Multi storeys parking bays. Pexels Image.

This article presents the statistics of Ford Motor Company’s distributors and dealers (collectively, “dealerships”). These statistics include the numbers of Ford’s dealerships worldwide, number of dealerships by brand, and dealership growth rates.

Ford Motor has stated that most of its vehicles, parts, and accessories are sold through distributors and dealers, the substantial majority of which are independently owned.

Let’s look at the numbers.

For other key statistics of Ford Motor, you may find more information on these pages:

Global Sales & Market Share

Wholesales

Revenue

- Revenue streams: sales of new and used cars, services, etc.,

- Revenue per employee in America, Europe, China, etc.,

- Revenue per car in North America, Europe, China, etc.,

Profit & Margin

Debt & Cash

Comparison With Peers

- Ford vs GM and Tesla: advertising and marketing budget,

- Ford vs General Motors: vehicle profit and margin,

- Ford vs Tesla: profit margin comparison,

Other Statistics

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why are Ford Motor’s dealerships on the decline?

Consolidated Results

A1. Total Dealerships Worldwide

A2. Growth Rates Of Worldwide Dealerships

Results By Brand

B1. Ford Brand And Lincoln Brand Dealerships

B2. Ford Brand And Lincoln Brand Dealerships In Percentage

Growth Rates By Brand

C1. Growth Rates Of Ford Brand And Lincoln Brand Dealerships

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Ford Brand Dealerships: Ford brand dealerships are retail outlets authorized by the Ford Motor Company to sell and service Ford vehicles.

They offer a wide range of new and pre-owned Ford cars, trucks, SUVs, and parts and maintenance services. These dealerships are staffed with sales professionals and trained technicians who specialize in Ford vehicles, ensuring that customers receive knowledgeable assistance in purchasing and maintaining their vehicles.

Additionally, Ford dealerships often provide financing options and special offers to facilitate the buying process for their customers.

Ford-Lincoln Brand Dealerships: Ford-Lincoln brand dealerships are automotive retail businesses officially authorized to sell and service vehicles manufactured by the Ford Motor Company, including its Ford and luxury Lincoln brand vehicles.

These dealerships offer a wide range of new and pre-owned cars, trucks, and SUVs from the Ford and Lincoln line-ups. In addition to vehicle sales, Ford-Lincoln dealerships provide comprehensive after-sales services such as maintenance, repairs, parts replacement, and warranty services, ensuring that customers receive support throughout their vehicle ownership.

These dealerships are part of Ford’s efforts to cater to a broad spectrum of customers, from those looking for practical and reliable vehicles to those seeking luxury and premium driving experiences.

Lincoln Brand Dealerships: Lincoln Brand dealerships are retail outlets specializing in the sale of Lincoln vehicles, a luxury vehicle brand of the American automaker Ford Motor Company.

These dealerships offer a range of new and pre-owned Lincoln models, including sedans, SUVs, and crossovers. In addition to vehicle sales, Lincoln Brand dealerships provide comprehensive after-sales services such as maintenance, repairs, parts replacement, and warranty services.

They are known for offering a premium buying and service experience, aligning with the luxury status of the Lincoln brand. Customers can expect personalized attention, upscale amenities, and a focus on customer satisfaction at these dealerships.

Why are Ford Motor’s dealerships on the decline?

Ford is actively restructuring its dealership network, and several factors are driving this shift:

-

Transition to Direct Sales: Ford is moving towards a direct-to-consumer model, particularly for electric vehicles (EVs). This approach reduces reliance on traditional dealerships and streamlines inventory management.

-

Profitability Optimization: The company aims to make dealerships more profitable by consolidating locations and increasing sales volume per dealer. This strategy allows Ford to focus on fewer, larger dealerships with expanded market areas.

-

Market Adaptation: Ford has been adjusting its network in response to changing consumer preferences, including online sales and build-to-order systems. This aligns with broader industry trends favoring digital integration and flexible purchasing options.

