IQOS and heat stick. Pixabay Image.

Philip Morris International (PMI) is one of the world’s leading tobacco companies. While PMI relies largely on cigarettes sales, it is steadily transitioning to non-combustible products, hoping to help smokers to switch to less-harmful alternatives.

During the transformation, Philip Morris International introduced several non-combustible products, including the IQOS blade which heats up but does not burn to provide users with a smokeless experience.

For your information, the IQOS blade uses proprietary Heated Tobacco Units or HTUs sold exclusively by PMI. Despite the tremendous amount of effort and investment undertaken by PMI, its cigarette sales still account for over 80% of the company’s total shipment volume as of fiscal 2023.

Can Philip Morris succeed in transitioning from a cigarette-based to a smokeless company? Probably.

In this article, we will look at PMI’s cigarettes and heated tobacco units (HTU) sales volume as well as the sales breakdown on a regional basis.

For your information, heater tobacco units or HTUs refer to heated tobacco consumables such as HEETS, also known as Heatsticks in some markets. Besides, Philip Morris’ HTUs are proprietary products that can only work on the company-produced IQOS blade.

Therefore, Philip Morris’ IQOS is modeled based on the razor and blade concept where users having the company-produced IQOS blade must also purchase its proprietary HTUs in order for the device to work.

Let’s look at the numbers!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Philip Morris International Distribute Its Products?

Consolidated Results

Results By Category

A2. Cigarette Sales Volume

A3. HTU Sales Volume

A4. Sales Breakdown By Percentage

Regional Sales Volume (New)

B1. Cigarette Sales By Region

B2. Cigarette Sales By Region In Percentage

B3. HTU Sales By Region

B4. HTU Sales By Region In Percentage

Regional Sales Volume (Legacy)

C1. Cigarette Sales By Region

C2. Cigarette Sales By Region In Percentage

C3. HTU Sales By Region

C4. HTU Sales By Region In Percentage

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Europe Region: Europe Region is headquartered in Lausanne, Switzerland, and covers all the European Union countries, Switzerland, the United Kingdom, and also Ukraine, Moldova and Southeast Europe.

SSEA, CIS & MEA: South and Southeast Asia, Commonwealth of Independent States, Middle East and Africa Region (“SSEA, CIS & MEA”) is headquartered in Dubai, United Arab Emirates.

It covers South and Southeast Asia, the African continent, the Middle East, Turkey, as well as Israel, Central Asia, Caucasus and Russia.

EA, CIS & PMI DF: East Asia, Australia, and PMI Duty Free Region (“EA, AU & PMI DF”) is headquartered in Hong Kong, and includes the consolidation of PMI’s international duty free business with East Asia & Australia.

Americas: Americas Region is headquartered in Stamford, Connecticut, and covers the United States, Canada and Latin America.

Heated Tobacco Units (HTU): Philip Morris International’s heated tobacco units (HTUs) are designed as an alternative to traditional cigarettes. HTUs are made from processed tobacco and are used with specially designed devices that heat the tobacco rather than burn it.

This heating process generates an aerosol that contains nicotine, flavors, and other ingredients without producing the harmful byproducts associated with combustion. Key features of HTUs include:

1. **Reduced Harm**: HTUs aim to reduce harmful chemicals typically found in cigarette smoke by heating rather than burning tobacco.

2. **Variety of Flavors**: HTUs often come in various flavors, appealing to a broader range of consumers.

3. **User Experience**: They provide a similar experience to smoking while potentially offering lower health risks.

4. **Regulatory Compliance**: The development and marketing of HTUs are subject to specific regulations in different regions, which can affect their availability and branding.

Overall, HTUs represent PMI’s effort to innovate within the tobacco industry and provide alternatives for consumers seeking reduced-risk options.

How Does Philip Morris International Distribute Its Products?

Philip Morris International (PMI) distributes its products through a variety of channels. The primary methods include:

1. **Direct Sales**: PMI sells its products directly to wholesalers and retailers, which allows them to maintain a close relationship with their distributors and ensure product availability.

