Ford truck off-road driving. Pexels Image.

Ford Motor categorizes its operations into five reportable segments: Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit.

These segments were introduced in fiscal year 2023, with prior financial data recast to align with the new structure.

Additionally, Ford consolidates its automotive divisions under a unified classification known as Company Excluding Ford Credit.

Let’s look at the revenue results!

For other key statistics of Ford Motor, you may find more information on these pages:

Global Sales & Market Share

Wholesales

Revenue

- Revenue streams: sales of new and used cars, services, etc.,

- Revenue per employee in America, Europe, China, etc.,

- Revenue per car in North America, Europe, China, etc.,

Profit & Margin

Debt & Cash

Comparison With Peers

- Ford vs GM and Tesla: advertising and marketing budget,

- Ford vs General Motors: vehicle profit and margin,

- Ford vs Tesla: profit margin comparison,

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why aren’t Ford Next (formerly Mobility) making any money?

Revenue By Segment (New)

A1. Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

A2. Percentage of Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

A3. Growth Rates of Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

Revenue By Segment (Consolidated)

B1. Revenue from Automotive, Ford Credit, and Mobility

B2. Percentage of Revenue from Automotive, Ford Credit, and Mobility

B3. Growth Rates of Revenue from Automotive, Ford Credit, and Mobility

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Company Excluding Ford Credit: Ford Motor Company, excluding Ford Credit, primarily operates through several key business segments:

- Ford Blue

- Ford Model e

- Ford Pro

- Ford Next

These segments represent Ford’s core automotive operations, excluding its financial services arm, Ford Credit.

Ford Blue: Ford Blue is Ford’s legacy business responsible for developing and selling Ford and Lincoln internal combustion engines (“ICE”) and hybrid vehicles.

Besides developing and selling new vehicles, Ford Blue also produces and sells service parts, accessories, and digital services to retail customers. Iconic gas and hybrid vehicles developed under Ford Blue include the F-150, Bronco, and Mustang.

Ford Model e: Ford Model e is responsible for the development and sale of electric vehicles (EV).

Apart from EVs, Ford Model e also designs and creates digital vehicle technologies, including embedded software and all of Ford’s electric architecture.

Ford Model e operates in North America, Europe, and China.

Ford Pro: Ford Pro is responsible for the sale of Ford and Lincoln ICE, hybrid, and electric vehicles, service parts, accessories, and services to commercial, government, and rental customers.

Ford Pro focuses on fleet sales to customers with large orders, such as those from commercial sectors, government, and rental companies.

Ford Pro’s vehicles sold in North America include the Super Duty and the Transit range of vans. In Europe, Ford Pro’s flagship vehicles include the Ranger. Ford Pro operates primarily in North America and Europe.

Ford Next: Ford Next, formerly called the Mobility, primarily includes expenses and investments for emerging business initiatives aimed at creating value for Ford in vehicle-adjacent market segments.

Ford’s Mobility was formerly responsible for developing autonomous driving technology, according to Ford Motor.

Ford Credit: Ford Credit, also known as Ford Motor Credit Company LLC, is the financial services arm of Ford Motor Company.

It primarily focuses on providing automobile financing for consumers and dealerships1. This includes financing for purchasing or leasing Ford and Lincoln vehicles, as well as offering commercial financing and lines of credit to dealerships.

Why aren’t Ford Next (formerly Mobility) making any money?

Ford Next, previously known as Ford Mobility, is a newer segment within Ford Motor Company, focusing on next-generation technologies and innovations.

Since it’s still in the investment and development phase, it hasn’t yet reached profitability. The company is likely channeling significant resources into research, development, and scaling these innovative technologies, which can take time to generate revenue and become profitable.

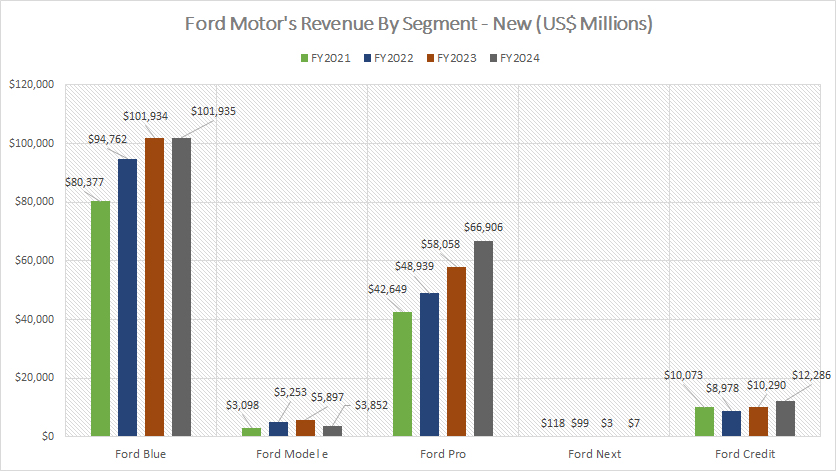

Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

Ford-revenue-by-new-segment

(click image to expand)

Ford Blue, Ford Model e, Ford Pro, and Ford Next are new reportable segments introduced as part of a reorganization in fiscal year 2023.

