Bull market. Source: Flickr

Pinterest (NYSE:PINS) has never paid a dividend since its initial public offering in April 2019. The following quote from Pinterest’s 2023 annual report explains the company’s dividend policy:

-

Dividend Policy

Given our focus on reinvesting in growth opportunities and maintaining financial flexibility, we do not currently intend to pay dividends in the foreseeable future.

Although Pinterest is currently a non-dividend-paying stock, this does not necessarily mean that the company will never pay a dividend in the future.

Pinterest has already achieved a decent profit and generated positive net cash from operations. Additionally, Pinterest is projected to make even more profits and generate higher cash flow. Therefore, the possibility of Pinterest paying a cash dividend in the future is very real to some extent.

In this article, we will explore the factors that support the potential for a dividend from Pinterest.

As the saying goes, every coin has two sides, and it is no exception for Pinterest. Therefore, apart from examining the pros, we will also delve into the factors that may not support a cash dividend from Pinterest.

Let’s take a look.

Investors looking for other statistics of Pinterest may find more resources on these pages:

- Pinterest R&D vs Meta, Twitter, and Snapchat,

- Pinterest revenue by country, and

- Pinterest profit margin vs Meta, Snap, and Twitter.

Please use the table of contents to navigate this page.

Table Of Contents

Favorable Factors For Dividends

A1. A Growing MAU

A2. An Increasing ARPU

A3. A Rising Revenue

A4. Cash Flow Positive

A5. Debt Free

Unfavorable Factors For Dividends

B1. Unprofitability

B2. Poor Margins

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

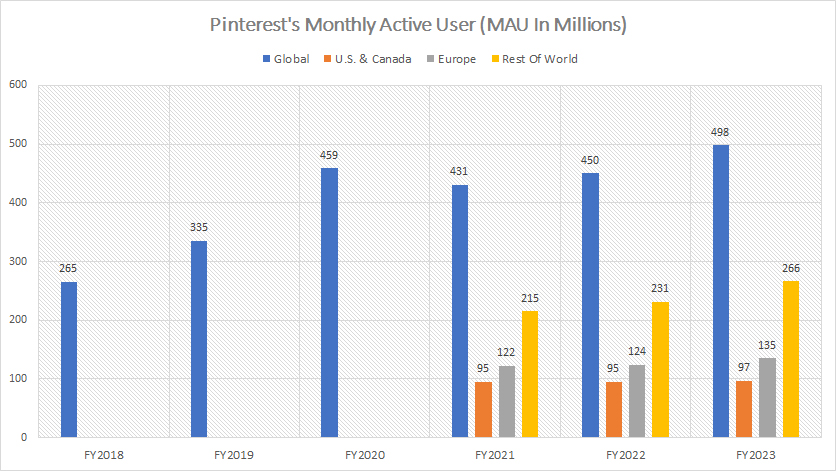

Pinterest’s Growing MAU

Pinterest monthly active users (click to enlarge)

The potential for Pinterest to become a cash dividend-paying company depends significantly on its Monthly Active Users (MAU). This metric measures user engagement on the social media platform, and the higher the MAU, the larger the user base.

Since Pinterest’s primary revenue source comes from advertising, an increase in MAU would enable the company to monetize more effectively. In other words, Pinterest will generate more revenue as its MAU grows.

The good news is that Pinterest has successfully grown its MAU numbers in all regions over the years, as shown in the chart above. For example, Pinterest’s global MAU has been on the rise since 2018, and its international user base has now become one of the largest among all regions.

Although Pinterest’s MAUs in all regions have been increasing, they still represent only a tiny fraction of what Facebook has achieved. According to this article – Pinterest MAU vs Facebook, Pinterest’s global MAU as of 2023 was only about one-fifth of Facebook’s MAU.

Given that Pinterest is still a relatively young social media company compared to Facebook, there is significant headroom for it to grow its MAU in the future. As Pinterest’s MAU continues to expand, so will its revenue and profitability.

Eventually, the prospect of Pinterest paying a cash dividend will likely become a reality. As the company continues to grow and strengthen its market position, the possibility of a cash dividend becomes increasingly feasible.