2. **Distributors**: The company often partners with local distributors with established networks and regional market knowledge. This is particularly important in markets where local laws and regulations may vary.

3. **Retail Partnerships**: PMI also collaborates with various retail chains, convenience stores, and supermarkets to ensure their products are widely available to consumers.

4. **Online Sales**: PMI offers e-commerce platforms where consumers can purchase products directly in some markets.

5. **Market-Specific Strategies**: The distribution approach may vary significantly by region, depending on local regulations, consumer preferences, and market dynamics.

These strategies help PMI reach a wide audience and adapt to different market conditions effectively.

Total Sales Volume

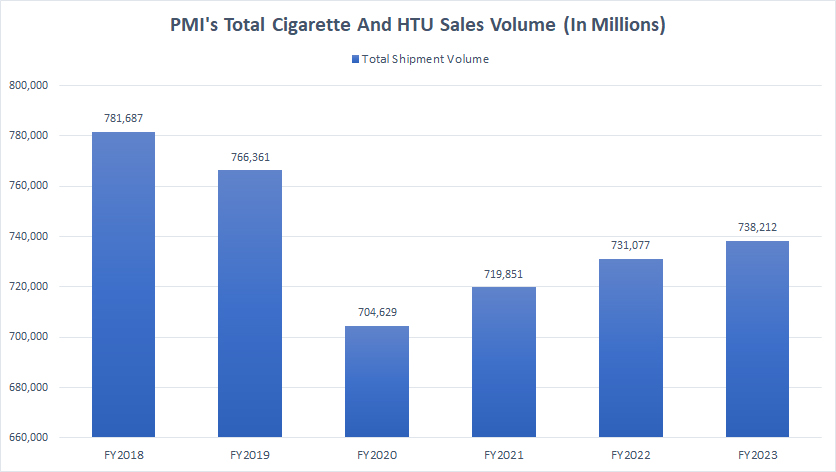

philip-morris-total-shipment-volume

(click image to expand)

The definition of heated tobacco units (HTU) is available here: HTUs.

Philip Morris International’s sales volume which include sales of cigarettes and heated tobacco units (HTU) topped 738.2 billion units in fiscal year 2023, up 1% over the prior year.

Since fiscal year 2020, Philip Morris International’s sales of cigarettes and heated tobacco units (HTU) have steadily increased. Despite reaching record figure in fiscal year 2023, the result still fell short of the pre-pandemic high recorded in 2018.

Fortunately, Philip Morris International’s sales of cigarettes and HTUs have not further declined during post-pandemic time. Rather, they have steadily increased, driven primarily by the rise in HTU sales.

Cigarette Sales Volume

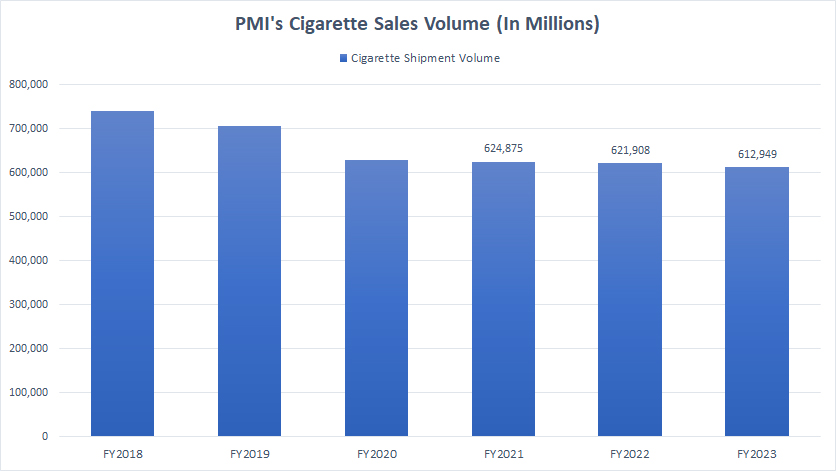

Philip Morris cigarette sales volume by year (click to enlarge)

Philip Morris International’s cigarette sales worldwide have been on the decline, as shown in the chart above, reaching a record low of 613 billion units as of fiscal year 2023, down 1.4% over the prior year or a massive 17% from 2018.

