A Tesla Model S. Image source: Flickr Image.

This article delves into various statistics related to Tesla’s regulatory credits, encompassing revenue figures, regulatory credits per vehicle, ratio of regulatory credits to total revenue, growth rates, and profitability with and without regulatory credits.

Let’s get started! You may find related statistic of Tesla on these pages:

- Tesla energy profit and margin,

- Tesla revenue per car and per employee, and

- Tesla expansion – superchargers, service fleets, and stores.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What Are Regulatory Credits?

O3. ZEV and GHG Credits

O4. Are Regulatory Credits Sustainable?

O5. Who Buys Telsa Regulatory Credits?

O6. How Regulatory Credits Contributes To Sales?

Revenue And Growth Rates

A1. Regulatory Credits Revenue

A2. Regulatory Credits Revenue YoY Growth Rates

Ratio To Total Revenue

B1. Regulatory Credits To Total Revenue Ratio

Projected Revenue Figures

C1. Projected Regulatory Credits Revenue

Regulatory Credits Per Vehicle

D1. Regulatory Credits Per Car

Effect Of Regulatory Credits On Gross Margin

E1. Automotive Gross Margin Excluding Regulatory Credits

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Regulatory Credits Revenue Per Vehicle: Tesla’s regulatory credits revenue per vehicle is calculated by dividing the total revenue Tesla earns from selling regulatory credits in a given period by the total number of vehicles it delivers in the same period.

Regulatory credits are earned by Tesla for producing zero-emission vehicles and can be sold to other manufacturers that need them to comply with environmental regulations. This revenue is an additional income stream for Tesla, separate from the income generated by selling its electric vehicles (EVs).

The specific amount per vehicle can vary each quarter depending on the total amount of regulatory credits sold and the number of vehicles delivered.

What are Regulatory Credits?

Regulatory credits are credits or points provided by state and federal governments as incentives for contributing to zero pollution in the environment. Essentially, these credits reward companies for producing vehicles that meet or exceed emission standards.

In states like California and several others in the US, auto manufacturers, including Tesla, Ford, General Motors, and others, are mandated by law to meet specific minimum emission standards for all the vehicles they produce and sell.

Failure to meet these standards can result in hefty fines or even the risk of having their licenses revoked by the state government.

The regulations allow automakers, like Tesla, to retain any surplus credits if they earn more than the required minimum. These surplus credits can then be sold to other manufacturers who need them to comply with the laws.

This trading of credits provides a financial incentive for companies that produce cleaner vehicles and helps those struggling to meet emission standards to avoid penalties.

ZEV and GHG Regulatory Credits

As electric vehicles produce zero emissions, Tesla has earned a substantial number of “Regulatory Credits,” specifically referred to as ZEV (Zero-Emission Vehicle) credits under California regulations.

These ZEV credits can be sold to other auto manufacturers who need them to meet the state’s stringent emission standards.

In addition to ZEV credits, another type of regulatory credit is the GHG (Greenhouse Gas) credit, which operates similarly. The GHG credit is applicable at the federal level and requires automakers to comply with national emission standards.

These credits are part of broader efforts to reduce greenhouse gas emissions and promote the adoption of cleaner technologies in the automotive industry.

Are Regulatory Credits Sustainable?

Tesla’s revenue from the sale of regulatory credits has been substantial over the past few years, totaling $2.8 billion in fiscal year 2024, $1.8 billion in fiscal year 2023, and $1.8 billion in fiscal year 2022.

These figures highlight the significant financial contribution that regulatory credits provide to Tesla’s overall revenue.

The good news for Tesla’s investors is that revenue from the sale of regulatory credits is likely to remain sustainable in the foreseeable future.

As long as the production of fossil-fueled vehicles persists and there is a demand for such vehicles, Tesla will continue to generate revenue from selling its surplus credits to other automakers.

