Maserati. Pixabay image.

Stellantis is a global automotive company in South America with a strong presence in Brazil, Argentina, Chile, Colombia, Peru, and Uruguay. The company was formed in January 2021 due to a merger between Fiat Chrysler Automobiles (FCA) and Groupe PSA.

Stellantis is now the fourth largest automaker in the world with a portfolio of 14 brands, including Jeep, Fiat, Peugeot, Citroën, Opel, and Vauxhall.

This article covers Stellantis’ vehicle sales and market share in South America, and its competitive position in this region versus other automobile companies. Let’s get started!

Investors looking for other sales statistics of Stellantis may find more resources on these pages:

- Stellantis global sales,

- Stellantis North America,

- Stellantis Europe,

- Stellantis China, India & Asia Pacific,

- Stellantis Middle East & Africa, and

- Stellantis Maserati.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Consolidated Sales

A1. Vehicle Sales In South America

Sales By Country

B1. Vehicle Sales In Brazil, Argentina, And Other South American Countries

B2. Percentage Of Vehicle Sales In Brazil, Argentina, And Other South American Countries

Sales Growth

B3. Vehicle Sales Growth In Brazil, Argentina, And Other South American Countries

Consolidated Market Share

C1. Market Share In South America

C2. Market Share In South America Before The Merger

Market Share By Country

D1. Market Share In Brazil, Argentina, And Other South American Countries

D2. Market Share In Brazil, Argentina, And Other South American Countries Before The Merger

Market Share Vs Competitors

E1. Market Share In Brazil Vs Competitors

E2. Market Share In Brazil Vs Competitors Before The Merger

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants, manufactured by joint ventures and third-party contract manufacturers, and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis vehicle wholesale.

South America: Stellantis’ South America includes Central America and the Caribbean islands.

Stellantis’ operations in South America include the manufacture, distribution and vehicle sales in South and Central America, primarily under the Fiat, Jeep, Peugeot and Citroën brands, with the largest focus of its business in Brazil and Argentina.

Stellantis’s manufacturing plants in South America are located in the main markets of Brazil and Argentina.

Vehicle Sales In South America

Stellantis-vehicle-sales-South-America

(click image to expand)

A definition of Stellantis’ vehicle sales is available here: vehicle sales.

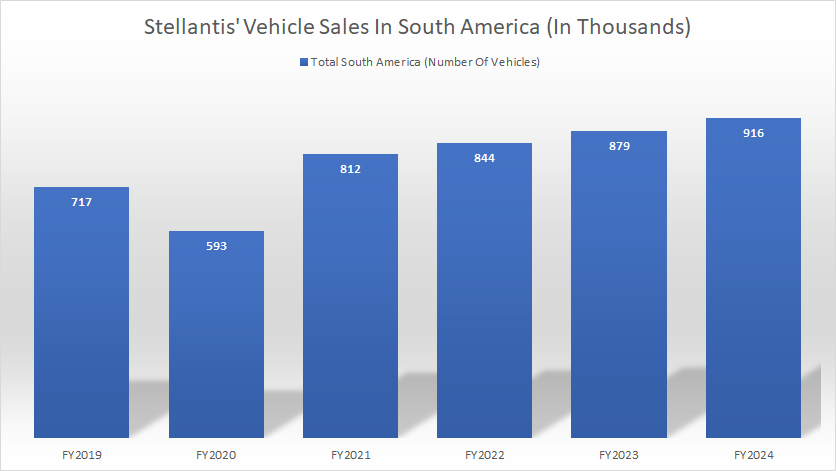

Stellantis has shown a steady and impressive growth trajectory in the South American market over recent years. By the close of fiscal year 2024, the company achieved total vehicle sales of 916,000 units in the region, reflecting a 4% increase from the 879,000 units sold in fiscal year 2023.

Notably, 2023’s sales figures also marked an improvement over the 844,000 units recorded in fiscal year 2022, underscoring a pattern of continuous year-over-year growth.

When evaluating Stellantis’ long-term performance, the results are even more striking. The company’s sales in South America for fiscal year 2024 were 28% higher than the 717,000 vehicles sold in 2019. This substantial growth over a five-year period highlights Stellantis’ ability to adapt to and capitalize on regional market dynamics, despite potential challenges in the broader automotive industry.