PMI’s declining cigarette sales illustrate fewer new smokers taking up smoking and existing smokers may have totally quit or switched to less-harmful alternatives such as smokeless or non-combustible tobacco products.

While PMI’s cigarette sales have been on the decline, the rate of decline seems to have slowed in recent years, particularly since 2020.

PMI’s cigarette sales are still the bread and butter of the company and accounts for the majority of its revenue.

HTU Sales Volume

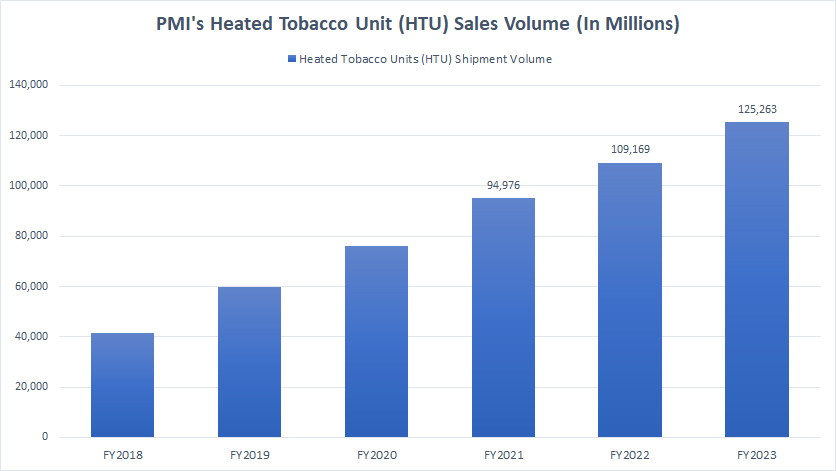

Philip Morris HTU sales volume by year (click to enlarge)

The definition of heated tobacco units (HTU) is available here: HTUs. HTUs or heated tobacco units are proprietary consumables that will only work on PMI-produced IQOS devices. Some of PMI’s HTUs include HEETS which are also referred to as HeatSticks in some markets.

That said, contrary to cigarette sales, Philip Morris International’s HTU sales have steadily increased, as seen in the chart above.

As of fiscal 2023, PMI’s HTU sales reached a record high of 125 billion units, representing a year-on-year growth rate of 15% from 2022 or a massive 200% increment from 2018.

PMI’s significant HTU sales growth is in sharp contrast with that of cigarettes, which has significantly decreased over time.

As Philip Morris International has been aggressively transitioning to a smokeless company, it is not a surprise to see the growing sales of the its HTUs over the years.

Breakdown Of Cigarette And HTU Sales By Percentage

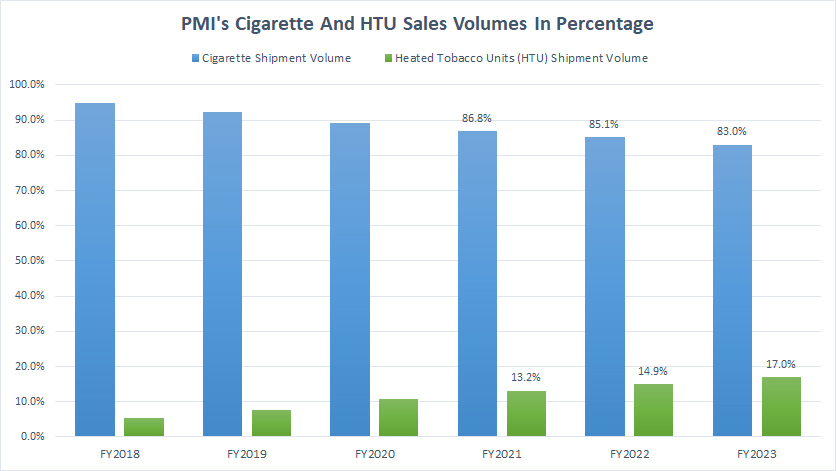

Philip Morris cigarette and HTU sales volume by percentage (click to enlarge)

The definition of heated tobacco units (HTU) is available here: HTUs. From the perspective of percentage, Philip Morris International’s sales of cigarette represent the majority of its total sales volume, with the ratio topping 83% as of 2023.