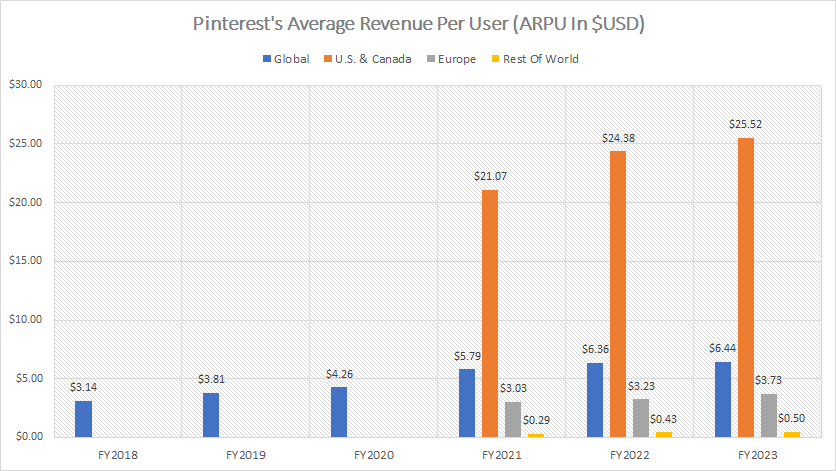

Pinterest’s Increasing ARPU

Pinterest average revenue per user (click to enlarge)

Similar to the growth in MAU, Pinterest’s ARPU (average revenue per user) has also been on the rise, as shown in the chart above. In 2023, Pinterest’s global ARPU reached a record high of US$ 6.44 , while the ARPU for the U.S. & Canada was among the highest at a substantial US$ 25.52 compared to other regions.

Pinterest’s growing ARPU signifies that the company is generating more revenue on a per-user basis. Therefore, the higher the ARPU, the more revenue Pinterest will earn from its users. Consequently, Pinterest’s total revenue will increase in tandem with the rising ARPU.

Despite reaching record highs in all regions as of 2023, Pinterest’s ARPU still represents only a fraction of the numbers achieved by Facebook, a more mature social media company, as highlighted in this article – Pinterest revenue per user vs Facebook. For instance, Pinterest’s global ARPU as of 2023 was only about one-fifth of Facebook’s ARPU.

Moreover, Pinterest’s ARPU in other regions, such as Europe and internationally, was among the lowest compared to Facebook and Snapchat, according to the same article. As a relatively young social media company, Pinterest has significant potential for growth in ARPU as it matures. Given the platform’s vast potential, Pinterest’s ARPU could eventually reach levels similar to those of Facebook and Snapchat.

The continuous growth in MAU and ARPU reinforces the potential for Pinterest to generate substantial revenue and profitability. As Pinterest’s ARPU increases, the company may consider returning capital to shareholders in the form of cash dividends, making the prospect of a dividend more likely in the future.

Ultimately, the factors supporting a potential dividend from Pinterest include the ongoing growth in MAU, the increasing ARPU, and the company’s ability to effectively monetize its user base.

By focusing on these growth areas and addressing market dynamics, Pinterest can strengthen its position and potentially reward shareholders with dividends as it continues to expand and mature.

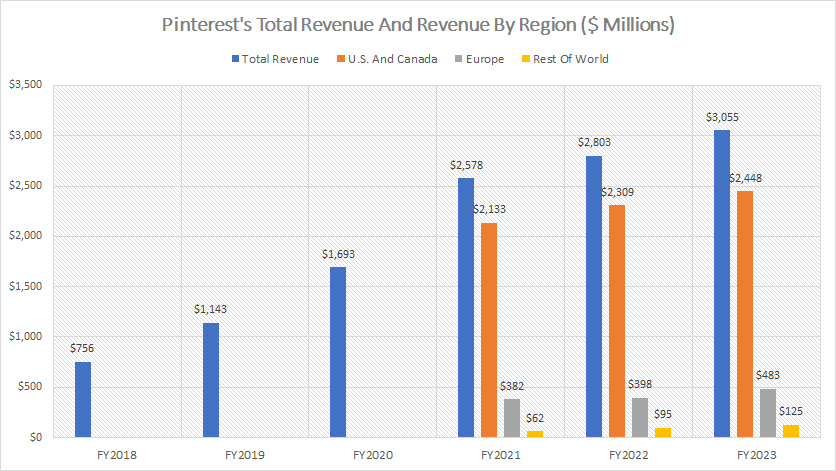

Pinterest’s Rising Revenue In All Regions

Pinterest total revenue and revenue by region (click to enlarge)

Pinterest’s total revenue and revenue by region have been on the rise due to the growing MAU and increasing ARPU. As shown in the chart above, Pinterest’s total revenue and revenue by country reached record highs in 2023, with the total revenue nearly quadrupling since 2018.

