A Tesla vehicle. Flickr Image.

When this article was published which was in mid of March 2021, Tesla’s stock price was traded at around $700 per share.

At this price, it represents a 15% drop from its record high of $900 per share recorded in Jan 2021.

While Tesla’s stock has declined quite substantially from its peak, it has soared more than 1000% over a 52-week period.

In other words, in as little as a year, Tesla’s stock has grown by 10X.

If you have invested $1000 in Tesla’s stock about a year ago, your total investment will be worth $10,000 now.

Since Tesla’s stock has already dropped more than 15% and is currently priced at $700 per share, is the stock a buy now?

Well, it depends on what you are looking for.

In this article, we will look at Tesla’s investment from the perspective of 4 criteria, and they are as follows:

2. Growth

3. Income, and

4. Company fundamentals.

Let’s move on!

Valuation

First, we investigate Tesla’s stock from a valuation perspective.

As mentioned, Tesla stock was traded at around $700 per share when this article was published.

Even though the $700 stock price wasn’t at a record high, Tesla’s stock was still at an extremely high valuation with respect to several ratios.

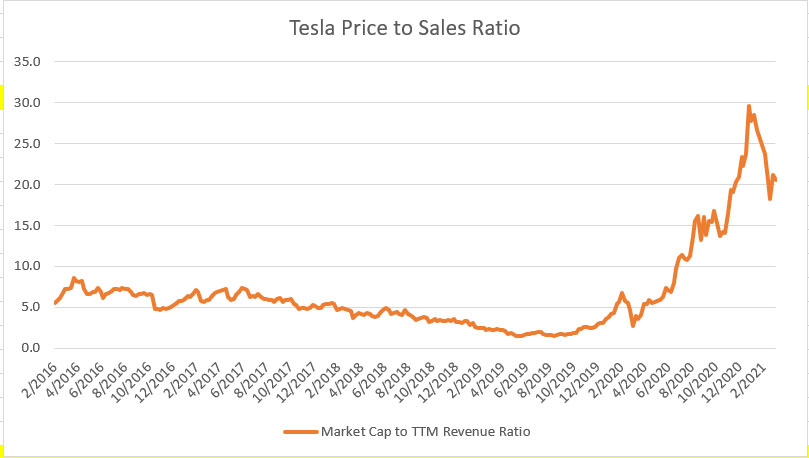

For example, the following chart shows Tesla’s price to sales ratio for the period from 2016 to 2021.

Tesla price to sales ratio

As of March 2021, Tesla’s price to sales ratio was around 20X according to the chart above.

In other words, Tesla’s stock was priced at more than 20X its TTM revenue, roughly 400% higher than its historical value of 5X.

Aside from the price to sales ratio, Tesla’s price to book value was also at an all-time high of 30X.

In terms of gross profitability, Tesla’s stock was priced at 100X its TTM gross income as of March 2021.

On a cash flow basis, Tesla’s stock was valued at nearly 250X its TTM free cash flow and more than 100X its TTM EBITDA.

In short, these ratios were way above their historical averages and Tesla’s stock looks extremely expensive at $700 per share by all measures.

Therefore, if you are a valued investor looking for a reasonably valued stock, Tesla’s stock is probably out of your radar.

Keep in mind that Tesla’s stock at the current price point will certainly be volatile as it reflects investors’ sky-high expectations.

Any mishaps or bad news to the company, be it authentic or just a rumor, will definitely plunge the stock price at a very large margin.

Investors looking for a less risky and non-volatile stock should stay out of Tesla’s investment.

Growth

Is Tesla a growth stock? Absolutely.

From a growth perspective, Tesla has been growing at a breakneck speed.

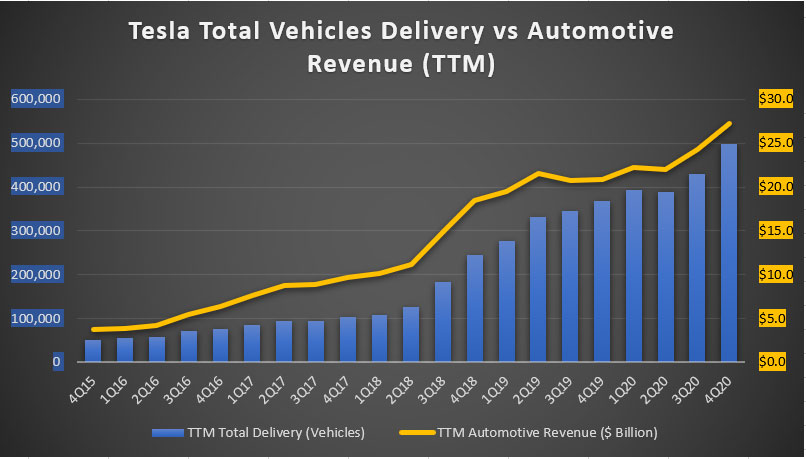

For example, the following chart shows the growth of Tesla’s total vehicle delivery and automotive revenue from a TTM standpoint.