On the other hand, Philip Morris’ HTU sales made up only 17% of the total volume as of 2023.

While there is still a long way to go for HTUs before becoming a mainstream product, the ratio to total volume for HTU has been on the rise , as shown in the chart above.

As seen, Philip Morris’ HTU percentages have significantly increased, and has grown from less than 10% in 2018 to 17% as of 2023. On the other hand, the percentages of PMI’s cigarette volume have declined from over 90% in 2018 to 83% as of 2023.

PMI’s decreasing cigarette and rising HTU sales have shown that, perhaps the transitioning has been working out as planned for the company. Moreover, the company is now getting less dependent on combustible tobacco products.

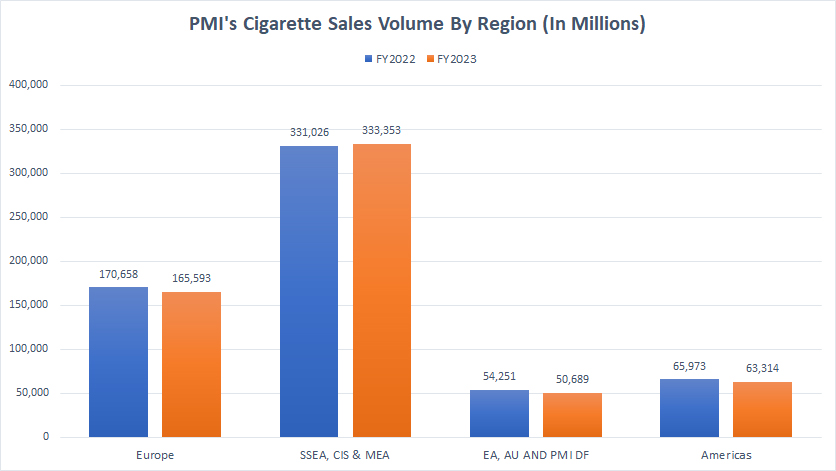

Cigarette Sales By Region (New)

philip-morris-cigarette-shipment-volume-by-region-new

(click image to expand)

The definitions of PMI’s regions are available here: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

Philip Morris International shipped 333.4 billion cigarettes in the SSEA, CIS & MEA region in fiscal year 2023, the highest among all regions under comparison.

PMI’s cigarette sales in Europe topped 165.6 billion units in fiscal year 2023, slightly lower than the 170.7 billion units shipped in 2022.

In the EA, AU, and PMI DF region, PMI shipped just 50.7 billion cigarettes in fiscal year 2023, while its total cigarette sales in Americas came in at 63.3 billion units.

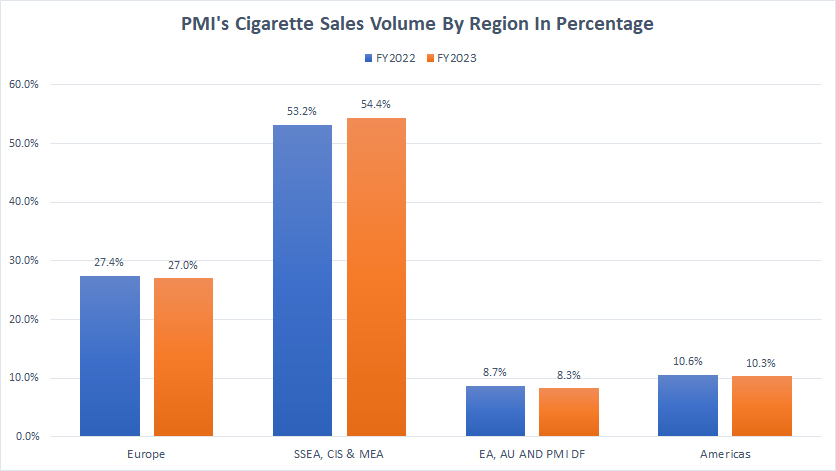

Cigarette Sales By Region In Percentage (New)

philip-morris-regional-cigarette-shipment-volume-by-percentage-new

(click image to expand)

The definitions of PMI’s regions are available here: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

PMI’s cigarette sales in the SSEA, CIS & MEA region have accounted for more than half of its total cigarette volume. In fiscal year 2023, the ratio reached 54.4%, the highest among all regions under comparison.