-

Network Reduction Plan: Since 2020, Ford has been systematically reducing its dealership count, targeting nearly a 50% reduction by 2025. Recent terminations of over 50 dealerships indicate that Ford is meeting its restructuring goals.

This shift reflects Ford’s broader strategy to modernize its sales operations while adapting to the evolving automotive landscape.

Total Dealerships Worldwide

Ford-Motor-number-of-worldwide-dealerships

(click image to expand)

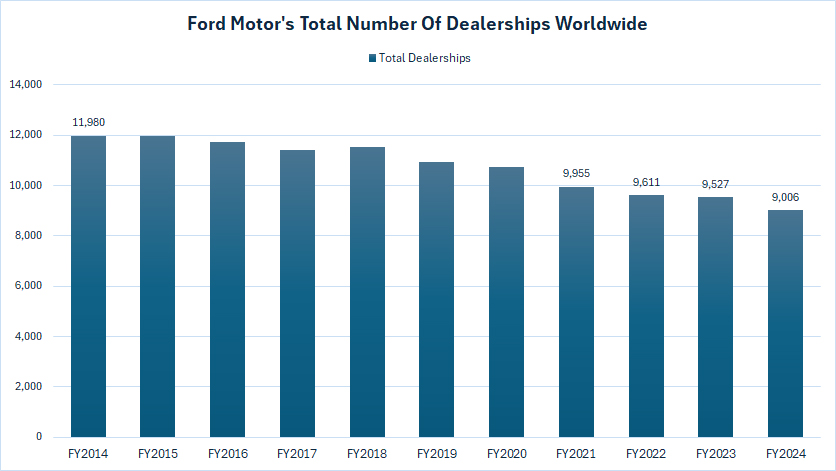

Ford Motor’s total number of dealerships globally has decreased from close to 12,000 in 2014 to only 9,000 as of the end of the fiscal year 2024. The decrease represents a drop of nearly 25% over the last ten years.

In short, Ford Motor had only about 9,000 dealerships globally by the end fiscal year 2024. This figure represents a 25% reduction from the 12,000 locations in 2014.

Growth Rates Of Worldwide Dealerships

Ford-Motor-growth-rates-of-worldwide-dealerships

(click image to expand)

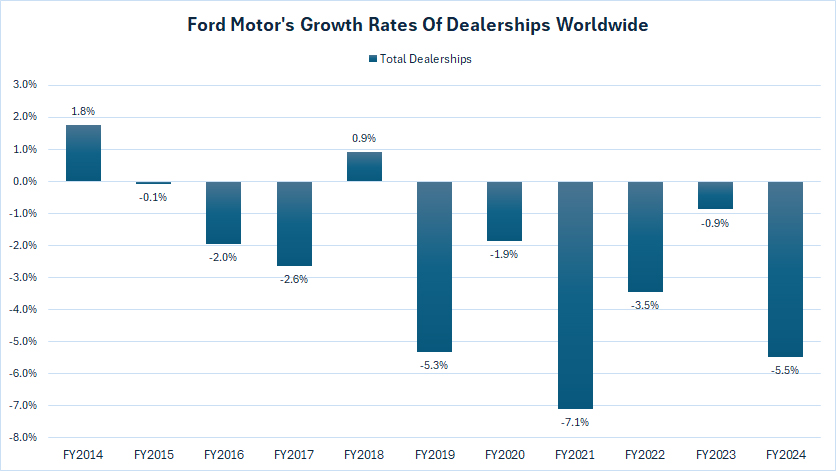

Ford has experienced a consistent decline in its worldwide dealership network, with negative growth rates in most observed periods. Between 2020 and 2024, the company’s dealership count contracted at an average annual rate of -4%.

Several strategic factors contribute to this ongoing reduction. First, Ford, like many of its industry peers, is expanding its online sales platforms, diminishing the reliance on traditional dealership locations.

Second, its focus on electrification necessitates a different sales and service approach. Since electric vehicles require less routine maintenance than internal combustion engine models, the demand for dealership service departments is naturally lower.

Third, operating physical dealership locations incurs substantial costs. To optimize profitability, Ford is streamlining its footprint, aligning with broader cost-cutting measures aimed at maintaining competitiveness in an evolving automotive industry.

