This article analyzes and reviews the Public Islamic Dividend Fund (PIDF).

The PIDF is a unit trust fund managed by Public Mutual Berhad in Malaysia.

It is one of Public Mutual’s largest unit trust funds, valued at MYR3.6 billion or USD756 million as of Aug 2023.

The fund invests primarily in Shariah-compliant equities or shares of companies based in Malaysia.

Apart from complying with Shariah requirements, the PIDF pays unit holders attractive dividends.

As a result, the Public Islamic Dividend Fund (PIDF) declares cash distributions on a semi-annual basis instead of annually.

Investors looking for regular and Shariah-compliant income may find this unit trust fund attractive as the yield is much better than a fixed deposit.

Let’s look at more details starting with the table of contents below.

Table Of Contents

Overview

A1. Fund Summary

Performance

B1. Annual Total Return

B2. Average Annual Return

B3. Capital And Income Growth

B4. Other Performance Data

Distribution And Income Received

C1. Cash Distribution And Unit Split

C2. Income And Yield

Asset Allocation

D1. Asset Allocation – Equity

D2. Asset Allocation – Non-Equity

D3. Asset Allocation – Cumulative

Liquidity

Top Holdings

F1. Top 10 Equities – Malaysia

F2. Top 10 Equities – Foreign

Correlation With Benchmark

G1. Unit Price Vs Benchmark

G2. Positive Correlation With Benchmark

G3. Negative Correlation With Benchmark

Conclusion And Reference

S1. Review Summary

– S11. Advantages

– S12. Disadvantages

S2. References and Credits

S3. Disclosure

Fund Summary

The following summary is obtained from the annual report for the financial year ended 30 April 2023, unless stated otherwise.

Category

Equity

Investment Objective

To provide income by investing in a portfolio of stocks that complies with Shariah requirements and which offer or have the potential to offer attractive dividend yields.

Launch Date

14 Feb 2006

Distribution Policy

SEMI-ANNUAL

Risk Level

Moderately High – 4 (on a scale of 1 – 5)

Volatility

Moderate – 9.8 By Lipper Analytics

Size

MYR3.6 billion (USD889 million based on an exchange rate of USD1 = MYR4.5) as of 30 August 2023.

Shariah Compliant

Yes

Sales Charge

Up To 5%

Expenses

1.52% Of Fund NAV On Average From 2020 To 2023

Performance

Annual Total Return

Annual total return for the financial year ended 30 April.

| Years | PIDF Annualized Return (%) | Benchmark Return (%) |

|---|---|---|

| 2023 | -4.86 | -9.32 |

| 2022 | -7.08 | -8.29 |

| 2021 | 25.20 | 19.86 |

| 2020 | 0.61 | -6.81 |

| 2019 | -5.30 | -8.77 |

| 2018 | 5.38 | 1.76 |

The Public Islamic Dividend Fund (PIDF), which consists primarily of equity, registered an annual total return of -4.86% for the financial year ended 30 April 2023.

The performance of the fund in 2023 was slightly better than the benchmark’s return of -9.32%.

Looking into the breakdown of the return number, the PIDF’s equity portfolio contributed a return -3.91% while its money market portfolio contributed a return of +2.64% in fiscal 2023.

The fund had an average equity exposure of 91% and an average money market exposure of 9% as at 30 April 2023, which provided the fund with an attributed return of -3.55% and 0.24% for equity and money market, respectively.

Adjusted for an expense of 1.55%, the total return of the unit trust fund totaled -4.86% for the financial year 2023.

According to the PIDF’s 2023 annual report, the smaller decline of the fund compared to the benchmark was primarily due to the fund’s equity holdings within the Basic Materials and Consumer sectors outperforming the broader market during the financial year under review.

Average Annual Return

Average annual return for the following years ended 30 April 2023.

| Years | PIDF Average Return (%) | Benchmark Average Return (%) |

|---|---|---|

| 1 Year | -4.86 | -9.32 |

| 3 Years | 3.57 | -0.11 |

| 5 Years | 1.09 | -3.05 |

| 10 Years | 3.08 | -0.36 |

| Since Commencement | 11.62 | 4.76 |

On average, the Public Islamic Dividend Fund (PIDF) generated an average annual return of 3.57%, 1.09% and 3.08% for the financial year ended 30 April 2023 in 3 years, 5 years, and 10 years, respectively.