On the other hand, cigarette sales in Europe accounted for 27% of PMI’s overall cigarette volume, while the EA, AU And PMI DF and Americas regions accounted for 8.3% and 10.3%, respectively, in 2023.

The EA, AU And PMI DF region has accounted for the smallest portion of Philip Morris International’s cigarette volume in the last two years.

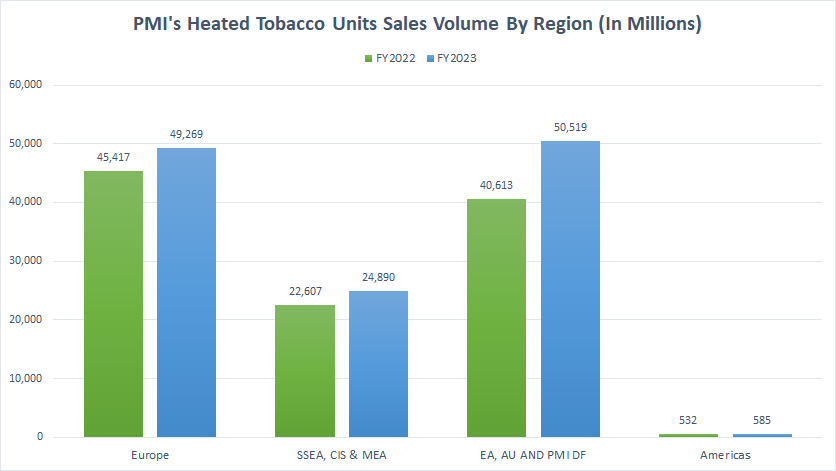

HTU Sales By Region (New)

philip-morris-HTU-shipment-volume-by-region-new

(click image to expand)

The definitions of PMI’s regions are available here: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas. The definition of PMI’s HTUs is available here: HTUs.

Among all regions, Philip Morris International has shipped the most HTUs in the EA, AU And PMI DF region, with sales volume coming in at 50.5 billion units in fiscal year 2023 in this region.

Europe came in at 49.3 billion units of HTUs sales in fiscal year 2023, the second highest among all regions.

PMI shipped just 24.9 billion HTUs in the SSEA, CIS & MEA region in fiscal year 2023, slightly higher than the 22.6 billion units shipped in 2022.

PMI’s HTU sales in Americas has been negligible in the last two years, topping just 585 million units in fiscal year 2023.

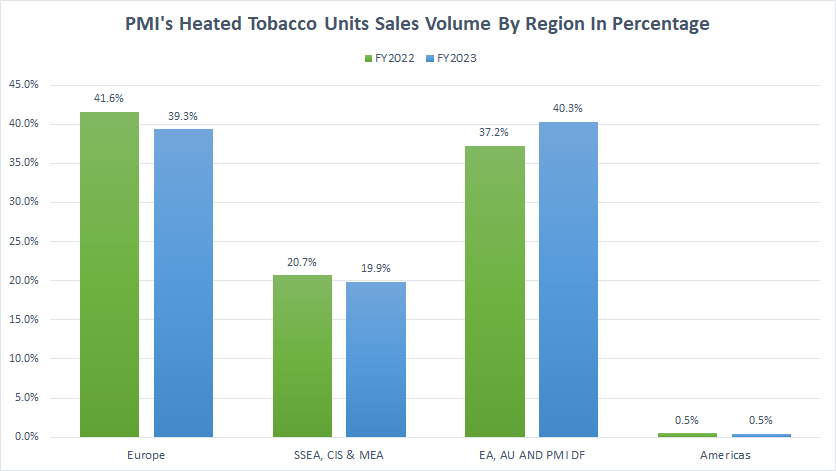

HTU Sales By Region In Percentage (New)

philip-morris-regional-HTU-shipment-volume-by-percentage-new

(click image to expand)

The definitions of PMI’s regions are available here: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas. The definition of PMI’s HTUs is available here: HTUs.

