Ford River Rouge Complex, Dearborn, MI. Image source: Flickr

Cash is the lifeblood of any business, and Ford Motor Company (NYSE: F) is no exception. Renowned for its expertise in designing and manufacturing cars, trucks, and SUVs, Ford operates in a capital-intensive industry where cash plays an indispensable role.

This importance is magnified by Ford’s commitment to returning substantial cash to shareholders through dividends and stock buybacks. Managing a cash-heavy operation, the company invests heavily each quarter in factories, equipment, offices, warehouses, and workforce.

Simultaneously, Ford generates significant operating and free cash flow, ensuring it maintains financial vitality while meeting its strategic and shareholder obligations.

This article explores various cash metrics for Ford, including cash on hand, operating cash flow, free cash flow, and net cash from financing activities. It examines how these indicators have evolved over time, offering insights into the company’s changing financial position

Let’s take a look!

You may find other key statistic of Ford Motor on these pages:

Revenue

- Ford revenue streams: new and used vehicle sales, services, and more,

- Ford revenue per employee in America, Europe, China, and more,

- Ford revenue per car in North America, Europe, China, and more

Global Sales & Market Share

Wholesales

Profit Margin

Comparison With Peers

- Ford vs Tesla & GM: marketing and advertising expenses,

- Ford vs GM: vehicle profit and margin,

- Ford Motor vs Tesla: R&D budget

Other Statistics

- Ford liquidity ratios,

- Ford financial health,

- Ford total employees, employees by country, and diversity

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Ford Spend Its Cash?

Consolidated Results

A1. Cash On Hand

Type Of Cash

Ratio

C1. Cash On Hand To Current Assets Ratio

Cash Flow

D1. Net Cash From Operations

D2. Free Cash Flow

D3. Adjusted Free Cash Flow

Cash Flow Margins

E1. All Related Cash Flow Margin

Cash From Debt Borrowing And For Debt Repayment

F1. Net Cash From Financing Activities

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Free Cash Flow: Free cash flow (FCF) is a financial metric representing a company’s cash generated after accounting for the cash outflows needed to support operations and maintain its capital assets.

Essentially, it’s the excess cash the company produces after paying for its operating expenses and capital expenditures.

Free cash flow is a crucial indicator of a company’s financial health and its ability to generate sufficient cash to support its business, invest in growth opportunities, pay dividends to shareholders, and reduce debt. It is calculated as:

[ {Free Cash Flow} = {Net Cash from Operating Activities} – {Capital Expenditures} ]

Investors and analysts often use this metric to assess a company’s profitability, efficiency, and potential for growth and expansion.

Cash Flow Margin: The cash flow margin is a financial metric measuring the efficiency of a company in converting its sales into cash.

It’s expressed as a percentage and calculated by dividing the cash flow from operating activities by the net sales or revenue of the company.

This ratio provides insights into the company’s ability to generate cash from its sales. It is crucial for covering its expenses, paying down debt, and funding new investments without relying on external financing.

A higher cash flow margin indicates that the company is efficiently managing its operations to produce more cash, which is a positive sign for investors and creditors. It’s a useful indicator of the company’s financial health and operational efficiency.

Net Cash From Financing Activities: Net Cash from Financing Activities refers to the section of a company’s cash flow statement showing the net cash flows used to fund the company.

This includes transactions involving equity, debt, and dividends. Specifically, it captures the inflow of cash from investors or banks and the outflow of cash to shareholders as dividends or to repay debt obligations.

The calculation of net cash from financing activities includes issuing stock, debt issuance, dividend payments, and debt repayment. It is a crucial component for understanding how a company finances its operations and growth, indicating whether it generates more cash than it uses or vice versa.

This metric is essential to a company’s financial health and provides investors with insight into its financial strategy and ability to manage its capital structure effectively.

How Does Ford Spend Its Cash?

Ford Motor Company allocates its cash in several key areas to ensure sustainable growth, operational efficiency, and shareholder value. These areas include:

1. **Research and Development (R&D):** A significant portion of Ford’s cash is invested in research and development to innovate and improve their vehicle lineup, including developing electric vehicles (EVs), autonomous vehicles, and other cutting-edge technologies.

2. **Capital Expenditure (CapEx):** This includes investments in property, plants, and equipment to expand manufacturing capabilities, improve production efficiencies, and maintain the competitiveness of their facilities worldwide.

