Ford by Flickr Image.

This article covers the vehicle retail sales and market share of Ford Motor Company.

The difference between retail and wholesale is explained below:

Wholesale

Wholesale represents sales to car dealerships and are recognized as revenue in Ford’s income statements.

Retail

Retail sales represent dealership sales to end customers and are estimated based on vehicle registrations. For such sales, Ford does not recognize the revenue generated from the sales of dealerships to end customers, and in most cases, the retail sales data merely represents the strength of Ford’s brands.

For other sales statistics of Ford Motor, you may find more information on these pages:

Global Sales & Market Share

- Ford sales by country and region,

- Ford market share by country and region,

- Ford global ev sales and ev sales by model.

Wholesales

U.S. Sales

- Ford U.S. truck, SUV, and car sales,

- Ford sales by vehicle type – electric, hybrid, and internal combustion,

- Ford Lincoln vehicle sales,

- Ford Lincoln sales by model,

- Ford SUV sales by model – Explorer, Escape, Bronco, etc., and

- Ford truck sales by model.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why are Ford’s sales and market share on the decline?

Global Results

A1. Global Vehicle Sales

A2. Global Market Share

Results By Region

B1. Vehicle Sales By Region

B2. Market Share By Region

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Retail Sales: Ford’s retail sales represent primarily sales by dealers, sales to the government, and leases to Ford management, and is based, in part, on estimated vehicle registrations. Ford’s retail sales include sales of medium and heavy trucks.

Market Share: Ford’s market share is defined as the percentage of its retail sales with respect to the industry volume in the relavant market or region, according to its annual reports. The market share equation is as follows:

Market Share = Retail Sales / Industry Volume

According to Ford, the industry volume is an internal estimate based on publicly available data collected from various government, private, and public sources around the globe. It includes medium and heavy trucks.

Europe 20: Europe 20 markets are United Kingdom, Germany, France, Italy, Spain, Austria, Belgium, Czech Republic, Denmark, Finland, Greece, Hungary, Ireland, the Netherlands, Norway, Poland, Portugal, Romania, Sweden, and Switzerland.

Europe 20 excludes Russia and Turkey.

Why are Ford’s sales and market share on the decline?

Several factors are contributing to the decline in Ford’s sales and market share:

- Supply Chain Disruptions: The global semiconductor shortage has significantly impacted Ford’s production capabilities, leading to delays and reduced inventory. This has affected the availability of popular models and hindered sales growth.

- Labor Strikes: The United Auto Workers (UAW) strike in 2023 had a substantial impact on Ford’s production, particularly at key plants producing high-demand models like the Ford Bronco, Ranger, and F-Series trucks. The strike led to inventory depletion and disrupted sales.

- Increased Competition: The automotive market is highly competitive, with numerous established and emerging brands vying for market share. Ford faces stiff competition from both traditional automakers and new entrants in the electric vehicle (EV) market.

- Economic Factors: Economic conditions, such as inflation and rising interest rates, can influence consumer spending on vehicles. Potential buyers may be more cautious about making high-value purchases during uncertain economic times.

- Shift in Consumer Preferences: There is a growing consumer preference for electric and hybrid vehicles. While Ford has made strides in electrification, it is still catching up to competitors like Tesla in terms of EV market share.

- Brand Perception and Innovation: Ford needs to continuously innovate and expand its product lineup to attract more customers. The success of competitors’ new models and technological advancements can impact Ford’s sales performance.

- Dealer Network Optimization: Ford has been reducing its dealer network to streamline operations and match supply with demand. While this strategy aims to improve efficiency, it may also impact sales volume in the short term.

Overall, a combination of supply chain challenges, labor strikes, increased competition, economic factors, shifting consumer preferences, and the need for continuous innovation are contributing to the decline in Ford’s sales and market share.

