Altria’s vaping devices. Flickr Image.

Altria Group, listed on the NYSE with the ticker MO, is a remarkable company that generates tonnes of cash. The company produces billions of dollars in operating and free cash flow.

Besides cash, Altria is also highly profitable and runs a high margins business.

The company’s earnings are solid and have been increasing year-over-year on an adjusted basis. As a result, Altria returns massive amounts of cash to stockholders through dividends and share buybacks.

In this article, we will explore Altria’s cash on hand and cash flow. In addition to cash, we look at some ratios, such as the cash-to-assets ratio and cash flow margins.

Furthermore, we will analyze Altria’s net cash from financing activities to understand how the company handles its borrowing.

Investors looking for other statistics about the company may find more information on these pages:

- Altria vs Philip Morris International,

- Altria revenue streams and profit margin, and

- Altria debt due and liquidity.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Altria Manage Its Cash?

Consolidated Results

A1. Cash On Hand

Ratio

B1. Cash On Hand To Current Assets Ratio

Cash Flow

C1. Net Cash From Operations

C2. Free Cash Flow

Cash Flow Margins

D1. Operating Cash Flow Margin

D2. Free Cash Flow Margin

Cash From Debt Borrowing And For Debt Repayment

E1. Net Cash From Financing Activities

Free Cash Flow Vs Debt Repayment And Capital Return

F1. Free Cash Flow Less Debt Repayment And Capital Returns

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Cash To Current Assets Ratio: The cash to current assets ratio is a financial metric measuring the proportion of a company’s cash and cash equivalents relative to its total current assets.

This ratio provides insight into a company’s liquidity and its ability to meet short-term obligations without having to rely on the sale of inventory or other non-cash assets.

Here’s how it’s calculated:

\[ Cash\ To\ Current\ Assets\ Ratio = \frac{Cash\ And\ Cash\ Equivalents}{Total\ Current\ Assets} \times 100\% \]

A higher ratio indicates that a company has a greater proportion of cash on hand compared to its current assets, suggesting strong liquidity and financial flexibility.

Conversely, a lower ratio may indicate potential liquidity issues, as the company might have to convert other assets to cash to meet its short-term liabilities.

Free Cash Flow: Free cash flow (FCF) is a financial metric representing a company’s cash generated after accounting for the cash outflows needed to support operations and maintain its capital assets.

Essentially, it’s the excess cash the company produces after paying for its operating expenses and capital expenditures.

Free cash flow is a crucial indicator of a company’s financial health and its ability to generate sufficient cash to support its business, invest in growth opportunities, pay dividends to shareholders, and reduce debt. It is calculated as:

[ {Free Cash Flow} = {Net Cash from Operating Activities} – {Capital Expenditures} ]

Investors and analysts often use this metric to assess a company’s profitability, efficiency, and potential for growth and expansion.

Cash Flow Margin: The cash flow margin is a financial metric measuring the efficiency of a company in converting its sales into cash.

It’s expressed as a percentage and calculated by dividing the cash flow from operating activities by the net sales or revenue of the company.

This ratio provides insights into the company’s ability to generate cash from its sales. It is crucial for covering its expenses, paying down debt, and funding new investments without relying on external financing.

A higher cash flow margin indicates that the company is efficiently managing its operations to produce more cash, which is a positive sign for investors and creditors. It’s a useful indicator of the company’s financial health and operational efficiency.

Net Cash From Financing Activities: Net Cash from Financing Activities refers to the section of a company’s cash flow statement showing the net cash flows used to fund the company.

This includes transactions involving equity, debt, and dividends. Specifically, it captures the inflow of cash from investors or banks and the outflow of cash to shareholders as dividends or to repay debt obligations.

The calculation of net cash from financing activities includes issuing stock, debt issuance, dividend payments, and debt repayment. It is a crucial component for understanding how a company finances its operations and growth, indicating whether it generates more cash than it uses or vice versa.

This metric is essential to a company’s financial health and provides investors with insight into its financial strategy and ability to manage its capital structure effectively.

How Does Altria Manage Its Cash?