Europe and the EA, AU And PMI DF regions, each, are accounting for around 40% of Philip Morris International’s total HTU sales volume.

The SSEA, CIS & MEA region has accounted for 20%, while the Americas region has accounted for less than 1% of PMI’s overall HTU sales.

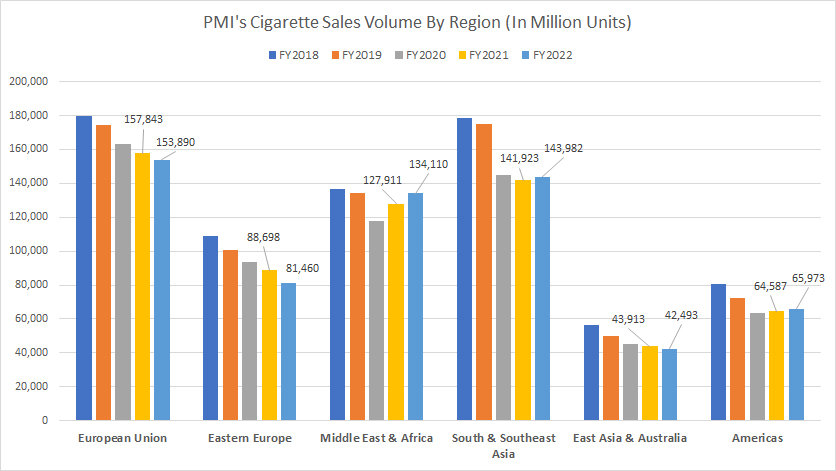

Cigarette Sales By Region (Legacy)

Philip Morris cigarette sales volume by region (click to enlarge)

This section is a legacy report as PMI is no longer providing the shipment volume in these regions.

A notable trend worth pointing out is Philip Morris’ declining cigarette shipment volumes in all regions around the world as shown in the chart above.

For example, PMI’s cigarette shipment volume in European Union has declined by more than 20 billion units or 14% since 2018 and reached 154 billion units as of 2022, a record low in the past 5 years.

Similarly, Philip Morris’ cigarette sales in South & Southeast Asia have probably declined the most among all regions in the world during the past 5 years, dropping from 178.5 billion sticks reported in 2018 to only 144 billion sticks as of 2022, down by a massive 34.5 billion sticks or 19% in the same period.

Also, things are not looking good in Eastern Europe, particularly Russia, where PMI’s cigarette sales in this region have declined by 25% since 2018.

While cigarette sales in the European Union and Eastern Europe have been on a downtrend, their respective revenue seems to be on an increase in the past 5 years, according to this article – Philip Morris Revenue By Region.

The growing revenue reported in the European region has probably been helped by the increasing sales of HTU in these regions.

We will look at HTU sales by region in the next discussions.

Before heading out, let’s briefly look at the ranking of PMI’s cigarette shipment volume by region.

For example, Philip Morris ships the most cigarettes to the European Union, notably at 154 billion sticks in 2022.

The South & Southeast Asia region comes after the European Union, with 144 billion sticks of cigarettes sold in 2022.

The third place goes to the Middle East & Africa where 134 billion sticks of cigarettes were sold in 2022.

In short, the European Union is Philip Morris’ biggest market for its cigarettes while East Asia & Australia is the smallest market whose cigarette sales totaled only 42.5 billion units in 2022.