3. **Debt Repayment:** Ford manages its cash flow to meet debt obligations, reducing interest expenses and improving its credit rating, which can lower future borrowing costs.

4. **Dividends:** To reward shareholders, Ford allocates a portion of its cash to pay dividends, which can help attract and retain investors.

5. **Share Buybacks:** Ford may sometimes use its cash to buy back shares of its own stock, aiming to boost shareholder value by increasing earnings per share and reducing the total share count.

6. **Strategic Acquisitions:** Ford occasionally uses cash to acquire companies that can complement its existing business lines, drive growth, or enhance technological capabilities.

7. **Liquidity Reserves:** Maintaining a healthy cash reserve is crucial for Ford to navigate economic downturns, unexpected expenses, or investment opportunities without needing immediate external financing.

By strategically managing its cash across these areas, Ford aims to stay competitive, drive innovation, and create long-term value for its stakeholders.

Cash On Hand

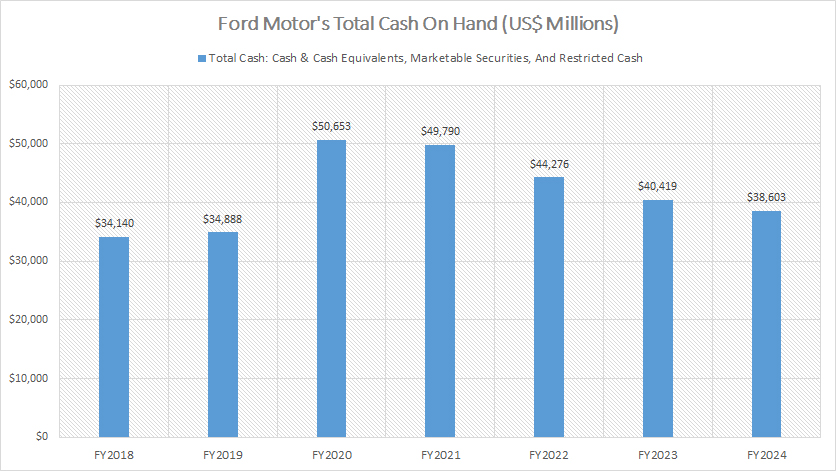

Ford Motor’s cash on hand

(click image to expand)

Ford’s cash on hand has demonstrated stability over the years, generally ranging between $30 billion and $40 billion in most fiscal periods

During fiscal 2020, however, Ford’s cash reserves surged past $40 billion and even exceeded $50 billion, likely as a response to the financial uncertainties brought about by the COVID-19 pandemic.

In the years following the pandemic, Ford’s cash on hand reverted to pre-COVID levels, hovering around $35 billion. By the close of fiscal year 2024, the company’s total cash stood at $38.6 billion.

Cash On Hand Breakdown

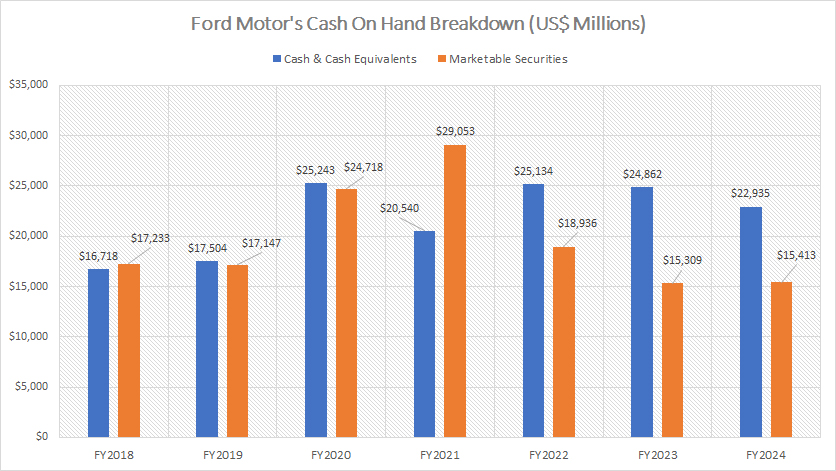

Ford Motor’s cash on hand breakdown

(click image to expand)

Ford’s cash on hand is primarily derived from two sources: cash and cash equivalents, and marketable securities.

The company’s restricted cash is minimal and, therefore, excluded from the chart above.