The definitions of Ford’s new segments are available here: Ford Blue, Ford Model e, Ford Pro, And Ford Next.

Revenue in FY2024:

| Segment | Revenue |

|---|---|

| (US$ Billions) | |

| Ford Blue | $101.9 |

| Ford Model-e | $3.9 |

| Ford Pro | $66.9 |

| Ford Next | $0.0 |

| Ford Credit | $12.3 |

3-Year Revenue Trend from FY2021 to FY2024:

| Segment | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Ford Blue | $80.4 to $101.9 | 26.8% |

| Ford Model-e | $3.1 to $3.9 | 24.3% |

| Ford Pro | $42.6 to $66.9 | 56.9% |

| Ford Next | $0.1 to $0.0 | -100.0% |

| Ford Credit | $10.1 to $12.3 | 22.0% |

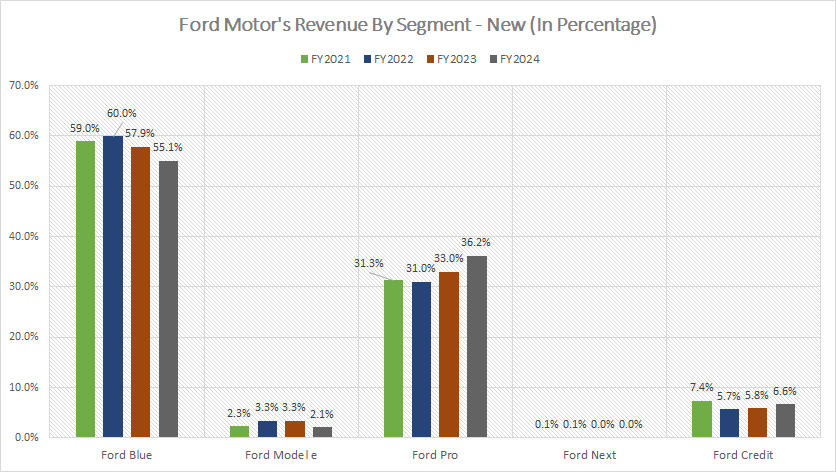

Percentage of Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

Ford-revenue-by-new-segment-in-percentage

(click image to expand)

Ford Blue, Ford Model e, Ford Pro, and Ford Next are new reportable segments introduced as part of a reorganization in fiscal year 2023.

The definitions of Ford’s new segments are available here: Ford Blue, Ford Model e, Ford Pro, And Ford Next.

Revenue Share in FY2024:

| Segment | Revenue Share (%) |

|---|---|

| Ford Blue | 55.1% |

| Ford Model-e | 2.1% |

| Ford Pro | 36.2% |

| Ford Next | 0% |

| Ford Credit | 6.6% |

3-Year Revenue Share Trend from FY2021 to FY2024:

| Segment | Revenue Share (%) |

|---|---|

| Ford Blue | 59.0% to 55.1% |

| Ford Model-e | 2.3% to 2.1% |

| Ford Pro | 31.3% to 36.2% |

| Ford Next | 0.1% to 0.0% |

| Ford Credit | 7.4% to 6.6% |

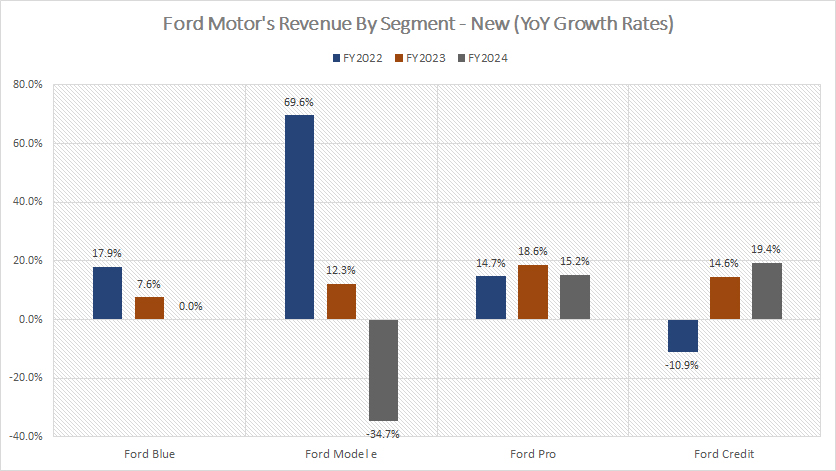

Growth Rates of Revenue from Ford Blue, Ford Model e, Ford Pro, Ford Next, and Ford Credit

Ford-revenue-by-new-segment-growth-rates

(click image to expand)

Ford Blue, Ford Model e, Ford Pro, and Ford Next are new reportable segments introduced as part of a reorganization in fiscal year 2023.