Since commencement in 2006, the PIDF performs even better and boosts an annualized return of 11.62% compared to an annualized return of only 4.76% return for its benchmark.

Therefore, the Public Islamic Dividend Fund (PIDF) performs much better on a long-term basis and certainly beats inflation by a wide margin.

Capital And Income Growth

Capital And Income Growth

| As at 30 April | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Capital Growth (%) | -8.13 | -8.71 | 23.53 | -0.65 |

| Income Growth (%) | 3.56 | 1.79 | 1.35 | 1.27 |

Another performance metric to keep an eye on is the capital and income growth of the fund.

The PIDF boosts decent income growth, which averaged about 2% between fiscal 2020 and 2023, as presented in the table above.

However, the PIDF lacks capital growth. On average, capital growth totaled only 1.51% over the past four years.

The poor performance of the capital aspect of the fund may be forgivable as the fund’s objective is not to seek capital appreciation but to provide income to unit holders.

Other Performance Data

Other performance data for the financial year ended 30 April.

Unit Prices (MYR) => prices quoted are ex-distribution

| As at 30 April | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Highest NAV per unit for the year | 0.3657 | 0.4117 | 0.4312 | 0.3647 |

| Lowest NAV per unit for the year | 0.3196 | 0.3628 | 0.3376 | 0.3004 |

Net Asset Value (NAV) and Units In Circulation (UIC) as at the end of the financial year

| As at 30 April | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total NAV (MYR’000) | 3,556,276 | 4,018,363 | 4,594,300 | 4,295,802 |

| UIC (in ’000) | 10,511,331 | 10,880,622 | 11,260,329 | 12,546,772 |

| NAV per unit (MYR) | 0.3383 | 0.3693 | 0.4080 | 0.3424 |

Total Expense Ratio

| As at 30 April | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total Expense Ratio (%) | 1.52 | 1.52 | 1.52 | 1.53 |

A lower ratio is preferable as it indicates lower expenses of the unit trust fund.

Portfolio Turnover Ratio

| As at 30 April | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Portfolio Turnover Ratio (time) | 0.07 | 0.11 | 0.18 | 0.14 |

A lower ratio is preferable as it indicates lower trading activities and thus, lower expenses and more money for unit holders.

An important feature to look at when buying a unit trust fund such as The Public Islamic Dividend Fund (PIDF) is to look at the size of the fund, ie. the NAV or net asset value of the fund.

On a long-term basis, the NAV of the fund should always be on the rise. However, the PIDF’s NAV has shrunk by nearly 20% since fiscal 2020, as shown in the table above.

The decline in NAV can be attributed to a number of reasons, including an over-distribution of cash, lack of capital injection from new investors, exit of existing unit holders, etc., which all point to the poor performance of the fund.

Therefore, investors may want to keep an eye on this aspect of the fund.

Besides, the unit in circulation of the PIDF also has shrunk significantly since fiscal 2020, implying an excessive exit of unit holders.

On a side note, the NAV per unit may not be an accurate indicator of performance of the fund due to cash distribution and/or unit split which can significantly affect the value of the NAV per unit.

Cash Distribution And Unit Split

| Declaration Date | ||||||

|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | ||||

| 2023-04-28 | 2022-10-31 | 2022-04-29 | 2021-10-29 | 2021-04-30 | 2020-10-30 | |

| Final & Interim Distribution Per Unit (Cent In MYR) | 0.50 | 0.75 | 0.50 | 0.50 | 0.75 | 1.25 |

| Distribution Per Unit (Cent In MYR) | 1.25 | 1.00 | 2.00 | |||

| Average Yield (%) | 3.4 – 4.0 | 2.4 – 2.8 | 4.6 – 5.9 | |||

| Distribution In Cash Amount (MYR In Millions) | 132.5 | 110.0 | 231.0 | |||

| Unit Split | – | – | – | |||

The Public Islamic Dividend Fund (PIDF)’s main objective is to provide income to unit holders and it meets its target every year.

The unit trust has been declaring cash distribution or dividends without fail since 2013.

However, the table above shows only the cash distributions for the last 3 years between the financial year 2021 and 2023.

