Ford Mustang. Pixabay Image

This article explores Ford’s vehicle wholesale distribution across various countries, emphasizing key markets such as the United States, China, Canada, the United Kingdom, and others.

Let’s take a look at Ford’s vehicle wholesale.

For other key statistics of Ford Motor, you may find more information on these pages:

Global Sales & Market Share

Other Wholesales

Revenue

Debt & Cash

- Ford financial health: debt level, payment due, and liquidity,

- Ford cash flow and cash on hand analysis,

Other Statistics

- Ford vs GM and Tesla: advertising and marketing budget,

- Ford vs General Motors: vehicle profit and margin,

- Ford vs Tesla: profit margin comparison,

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Ford Distribute Its Vehicles?

Global Wholesale

A1. Global Wholesale

Results By Country

B1. Vehicle Wholesale from the U.S., China, and Canada

B2. Vehicle Wholesale from the U.K., Germany, and Türkiye

B3. Vehicle Wholesale from Italy, Australia, and France

Results In Percentage

C1. Vehicle Wholesale By Country In Percentage

Sales Growth

D1. Vehicle Wholesale By Country YoY Growth Rates

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Wholesale: According to Ford, its wholesale unit volumes include sales of medium and heavy trucks.

Wholesale unit volumes also include all Ford and Lincoln badged units (whether produced by Ford or by an unconsolidated affiliate) that are sold to dealerships or others, units manufactured by Ford that are sold to other manufacturers, units distributed by Ford for other manufacturers, local brand units produced by its unconsolidated Chinese joint venture Jiangling Motors Corporation, Ltd. (“JMC”) that are sold to dealerships or others, and from the second quarter of 2021, Ford badged vehicles produced in Taiwan by Lio Ho Group.

Vehicles sold to daily rental car companies that are subject to a guaranteed repurchase option (i.e., rental repurchase), as well as other sales of finished vehicles for which the recognition of revenue is deferred (e.g., consignments), are also included in wholesale unit volumes.

Revenue from certain vehicles in wholesale unit volumes (specifically, Ford badged vehicles produced and distributed by its unconsolidated affiliates, as well as JMC brand vehicles) are not included in Ford’s revenue.

Vehicle Retail vs Wholesale: The key difference between vehicle retail and wholesale lies in the nature of the transaction and the parties involved:

-

Vehicle Retail Sales: These involve selling vehicles directly to end-users, such as individual consumers or businesses, through dealerships or other retail channels. Retail sales focus on the final purchase intended for personal use or organizational needs, and they provide insight into consumer demand.

-

Vehicle Wholesale Sales: These transactions occur between manufacturers and distributors or dealerships. Wholesale sales typically involve bulk purchases where dealerships acquire inventory to sell to end-users. Wholesale data helps track manufacturer performance and supply chain dynamics, rather than direct consumer behavior.

In summary, retail sales represent final consumption, while wholesale sales reflect intermediary transactions within the distribution network.

How Does Ford Distribute Its Vehicles?

Ford distributes its vehicles, parts, and accessories through distributors and dealers (collectively, “dealerships”), most of which are independently owned.

At December 31, the approximate number of dealerships worldwide distributing Ford’s vehicle brands was as follows:

Ford’s number of dealerships worldwide as at Dec 31.

| Brands | Dealerships Worldwide | |

|---|---|---|

| 2023 | 2024 | |

| Ford | 8,639 | 8,212 |

| Ford-Lincoln Combined | 503 | 451 |

| Lincoln | 385 | 343 |

| Total | 9,527 | 9,006 |

Global Wholesale

ford-global-vehicle-wholesale

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

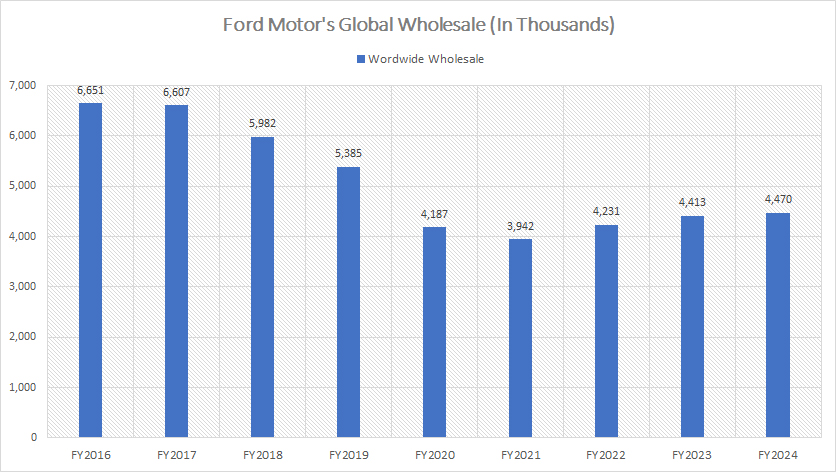

Ford achieved global deliveries of 4.5 million vehicles in fiscal year 2024, marking a modest increase from the 4.4 million vehicles delivered in 2023.