The definitions of Ford’s new segments are available here: Ford Blue, Ford Model e, Ford Pro, And Ford Next.

Revenue Growth in FY2024

| Segment | Growth Rates |

|---|---|

| Ford Blue | 0.0% |

| Ford Model-e | -34.7% |

| Ford Pro | 15.2% |

| Ford Credit | 19.4% |

3-Year Average Revenue Growth from FY2022 to FY2024:

| Segment | Growth Rates |

|---|---|

| Ford Blue | 8.5% |

| Ford Model-e | 15.7% |

| Ford Pro | 16.2% |

| Ford Credit | 7.7% |

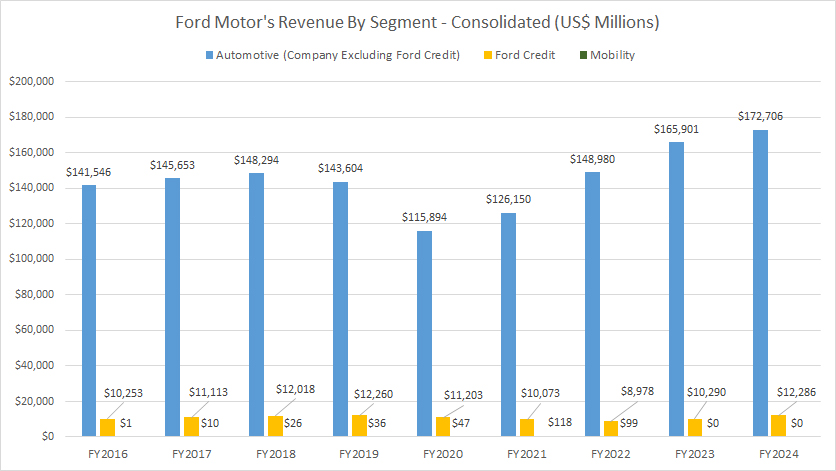

Revenue from Automotive, Ford Credit, and Mobility

Ford-Motor-Automotive-Ford-Credit-and-Mobility-revenue

(click image to expand)

Historically, Ford’s business structure consisted of three main segments: Automotive, Ford Credit, and Mobility. However, in 2023, the company undertook a significant reorganization.

The Automotive segment was restructured into a single entity known as Company Excluding Ford Credit, which also encompasses the Mobility division.

Concurrently, the Mobility segment was rebranded and renamed Ford Next to reflect its focus on next-generation technologies and innovations.

Revenue in FY2024:

| Segment | Revenue |

|---|---|

| (US$ Billions) | |

| Automotive | $172.7 |

| Ford Credit | $12.3 |

| Mobility | $0 |

3-Year Revenue Trend from FY2021 to FY2024:

| Segment | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Automotive | $126.1 to $172.7 | 36.9% |

| Ford Credit | $10.1 to $12.3 | 22.0% |

| Mobility | – | – |

5-Year Revenue Trend from FY2019 to FY2024:

| Segment | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Automotive | $143.6 to $172.7 | 20.3% |

| Ford Credit | $12.3 to $12.3 | 0.0% |

| Mobility | – | – |

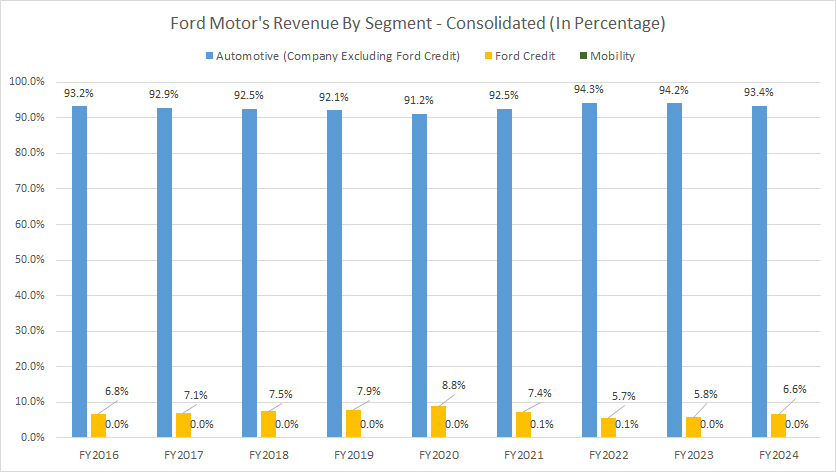

Percentage of Revenue from Automotive, Ford Credit, and Mobility

Ford-Motor-Automotive-Ford-Credit-and-Mobility-revenue-in-percentage

(click image to expand)

Historically, Ford’s business structure consisted of three main segments: Automotive, Ford Credit, and Mobility. However, in 2023, the company undertook a significant reorganization.