Altria manages its cash through a balanced approach of investing in its business and returning cash to shareholders. Here are some key aspects of their cash management strategy:

1. Investing in Growth: Altria invests in expanding its smoke-free product portfolio, including acquisitions like NJOY and the development of new products.

2. Shareholder Returns: Altria returns cash to shareholders through dividends and share repurchases. For example, they have paid out nearly $7.8 billion in dividends and share repurchases over the past few years.

3. Capital Expenditures: Altria plans its capital expenditures to support its business operations and growth initiatives.

4. Debt Management: Altria manages its debt levels to maintain financial flexibility and support its strategic goals.

By strategically managing its cash across these areas, Altria aims to stay competitive, drive innovation, and create long-term value for its stakeholders.

Cash On Hand

altria-cash-on-hand

(click image to expand)

Altria’s cash on hand consists of cash and equivalents. As of the end of fiscal year 2023, Altria’s cash on hand reached $3.7 billion, down 8% from a year ago and 18% lower from 2021.

Altria’s cash on hand has shown significant fluctuations between fiscal year 2018 and 2023, ranging from $1.3 billion to $4.9 billion. This variability reflects the company’s strategic financial maneuvers, such as investments in growth, shareholder returns, capital expenditures, and debt management.

In particular, Altria’s cash on hand reached its highest level during the COVID-19 pandemic in fiscal year 2020. During this period, Altria maintained a higher-than-average cash position to ensure liquidity and financial flexibility.”

However, in recent years, Altria’s cash on hand has slowly normalized to pre-pandemic levels. Since fiscal year 2020, we can see that Altria’s cash on hand has been on the decline.

Cash On Hand To Current Assets Ratio

altria-cash-on-hand-to-current-assets-ratio

(click image to expand)

You can find the definition of cash to current assets ratio here: cash to current assets ratio.

Altria’s cash on hand constitutes a significant portion of its current assets, as shown in the chart above. In the fiscal year, the cash-to-current assets ratio reached a high of 65%.

This ratio indicates that 65% of the company’s current assets consist of cash and cash equivalents. From this ratio, it’s evident that Altria prioritizes holding a significant amount of cash to ensure liquidity.

Particularly during the COVID-19 pandemic in 2020-2021, Altria’s cash to current assets ratio reached its peak, surpassing 70%. Even in the post-pandemic period, Altria’s cash to current assets ratio has remained relatively high. Once again, the high cash to current assets ratio illustrates Altria’s emphasis on cash and liquidity.

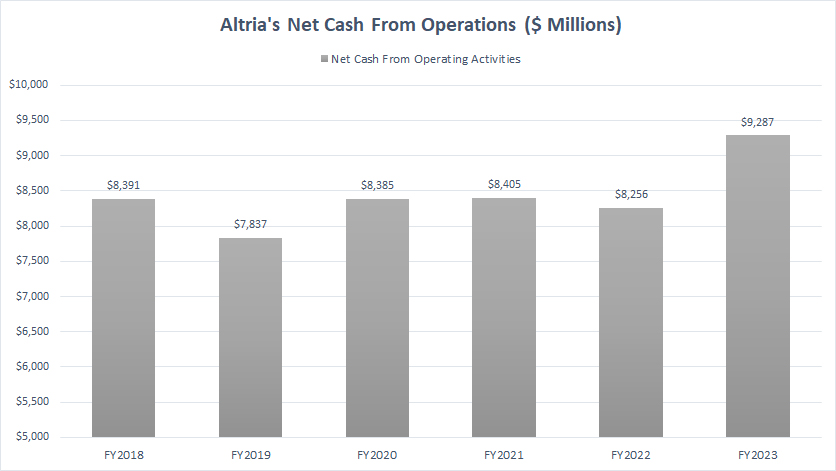

Net Cash From Operations

Altria’s net cash from operating activities

(click image to expand)

Altria generates solid and consistent operating cash flow, as illustrated in the graph above. In fact, the company has never experienced negative operating cash flow since fiscal year 2018.

In fiscal year 2023, Altria’s net cash from operations reached $9.3 billion, a record figure in six years. On average, Altria generated operating cash flow of $8.6 billion annually between fiscal year 2021 and 2023.