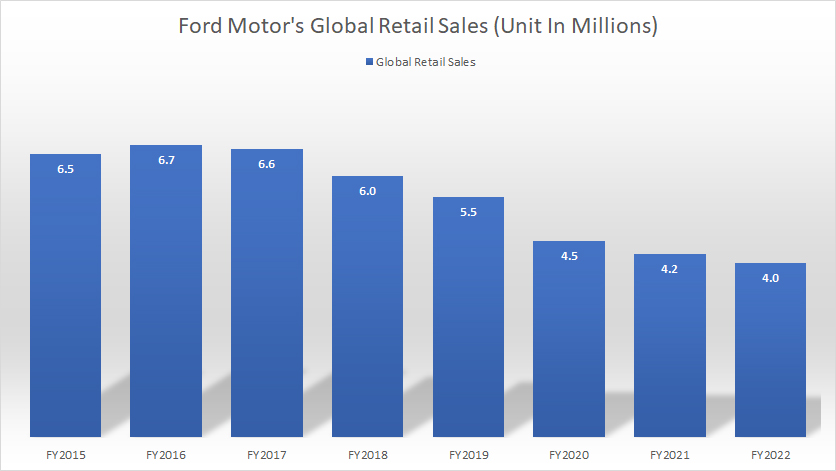

Global Vehicle Sales

Ford-Motor-global-vehicle-sales

(click image to expand)

The definition of Ford’s vehicle retail sales is available here: retail sales.

Ford has ceased publishing its global retail volume in annual reports since 2023. Consequently, the available data extends only up to fiscal year 2022.

Ford’s global vehicle sales have experienced a marked downturn over the past eight years, as illustrated in the accompanying chart.

In fiscal year 2022, Ford’s global sales plummeted to just 4.0 million units, setting a record low not seen since fiscal year 2015 and reflecting a nearly 5% decline from fiscal year 2021.

Between fiscal years 2015 and 2022, Ford’s global vehicle sales achieved their zenith in fiscal year 2016, with a total of 6.7 million units sold.

However, since that peak, Ford’s sales figures have consistently declined, culminating in a substantial reduction of 2.7 million vehicles, or 40%, from 2016 to 2022.

Furthermore, during the period from fiscal year 2015 to 2022, Ford has not experienced any sales growth, underscoring a continuous and persistent decline over these years.

Several factors could have contributed to Ford’s downward trajectory, including increasing competition, shifts in consumer preferences, and potential supply chain disruptions.

It’s evident that Ford faces significant challenges in reversing this trend and regaining its former sales momentum. Moving forward, the company may need to innovate and adapt to the evolving automotive market to restore its growth trajectory.

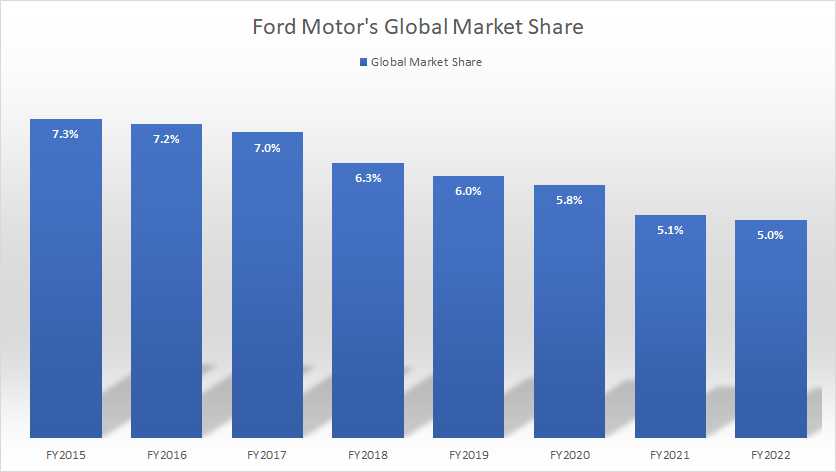

Global Market Share

Ford-Motor-global-market-share

(click image to expand)

The definition of Ford’s market share is available here: market share.

Ford has ceased publishing its global market share in annual reports since 2023. Consequently, the available data extends only up to fiscal year 2022.

Ford’s global market share experienced a dramatic decline, plunging to just 5.0% in fiscal year 2022 — the lowest level recorded between 2015 and 2022. From 2020 to 2022, Ford’s average global market share was 5.3%, indicating a gradual decrease over these years.

In the period between fiscal years 2015 and 2022, Ford’s worldwide market share reached its highest point at 7.3% in fiscal year 2015. However, this peak was followed by a persistent downward trend, with the company’s market share hitting record lows in subsequent years.

Several factors may have contributed to Ford’s continuous market share decline. The automotive industry has become increasingly competitive, with new players entering the market and existing competitors improving their offerings.

Additionally, shifts in consumer preferences towards electric and hybrid vehicles, as well as increased demand for more environmentally friendly and technologically advanced cars, may have impacted Ford’s market share.