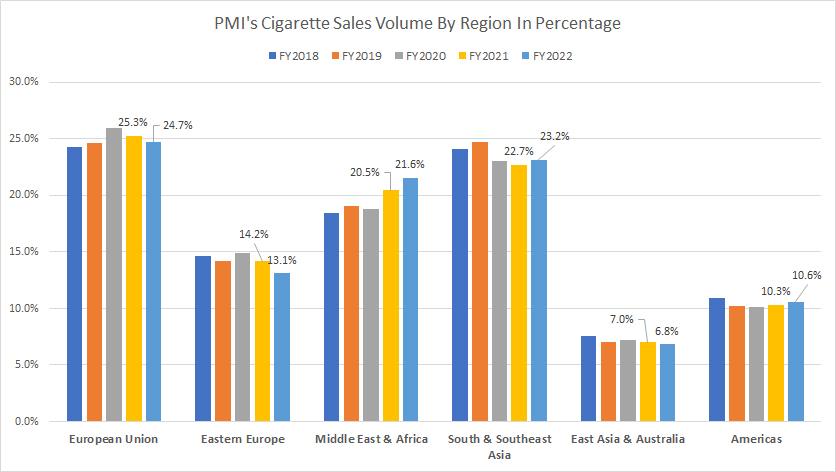

Cigarette Sales By Region In Percentage (Legacy)

Philip Morris regional cigarette sales volume by percentage (click to enlarge)

This section is a legacy report as PMI is no longer providing the shipment volume in these regions.

Of all regions, Philip Morris’ European Union contributes the most in terms of cigarette shipment volume, topping 25% of total sales volume as of 2022.

Philip Morris’ South and Southeast Asia came in second, with a cigarette sales volume making up 23% of total volume in 2022.

Total cigarette sales in the Middle East & Africa region represent about 22% of the total volume as of 2022.

On the other hand, East Asia & Australia has the least percentage, only at 7% as of 2022.

A trend worth pointing out is the declining ratio in most regions around the world. However, the Middle East & Africa seems like the only region with a growing percentage. For example, the number for the Middle East & Africa region has grown by 3 ppts since 2018.

Interestingly, PMI’s cigarette sales in the Middle East & Africa have been roughly flat during the same period.

The growing percentage should point out that Philip Morris’ cigarette sales in the Middle East & Africa have been reasonably strong and resilient compared to other regions whose sales volumes have significantly declined.

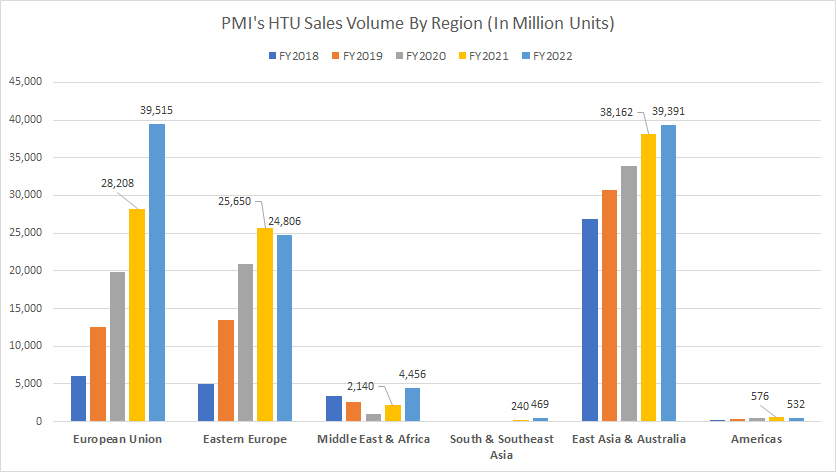

HTU Sales By Region (Legacy)

Philip Morris HTU sales volume by region (click to enlarge)

This section is a legacy report as PMI is no longer providing the shipment volume in these regions.

In terms of heated tobacco units (HTUs) shipment volume, Philip Morris recorded the highest sales figure in the European Union region, notably at nearly 40 billion units as of 2022.

This figure also has been on an increase and has grown by more than 500% since 2018, possibly the region with the best growth rates among all other regions in the world.