A key observation is that Altria has maintained robust operating cash flow despite the decline in cigarette sales. Altria has managed to offset declining cigarette sales by increasing prices over the years.

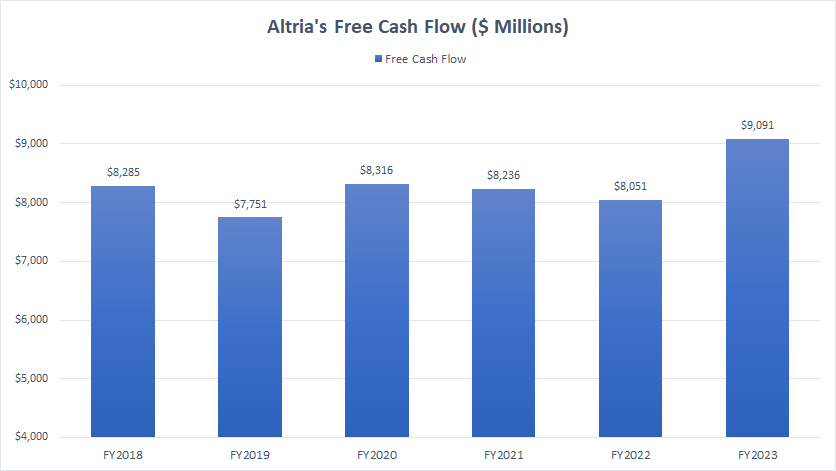

Free Cash Flow

Altria’s free cash flow

(click image to expand)

You can find the definition of free cash flow here: free cash flow. In short, free cash flow reflects the cash available after accounting for capital expenditures.

Similar to its operating cash flow, Altria consistently generates solid and reliable free cash flow, as shown in the chart above. Since fiscal year 2018, Altria’s free cash flow has averaged $8.5 billion annually. In fiscal year 2023, Altria’s free cash flow reached a record figure of $9.1 billion.

Altria has maintained a high level of free cash flow largely because it incurs minimal capital expenditures.

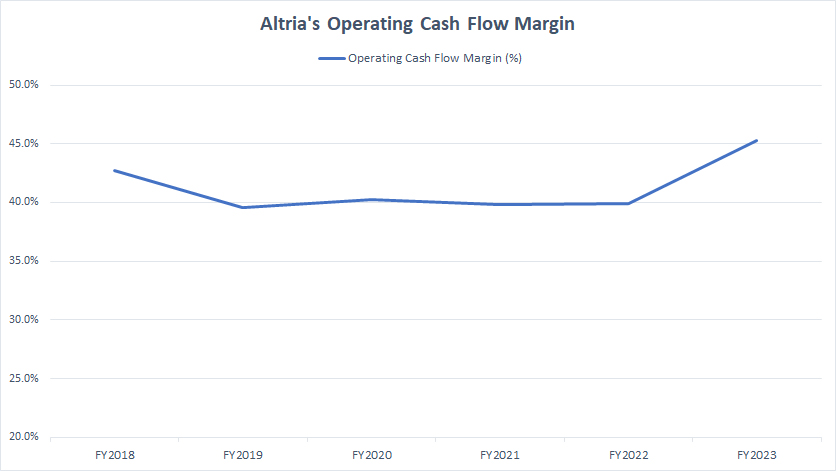

Operating Cash Flow Margin

altria-operating-cash-flow-margin

(click image to expand)

The operating cash flow margin measures Altria’s efficiency in converting revenue to net cash from operating activities. You can find the definition of cash flow margin here: cash flow margin.

Altria’s cash flow conversion from revenue is solid and consistent, as reflected by the stable margins displayed in the graph above.

Since fiscal year 2018, Altria’s cash flow conversion from revenue has consistently stayed above 40%, which is likely one of the highest ratios ever recorded by any company. In fiscal year 2023, this ratio increased to 45%, the highest in six years.

With a ratio of 45%, Altria can convert every $1 of sales into $0.45 of operating cash flow.