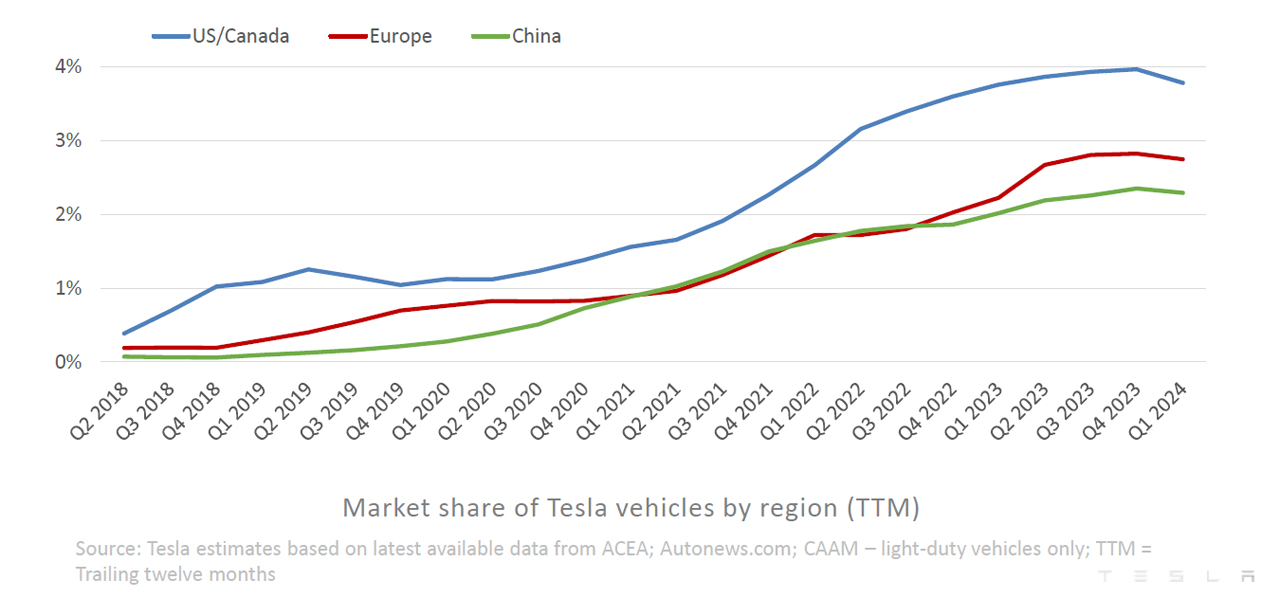

As of 2024, Tesla holds less than 5% of the entire automotive market in most regions, as shown in the following snapshot:

tesla-market-share-global

(click image to expand)

Given this market share, Tesla’s sales of regulatory credits are expected to continue, and there is potential for these sales to increase as Tesla gains a more significant share of the automotive market.

Since fiscal year 2020, Tesla’s regulatory credit sales have increased by an average of 47% year-over-year, reflecting a growing demand for these credits as automakers strive to meet emission standards.

This consistent growth demonstrates the financial benefits that regulatory credits bring to Tesla.

In conclusion, Tesla’s revenue from regulatory credits plays a crucial role in its financial performance.

With the ongoing demand for zero-emission vehicles and the need for traditional automakers to purchase credits to meet regulatory standards, Tesla’s revenue from these credits is poised for continued growth.

Investors can remain optimistic about this sustainable revenue stream as Tesla continues to expand its market presence.

Who Buys Tesla Regulatory Credits?

Tesla sells regulatory credits to other automakers that need them to comply with emissions standards set by governments worldwide.

These buyers are typically manufacturers who aren’t producing enough electric vehicles (EVs) or other zero-emission vehicles to meet the required regulatory standards.

By purchasing credits from Tesla, which has a surplus due to its all-electric vehicle lineup, these companies can avoid significant fines and continue selling their traditional combustion engine vehicles in certain markets.

This system allows them to bridge the gap between their current production capabilities and the stringent emission requirements.

In short, Tesla’s sale of regulatory credits plays a vital role in helping other automakers meet emission standards while providing Tesla with a valuable revenue stream.

This system incentivizes the production of zero-emission vehicles and supports a gradual transition towards cleaner transportation across the industry.

How Regulatory Credits Contributes To Sales?

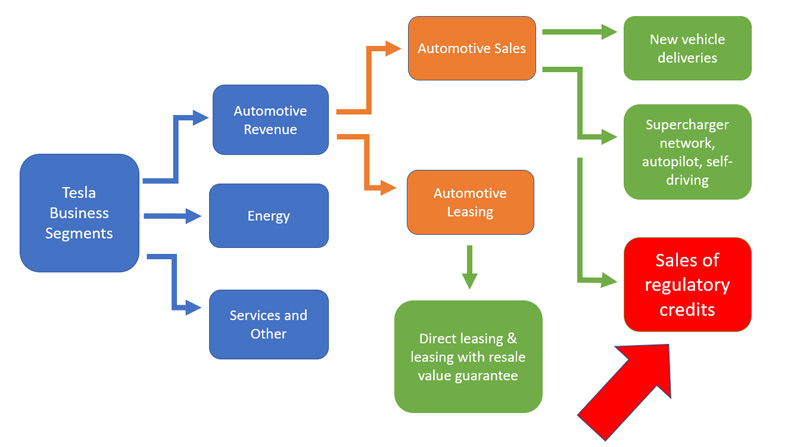

Tesla regulatory credits revenue

(click image to expand)

The diagram above illustrates that Tesla’s regulatory credits revenue is categorized under the automotive segment.