Since 2019, Stellantis has consistently maintained robust vehicle volumes in South America, illustrating not only the effectiveness of its strategies but also its resilience and competitive positioning in the region.

This sustained performance cements its role as a key player in the South American automotive market and reflects its commitment to meeting the demands of customers across diverse markets.

Vehicle Sales In Brazil, Argentina, And Other South American Countries

Stellantis-vehicle-sales-South-America-by-country

(click image to expand)

The definitions of Stellantis’ vehicle sales is available here: vehicle sales.

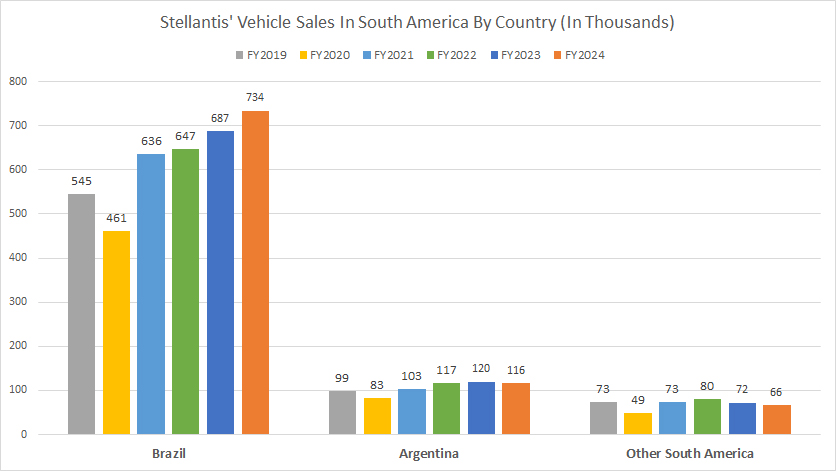

Brazil has been Stellantis’ biggest market in South America, with vehicle sales in this country reaching 734,000 units in fiscal year 2024, a significant rise from the 687,000 vehicles sold in 2023.

In fiscal year 2022, Stellantis delivered 647,000 vehicles in Brazil, up slightly from 636,000 vehicles in 2021. Compare to the sales figure five years ago, Stellantis’ 2024 sales in Brazil was 35% higher.

For Argentina, Stellentis sold only 116,000 vehicles in fiscal year 2024, which was a distant second from Brazil. Sales in other South American countries totaled only 66,000 units in 2024.

A noticeable trend is that Stellantis’ vehicle sales in most countries in South America have remained relatively solid since 2019, highlighting Stellantis’ solid competitive position in the South American region.

Vehicle Sales In Brazil, Argentina, And Other South American Countries In Percentage

Stellantis-vehicle-sales-South-America-by-country-in-percentage

(click image to expand)

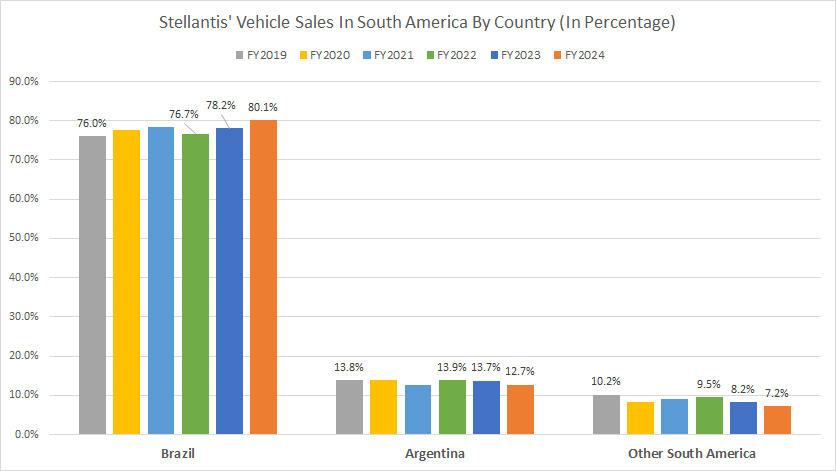

Vehicle sales in Brazil contributed 80% of Stellantis’s total South America volume in fiscal year 2024, up slightly from 78% in 2023.