Typically, the amount of Ford’s cash and cash equivalents surpasses that of its marketable securities in most periods.

Since 2018, Ford has witnessed a consistent increase in cash and cash equivalents, which reached over $23 billion by the end of 2024.

In contrast, the company’s marketable securities remained stable, amounting to $15.4 billion during the same fiscal year.

Cash On Hand To Current Assets Ratio

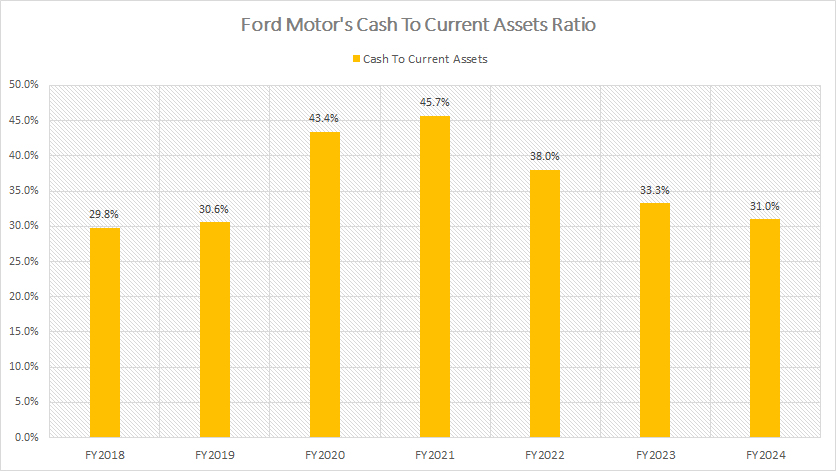

Ford Motor’s cash on hand to current assets ratio

(click image to expand)

To find out the magnitude of Ford’s cash on hand, we have to inspect it from the perspective of the company’s current assets.

By the end of fiscal year 2024, Ford’s cash on hand to current assets ratio had normalized to its pre-COVID level of 31%.

During the pandemic, however, this ratio peaked at an impressive 46%, reflecting the heightened liquidity Ford maintained to navigate the challenges of the crisis.

Net Cash From Operations

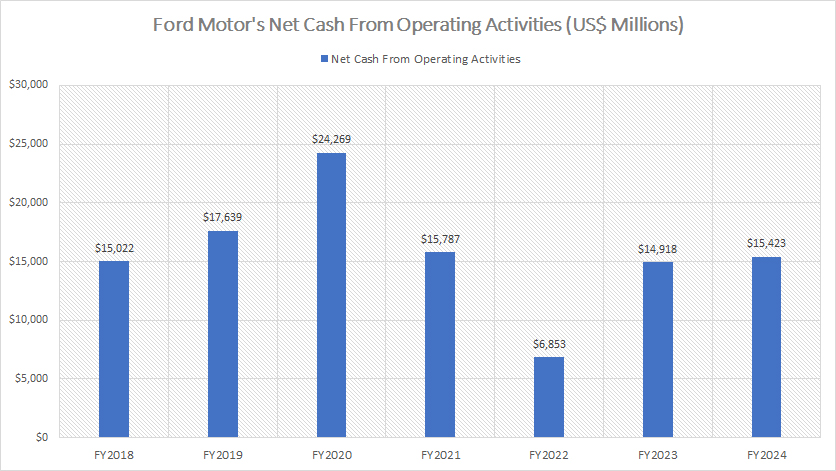

Ford’s operating cash flow

(click image to expand)

Ford consistently generates positive net cash from operations, even amid disruptions such as the COVID-19 pandemic, material shortages, and inflationary pressures.

The company’s operating cash flow reached a high of $24.3 billion in fiscal year 2020. However, it was significantly affected during the pandemic, dropping to a historic low of $6.9 billion in fiscal year 2022.