The Automotive segment was restructured into a single entity known as Company Excluding Ford Credit, which also encompasses the Mobility division.

Concurrently, the Mobility segment was rebranded and renamed Ford Next to reflect its focus on next-generation technologies and innovations.

Revenue Share in FY2024:

| Segment | Revenue Share (%) |

|---|---|

| Automotive | 93.4% |

| Ford Credit | 6.6% |

| Mobility | 0% |

3-Year Revenue Share Trend from FY2021 to FY2024:

| Segment | Revenue Share (%) |

|---|---|

| Automotive | 92.5% to 93.4% |

| Ford Credit | 7.4% to 6.6% |

| Mobility | – |

5-Year Revenue Share Trend from FY2019 to FY2024:

| Segment | Revenue Share (%) |

|---|---|

| Automotive | 92.1% to 93.4% |

| Ford Credit | 8.8% to 6.6% |

| Mobility | – |

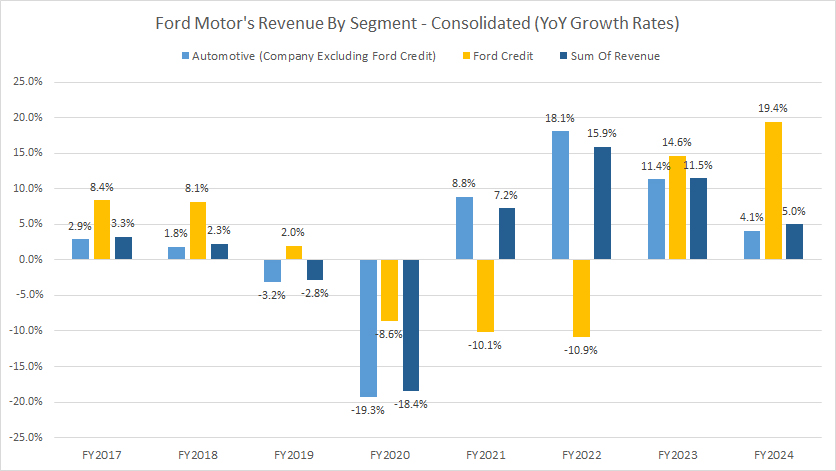

Growth Rates of Revenue from Automotive, Ford Credit, and Mobility

Ford-revenue-by-consolidated-segment-growth-rates

(click image to expand)

Historically, Ford’s business structure consisted of three main segments: Automotive, Ford Credit, and Mobility. However, in 2023, the company undertook a significant reorganization.

The Automotive segment was restructured into a single entity known as Company Excluding Ford Credit, which also encompasses the Mobility division.

Concurrently, the Mobility segment was rebranded and renamed Ford Next to reflect its focus on next-generation technologies and innovations.

Revenue Growth in FY2024

| Segment | Growth Rates |

|---|---|

| Automotive | 4.1% |

| Ford Credit | 19.4% |

| Total Revenue | 5.0% |

3-Year Average Revenue Growth from FY2022 to FY2024:

| Segment | Growth Rates |

|---|---|

| Automotive | 11.2% |

| Ford Credit | 7.7% |

| Total Revenue | 10.8% |

5-Year Average Revenue Growth from FY2020 to FY2024:

| Segment | Growth Rates |

|---|---|

| Automotive | 4.6% |

| Ford Credit | 0.0% |

| Total Revenue | 4.2% |

Insight

Ford Motor Company’s new segments, established in fiscal 2023, highlight the company’s strategic approach to market demands and future growth.

While Ford Blue remains the cornerstone, contributing the majority of the revenue, Ford Model e and Ford Pro are emerging as significant segments with substantial growth potential.

Ford Model e aligns with the shift towards electric vehicles, and Ford Pro addresses the needs of commercial buyers, ensuring a balanced approach to Ford’s revenue generation and market presence.

In addition, the company’s diversified revenue streams ensure financial stability and growth, with the automotive segment leading the way and Ford Credit playing a supporting role in facilitating vehicle sales and maintaining customer relationships.

Credits and References

1. All financial figures presented were obtained and referenced from Ford Motor’s annual reports published on the company’s investor relations page: Ford shareholders page.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.