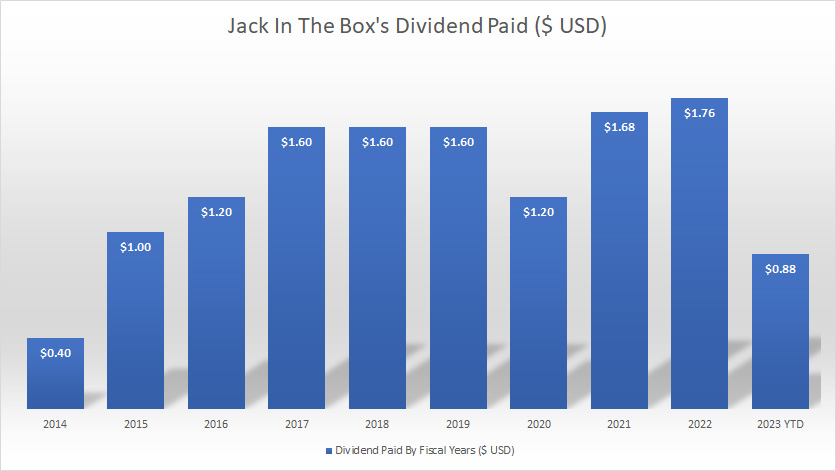

Jack In The Box dividend paid (click image to enlarge)

A look at Jack In The Box’s dividend history shows that the cash dividend payments are quite reliable.

As shown in the chart above, Jack In The Box raised its dividends the most in the early years which was between 2014 and 2017.

After 2017, Jack In The Box’s cash dividends stayed roughly flat at $1.60 USD per share but dived considerably in 2020 to $1.20 USD per share during the COVID period when the company suspended a quarterly dividend.

For your information, this was the only time when Jack In The Box suspended its dividend.

In the following year, Jack In The Box raised its cash dividends by a massive 40% to $1.68 USD per share after it realized that its businesses were actually thriving during the COVID age.

In fact, Jack In The Box’s booming business during the COVID age was primarily driven by the growing delivery orders through its Apps when most people were locked at home.

The swift action taken by the management teams during the COVID lockdown shows that the company is innovative and can overcome obstacles and thrive even during challenging times.

On average, Jack In The Box grew its cash dividend by a massive 28% between 2014 and 2022 as shown in the table below.

Dividend Growth Rates As At The End Of The Financial Year

| Fiscal Year | Jack In The Box |

|---|---|

| Dividend Growth Rates (%) | |

| 2015 | 150.0% |

| 2016 | 20.0% |

| 2017 | 33.3% |

| 2018 | 0.0% |

| 2019 | 0.0% |

| 2020 | -25.0% |

| 2021 | 40.0% |

| 2022 | 4.8% |

| – | – |

| Average | 27.9% |

In short, Jack In The Box is a reliable dividend payer and the management is willing to raise the dividend rates and even exceed the prior rates when businesses recover.

Jack In The Box Strong Capital Returns To Shareholders

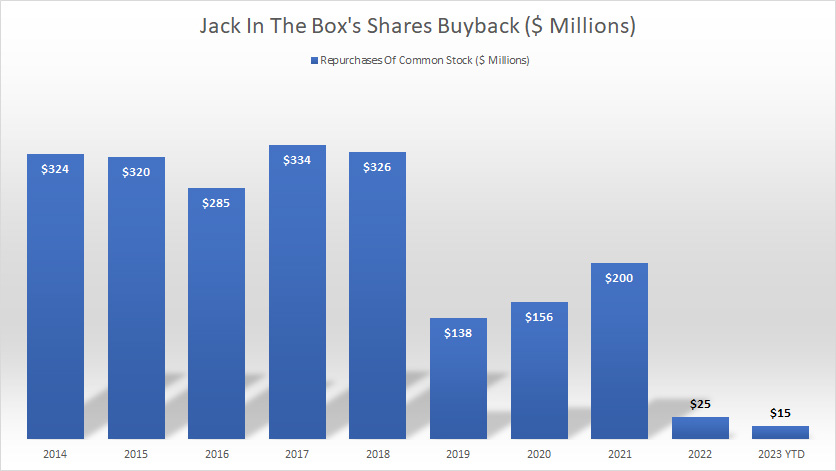

Jack In The Box share buyback click image to enlarge)

Since 2014, Jack In The Box has been buying back its shares as shown in the chart above.