On the other hand, Argentina’s sales accounted for only 12.7% of Stellantis’ total South America volume in 2024, while other countries in South America formed 7.2%.

The percentage figures in most countries in South America have remained relatively stable over the last several years. The sales contribution from Brazil has increased slightly from 76% in 2019 to80% as of 2024, while the sales contribution from other South American countries has declined.

Vehicle Sales Growth In Brazil, Argentina, And Other South American Countries

Stellantis-vehicle-sales-South-America-by-country

(click image to expand)

The definitions of Stellantis’ vehicle sales is available here: vehicle sales.

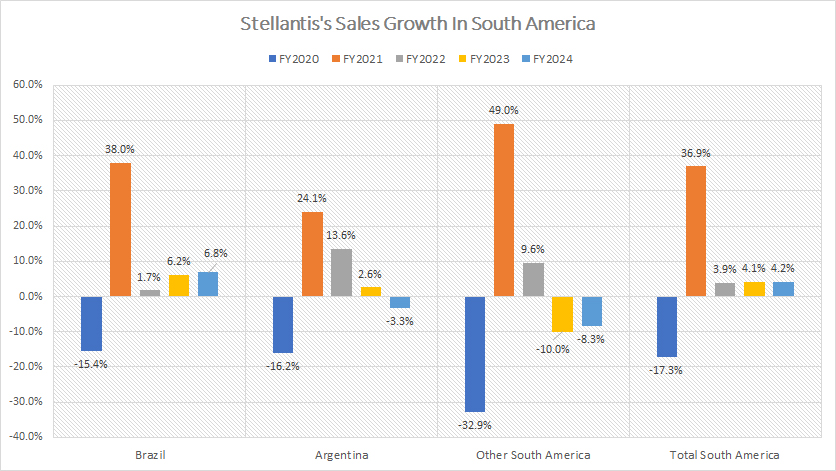

Stellantis’ vehicle sales growth in South America has experienced a marked slowdown since the robust recovery observed in 2021, as illustrated by recent data. During fiscal year 2021, Stellantis’ vehicle sales in the region surged by an impressive 37% year-over-year, reflecting a post-pandemic rebound and a highly favorable market environment. However, by fiscal year 2024, the growth had decelerated significantly to just 4%, indicating a stabilization in the market or possible challenges in sustaining rapid expansion.

The most pronounced decline was seen in Stellantis’ sales across other South American countries (excluding Brazil and Argentina), where year-over-year growth plummeted from a remarkable 49% in 2021 to a contraction of -8% in 2024. This downturn suggests headwinds in these smaller markets, potentially due to economic constraints, evolving consumer preferences, or increased competition.

In Brazil and Argentina, two of Stellantis’ core markets in South America, sales growth also slowed sharply over the period. For example, in Brazil, sales growth fell from 38% in 2021 to a modest 6.8% in 2024. Similarly, in Argentina, the company recorded a drop in growth from 24% in 2021 to -3.3% in 2024, reflecting contractionary pressures that may be affecting purchasing power and market demand.

Despite the overall deceleration, there was positive news from Brazil in 2024. Stellantis managed to achieve nearly 7% growth in vehicle sales, making Brazil the only market in South America to report year-over-year sales growth for the year. This resilience highlights the importance of Brazil within Stellantis’ regional strategy and reflects its ability to maintain its dominant market position amid a slowing growth trajectory across the region.