In 2023, the Public Islamic Dividend Fund (PIDF) declared an interim and a final cash dividend or cash distribution of 1.25 cents per unit, a much higher figure compared to that of 2022 which totaled 1.00 cents.

The average yield ranged from 3.4% to 4.0% annually, a slightly better rate than a fixed deposit which returned less than 3%.

The average yield was lower in 2021, notably between 2.4% and 2.8%, depending on the purchase price of the unit trust.

In cash amount, the cash distribution used up MYR132.5 million of cash in fiscal 2023 compared to MYR110.0 million in fiscal 2022, a rise of 20% year-over-year.

Also, the Public Islamic Dividend Fund (PIDF) has never initiated a unit split in the 3 years from 2021 to 2023.

Income And Yield

| As at 30 April (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Profit From Shariah‑Based Placements | 6,269 | 2,510 | 2,828 |

| Distribution Income | 1,721 | 1,516 | 1,424 |

| Dividend Income | 176,784 | 135,736 | 132,244 |

| Total Income | 184,774 | 139,762 | 136,496 |

| Average NAV | 3,787,420 | 4,306,331 | – |

| Average Income Yield % | 4.9 | 3.2 | – |

The Public Islamic Dividend Fund (PIDF) receives various sources of income such as profit from Shariah‑based placements, distribution income, and dividend income.

The majority of the income is from dividend income.

In 2023, the PIDF earned a total income of MYR185 million compared to a total income of MYR140 million reported in 2022, representing a rise of 32% year-on-year.

As a result, the average income yield for the financial year 2023 totals a massive 4.9%, which, in my opinion, is substantially better than most unit trust funds that usually yield only 1%.

It is not unexpected to see such a massive yield in the PIDF unit trust as the primary objective of the fund is to provide dividend income to investors.

Asset Allocation – Equities

| As at 30 April (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Malaysia | ||||

| Basic Materials | 10.2 | 13.5 | 8.8 | 4.5 |

| Communications | 10.8 | 9.8 | 9.9 | 11.5 |

| Consumer Cyclical | 1.0 | 1.1 | 1.3 | 1.7 |

| Consumer Non-Cyclical | 19.6 | 18.6 | 23.7 | 26.0 |

| Diversified | 1.6 | 1.4 | 1.5 | 1.4 |

| Energy | 7.2 | 6.5 | 6.6 | 8.2 |

| Financial | 2.0 | 2.1 | 2.0 | 1.5 |

| Industrial | 10.8 | 13.1 | 13.0 | 11.7 |

| Technology | 5.1 | 4.5 | 2.9 | – |

| Utilities | 7.9 | 7.1 | 6.7 | 8.8 |

| Sub Total | 76.2 | 77.7 | 76.4 | 75.3 |

| Hong Kong | ||||

| Communications | – | – | – | 0.1 |

| Consumer Cyclical | 1.0 | – | – | – |

| Consumer Non-Cyclical | 0.5 | – | – | – |

| Sub Total | 1.5 | – | – | 0.1 |

| Korea | ||||

| Communications | 1.9 | 1.1 | 0.9 | – |

| Technology | 1.1 | 1.1 | 2.4 | 2.2 |

| Sub Total | 3.0 | 2.2 | 3.3 | 2.2 |

| Taiwan | ||||

| Technology | 2.0 | 2.0 | 3.8 | 1.9 |

| Thailand | ||||

| Industrial | – | – | – | 0.4 |

| United States | ||||

| Communications | 3.6 | 3.2 | 2.8 | 2.2 |

| Consumer Cyclical | – | – | – | 0.4 |

| Consumer Non-Cyclical | 1.1 | 1.3 | 1.1 | 2.0 |

| Financial | – | – | 1.5 | 2.2 |

| Technology | 5.9 | 9.2 | 9.2 | 5.9 |

| Sub Total | 10.6 | 13.7 | 14.6 | 12.7 |

| TOTAL EQUITY SECURITIES | 93.3 | 95.6 | 98.1 | 92.6 |

| OTHER ASSETS & LIABILITIES | -1.2 | -1.2 | -1.6 | +1.5 |

In terms of equity holdings, Malaysian equities made up the largest portion of the Public Islamic Dividend Fund (PIDF) equity portfolio, reportedly at 76.2% of NAV as of 30 April 2023.

The percentage of Malaysia equity had not changed much in the last 4 years between 2020 and 2023.

