EV charging. Pixabay Image

This article presents General Motors (GM)’s electric vehicle (EV) sales performance within the U.S. market, alongside its corresponding market share.

Additionally, it delves into GM’s EV sales figures by individual models. GM has achieved significant diversification in its EV lineup, featuring models such as the Bolt EV, Blazer EV, Silverado EV, Sierra EV, and more.

Keep in mind that the vehicle sales data presented is based on the retail volume.

Let’s take a closer look!

For other key statistics of General Motors, you may find more information on these pages:

Global Sales & Market Share

Wholesale

U.S. Sales & Market Share

Revenue

Profit Margin

Debt & Cash

GM China Statistics

Other Statistics

- GM vs Tesla: vehicle profit and margin analysis,

- GM vs Tesla: R&D budget,

- Inventory levels, inventory days and turnover ratio,

- Share buyback history

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. General Motors EV Strategy

Consolidated Results

A1. Total U.S. EV Sales

A2. U.S. EV Sales as a Percentage of Total Sales

Market Share

Sales By Model

C1. Chevrolet

C2. Cadillac, GMC, and BrightDrop

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Existing And Upcoming EV Models: General Motors’ existing and upcoming EV models:

Existing Models

-

Cadillac

- Cadillac LYRIQ

- Cadillac Escalade IQ

-

Chevrolet

- Bolt EV and Bolt EUV

- Chevrolet Silverado EV

- Chevrolet Blazer EV

- Chevrolet Equinox EV

-

GMC

- GMC HUMMER EV

- GMC Sierra EV

-

Commercial Van

- BrightDrop Zevo

Upcoming Models

- Cadillac CELESTIQ

- Cadillac OPTIQ

- Buick Electra E4 and E5

- Corvette

General Motors EV Strategy

General Motors has set a goal of producing 30 new electric vehicles by 2025, with an investment of $27 billion in EV and autonomous vehicle technology.

GM’s Ultium battery technology is a key component of this strategy, offering a longer range and faster charging times than previous battery technology.

GM has also made significant investments in charging infrastructure, with plans to install 40,000 charging stations across the United States. The company has also formed partnerships with major charging networks to enhance the accessibility and availability of charging stations.

In addition, GM has announced plans to halt production of gasoline and diesel-powered vehicles by 2035 and to become carbon-neutral by 2040. This ambitious plan aligns with GM’s commitment to sustainability and reducing its carbon footprint.

Overall, GM’s EV strategy is focused on innovation, sustainability, and accessibility to make electric vehicles more accessible and affordable for consumers.

Total U.S. EV Sales

General-Motors-U.S.-EV-sales

(click image to expand)

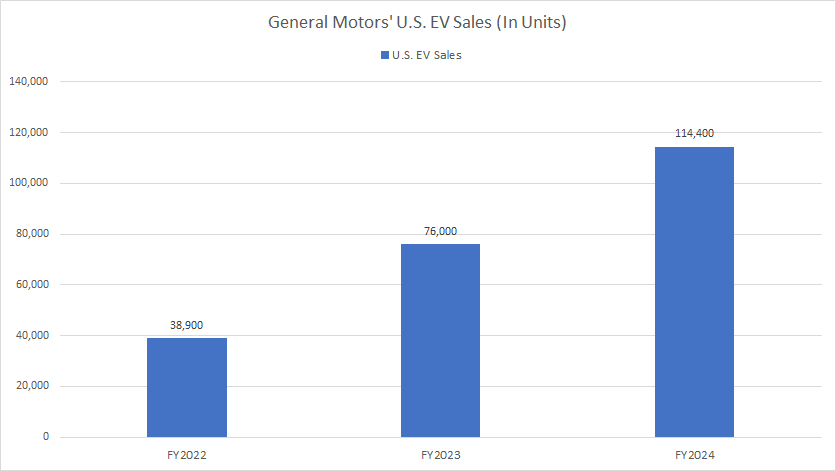

General Motors (GM) reported U.S. electric vehicle (EV) sales of 38,900 units in fiscal year 2022, 76,000 units in 2023, and 114,400 units in 2024.

This remarkable growth reflects a nearly 200% increase in GM’s domestic EV sales since 2022, showcasing the company’s strides in scaling its EV operations and strengthening its market position.

A substantial share of these sales can be attributed to the Bolt EV and Bolt EUV models, which have been pivotal to GM’s EV strategy.

Over the three-year period from 2022 to 2024, these models collectively accounted for approximately 47% of GM’s total EV sales in North America.