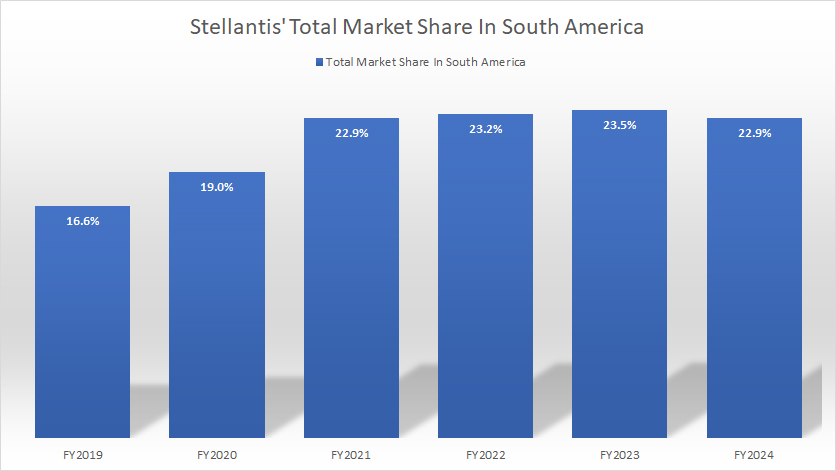

Market Share In South America

Stellantis-market-share-South-America

(click image to expand)

Stellantis achieved a market share of 22.9% in South America in fiscal year 2024, down from 23.5% in 2023. In fiscal year 2022, Stellantis’ total market share in South America was 23.2%, while it achieved market share of 22.9% in 2021. The average market share stood at 23% from fiscal year 2022 to 2024.

Since 2019, Stellantis’ total market share in South America has risen from 16.6% in 2019 to 22.9% in the latest result, indicating the automaker’s increasing competitive position in this region.

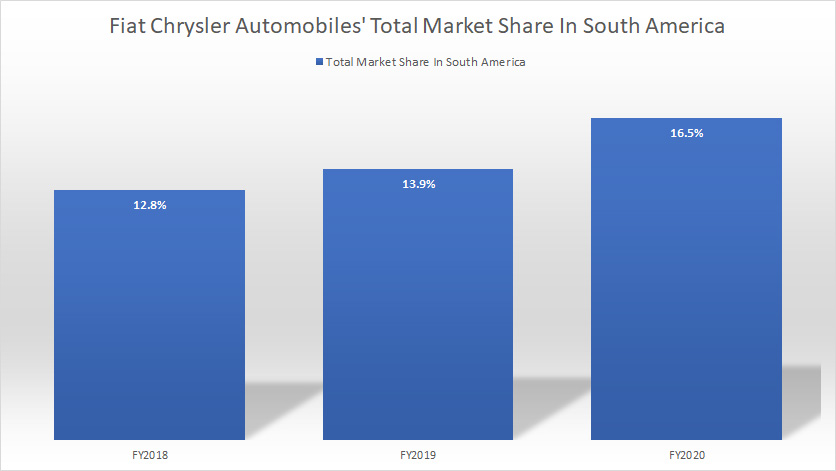

Market Share In South America Before The Merger

FCA-market-share-South-America

(click image to expand)

Before the merger, Stellantis, formerly known as FCA or Fiat Chrysler Automobiles, had a market share of 16.5%, 13.9%, and 12.8% in South America in fiscal years 2020, 2019 and 2018, respectively.

Stellantis had a smaller market share in South America before the merger. After the merger, Stellantis’ market share in the South American region surged to 23.2% and 22.9% in fiscal 2022 and 2021, respectively, as shown here: Stellantis market share.

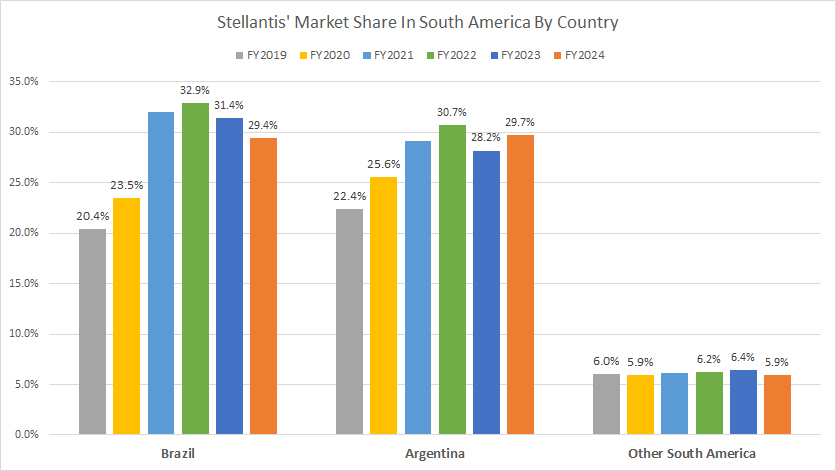

Market Share In Brazil, Argentina, And Other South American Countries

Stellantis-market-share-South-America-by-country

(click image to expand)

Stellantis held a market share of 29.4% in Brazil at the end of fiscal year 2024, the highest among all South American countries within the company’s market.