Equities from the United States87% of the unit trust’s NAV as of 2023 and it was similarly high in other financial years.

As a result, the equity holdings from other countries such as Hong Kong, Korea, Taiwan and Thailand in PIDF had been insignificant between 2020 and 2023.

Also, the equity holdings of the fund from Malaysia have been in sectors that are defensive and that consist of strong dividend payers, such as Consumer Non-Cyclical, Industrial, Basic Materials, Communications, and Utilities.

In addition, these sectors have been in the top 5 positions of the Public Islamic Dividend Fund (PIDF) for Malaysian equities.

For equities in the U.S., the Technology sector has been the largest holding in the PIDF’s portfolio, topping 5.9% of NAV as of 2023.

However, the percentage of the U.S. equities came down significantly in fiscal 2023 over 2022.

You may notice that the equity percentage in most sectors in countries such as Malaysia and the U.S. has remained roughly the same.

Perhaps, this explains the low rebalancing activities (trading activities) of the Public Islamic Dividend Fund (PIDF).

As seen in prior discussions, the portfolio turnover ratio for PIDF measured only 0.07 as of 2023, a very low ratio indeed.

Asset Allocation – Non-Equity

| As at 30 April (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Collective Investment Funds – Malaysia | 1.2 | 1.0 | 0.9 | 1.1 |

| Shariah-Based Placements With Financial Institutions | 6.7 | 4.6 | 2.6 | 4.8 |

| TOTAL NON-EQUITY | 7.9 | 5.6 | 3.5 | 5.9 |

| OTHER ASSETS & LIABILITIES | -1.2 | -1.2 | -1.6 | +1.5 |

In terms of non-equity holdings in the fund, the Public Islamic Dividend Fund (PIDF)’s position in this type of investment remained nearly the same in the last 4 years from 2020 to 2023.

For example, the collective investment funds in Malaysia in the portfolio have remained the same since 2020, roughly at 1%.

For your information, a collective investment fund is a pool of investments such as ETF, REIT, and unit trust.

On the other hand, Shariah-based placement is a type of investment equivalent to a deposit.

This particular investment in PIDF also had been nearly the same in terms of the percentage of NAV between 2020 and 2023, topping just 6.7% as of 2023.

On a cumulative basis, the total non-equity investment in the Public Islamic Dividend Fund (PIDF) came in at 7.9% of NAV as of 2023, a slightly higher figure compared to that of 2022 and also has been on the rise since fiscal 2020.

In short, the Public Islamic Dividend Fund (PIDF) held only a small portion of non-equity investment in its portfolio.

Asset Allocation – Cumulative

Change In Portfolio Exposures

| As at 30 April | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Investment Type | |||

| Shariah-Compliant Equity And Equity-Related Securities | 93.1 | 95.3 | 97.2 |

| Islamic Money market | 6.9 | 4.7 | 2.8 |

Since fiscal 2021, the Public Islamic Dividend Fund (PIDF)’s equity portfolio has declined steadily and reached only 93.1% as of fiscal 2023, from the 97.2% reported in fiscal 2021.

On the other hand, the money market portfolio of the fund grew from 2.8% in fiscal 2021 to 6.9% as of 30 April 2023.

Perhaps, the PIDF was expecting an unfavorable bet on Malaysian equity in 2023 and beyond and therefore, the reduced exposure.

Cash And Deposits

| As at 30 April (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Deposits And Cash | |||

| Shariah‑Based Placements With Financial Institutions | 237,933 | 185,679 | 121,846 |

| Cash At Banks | 15,945 | 6,176 | 7,098 |

| Total | 252,878 | 191,855 | 128,944 |

| Total Net Assets | |||

| Net Asset Value (“NAV”) | 3,556,276 | 4,018,363 | 4,594,300 |

| Ratio Of Liquid Assets To NAV (%) | 7.1 | 4.8 | 2.8 |

Liquid assets consist primarily of deposits and cash at the bank.

In the case of the Public Islamic Dividend Fund, the deposits are Shariah-based placements.

The Public Islamic Dividend Fund (PIDF) held cash and Shariah‑Based placements of MYR253 million as of 2023, roughly 32% higher than the figure in 2022 and nearly doubled the amount in 2021.