Furthermore, supply chain disruptions and economic uncertainties could have played a role in this decline. As Ford navigates these challenges, it may need to invest in innovation, improve its product lineup, and adapt to the evolving market demands to regain and potentially expand its market share in the future.

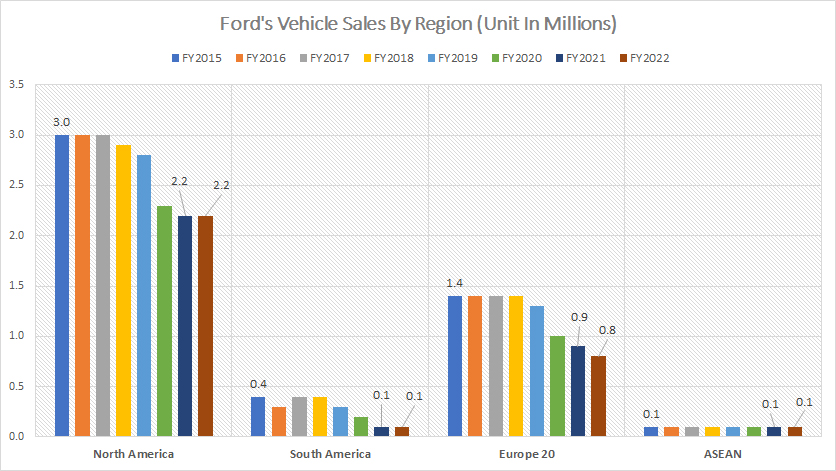

Vehicle Sales By Region

Ford vehicle sales by region

(click image to expand)

The definitions of Ford’s vehicle sales and Europe 20 are available here: retail sales and Europe 20.

Ford has ceased publishing its sales by region data in annual reports since 2023. Consequently, the available data extends only up to fiscal year 2022.

Ford’s vehicle sales predominantly stem from North America and Europe, as depicted in the accompanying chart. In fiscal year 2022, Ford managed to sell approximately 2.2 million vehicles in North America, aligning closely with the previous year’s results.

On the other hand, Ford’s sales in Europe totaled only 0.8 million vehicles — a significantly lower figure compared to North America and slightly lower than the result in fiscal year 2021.

Cumulatively, sales in both North America and Europe amounted to 3.0 million vehicles, representing a substantial 75% of Ford’s global retail volumes.

In contrast, Ford’s retail sales in South America and the ASEAN region each tallied at a mere 0.1 million vehicles in fiscal year 2022 — the lowest among all compared regions.

A noticeable and concerning trend is the ongoing decline in vehicle sales across most regions, as illustrated in the graph above. For instance, since 2015, Ford’s vehicle sales in North America have dropped by about 27%, plummeting from 3.0 million units to just 2.2 million units between fiscal years 2015 and 2022.

Similarly, Ford’s vehicle sales in Europe have experienced a more pronounced decline of over 40% since 2015, falling from 1.4 million vehicles to only 0.8 million during the same eight-year period.

Ford has faced parallel declines in South America and the ASEAN region. Since fiscal year 2015, Ford’s retail volumes in South America have nosedived from 0.4 million to 0.1 million over eight years, while sales in the ASEAN region have remained stagnant at 0.1 million.

Several factors may contribute to Ford’s persistent decline across all regions, including intensifying competition, evolving consumer preferences towards electric and hybrid vehicles, and heightened demand for more environmentally friendly and technologically advanced automobiles.

Additionally, supply chain disruptions and economic uncertainties may have further compounded the challenges Ford faces in these markets.

To address these declines and revitalize its sales, Ford may need to invest in innovative technologies, diversify its product lineup, and adapt to the evolving market demands to reclaim and potentially expand its market share in the coming years.