Free Cash Flow Margin

altria-free-cash-flow-margin

(click image to expand)

Similarly, the free cash flow margin measures Altria’s efficiency in converting revenue to free cash flow. You can find the definition of cash flow margin here: cash flow margin.

Altria’s free cash flow margin closely mirrors its operating cash flow margin, primarily because of the company’s minimal capital expenditures. Basically, Altria spends almost nothing on capital expenditures.

As a result, Altria has maintained a high level of cash conversion from revenue, as shown in the chart above. The company’s free cash flow margin reached 44% in fiscal year 2023 and has averaged 41% annually since 2021, marking one of the highest ratios observed in any company.

Net Cash From Financing Activities

Altria’s net cash from financing activities

(click image to expand)

The net cash from financing activities shows whether cash was used to repay debt (negative numbers) or received from borrowings (positive numbers). You can find the definition of net cash from financing activities here: net cash from financing activities.

Note that the net cash from financing activities shown in the chart above excludes cash flows from capital returns to eliminate the effects of dividends and stock buybacks.

Altria used to generate positive net cash from financing activities. However, recent figures suggest that the company has been repaying debt, resulting in the negative net cash from financing activities, as depicted in the chart above.

As shown in the plot above, Altria’s net cash from financing activities has been negative in the last three years, averaging around -$1.2 billion. In fiscal year, this figure hovered around -$600 million.

Altria’s negative net cash from financing activities over the past three years suggests that the company is using more cash to pay off debt than it is receiving from issuing new debt or equity.

In short, Altria’s consistent cash outflow from financing activities indicates strong cash flow from operations and a strategic decision to reduce leverage.

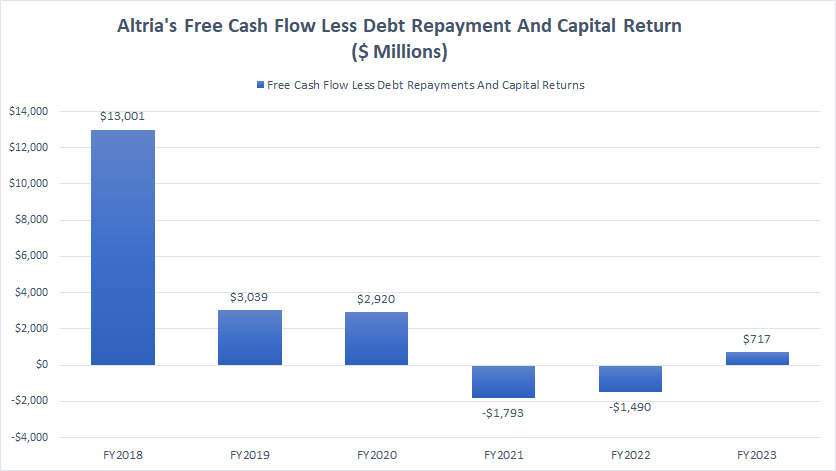

Free Cash Flow Less Debt Repayment And Capital Returns

altria-free-cash-flow-less-debt-repayment-and-capital-return

(click image to expand)

The free cash flow, less debt repayment and capital returns shown in the chart, indicates whether there is an excess of cash after these obligations for Altria.

In fiscal years 2021 and 2022, Altria experienced a cash deficit after accounting for debt payments and capital returns. However, in fiscal year 2023, Altria returned to a positive cash flow, which was good news for investors and shareholders. In fiscal year 2023, Altria had a cash inflow of $700 million after accounting for debt payments and capital returns.

However, if the negative cash outflow shown in the chart above continues consistently, Altria might need to rely on external capital to finance its debt payments and capital returns.

Therefore, investors should monitor this metric periodically.

Summary

Altria has managed to maintain a strong cash position and generate significant free cash flow, despite some fluctuations in operating cash flow and negative net cash from financing activities.

The company’s ability to generate consistent cash flow from operations and maintain a high free cash flow margin has been a positive indicator for investors and shareholders.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Altria’s annual reports published in the company’s investors relation page: Altria’s Events And Presentations.

2. Flickr Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link back to this article from any website so that more articles like this can be created.

Thank you!