In addition to the overall revenue growth, Pinterest’s revenue in the U.S. & Canada, Europe, and internationally has also seen considerable increases since 2018. This regional growth reflects the platform’s expanding user base and its enhanced ability to monetize through advertising.

While a cash dividend may not necessarily stem directly from revenue, the soaring sales figures significantly increase the likelihood of Pinterest considering such a move. The robust revenue growth highlights the company’s financial strength and its potential to generate substantial profits in the future.

As Pinterest continues to expand its MAU and ARPU, its financial performance is likely to improve further. This positive trajectory could lead to discussions about capital returns to shareholders in the form of cash dividends.

Ultimately, the increasing revenue and user engagement metrics strengthen the case for Pinterest potentially becoming a dividend-paying company in the future.

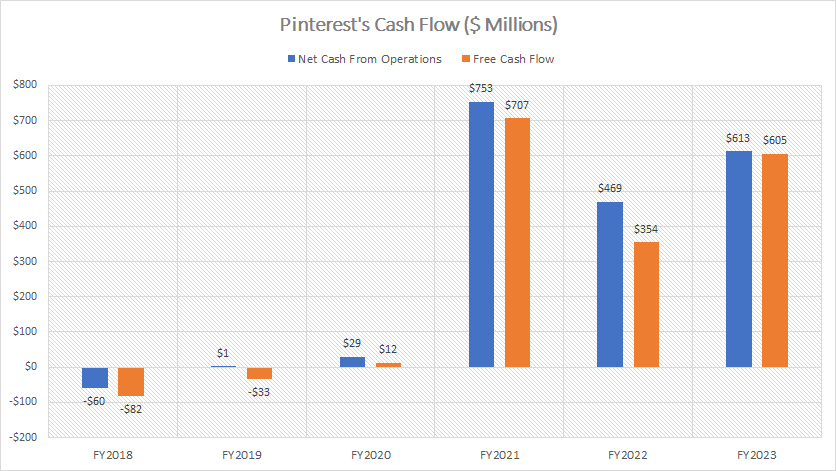

Pinterest’s Positive Cash Flow

Pinterest cash flow (click to enlarge)

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

The cash flow is certainly a crucial determining factor for Pinterest to potentially become a dividend-paying company, as dividends are usually paid out from cash flow.

As seen, Pinterest has been generating positive cash flow since 2020. For example, Pinterest’s net cash from operations has been positive since 2020, totaling over $600 million as of fiscal year 2023 — one of the highest figures ever reported.

Similarly, Pinterest’s free cash flow has also been positive since 2020, reaching a record figure of $over 600 million in 2023, a seemingly impressive figure over the past five years.

While this positive cash flow may not be as substantial as the billions generated by established dividend-paying companies, it marks a significant milestone for Pinterest. The company has successfully transitioned from being cash flow negative to cash flow positive since 2020, achieving this status for three consecutive years.

Having positive net cash from operations and free cash flow is vital for Pinterest as it means the company no longer needs to rely on external capital injections. The extra cash generated can be allocated to various purposes, including returning capital to shareholders in the form of dividends.

Therefore, it is crucial for Pinterest to continuously produce positive cash flow if it aims to become a dividend-paying stock. In summary, Pinterest’s positive cash flow is a significant step forward and makes the prospect of a cash dividend increasingly likely.

Given these factors, it becomes evident that Pinterest’s financial health and consistent cash flow generation are pivotal in determining its ability to pay dividends. As the company continues to grow and strengthen its market position, the likelihood of Pinterest becoming a dividend-paying company becomes more tangible.