In 2021, the Public Islamic Dividend Fund (PIDF) held just MYR129 million of cash and Shariah-based placements.

Concerning the fund’s NAV, the ratio came in at 7.1%, 4.8%, and 2.8% for the financial years 2023, 2022, and 2021, respectively.

Therefore, the ratio measured in 2023 was much higher than in 2022 and tripled the ratio in 2021.

The significant rise in liquidity in 2023 compared to all prior years may indicate an unfavorable equity market in 2023 and beyond.

Perhaps, the fund manager was expecting a bearish outlook for the Malaysian stock market in the foreseeable future.

Top 10 Equities – Malaysia

| As at 30 April 2023 | ||||

|---|---|---|---|---|

| Average Purchased Price (MYR) | Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | |||

| Tenaga Nasional Berhad | Utilities | 12.04 | 280,021 | 7.9 |

| Press Metal Aluminium Holdings Berhad | Basic Materials | 3.05 | 189,503 | 5.3 |

| Petronas Chemicals Group Berhad | Basic Materials | 7.13 | 172,531 | 4.9 |

| IHH Healthcare Berhad | Consumer Non-Cyclical | 5.08 | 148,219 | 4.2 |

| Nestle (Malaysia) Berhad | Consumer Non-Cyclical | 60.90 | 138,413 | 3.9 |

| Telekom Malaysia Berhad | Communications | 5.23 | 136,620 | 3.9 |

| Axiata Group Berhad | Communications | 5.37 | 121,861 | 3.4 |

| Sime Darby Plantation Berhad | Consumer Non-Cyclical | 5.38 | 112,408 | 3.2 |

| MISC Berhad | Industrial | 7.99 | 101,473 | 2.8 |

| Inari Amertron Berhad | Technology | 2.92 | 96,171 | 2.7 |

| Total | – | – | 1,497,220 | 42.2 |

The table above shows the top 10 equity holdings of the Public Islamic Dividend Fund (PIDF) for Malaysian equities traded on the Kuala Lumpur Stock Exchange.

Tenaga Nasional Berhad accounted for 7.9% of the unit trust’s NAV or MYR280 million in monetary value as of 30 April 2023, making it the largest equity holding of the fund for Malaysian equities.

Press Metal Aluminium Holdings Berhad claimed the 2nd spot at 5.3% of the fund’s NAV or MYR189.5 million.

At 4.9% of NAV or MYR172.5 million, Petronas Chemicals Group Berhad sat at the 3rd spot as one of the largest equity holdings of PIDF.

For your information, all equities in the top 10 positions are blue-chip counters that pay attractive dividends.

This trend is not unexpected as the PIDF is an income-driven unit trust that focuses on distributing cash to investors.

In addition, the top 10 equity holdings alone made up 42% of the fund’s NAV, or nearly MYR1.8 billion as of 30 April 2023.

In my opinion, I believed the equity portfolio of PIDF is somewhat diversified considering that each equity in the top 10 holdings accounted for an average of only 4.2% of the fund’s NAV.

Apart from that, most counters within the fund’s portfolio for Malaysian equities are blue-chip counters that pay dividend incomes.

Subsequently, the dividend income obtained will be returned to unit holds as cash distributions.

Moreover, the unit trust fund relies mainly on the economic growth of Malaysia.

We saw in the previous discussion that Malaysian equity alone accounted for 76% of the fund’s NAV.

Therefore, if the growth of the Malaysian economy comes to a standstill or even a decline, the Public Islamic Dividend Fund (PIDF) will be negatively impacted.

Top 10 Equities – Foreign

| As at 30 April 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | ||

| Meta Platforms Inc | Communications | 82,590 | 2.3 |

| Microsoft Corp | Technology | 71,039 | 2.0 |

| Taiwan Semiconductor Manufacturing Co., Ltd | Technology | 70,679 | 2.0 |

| Samsung SDI Co., Ltd | Technology | 68,341 | 1.9 |

| Apple Inc | Technology | 60,922 | 1.7 |

| Adobe Inc | Technology | 49,170 | 1.4 |

| Alphabet Inc – Class A | Communications | 45,412 | 1.3 |

| Abbott Laboratories | Consumer Non-Cyclical | 40,414 | 1.1 |

| Samsung Electronics Co Ltd | Technology | 39,284 | 1.1 |

| Topsports International Holdings Ltd | Consumer Cyclical | 34,540 | 1.0 |

| TOTAL EQUITY – FOREIGN | – | 562,391 | 15.8 |

Of the top 10 foreign equity holdings, 6 of them were U.S. equities while 2 were from Korea, 1 was from Hong Kong and the remaining was Taiwan equities.