Since reaching a low of 3.9 million deliveries in fiscal year 2021, Ford’s vehicle wholesale volumes have experienced a notable recovery.

However, despite this post-COVID rebound, the company’s worldwide vehicle sales remain considerably below their historical peak.

From a broader perspective, spanning fiscal years 2016 to 2024, Ford’s global vehicle deliveries have steadily declined, dropping from 6.7 million units in 2016 to 4.5 million units in 2024.

Vehicle Wholesale from the U.S., China, and Canada

ford-vehicle-wholesale-U.S.-China-and-Canada

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

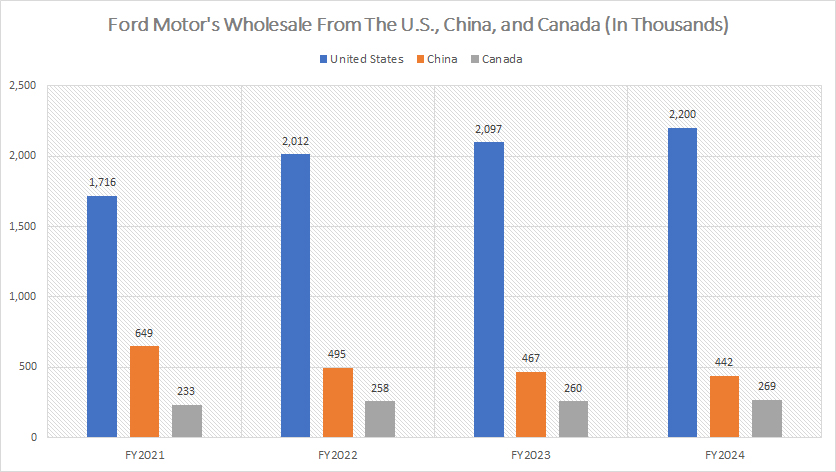

A noticeable trend is the contrasting performance of Ford’s vehicle wholesale across regions, with strong recoveries observed in the U.S. and Canada over the past four years, while results in China have significantly declined.

-

United States: The U.S. continues to be Ford’s largest market, with vehicle wholesale volumes reaching 2.2 million units in fiscal year 2024, showing a modest increase from 2.1 million units in fiscal year 2023.

-

China: As Ford’s second-largest market, China has seen a sharp decline in wholesale volumes, dropping to 442,000 vehicles in fiscal year 2024. This represents a significant decrease from the 649,000 units delivered three years ago.

-

Canada: Wholesale volumes in Canada have shown considerable growth, rising to 260,000 vehicles in fiscal year 2024 — an impressive 15% increase compared to the 233,000 units sold in fiscal year 2021.

Vehicle Wholesale from the U.K., Germany, and Türkiye

ford-vehicle-wholesale-U.K.-Germany-and-Turkey

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

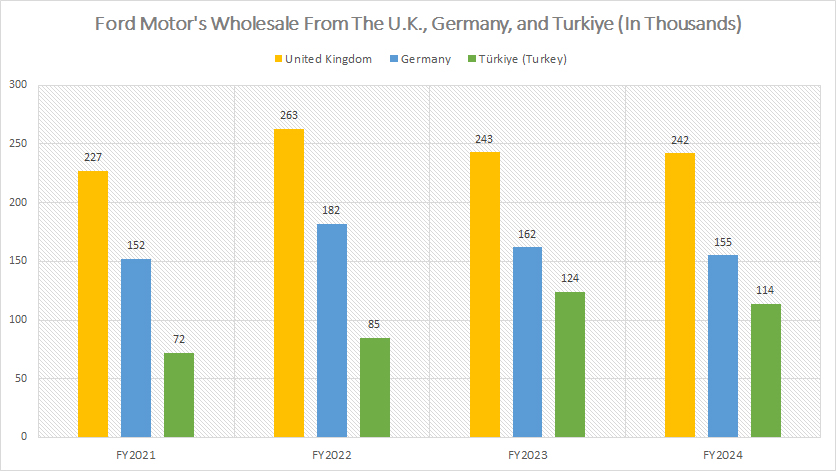

Over the past four years, Ford’s vehicle wholesale volumes in the United Kingdom and Germany have remained relatively stable, while those in Türkiye have nearly doubled during the same period.

-

United Kingdom: Vehicle wholesale volumes in the U.K. reached 242,000 units in fiscal year 2024, consistent with the levels reported in fiscal year 2023.

-

Germany: In Germany, wholesale volumes declined slightly, dropping to 155,000 units in fiscal year 2024 from 162,000 units in fiscal year 2023.

-

Türkiye: Wholesale volumes in Türkiye experienced remarkable growth, reaching 114,000 units in fiscal year 2024, a significant 59% increase from the 72,000 units delivered in fiscal year 2021.