Tesla’s regulatory credits revenue is aggregated with other sources, such as new vehicle deliveries, sales of Supercharging services, and Autopilot, to form the total automotive revenue.

In fiscal year 2024, revenue from regulatory credits made up approximately 3.6% of Tesla’s automotive revenue.

Regulatory Credits Revenue

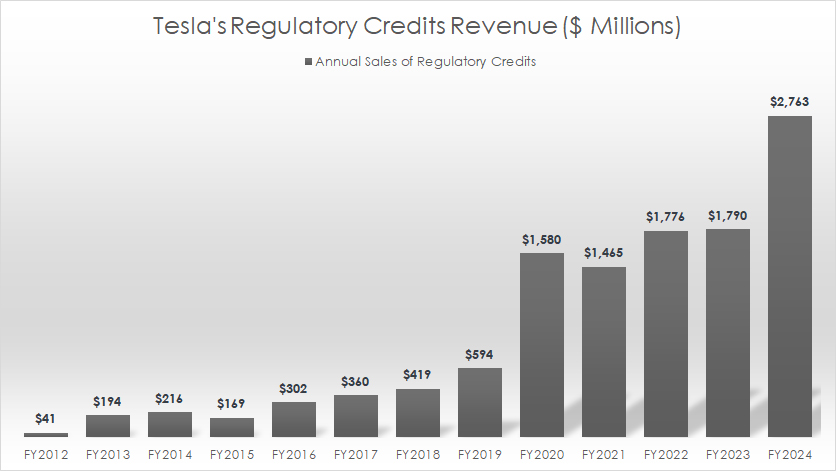

Tesla’s regulatory credits revenue by year

(click image to expand)

Tesla’s sales of regulatory credits have seen a remarkable increase over the past decade, culminating in $2.8 billion in fiscal year 2024. This represents a more than 50% increase compared to fiscal year 2023, where Tesla earned $1.8 billion from regulatory credits.

The revenue from regulatory credits in fiscal year 2023 was consistent with the figure reported in fiscal year 2022, also at $1.8 billion.

The 50% increase in revenue from fiscal year 2023 to 2024 underscores Tesla’s ability to generate substantial income from regulatory credits. This growth highlights the increasing demand for credits as more automakers strive to meet emission standards.

The overall trend over the past decade shows a steady rise in Tesla’s regulatory credits revenue. This growth aligns with the broader adoption of electric vehicles (EVs) and stricter emission regulations worldwide.

The continued demand for regulatory credits suggests that this revenue stream will remain relevant as long as traditional automakers need to comply with emission standards. Tesla’s leading position in the EV market ensures a steady supply of credits for sale.

Regulatory Credits Revenue YoY Growth Rates

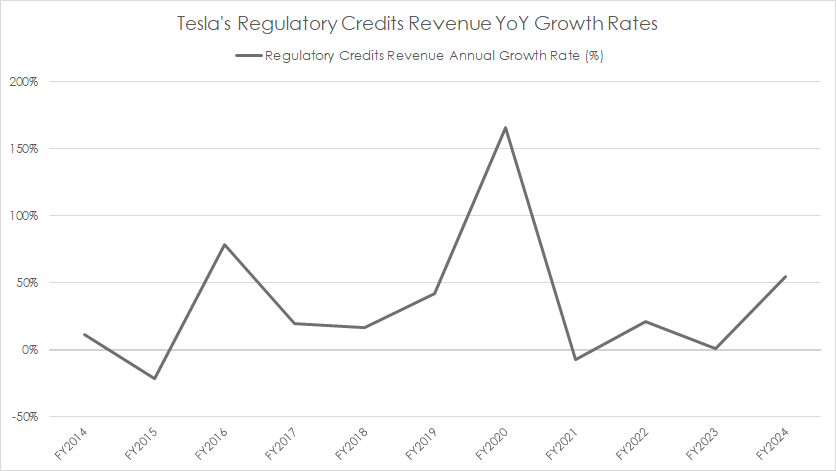

Tesla’s regulatory credits revenue growth rates

(click image to expand)

The growth of Tesla’s revenue from regulatory credits has slowed considerably over the past few years. However, in fiscal year 2024, it experienced a notable surge, increasing by an impressive 50% year-over-year.