Among the foreign equities, Meta Platform accounted for the biggest position, notably at 2.3% of NAV or MYR83 million.

Microsoft Corp came in second at 2.0% of NAV or MYR71 million.

Taiwan Semiconductor Manufacturing Co., Ltd, accounted for 2.0% of NAV or MYR71 million as of 30 April 2023.

Samsung SDI Co., Ltd took 4th place at 1.9% of NAV or MYR68 million.

Similar to its Malaysian equities, the Public Islamic Dividend Fund (PIDF)’s foreign portfolio also comprised mostly dividend-paying companies.

For example, of the top 10 foreign equities, 7 of them, excluding Alphabet Inc., Meta Platforms Inc., and Adobe Inc., are blue-chip counters that pay attractive dividends.

Again, this equity composition is not unexpected because the PIDF is an income-driven fund that invests primarily in dividend stocks.

Last but not least, the top 10 equity holdings alone made up 15.6% of NAV or MYR562 million as of 30 April 2023.

This NAV percentage is moderately low and makes the PIDF unit trust less exposed to foreign equity.

However, some exposure to foreign equity is good for the fund as the PIDF does not have to be entirely dependent on Malaysia’s economic growth.

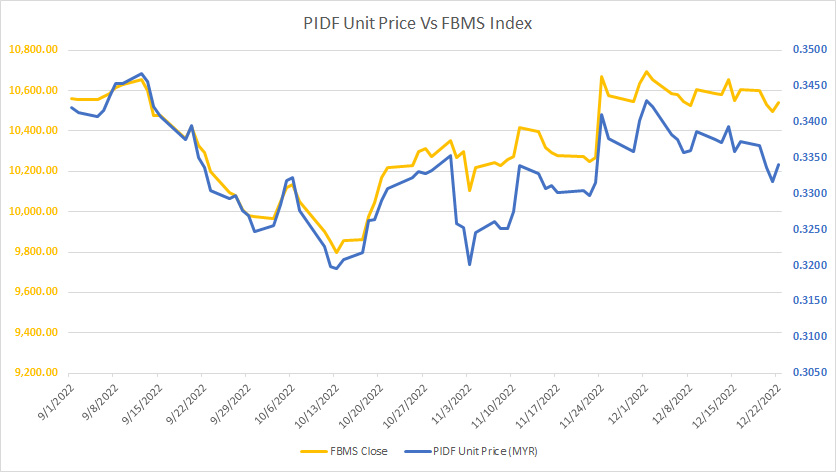

Unit Price Vs Benchmark

PIDF Unit Price Vs FBMS

(click image to expand)

The benchmark for the Public Islamic Dividend Fund (PIDF) is FTSE Bursa Malaysia EMAS Shariah Index (FBMS) but it carries only a weight of up to 90%, according to the 2023 annual report.

The remaining 10% of the benchmark comes from the 3-month Islamic Interbank Money Market (IIMM) rate.

That being said, this correlation was performed back in 2022 over 3 months.

Although carrying only a weight of up to 90%, the correlation between PIDF and FBMS can still be done and I am curious to see how the results will turn out.

As seen, the unit price of the Public Islamic Dividend Fund (PIDF) still tracks closely the volatility of the FBMS index despite weighting up to 90%.

Positive Correlation With Benchmark

Positive Correlation

| Positive Correlation | |||

|---|---|---|---|

| FBMS Index Changes | PIDF Unit Price Changes In MYR | Rise Ratio | |

| Date | |||

| 12/22/2022 | 45.15000 | 0.00240 | 0.000053 |

| 12/16/2022 | 56.31000 | 0.00140 | 0.000025 |

| 12/14/2022 | 73.17000 | 0.00220 | 0.000030 |

| 12/01/2022 | 3.07000 | 0.00100 | 0.000326 |

| 12/09/2022 | 82.80000 | 0.00270 | 0.000033 |

| 12/01/2022 | 60.77000 | 0.00280 | 0.000046 |

| 11/30/2022 | 89.19000 | 0.00430 | 0.000048 |

| Average | – | – | 0.000049 |

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000049.