Apart from Brazil, Stellantis also holds a solid market share in Argentina, totaling 29.7% as of 2024. For the rest of the countries in South America, Stellantis’ market share arrived at 5.9% in 2024.

A noticeable trend is that Stellantis’ market share in Brazil and Argentina has significantly increased since 2019, demonstrating the company’s strong market position in the South American region.

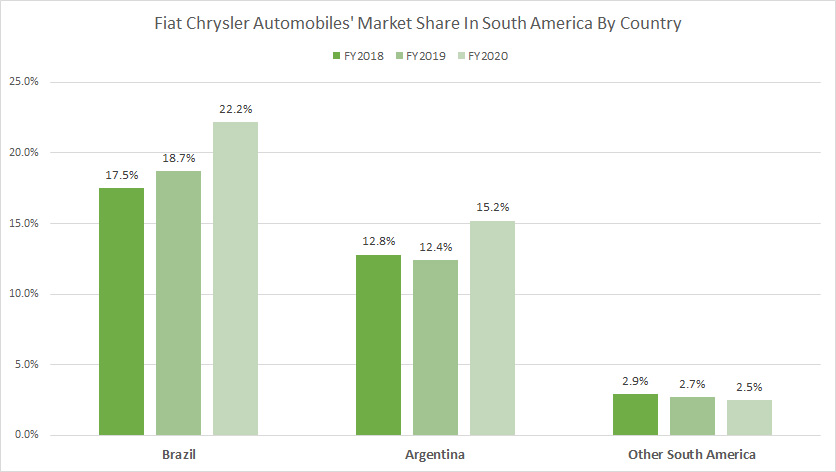

Market Share In Brazil, Argentina, And Other South American Countries Before The Merger

FCA-market-share-South-America-by-country

(click image to expand)

Before the merger in 2021, Stellantis, formerly known as FCA or Fiat Chrysler Automobiles, held a market share of 22.2%, 18.7%, and 17.5% in Brazil in fiscal years 2020, 2019 and 2018, respectively.

Similarly, Stellantis’ market share in Argentina landed at 15.2%, 12.4%, and 12.8% in fiscal years 2020, 2019, and 2018, respectively.

All market share numbers before the merger are apparently lower than those after the merger. In short, Stellantis held a much higher market share in Brazil and Argentina after the merger.

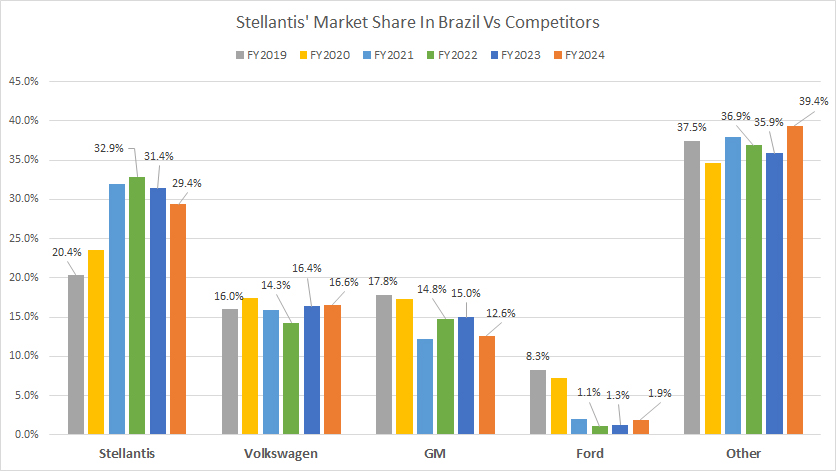

Market Share In Brazil Vs Competitors

Stellantis-market-share-Brazil-vs-competitors

(click image to expand)

Stellantis continues to dominate the Brazilian automotive market, outpacing competitors like General Motors, Volkswagen, and Ford Motor by a significant margin.