Tesla vehicle delivery and automotive revenue

In terms of Tesla’s total vehicle delivery, the figure has grown 36% in 2020 4Q and reached 500,000 units on a TTM basis.

Similarly, Tesla’s automotive revenue reached a record high at $27 billion as of 2020 4Q on a TTM basis, representing a YoY growth of more than 30%.

On average, Tesla’s vehicle delivery grew 30% in 2020 while the automotive revenue reported a 16% growth rate in the same year.

Well, these are past results you may say.

The question is, will there be more growth in the future? Yes, you bet.

For example, General Motors, one of the largest automakers in the U.S., has raked in automotive sales in excess of $100 billion in 2020.

The highest sales figure that GM has ever done was $160 billion from a TTM perspective.

Similarly, Ford Motor Company’s automotive sales totaled as much as $115 billion in 2020.

Not to mention that these powerful automakers such as Ford and GM have delivered up to 6 million vehicles per year in the past.

By comparison, Tesla vehicle deliveries totaled only half a million units in the entire year of 2020.

Therefore, Tesla has delivered only a fraction of what its peers have done in the past.

In terms of sales revenue, GM and Ford’s automotive sales were at least 4X to 6X higher than Tesla’s figures in 2020.

To sum it up, Tesla still has plenty of growth opportunities lying ahead.

If Tesla were to achieve the same sales revenue as its peers, it will be at least 3 to 5 years down the road, which means Tesla will have several more years of growth.

Keep in mind that we have not even talked about Tesla’s other growth areas, including its energy segment in which Elon Musk has repeatedly said that this business segment will someday grow to be as large as if not larger than its automotive counterpart.

All in all, for investors who are looking for growth opportunities, Tesla’s stock definitely fits your criteria irrespective of the stock price.

So, Tesla’s stock at $700 per share is definitely a buy.

Income

Income investors who are seeking cash dividend payments from Tesla will be disappointed.

For your information, Tesla has neither declared nor paid any cash dividends since its inception.

Additionally, Tesla will probably not be paying cash dividends in the foreseeable future due mainly to the money-losing nature of the business.

While Tesla may have made some profits in 2020, these profits had been too small to even cover the company’s capital outlay, let alone a cash dividend.

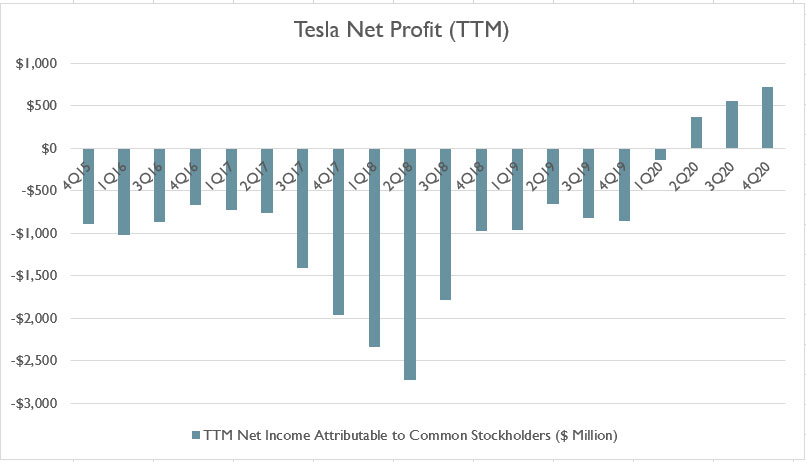

According to the chart below, Tesla’s TTM net income or net profits came to slightly more than $700 million in the 4th quarter of 2020.

Tesla TTM net income

During the same period, Tesla spent as much as $3 billion in cash on capital expenditures.

Aside from capital expenditures, Tesla also has a cash outflow that averaged around $500 million for debt repayments in the last 5 quarters.

While profitability and cash flow are not an apple to apple comparison, it shows that the profits Tesla made had been quite limited compared to the cash paid.