The popularity of the Bolt lineup highlights its role as an accessible and appealing option for consumers transitioning to electric mobility.

U.S. EV Sales as a Percentage of Total Sales

General-Motors-U.S.-EV-sales-to-total-retail-volume

(click image to expand)

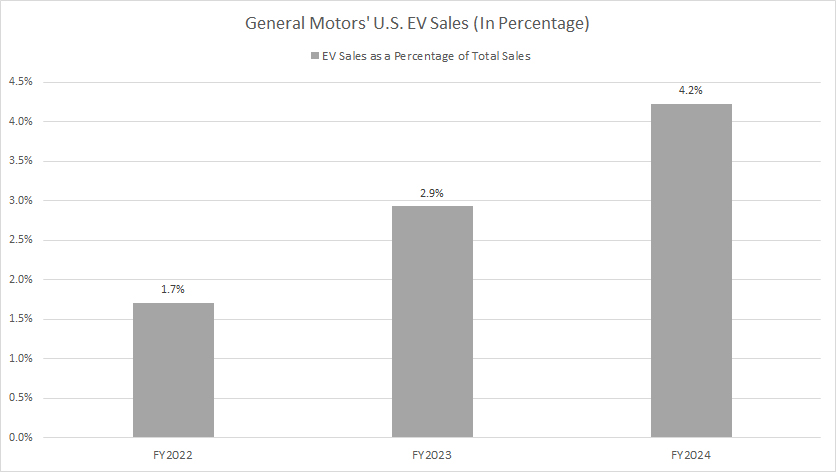

General Motors (GM) sold 38,900 and 76,000 electric vehicles in the U.S. in 2022 and 2023, respectively. These sales accounted for 1.7% and 2.9% of the total retail vehicle volume in North America.

By 2024, this ratio increased to 4.2%, signifying substantial progress in GM’s EV market penetration.

U.S. EV Market Share

General-Motors-U.S.-EV-market-share

(click image to expand)

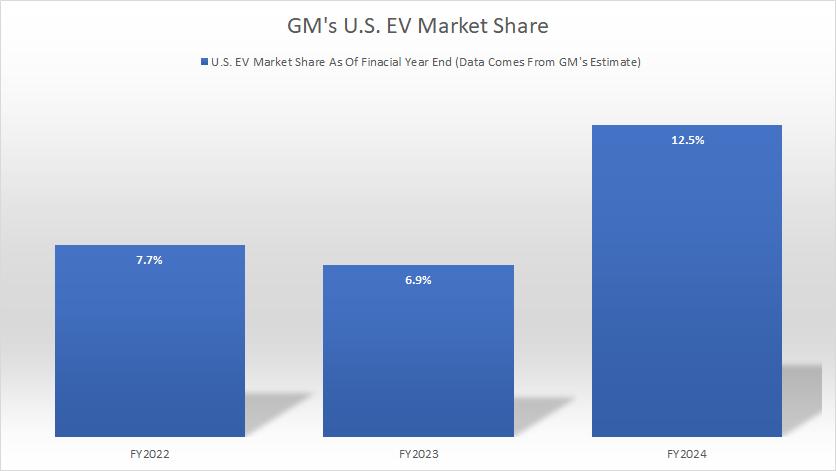

General Motors’ U.S. electric vehicle market share rose from 6.8% at the end of fourth quarter in 2023 to 12.5% by the end of the fourth quarter in 2024.

Chevrolet

General-Motors-Chevrolet-EV-sales

(click image to expand)

You may find more information about GM’s existing and upcoming EV models here: GM’s existing and upcoming EV models.

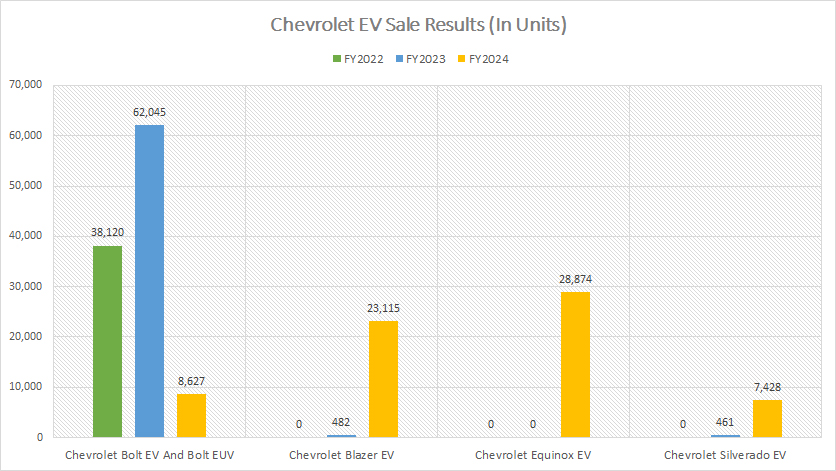

The majority of General Motors’ EV sales in the U.S. between fiscal years 2022 and 2024 originated from the Bolt EV and Bolt EUV models, as illustrated in the accompanying chart.