Over the past five years, the average annual growth rate of Tesla’s regulatory credits revenue has been approximately 47%.

The recent slowdown in the growth of Tesla’s regulatory credits revenue indicates a period of stabilization after years of rapid expansion. This trend may reflect market saturation or changes in regulatory environments.

Despite the slowdown, fiscal year 2024 saw a remarkable resurgence, with a 50% year-over-year increase in revenue from regulatory credits. This surge underscores the ongoing demand for regulatory credits as automakers strive to meet emission standards.

The persistent need for traditional automakers to comply with stringent emission standards has driven demand for regulatory credits. Tesla, with its surplus of credits, has been able to capitalize on this demand.

As long as emission standards remain stringent and traditional automakers continue to rely on combustion engine vehicles, the demand for regulatory credits is expected to persist. Tesla’s position as a leader in the EV market ensures a steady supply of credits for sale.

With ongoing advancements in EV technology and increasing adoption of electric vehicles, Tesla’s regulatory credits revenue may continue to grow. The company’s ability to innovate and expand its market presence will be key factors in driving future growth.

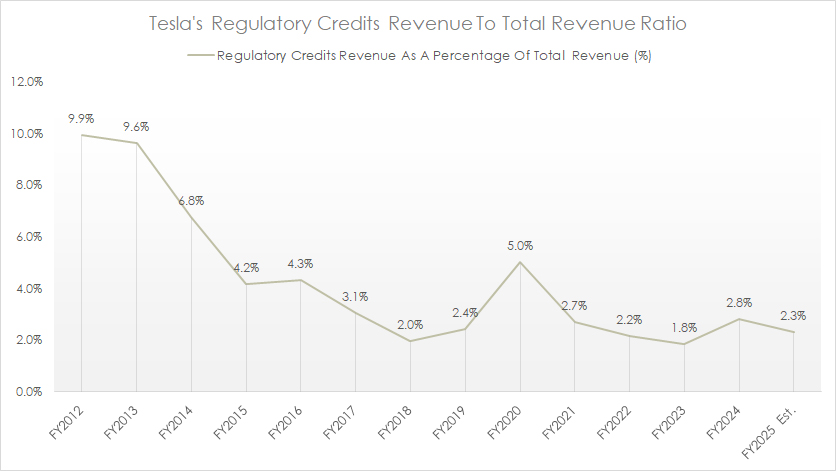

Regulatory Credits To Total Revenue Ratio

Tesla regulatory credits to total revenue ratio

(click image to expand)

Tesla’s regulatory credits revenue accounted for approximately 2.8% of the company’s total revenue in fiscal year 2024, marking a significant increase from the 1.8% recorded in fiscal year 2023.

Over the long term, Tesla’s regulatory credits revenue as a percentage of total revenue has shown a declining trend.

This suggests that while regulatory credits remain an important revenue stream, their proportion relative to Tesla’s rapidly growing total revenue is decreasing.

Between fiscal years 2022 and 2024, the average ratio of regulatory credits revenue to total revenue has been approximately 2.3%.

Based on the average figure, it is likely that the ratio of Tesla’s regulatory credits revenue to total revenue will hover around the 2.3% mark in the foreseeable future.

This stability is driven by continued demand for regulatory credits and Tesla’s strong position in the electric vehicle market.

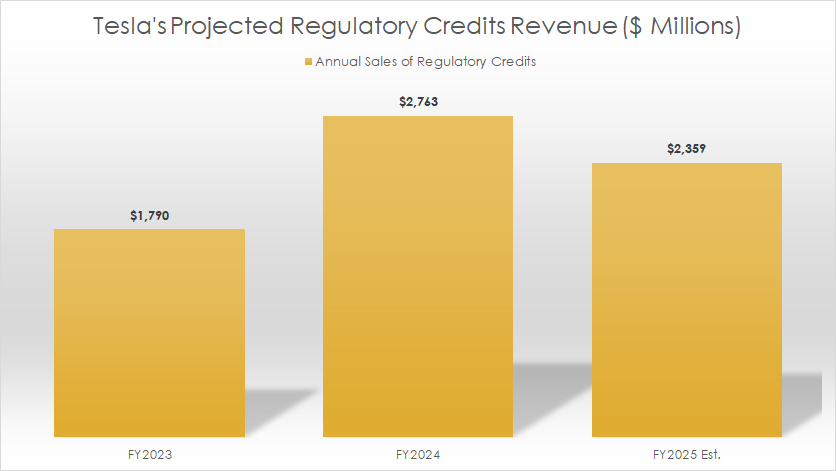

Projected Regulatory Credits Revenue

Tesla-projected-regulatory-credits-revenue

(click image to expand)