As of fiscal year 2024, Stellantis retained its leading position in Brazil with an impressive market share of 29%, underscoring its consistent performance and strong consumer appeal in its largest market by sales volume. This figure solidifies Stellantis’ leadership in Brazil for the past five years, during which its market position has significantly outperformed its rivals.

In the same year, General Motors and Volkswagen struggled to close the gap, holding market shares of 12.6% and 16.6%, respectively. Ford Motor, in comparison, recorded a notably lower market share of just 1.9%, marking a significant decline from its 8.3% share in 2019. This downward trend highlights the challenges Ford has faced in maintaining competitiveness in Brazil, a market crucial for automotive sales in South America.

Interestingly, neither Japanese nor Korean automakers — including industry leaders such as Toyota and Hyundai/Kia — secured a spot among the top three automotive players in Brazil. Stellantis’ ability to sustain its dominant position in such a competitive market environment demonstrates the effectiveness of its localized strategies and its deep understanding of consumer preferences in the region.

Stellantis’ growth trajectory in Brazil not only showcases its robust business model but also underscores the strategic advantage it holds within the South American automotive market. Its unwavering market leadership, supported by innovative product offerings and tailored marketing strategies, continues to shape the competitive landscape in Brazil.

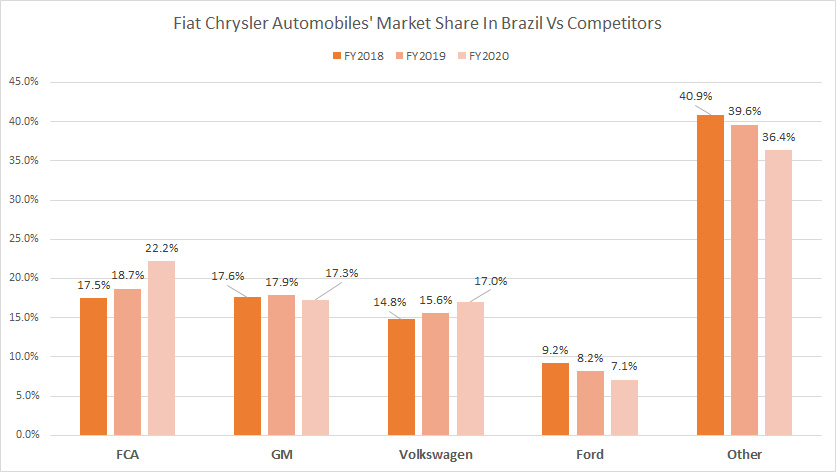

Market Share In Brazil Vs Competitors Before The Merger

FCA-market-share-Brazil-vs-competitors

(click image to expand)

Before the merger, Stellantis, formerly known as FCA, had a much lower market share in Brazil.

Although Stellantis’ market share was much lower before the merger, it was still the top automaker in Brazil with the largest market position.

After the merger, Stellantis’ market position in Brazil has become even larger, far outpacing GM, Volkswagen, and Ford, as shown here: Stellantis’ Brazil market position.

Insight

Stellantis’ significant market strength in South America, particularly after the merger between Fiat Chrysler Automobiles (FCA) and Groupe PSA in 2021. This merger has propelled Stellantis to gain a larger market share across the region, cementing its dominance in crucial markets like Brazil and Argentina.

In Brazil, Stellantis leads with a commanding market share of 29.4% in 2024, far ahead of competitors like General Motors, Volkswagen, and Ford Motor. Similarly, in Argentina, the company holds an impressive market share of 29.7%. The absence of Japanese and Korean automakers like Toyota and Hyundai/Kia from the top three further highlights Stellantis’ unrivaled position.

This sustained market dominance is attributed to Stellantis’ tailored strategies, including leveraging its diverse portfolio of brands (such as Jeep, Fiat, Peugeot, and Citroën) and aligning product offerings with regional consumer preferences. The merger has strengthened its competitive position, enabling consistent growth in both sales volume and market share.

References and Credits

1. All financial figures presented were obtained and referenced from Stellantis’ annual reports (20-F) published on the company’s investor relations page: Stellantis Investor Relation.

2. Pixabay images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.