At this ratio, a 1-point index increment in the FBMS index will result in an MYR0.000049 increase in the PIDF unit price.

For a 100-point index increment, the PIDF unit trust fund will increase by MYR0.0049 or MYR0.5 cents on average.

Negative Correlation With Benchmark

Negative Correlation

| Negative Correlation | |||

|---|---|---|---|

| FBMS Index Changes | PIDF Unit Price Changes In MYR | Fall Ratio | |

| Date | |||

| 12/21/2022 | -38.10000 | -0.00200 | 0.000052 |

| 12/20/2022 | -69.15000 | -0.00300 | 0.000043 |

| 12/19/2022 | -5.21000 | -0.00060 | 0.000115 |

| 12/15/2022 | -101.81000 | -0.00350 | 0.000034 |

| 12/13/2022 | -6.98000 | -0.00040 | 0.000057 |

| 12/12/2022 | -20.89000 | -0.00110 | 0.000053 |

| 12/08/2022 | -19.05000 | 0.00030 | -0.000016 |

| Average | – | – | 0.000106 |

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000106.

The average ratio indicates that when the FBMS index falls by 1 index point, the PIDF unit price will fall by about MYR0.000106 on average.

From a 100-point perspective, the PIDF unit price will fall by about MYR0.0106 or MYR1.1 cents on average.

As the falling ratio is twice as large as the rising ratio, the Public Islamic Dividend Fund (PIDF) unit price is more sensitive to an index drop than an index rise.

As a result, the PIDF unit trust will have a unit price drop more than a unit price rise when the FBMS index moves.

Review Summary

Advantages (Results Were Up To 30 Apr 2023)

1. The Public Islamic Dividend Fund (PIDF) pays cash distribution year in and year out without fail. The yield came in between 3.4% and 4.0% in fiscal 2023 (depending on the purchase unit price) and the rate was slightly better than a fixed deposit.

2. The majority of the equities held by the fund were from blue-chip counters and they pay dividends to the fund. The amount of dividends collected in fiscal 2023 totaled MYR177 million, a record figure over the past 3 years.

3. The Public Islamic Dividend Fund (PIDF) also held foreign equities and the exposure was 16% as of fiscal 2023. These foreign equities also pay dividend income to the fund. Together with the equities from Malaysia, the fund collects a growing income, which has risen from MYR136 million in 2021 to MYR185 million in 2023.

4. The income yield of the fund totaled 4.9% as of 2023. It was one of the highest that I have seen among all funds managed by Public Mutual. The best part is that this yield has risen significantly in 2023 over 2022.

5. The Public Islamic Dividend Fund (PIDF) performs much better on a long-term basis and has an average annualized return of 11.6% since 2006. It beats its benchmark by a wide margin and certainly beats inflation on a long-term basis.

6. The PIDF should be a safe unit trust considering that the portfolio consists primarily of equities of mega-cap companies.

Disadvantages (Results Were Up To 30 Apr 2023)

1. The Public Islamic Dividend Fund (PIDF) depends largely on the growth of the Malaysian economy as the fund’s exposure to Malaysia equity was 76% as of 2023.

2. If the Malaysian economy performs poorly, the fund will follow suit. Over the last several years, the return of the fund has been poor, primarily driven by the poor performance of the Malaysian economy.

3. The correlation of the fund with the FBMS benchmark shows that the fund was more sensitive to a market decline than a rise. In this aspect, the volatility of the PIDF may be much greater during a market downturn.

4. The PIDF has declined in size since fiscal 2020, notably at 19% over the last 4 years. In fiscal 2020, the fund was worth roughly MYR4.3 billion. However, it was worth only MYR3.6 billion as of 30 Apr 2023.

References and Credits

1. All financial information presented in this article was obtained and referenced from documents contained in the following links:

a) Public Mutual Unit Trust Fund

b) FBMS index

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor advice to purchase a security. The Public Islamic Dividend Fund (PIDF) is not in any way sponsored, endorsed, sold, or promoted by StockDividendScreener.com.

Therefore, StockDividendScreener.com shall not be liable (whether in negligence or otherwise) to any person for any error in this article.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!