In the following years, Ford’s operating cash flow rebounded, returning to pre-COVID levels and totaling $15 billion by fiscal year 2024

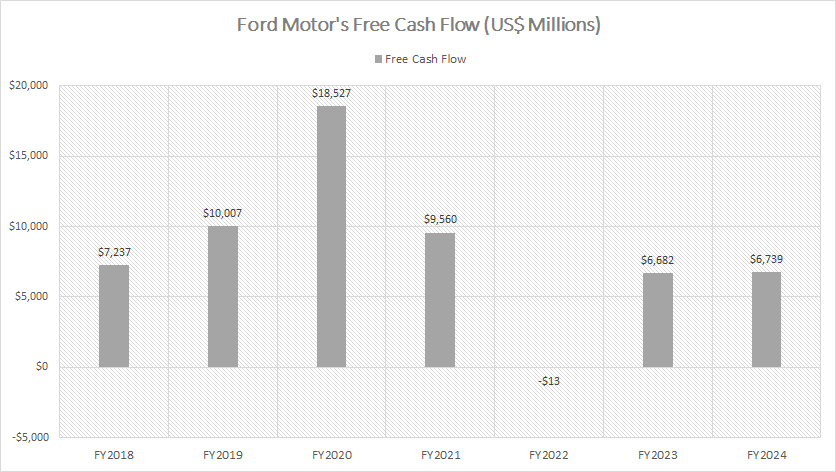

Free Cash Flow

Ford Motor’s free cash flow

(click image to expand)

Free cash flow is operating cash flow net of capital expenditures. The definition of free cash flow is available here: free cash flow.

Ford’s free cash flow mirrors the trend of its net cash from operations.

Notably, Ford has consistently maintained positive free cash flow, with the exception of fiscal year 2022, when it dipped to -$13 million. The company’s free cash flow reached its highest point at $18.5 billion in fiscal year 2020.

In the post-COVID period, Ford’s free cash flow stabilized, aligning with pre-pandemic levels and amounting to approximately $6.7 billion.

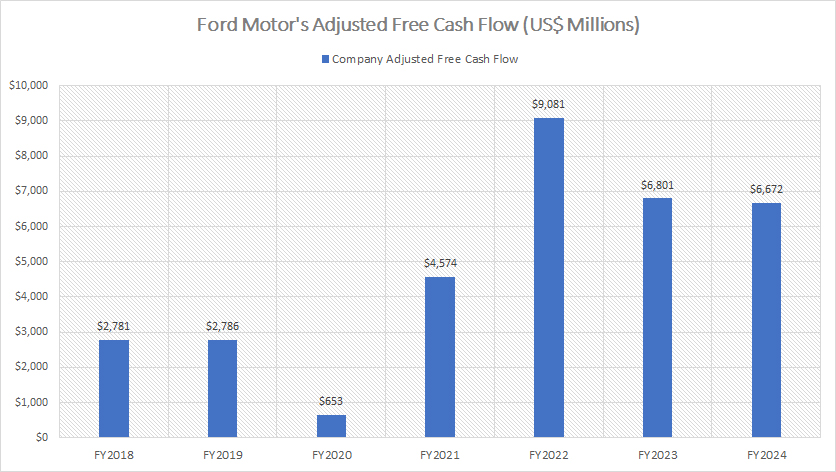

Adjusted Free Cash Flow

Ford Motor’s adjusted free cash flow

(click image to expand)

Ford’s adjusted free cash flow is primarily the cash flow from the automotive segment and is provided by the company in all earnings releases.

Here is the equation for Ford’s adjusted free cash flow:

Adjusted free cash flow = Consolidated net cash from operations – Net cash from operations by Ford Credit – Capital spending + Ford Credit cash dividends payable to the company

Ford’s adjusted free cash flow followed a distinctly different trajectory compared to its operating cash flow and free cash flow discussed earlier.

At the onset of the pandemic, Ford’s adjusted free cash flow sharply declined, reaching a mere $653 million in fiscal year 2020. However, it experienced a substantial rebound in the post-pandemic years.

In the post-COVID period, Ford’s adjusted free cash flow surged to $9.1 billion in fiscal year 2022 before stabilizing at $6.7 billion by the end of fiscal year 2024.

Notably, while Ford’s adjusted free cash flow has recovered, it remains highly cyclical and largely dependent on the performance of the automotive sector.

A downturn in automotive sales — such as the disruption witnessed in 2020 — would likely lead to a significant decline in adjusted free cash flow.