Ford Brand And Lincoln Brand Dealerships

Ford-Motor-breakdown-of-worldwide-dealerships

(click image to expand)

The definitions of Ford brand and Lincoln brand dealerships are available here: Ford brand dealerships, Ford-Lincoln brand dealerships, and Lincoln brand dealerships.

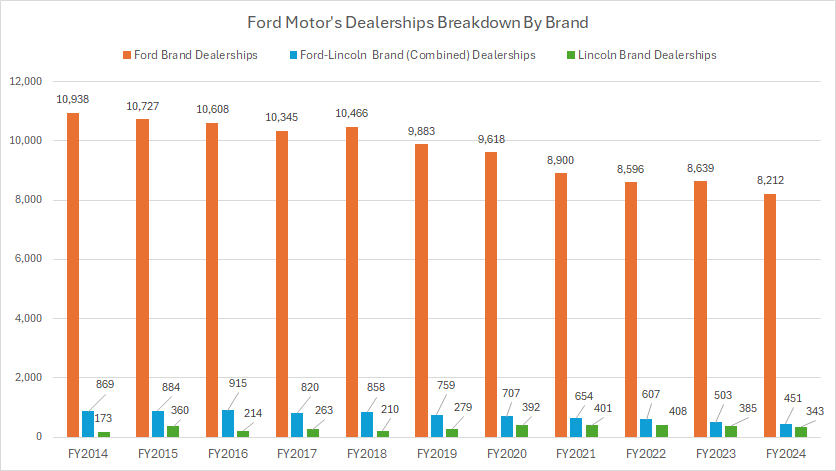

Of the total dealerships globally, the majority of them are Ford brand dealerships, as shown in the chart above.

Ford-Lincoln brand and Lincoln brand dealerships make up only a small portion of Ford Motor’s global dealerhips.

Dealerships in FY2024:

| Segment | Dealerships |

|---|---|

| (In Numbers) | |

| Ford Brand | 8,212 |

| Ford-Lincoln Brand | 451 |

| Lincoln Brand | 343 |

3-Year Dealerships Trend from FY2021 to FY2024:

| Segment | Dealerships | % Changes |

|---|---|---|

| (In Numbers) | ||

| Ford Brand | 8,900 to 8,212 | -7.7% |

| Ford-Lincoln Brand | 654 to 451 | -31.0% |

| Lincoln Brand | 401 to 343 | -14.5% |

5-Year Dealerships Trend from FY2019 to FY2024:

| Segment | Dealerships | % Changes |

|---|---|---|

| (In Numbers) | ||

| Ford Brand | 9,883 to 8,212 | -16.9% |

| Ford-Lincoln Brand | 759 to 451 | -40.6% |

| Lincoln Brand | 279 to 343 | 22.9% |

10-Year Dealerships Trend from FY2014 to FY2024:

| Segment | Dealerships | % Changes |

|---|---|---|

| (In Numbers) | ||

| Ford Brand | 10,938 to 8,212 | -24.9% |

| Ford-Lincoln Brand | 869 to 451 | -48.1% |

| Lincoln Brand | 173 to 343 | 98.3% |

Ford Brand And Lincoln Brand Dealerships In Percentage

Ford-Motor-breakdown-of-worldwide-dealerships-in-percentage

(click image to expand)

The definitions of Ford brand and Lincoln brand dealerships are available here: Ford brand dealerships, Ford-Lincoln brand dealerships, and Lincoln brand dealerships.