During this period, GM sold over 100,000 units of the Bolt EV and Bolt EUV in the U.S., representing approximately 47% of its total retail volume.

However, fiscal year 2024 marked a notable shift in GM’s U.S. EV sales, with increased demand for other models, including the Chevrolet Blazer EV, Chevrolet Equinox EV, and Chevrolet Silverado EV.

In fiscal year 2024, the sales figures for these models stood at 23,100 units for the Blazer EV, 28,900 units for the Equinox EV, and 7,400 units for the Silverado EV.

Meanwhile, U.S. sales of the Bolt EV and Bolt EUV experienced a significant decline, dropping from 62,000 units in fiscal year 2023 to just 8,600 units in 2024.

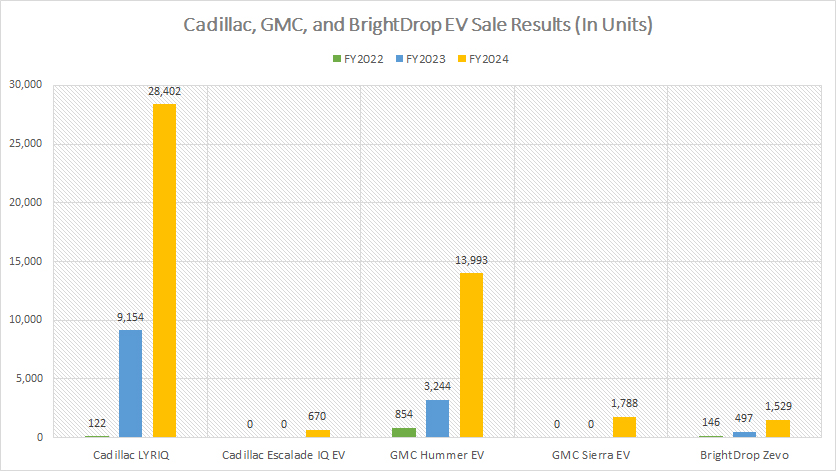

Cadillac, GMC, and BrightDrop

General-Motors-Cadillac-GMC-and-BrightDrop-EV-sales

(click image to expand)

You may find more information about GM’s existing and upcoming EV models here: GM’s existing and upcoming EV models.

In fiscal year 2024, GM experienced a notable increase in sales for its other EV models, particularly from the Cadillac and GMC lineups.

For instance, GM sold 28,400 units of the Cadillac LYRIQ and 670 units of the Cadillac IQ EV. Meanwhile, the GMC Hummer EV recorded sales of 14,000 units, and the GMC Sierra EV reached 1,800 units during the same period.

Additionally, U.S. sales of the BrightDrop Zevo surged to 1,500 units in fiscal year 2024, a significant jump from the 500 vehicles sold in 2023, more than tripling its performance year-over-year.

Insight

An notable insight is GM’s transition in sales contributions across its EV models.

While the Bolt EV and Bolt EUV dominated early sales and accounted for approximately 47% of GM’s total EV retail volume between 2022 and 2024, their sales sharply declined in 2024 as newer models like the Chevrolet Blazer EV, Equinox EV, and Silverado EV gained traction.

Similarly, GM’s Cadillac and GMC EV offerings, such as the Cadillac LYRIQ and GMC Hummer EV, recorded robust sales growth, highlighting diversification in its EV lineup and a shift toward higher-end models.

This shift indicates GM’s evolving strategy to appeal to a broader range of consumers, leveraging a mix of accessible, mid-range, and premium electric vehicles to cement its leadership in the expanding EV market.

The company’s increasing EV market share — rising from 6.8% in 2023 to 12.5% in 2024 — reinforces the effectiveness of this approach.

References and Credits

1. All sales and market share figures presented were obtained and referenced from GM’s annual and quarterly reports published on the company’s investor relations page: GM Shareholder Information.

2. Pixabay Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.