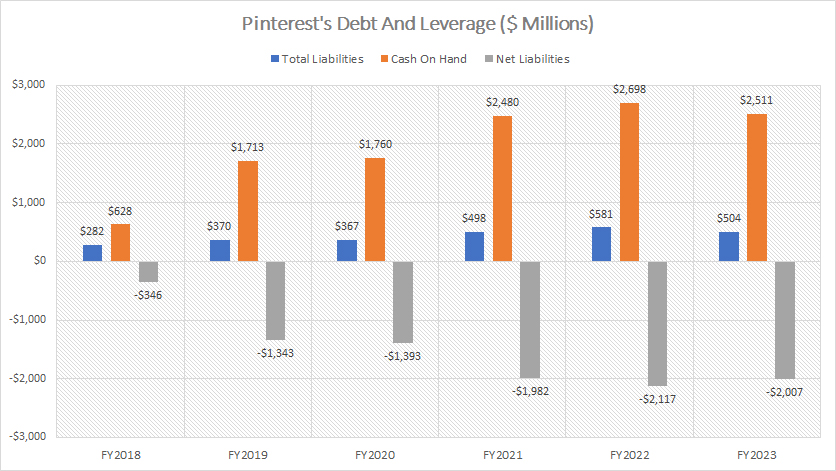

Pinterest Is Debt Free

Pinterest debt and leverage (click to enlarge)

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

As discussed, Pinterest has been able to produce positive cash flow since 2020. Although its cash flow was negative prior to 2020, the negative results were minimal and likely did not significantly impact the company’s cash position.

Due to this, the company has managed to avoid debt all these years. As shown in this article – Pinterest debt vs Meta, Twitter, and Snap, Pinterest’s debt level has been zero in the past five years, whether short-term or long-term debt.

As a result, Pinterest has consistently maintained negative net liabilities after accounting for its cash position. In other words, Pinterest could literally pay off its entire liabilities with its cash on hand throughout these years.

Being debt-free is advantageous not only for Pinterest but also for its shareholders, as the company is not bound by any credit agreements or debt arrangements that could hinder its ability to return capital to shareholders. Therefore, Pinterest will be able to declare a cash dividend whenever it is ready to do so.

Moreover, this debt-free status bodes well for Pinterest’s financial health and flexibility, providing it with the ability to invest in growth opportunities and withstand market fluctuations without the burden of debt repayments.

The case for a cash dividend from Pinterest becomes even more compelling considering its strong cash flow generation and debt-free status. The company’s ability to produce positive cash flow for three consecutive years marks a significant milestone in its financial journey.

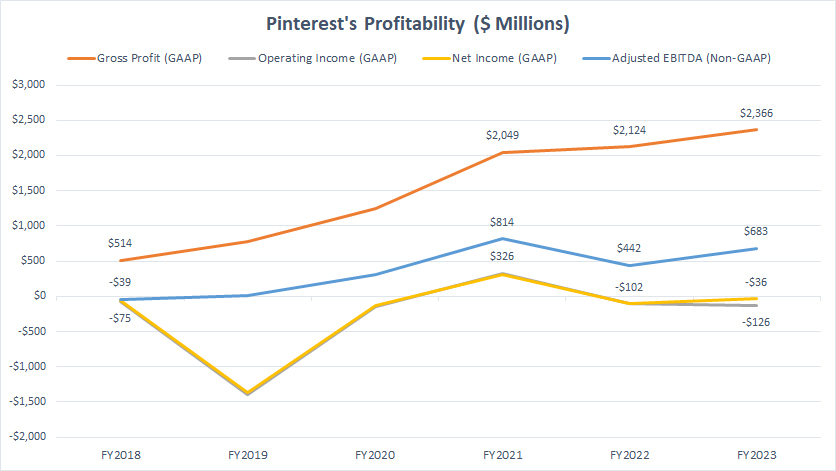

Pinterest Is Unprofitable

Pinterest profitability (click to enlarge)

* EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

The only factor holding Pinterest back from declaring a cash dividend is the company’s unprofitability.

Although Pinterest’s gross profit has been extremely impressive over the years, as shown in the chart above, its operating income and net income have lagged behind. For instance, Pinterest managed to make a profit in only 1 out of the 5 fiscal years between 2018 and 2023.

To make matters worse, Pinterest’s profitability in that sole profitable year — fiscal 2021 — was a meager $300 million in operating and net profit on a GAAP basis. In other fiscal years, Pinterest incurred losses ranging from $100 million to nearly $1.5 billion.