Cumulatively, Jack In The Box has bought back its shares at a total sum of $2.1 billion as of 1Q 2023, a figure that is much bigger than its market capitalization.

As a result, Jack In The Box ran into a stockholders’ deficit of roughly $700 million as of Q1 2023 because the company’s accumulated value of its treasury stocks was so much bigger than the stockholders’ equity.

For your information, Jack In The Box’s estimated value for its treasury stocks was at $3 billion as of Q1 2023.

Mind you, the reported value of the treasury stocks was at costs (the value recorded at the time of purchase), and they could be worth a lot more if these stocks were to be resold in the open market.

Nevertheless, the point here is that apart from paying a dividend, Jack In The Box also is a keen buyer of its own stocks, thereby giving shareholders a very good return on investment.

As of Q1 2023, there was $160 million remaining under the share repurchase program which will expire in November 2023.

Until then, Jack In The Box may actually bump the dividends significantly after the share repurchase program expires by the end of the year.

The reason is that the cash spent on dividends was only about $40 million which is remarkably less than the cash spent on shares repurchase.

For now, we are just going to keep our fingers crossed.

Jack In The Box’s Solid Cash Flow

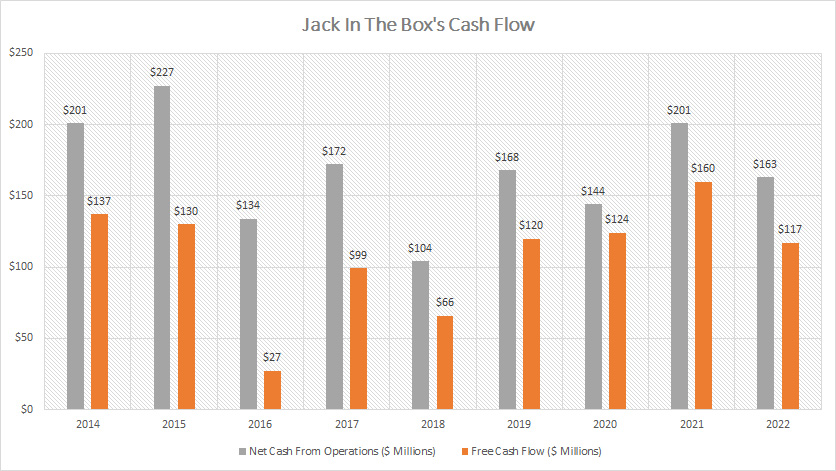

Jack In The Box cash flow (click image to enlarge)

Apart from being a profitable company, Jack In The Box also is a cash cow as seen in the chart above.

As seen, Jack In The Box’s operating net cash has always been positive and also quite consistent over the past 9 years.

As a result, the surplus of cash from operations has resulted in positive free cash flow all these years after accounting for capital expenditures.

The positive net cash is important not only as an indicator that the business is healthy but also suggests that the company can afford the dividend payments as dividends are paid out of cash.

Jack In The Box’s dividend payout ratio looks something like the figures shown in the following table.