Vehicle Wholesale from Italy, Australia, and France

ford-vehicle-wholesale-Italy-Australia-and-France

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

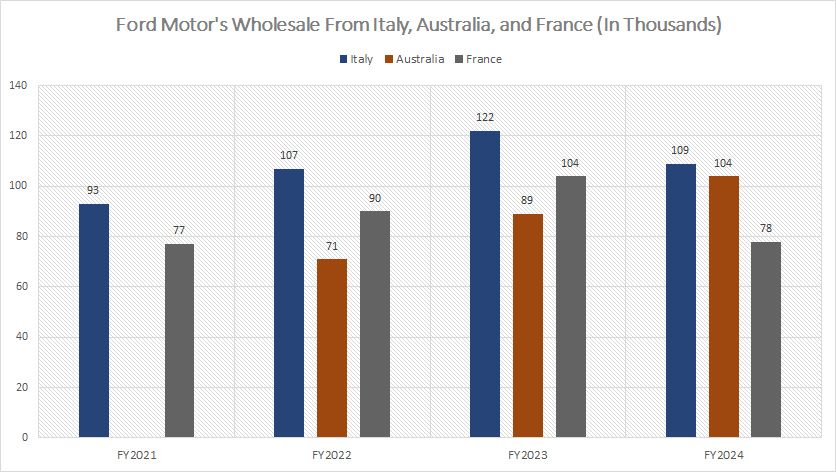

Over the past four years, Ford’s vehicle wholesale volumes in Italy and Australia have shown significant improvement, while those in France have remained flat.

-

Italy: Vehicle wholesale volumes in Italy increased to 109,000 units in fiscal year 2024, a considerable jump from 93,000 vehicles in fiscal year 2021.

-

Australia: In Australia, wholesale volumes rose to 104,000 units in fiscal year 2024, up remarkably from 71,000 vehicles sold two years ago.

-

France: Ford’s results in France have remained flat, with wholesale volumes totaling only 78,000 vehicles in fiscal year 2024, roughly 25% lower from 104,000 vehicles in fiscal year 2023.

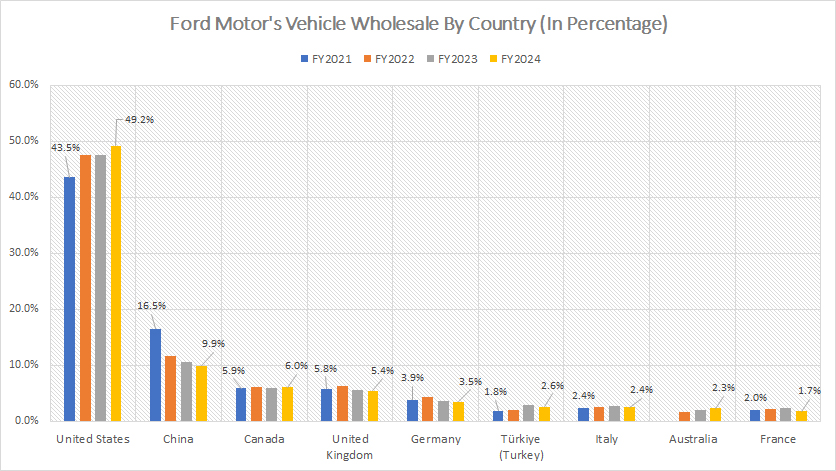

Vehicle Wholesale By Country In Percentage

ford-vehicle-wholesale-by-country-in-percentage

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

From a percentage perspective, Ford’s sales in the U.S. made up 49% of its global wholesale volume in fiscal 2024, up significantly from 43.5% in 2021.

Ford’s wholesale percentage in China declined to 10% as of 2024, down considerably from 16.5% recorded in 2021.

For most European countries, the percentage figures have remained relatively flat, while the results in Turkey have increased from 1.8% in 2021 to 2.6% in 2024.

Vehicle Wholesale By Country YoY Growth Rates

ford-vehicle-wholesale-by-country-yoy-growth-rates

(click image to expand)

You can find the definition of Ford’s vehicle wholesale here: vehicle wholesale. More information about the difference between vehicle wholesale and retail is available here: wholesale vs retail.

Ford achieved the most consistent vehicle wholesale growth in the U.S., with an average annual increase of 9% over the past three years.

Australia outperformed all other countries, recording an impressive average annual growth rate of 21% during the same period.

Conversely, China experienced the steepest decline in vehicle wholesale growth for Ford Motor, with an average annual drop of 12% over the past three years.

Insight

Ford has demonstrated a substantial recovery in global vehicle wholesale during the post-pandemic periods, with notable advancements in North America, particularly in the U.S., over the past three years.

In Europe, wholesale volumes saw significant deterioration in 2024 compared to 2023, with most major European markets seeing a decline in sales.

Ford’s vehicle wholesale performance in China has faced considerable challenges. Sales in this region have declined by more than half, amounting to only 442,000 units as of 2024 — the lowest figure ever recorded.

References and Credits

1. All vehicle wholesale data presented in this article were obtained and referenced from Ford’s quarterly and annual reports published on the company’s investor relations page: Ford’s Investor Relations.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

Thank you!