PMI also generated one of the best HTU sales in East Asia & Australia region in 2022, at 39.4 billion units, representing a rise of 3% over 2021 or 46% over 2018.

Interestingly, Philip Morris’ cigarette sales in East Asia & Australia were at the bottom of the list but its HTU sales were one of the highest among all other regions.

The Eastern Europe region comes in third in terms of HTU sales figures and the recorded number was 24.8 billion sticks for fiscal 2022.

For other regions such as the Middle East & Africa, South & Southeast Asia, and the Americas, Philip Morris’ HTU sales in these regions have been very low despite recording some of the highest cigarette volumes in the same regions.

While PMI sold less than 1 billion HTUs in regions such as South & Southeast Asia and the Americas, the opportunity for smokeless products in these regions is enormous.

Imagine if Philip Morris is able to convert a majority of these smokers to consuming the company’s smoke-free or non-combustible products.

A similar trend applies to the Middle East & Africa region where the number of smokers is disproportionately high compared to HTU users.

Therefore, the market opportunity for HTU products in these regions is still pretty much untapped and Philip Morris can take advantage of that since its user base is already there.

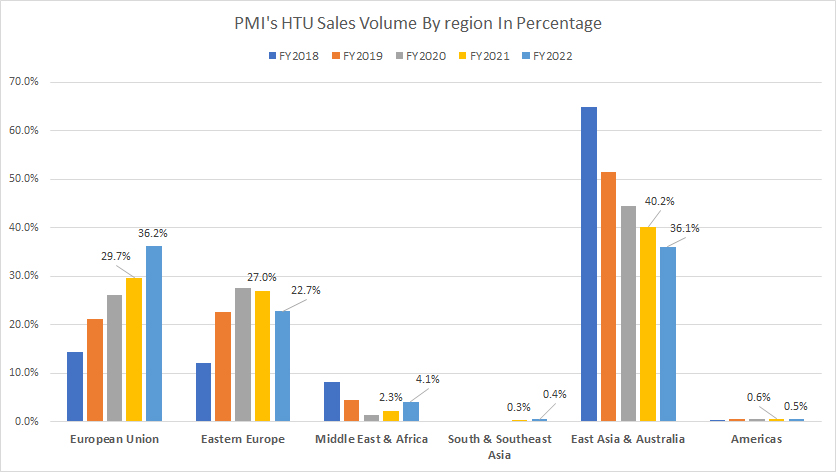

HTU Sales By Region In Percentage (Legacy)

Philip Morris regional HTU sales volume by percentage (click to enlarge)

This section is a legacy report as PMI is no longer providing the shipment volume in these regions.

Philip Morris’ HTU sales volume by percentage was the highest in both the European Union and East Asia & Australia regions.

Ironically, the percentage of HTU sales in East Asia & Australia has been on a decline while the respective absolute figure has been on the increase as seen in prior discussions.

The declining percentage of HTU sales in East Asia & Australia illustrates the significant rise of HTU sales in other regions, particularly the European Union and Eastern Europe.

For the rest of the regions such as South & Southeast Asia and the Americas, PMI’s HTU sales have made little to no progress as the ratios have been fewer than 1% in the last 5 years.

Conclusion

To recap, Philip Morris International (PMI) is going smoke-free while still maintaining its legacy cigarette business.

As a result, we are seeing that PMI’s cigarette sales have already reached a plateau and have been on the decline.

At the same time, PMI’s heated tobacco unit sales have been on the rise, reaching record figures in recent years.

As of fiscal 2024, PMI’s cigarette volume clocked 83% while HTU volume represented 17% of the total volume, showing that the transformation effort is working for the firm.

While smoke-free products have seriously gained in terms of sales percentage, Philip Morris was still pretty much a cigarette company as of 2023, with the majority of its sales volume still coming from its legacy smokeable products.

References and Credits

1. All financial figures in this article were obtained and referenced from PMI’s quarterly and annual filings available in Philip Morris International’s Reports And Filings.

2. Featured images in this article are obtained free and are used without any attribution from the following links: Pixabay

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website to create more articles like this.

Thank you!