Dividend Payout Ratio As At The End Of The Financial Year

| Fiscal Year | Jack In The Box | ||

|---|---|---|---|

| Cash Paid For Dividends ($ Millions) | Free Cash Flow ($ Millions) | Dividend Payout Ratio (%) | |

| 2014 | $16 | $137 | 12% |

| 2015 | $37 | $130 | 29% |

| 2016 | $40 | $27 | 148% |

| 2017 | $49 | $99 | 50% |

| 2018 | $45 | $66 | 68% |

| 2019 | $41 | $120 | 34% |

| 2020 | $28 | $124 | 23% |

| 2021 | $37 | $160 | 23% |

| 2022 | $37 | $117 | 32% |

| – | – | – | – |

| Average | $37 | $109 | 46% |

With an average payout ratio of just 46% for the past 9 years, Jack In The Box can definitely afford the dividends.

Again, Jack In The Box generates sufficient cash flow to cover the cash dividends.

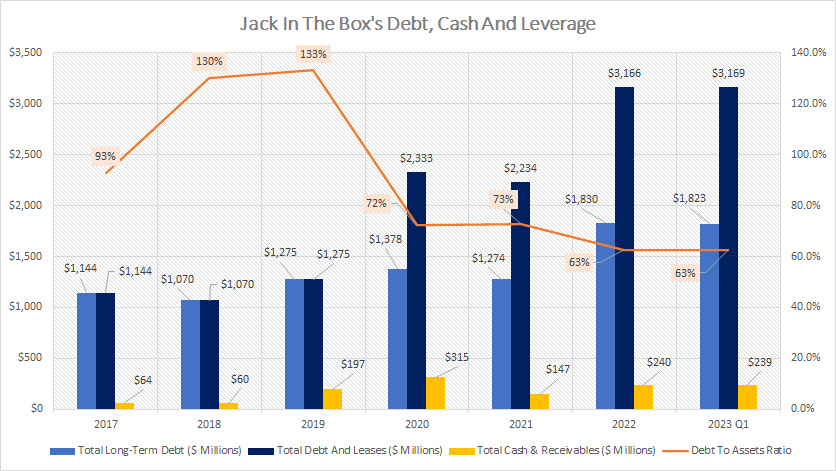

Jack In The Box’s High Debt Levels But Low On Cash

Jack In The Box debt, cash and leverage (click image to enlarge)

The only factor that may hold back Jack In The Box’s future dividend payments is the company’s growing debt levels.

As seen, Jack In The Box’s total long-term debt grew to a record high of $1.8 billion in 2022 after taking on more debt to take over Del Taco in the same fiscal year.

If we were to include operating leases, total debt would rise to more than $3 billion.

On the other hand, Jack In The Box’s total cash and receivables came in at slightly more than $200 million but was way too small to cover the company’s debt levels.

While debt levels have increased, the respective debt-to-asset ratio has decreased, illustrating the declining leverage of the company’s indebtedness with respect to assets.

This is the only bright spot regarding Jack In The Box’s debt.

Also, Jack In The Box’s interest coverage ratio was nearly 3.0X in fiscal 2022, indicating that the company has sufficient operating earnings to cover the interest expense.

However, if debt levels were to rise significantly in the future, Jack In The Box’s dividends could be in jeopardy.

Therefore, investors should keep an eye on the company’s rising debt levels.

Summary

In summary, there are more positive than negative factors that support Jack In The Box’s dividends.

Therefore, Jack In The Box is an excellent dividend stock and the cash dividend payment should be safe for years to come.

We have seen that the company not only survived the pandemic but even thrived on it.

Apart from the pandemic, Jack In The Box also has successfully overcome many other challenges which include the rising costs of doing business and the supply chain disruption.

On most occasions, the company emerged better and stronger with only minor scratches.

Again, Jack In the Box has the cash to cover the dividend payments and may even raise the dividend rate in the future.

References and Credits

1. All financial data in this article were obtained and referenced from Jack In The Box’s earnings reports, financial statements, and SEC filings which are available in Jack In The Box’s Investor Relations.

2. Featured images in this article are used under Creative Commons License and sourced from the following websites: Thomas Hawk and theimpulsivebuy.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!