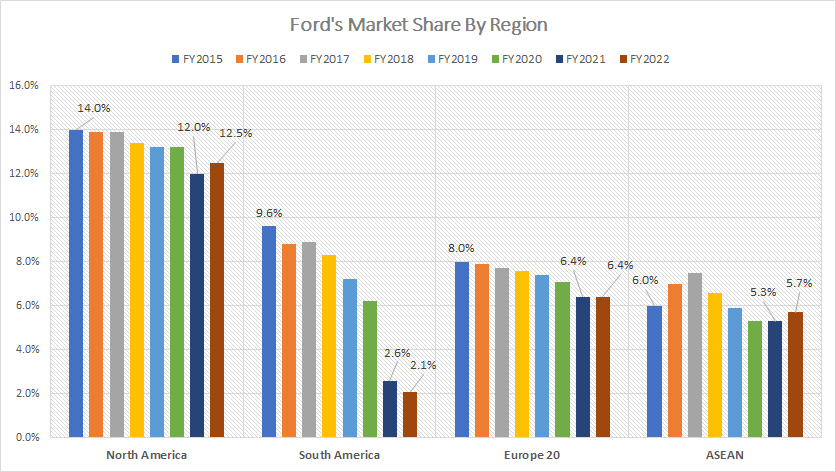

Market Share By Region

Ford market share by region

(click image to expand)

The definitions of Ford’s market share and Europe 20 are available here: market share and Europe 20.

Ford has ceased publishing its market share by region data in annual reports since 2023. Consequently, the available data extends only up to fiscal year 2022.

Investors should be concerned about more than just the decline in vehicle sales; Ford’s market share has also been plummeting in most regions, as illustrated in the chart above.

For instance, Ford’s market share in North America has dropped from 14% in 2015 to only 12.5% by 2022. Similarly, in Europe, Ford’s market share has fallen from 8% in 2015 to 6.4% by 2022.

South America has been hit the hardest, with Ford’s market share declining from 9.6% in 2015 to a mere 2.1% in 2022. Meanwhile, Ford’s market share in the ASEAN region has remained relatively stable, going from 6.0% in fiscal year 2015 to 5.7% in fiscal year 2022.

Several factors contribute to these troubling trends. The automotive industry has become increasingly competitive, with new entrants and existing players upping their game.

This has put pressure on Ford to innovate and keep pace with market demands. Additionally, consumer preferences are shifting toward electric and hybrid vehicles, as well as more technologically advanced and environmentally friendly options. These trends have challenged Ford to adapt and evolve its product lineup.

Moreover, supply chain disruptions and economic uncertainties have likely exacerbated the situation, making it even more difficult for Ford to maintain its market share.

As these challenges persist, Ford must focus on innovation, diversifying its offerings, and aligning with market trends to regain and expand its market presence.

For investors, it’s crucial to monitor how Ford addresses these issues and whether the company can successfully navigate the evolving landscape of the automotive industry. The ability to adapt and respond to market demands will be key to Ford’s future success and its capacity to restore investor confidence.

Conclusion

In summary, Ford Motor’s global vehicle sales have significantly declined across most regions and countries. In addition to the downturn in vehicle sales, Ford’s market share by region and country has also tumbled considerably in many markets.

These declines in sales and market share are concerning for shareholders and investors who are closely monitoring the company’s performance.

Moreover, Ford’s electrification push appears to have gained little traction, as internal combustion engine (ICE) vehicle sales still account for over 90% of the company’s total wholesale volumes. This ratio has remained relatively unchanged compared to the last several years, highlighting the slow progress in transitioning to electric vehicles.

To reverse these trends, Ford needs to take significant steps to regain its market share and boost sales. This may involve investing in new technologies, expanding its electric vehicle lineup, and improving the appeal and performance of its existing models. Additionally, Ford will need to address supply chain challenges and adapt to changing consumer preferences to remain competitive in the evolving automotive market.

In short, Ford has much work to do to restore investor confidence and achieve sustainable growth in the coming years. By focusing on innovation and market responsiveness, the company can potentially turn the tide and reclaim its position as a leading player in the global automotive industry.

References and Credits

1. All vehicle sales and market share data are obtained and referenced from Ford’s annual reports published on the company’s investor relations page: Ford’s Financials and Filings.

2. Flickr Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

Great insights on Ford’s sales and market share! It’s interesting to see how their strategies are evolving in response to market trends. The data really highlights the competitive landscape within the automotive industry. I’m curious to see how their electric vehicle sales will impact these numbers in the coming years!

Great analysis on Ford’s global vehicle sales! It’s interesting to see how they stack up against competitors and the impact of market trends on their performance. Looking forward to more insights like this!

Great insights on Ford’s global vehicle sales! It’s fascinating to see how their market share shifts in different regions. I’m particularly interested in how their new electric models will impact these figures in the coming years. Looking forward to more updates!