Again, is Tesla stock a good buy now? No, if you are looking for income such as cash dividend.

And Yes, only if you are seeking price appreciation from the investment.

Fundamentals

From a fundamental point of view, Tesla’s results have been improving since 2020.

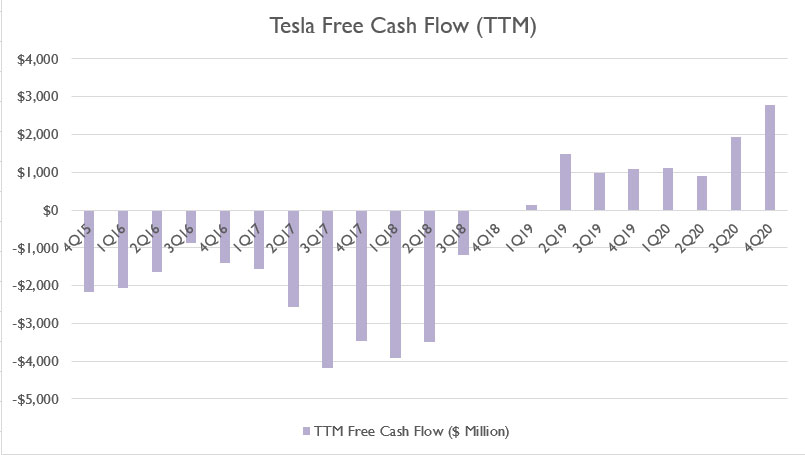

In particular, Tesla’s free cash flow has been positive since 2019 and reached a record high as of 4Q 2020 at nearly $3 billion on a TTM basis.

While Tesla has only started to be profitable in 2020, its free cash flow already has been positive way back in 2019 as shown in the following chart.

Tesla TTM free cash flow

The $3 billion free cash flow was a big deal for Tesla as it was one of the greatest milestones the company has ever achieved after the IPO.

Prior to having a positive free cash flow, Tesla has been burning cash that totaled up to $4 billion on a TTM basis.

Aside from free cash flow, Tesla’s earnings per share or EPS also has started to be positive in 2020 and reached $0.65 per share in 4Q 2020 on a TTM basis.

In other words, Tesla has started to be profitable, albeit a small one.

Also, from a short-term liquidity perspective, Tesla’s current ratio reached as much as 1.9 as of Q4 2020, the highest level ever achieved for the company.

When we stress test Tesla’s liquidity by stripping off some of its short-term assets such as inventory and prepaid expenses, the result shows that the company still has enough liquid assets to cover its entire short-term liabilities on the back of a 1.50 quick ratio.

Furthermore, Tesla also has been aggressively reducing its debt obligations in 2020.

As of 2020 Q4, Tesla’s total debt was down by about 15% year over year to only $10.5 billion, a level that was only seen in 2018.

It seems likes all results are pointing to an improving balance sheet for Tesla.

While Tesla’s balance sheet is still far from bullet proved, it’s on the right track and it has improved tremendously in 2020.

In short, Tesla has not only started to be profitable but also on track to having a solid balance sheet.

Is Tesla a good stock to buy now? I bet it is.

In fact, now is the best time to buy more of Tesla’s stock on the back of the improving fundamentals.

That said, Tesla has only started making little profit and generating small free cash flow.

If Tesla is having the profits and free cash flow of its peers such as Ford and GM, its stock price would have flown off to the moon.

Conclusion

Is Tesla’s stock a buy at $700 per share?

1. Valuation

No, Tesla is looking extremely expensive at $700 per share by all measures.

2. Growth

Yes, there are plenty of growth opportunities lying ahead for Tesla.

3. Income

No, Tesla does not pay any dividends.

4. Fundamentals

Yes, Tesla is on track to larger profitability and positive free cash flow on the back of an improving balance sheet.

References and Credits

1. All financial figures in this article was obtained and referenced from Tesla’s annual and quarterly statements available in Tesla Investor Relations.

2. Some ratios come from the author’s own calculation.

3. Featured images in this article are used under creative commons licenses and sourced from the following websites: Chris Yarzab and Clifton Johnston.

Popular posts that you might be interested:

Disclosure

Readers, investors, analysts, bloggers, visitors, researchers, writers, or academicians are encouraged to use, copy, quote, distribute, modify, edit, share and link any materials on this webpage such as the charts, snapshots, texts, paragraphs, etc. You can credit back to this page by a link or a mention of the website. Thanks for sharing!