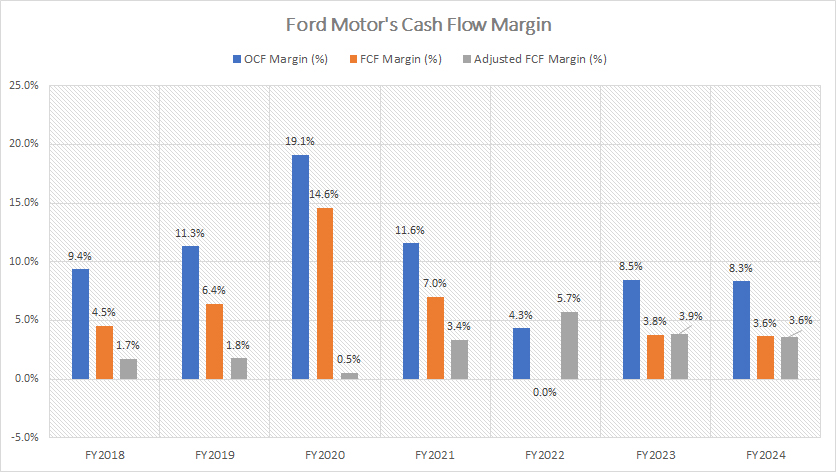

All Related Cash Flow Margin

Ford’s cash flow margin

(click image to expand)

The cash flow margin measures Ford’s efficiency in turning revenue into cash flow. The definition of cash flow margin is available here: cash flow margin.

Ford demonstrates notable efficiency in converting revenue into operating cash flow, maintaining an average operating cash flow margin of approximately 10% over the five-year period from 2020 to 2024.

During the same timeframe, the company achieved an average free cash flow margin of 6%. However, its adjusted free cash flow margin lagged behind, averaging only 3%, making it the lowest among the three metrics.

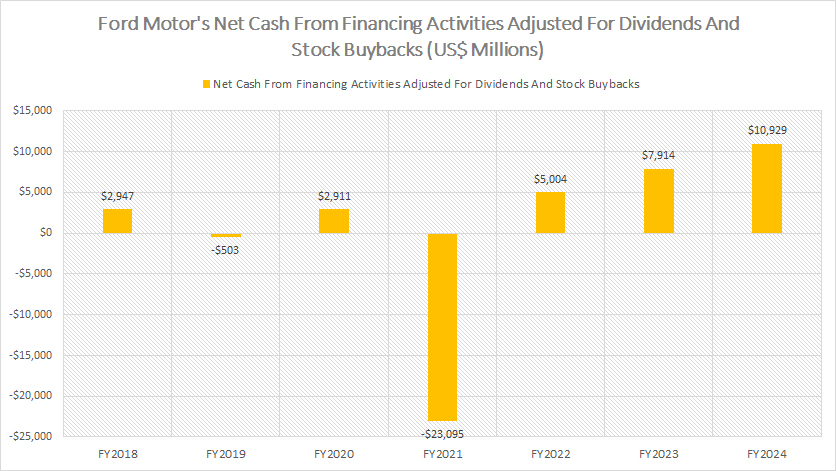

Net Cash from Financing Activities

Ford Motor’s net cash from financing activities

(click image to expand)

The net cash from financing activities depicts whether cash is taken for debt repayment (negative numbers) or cash is added from borrowings (positive numbers). The definition of net cash from financing activities is available here: net cash from financing activities.

It’s important to note that the data in the plot above excludes cash related to capital returns, such as dividend payments and share buybacks, to eliminate their impact.

With this adjustment, Ford’s net cash from financing activities has been predominantly positive in most periods, suggesting the company has been acquiring additional debt.

Notably, Ford significantly reduced its debt during the pandemic in fiscal year 2021. However, since 2022, Ford has resumed accumulating debt, as evidenced by positive net cash from financing activities.

By the end of fiscal year 2024, Ford’s net cash from financing activities climbed to $11 billion, reflecting a considerable increase in debt obligations.

Insight

Ford’s post-pandemic financial rebound showcases its resilience and strategic financial management. While the company faced liquidity challenges during the pandemic, reflected in adjusted free cash flow and operational cash flow dips, it swiftly recovered.

This recovery aligns with its renewed debt-taking initiatives post-2022, culminating in $11 billion in net cash from financing activities in fiscal year 2024.

However, Ford’s heavy reliance on the automotive sector renders its adjusted free cash flow cyclical — indicating vulnerability to disruptions like sales downturns.

Strategic diversification and optimizing debt management could bolster stability in future economic challenges.`

References and Credits

1. All financial figures presented were obtained and referenced from Ford’s quarterly and annual reports published on the company’s investor relations page: Ford’s Financials and Filings.

2. Flickr images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.