Assuming a ratio of 2.3% to total revenue, Tesla’s regulatory credits revenue could reach approximately $2.4 billion by the end of fiscal year 2025, with total revenue projected to be around $102.6 billion.

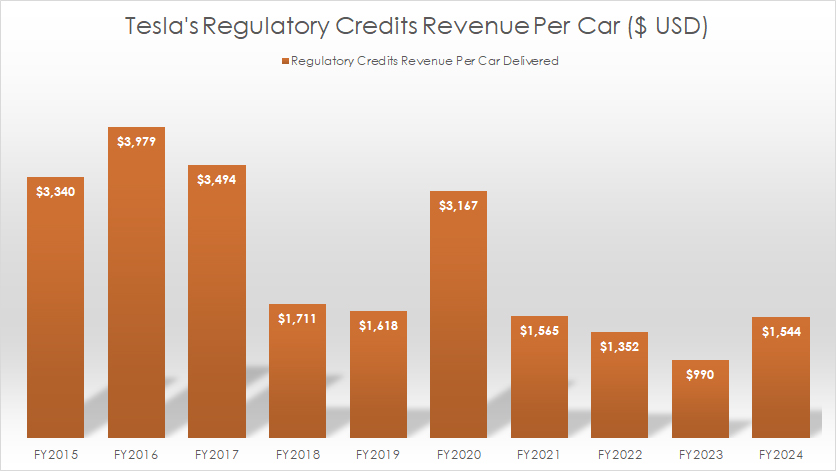

Regulatory Credits Per Car

Tesla-regulatory-credits-revenue-per-vehicle-sold

(click image to expand)

The definition of Tesla’s regulatory credit revenue per vehicle is available here: regulatory credit revenue per vehicle.

From a per-vehicle perspective, Tesla earned $1,352 in regulatory credits revenue per car sold in fiscal year 2022, representing a 14% decline compared to 2021 and a more than 50% drop from 2020. This figure further decreased to $990 per vehicle in fiscal year 2023.

However, in fiscal year 2024, Tesla’s regulatory credits revenue per vehicle surged to $1,544 per car. On average, Tesla’s regulatory credits revenue per vehicle hovered around $1,700 over the past five years from fiscal years 2020 to 2024.

Looking at the long-term trend, Tesla’s sales of carbon credits per vehicle have significantly declined, from over $3,000 per vehicle delivered in fiscal year 2015 to less than $1,000 per vehicle delivered by 2023.

If Tesla were to deliver 2.0 million vehicles and earn $2.4 billion in regulatory credits revenue in fiscal year 2025, the per-car carbon credit revenue would be estimated at approximately $1,200.

This continuous decline in regulatory credits revenue per car suggests that Tesla will likely continue to earn less carbon credits revenue per vehicle sold in the future, despite fluctuations in annual figures.

The continuous decline in regulatory credits revenue per vehicle suggests that Tesla’s reliance on this revenue stream is diminishing on a per-unit basis.

As the company scales up its production and deliveries, the relative contribution of regulatory credits to overall revenue per vehicle is decreasing.

This trend may be influenced by several factors, including increased competition in the electric vehicle market, changes in regulatory policies, and the overall growth of Tesla’s production capabilities.

As more automakers produce zero-emission vehicles, the demand for purchasing regulatory credits may stabilize or decrease, impacting Tesla’s revenue from this source.