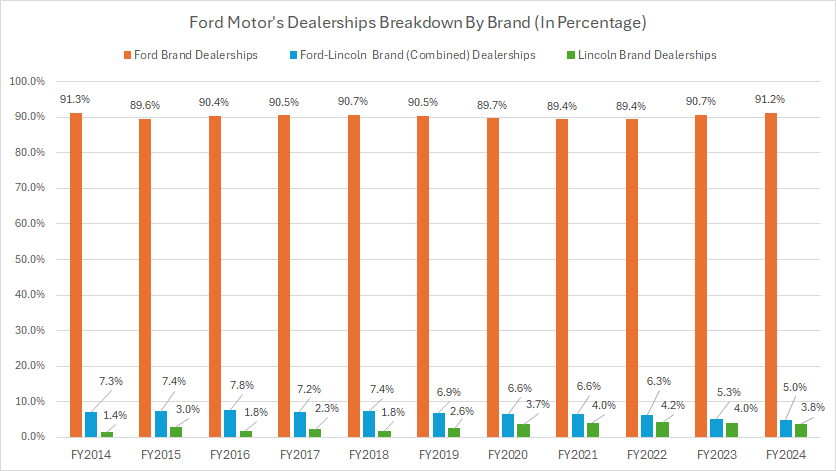

In terms of percentage, Ford brand dealerhips made up 91% of Ford Motor’s global dealerships as of the end of the fiscal year 2024, according to Ford’s 2024 annual report.

Ford-Lincoln brand and Lincoln brand dealerships consisted of just 5.0% and 3.8% of the total as of fiscal year 2024.

Here are the breakdowns:

Dealerships Share in FY2024:

| Segment | Dealerships Share (%) |

|---|---|

| Ford Brand | 91.2% |

| Ford-Lincoln Brand | 5.0% |

| Lincoln Brand | 3.8% |

3-Year Dealerships Trend from FY2021 to FY2024:

| Segment | Dealerships Share (%) |

|---|---|

| Ford Brand | 89.4% to 91.2% |

| Ford-Lincoln Brand | 6.6% to 5.0% |

| Lincoln Brand | 4.0% to 3.8% |

5-Year Dealerships Trend from FY2019 to FY2024:

| Segment | Dealerships Share (%) |

|---|---|

| Ford Brand | 90.5% to 91.2% |

| Ford-Lincoln Brand | 6.9% to 5.0% |

| Lincoln Brand | 2.6% to 3.8% |

10-Year Dealerships Trend from FY2014 to FY2024:

| Segment | Dealerships Share (%) |

|---|---|

| Ford Brand | 91.3% to 91.2% |

| Ford-Lincoln Brand | 7.3% to 5.0% |

| Lincoln Brand | 1.4% to 3.8% |

Growth Rates Of Ford Brand And Lincoln Brand Dealerships

Ford-Motor-growth-rates-of-worldwide-dealerships-breakdown

(click image to expand)

The definitions of Ford brand and Lincoln brand dealerships are available here: Ford brand dealerships, Ford-Lincoln brand dealerships, and Lincoln brand dealerships.

Dealerships Growth in FY2024

| Segment | Growth Rates |

|---|---|

| Ford Brand | -4.9% |

| Ford-Lincoln Brand | -10.3% |

| Lincoln Brand | -10.9% |

3-Year Average Dealerships Growth from FY2022 to FY2024:

| Segment | Growth Rates |

|---|---|

| Ford Brand | -2.6% |

| Ford-Lincoln Brand | -11.6% |

| Lincoln Brand | -4.9% |

5-Year Average Dealerships Growth from FY2020 to FY2024:

| Segment | Growth Rates |

|---|---|

| Ford Brand | -3.6% |

| Ford-Lincoln Brand | -9.8% |

| Lincoln Brand | 5.6% |

10-Year Average Dealerships Growth from FY2015 to FY2024:

| Segment | Growth Rates |

|---|---|

| Ford Brand | -2.8% |

| Ford-Lincoln Brand | -6.1% |

| Lincoln Brand | 13.1% |

Insight

Ultimately, Ford’s dealership contraction is reflective of a broader industry trend where automakers are reevaluating traditional dealership models in favor of more agile, tech-driven approaches. As Ford continues to advance its electrification goals, enhance digital sales platforms, and optimize its financial structure, its dealership network will likely continue evolving to align with these strategic priorities.

References and Credits

1. All financial figures presented were obtained and referenced from Ford’s quarterly and annual reports published on the company’s investor relations page: Ford shareholders page.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.