While Pinterest has been unprofitable in most fiscal years, its losses have been decreasing, and profitability has been improving. For example, Pinterest’s adjusted EBITDA (Non-GAAP) turned around from a loss to profitability, as shown in the chart above. As of fiscal year 2023, Pinterest’s adjusted EBITDA topped $683 million, one of the highest figures ever reported.

This trend indicates that Pinterest is moving in the right direction. The company’s financial performance is gradually improving, and it seems to be on a path to becoming highly profitable. I believe it is only a matter of time before Pinterest achieves consistent profitability.

When that time comes, the prospect of a cash dividend from Pinterest may soon become a reality for investors. Positive cash flow and a debt-free status already put Pinterest in a strong position. However, achieving sustained profitability will be the final piece of the puzzle needed to justify a cash dividend.

In summary, while Pinterest’s unprofitability has been a barrier to declaring dividends, the company’s improving financial performance suggests that a cash dividend could be within reach in the future. Investors should watch for continued growth in profitability as a key indicator of Pinterest’s potential to return capital to shareholders.

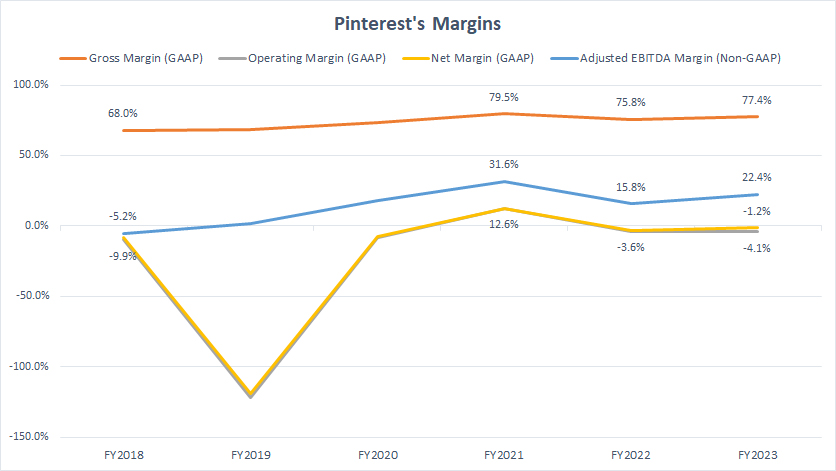

Pinterest Has Poor Margins

Pinterest margins (click to enlarge)

* EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

* Pinterest’s fiscal year begins on Jan 1 and ends on Dec 31.

Pinterest’s poor margins are primarily due to the unprofitable nature of the company’s operations. As shown in the chart above, Pinterest’s operating and net margins have been negative in most fiscal years, only managing to stay positive in 1 out of 5 fiscal years.

Although Pinterest has struggled with poor margins, they have improved significantly over the years. For example, Pinterest achieved operating and net margins above 10% in fiscal 2021, and the figures for 2023 were only slightly below 0%, illustrating narrowing losses and improving margins.

Additionally, Pinterest’s adjusted EBITDA margin reached an impressive 16% in 2022 and 22% in 2023, further highlighting an improving business outlook for the company.

If Pinterest continues its steady improvement in margins, a cash dividend declaration by the company may become a possibility in the foreseeable future. However, for now, Pinterest is still grappling with negative margins and unprofitability. Therefore, a cash dividend in the near future seems unlikely.

Investors will need to be patient with the company and allow management to implement the necessary strategies to improve profitability.

Despite the current challenges, Pinterest’s continuous efforts to enhance its financial performance and margins indicate a positive trajectory. The company’s ability to generate positive cash flow and maintain a debt-free status are significant advantages that provide a solid foundation for future growth and profitability.

In summary, while Pinterest’s poor margins have been a hindrance, the ongoing improvements and positive financial indicators suggest that a cash dividend may not be completely out of the question in the future. Investors should remain optimistic and supportive of the company’s efforts to achieve sustained profitability.

Conclusion

In summary, while Pinterest shows promising signs with positive cash flow, a debt-free status, and improving margins, its unprofitability remains a significant barrier to declaring cash dividends. Investors should keep an eye on Pinterest’s financial performance and management’s decisions for any potential changes in the future.

Credits and References

1. All Pinterest’s financial figures presented were obtained and referenced from the company’s annual reports published on the investor relations page:

a) Pinterest Investor Relations

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.