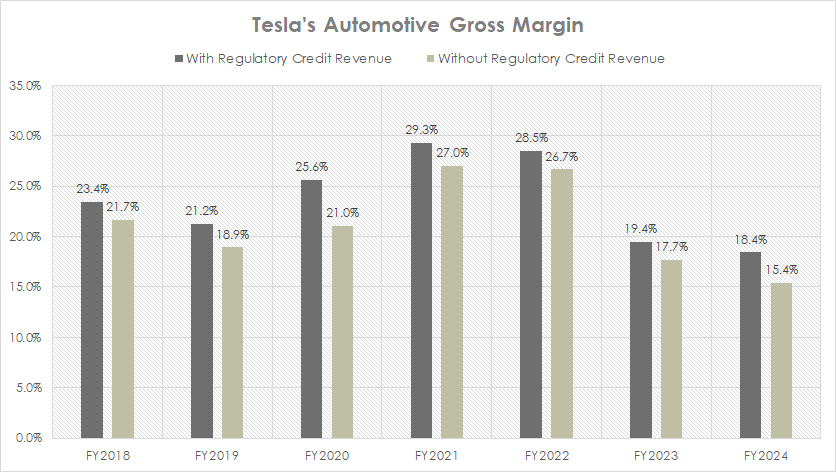

Automotive Gross Margin Excluding Regulatory Credits

Tesla’s automotive gross margin with and without regulatory credits revenue

(click image to expand)

Critics argue that the sale of regulatory credits has artificially boosted Tesla’s profitability and vehicle margin. These arguments hold some validity, as Tesla’s revenue from carbon credits may not be sustainable in the long run.

Tesla could face a future where emission credit buyers become scarce as more automakers electrify their fleets.

According to the chart, Tesla’s regulatory credits revenue has notably enhanced its automotive gross margin. On average, between fiscal years 2018 and 2024, this improvement has been around 2.5%.

For instance, in fiscal year 2020, Tesla’s automotive gross margin saw a significant jump of nearly 6% due to regulatory credits. In fiscal year 2023, the boost was a more modest 1.7%.

In fiscal year 2024, regulatory credits artificially inflated Tesla’s automotive gross margin by 3%, reaching 18.4%. Without the revenue from carbon credits, the automotive gross margin would have been 15% for the same period.

As the industry shifts towards electrification, Tesla’s reliance on regulatory credits for profitability may decrease. The company’s gross margins could be affected as fewer automakers need to purchase credits.

Tesla may need to adjust its strategy to focus more on its core business activities, such as vehicle sales, energy products, and services, to maintain profitability and healthy margins without the significant boost from regulatory credits.

In short, while the sale of regulatory credits has played a crucial role in boosting Tesla’s profitability and vehicle margins, the long-term sustainability of this revenue stream is uncertain.

As the automotive industry moves towards electrification, the demand for regulatory credits is expected to decline. Tesla may need to adapt its strategy to ensure continued growth and profitability without relying heavily on carbon credits.

Conclusion

Tesla’s regulatory credits revenue has been a significant contributor to its financial performance, providing a boost to profitability and automotive gross margins.

However, the sustainability of this revenue stream is uncertain, and Tesla may need to adapt its strategy to maintain growth and profitability.

The company’s ability to innovate and explore new revenue opportunities will be crucial in navigating the changing market dynamics.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s annual reports published on the company’s investor relations page: Tesla Update Letters and Presentations.

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

Battery Electric Vehicles are not emissions free. It would be great to see you cover the true emissions of these vehicles both in terms of manufacture and the source of the energy. The public deserves to know, since after all they are paying for it via the subsidies as well as the passed on costs of the regulatory credits.

Revenue is fine but do they EARN any profits from vehicle production solely? It seems the credits make them profitable and without them they lose money on every car.

Even with emission credit revenue included, Tesla doesn’t seem to make any meaningful profits!

EV regulatory credits are part of the business model, not just for TSLA but for other automobile manufacturers. TESLA is way ahead of the game and therefore is reaping the highest revenues from these credits. I don’t understand why people get hung up on one aspect of this company. We should be concerned with companies that are buying these credits just to meet emissions standards.

Really? Do your research what is the carbon footprint of an electric car. Those regulatory credits are quite absurd. And why the hell are they taking them from one car manufacturer and giving them to the car manufacturers instead of planting trees for example?

The Zev credit system is too complicated. The government should simply replace it with a flat tax on carbon.

Tesla doesn’t need a $1b per year government handout.

Apparently, this money does not come from the government. It comes from other automakers who has yet to comply with the emission standard. The government only acts as the moderator or the middleman.

Just exactly how do these regulatory credits work. Does TESLA sell vehicles, and/or vehicle technology to the ” Big Three”, etc..?

What happens when everybody starts making electric vehicle ? How will Tesla be profitable ?

Then Tesla will have nowhere to sell its regulatory credits!