The interior of a Hummer EV. Image by GMC.

This article presents the U.S. sales data for General Motors (NYSE: GM), specifically focusing on trucks, SUVs, and sedans/cars.

The sales figures discussed are based on retail data provided by GM in its annual reports. Broadly, General Motors categorizes its U.S. vehicle lineup into three segments:

- Trucks

- Cars (or Sedans)

- SUVs (or Crossovers)

This breakdown provides a clear view of GM’s diverse offerings in the U.S. market. Let’s look at the sale umbers!

For other key statistics of General Motors, you may find more information on these pages:

Global Sales & Market Share

Wholesale

U.S. Sales & Market Share

Revenue

Profit Margin

Debt & Cash

GM China Statistics

Comparison With Peers

- GM vs Ford: vehicle profit and margin comparison,

- GM vs Tesla & Ford: advertising and marketing budget,

- GM vs Tesla: R&D spending,

Other Statistics

- Inventory levels, inventory days and turnover ratio,

- Share buyback history,

- Asset analysis: receivables, property, etc.,

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is GM selling fewer sedan cars now?

Consolidated Results

A1. Total U.S. Sales

Sales By Vehicle Type

B1. Truck, SUV, and Sedan Sales

B2. Truck, SUV, and Sedan Sales In Percentage

Sales Growth

C1. Truck, SUV, and Sedan Sales Growth

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Retail Sales: General Motors’ retail sales refer to the transactions where General Motors (GM) vehicles are sold directly to consumers. This encompasses sales through dealerships or other channels that sell new and potentially pre-owned vehicles to individual buyers.

Retail sales are an important metric for the automotive industry, reflecting consumer demand and preferences for GM’s various brands and models. Industry analysts, investors, and competitors closely watch these sales figures as they provide insight into the company’s market performance, brand health, and operational success.

Market Share: General Motors’ market share is calculated by comparing the company’s vehicle sales to the total vehicle sales in the market over a specific period, typically on a quarterly or annual basis.

This calculation can be applied to various contexts, such as a particular country’s market, a region, or the global market. Here is the formula:

GM’s Market Share = {{GM’s Vehicle Sales} / {Total Market Vehicle Sales}} * 100%

This will give you General Motors’ market share as a percentage of the total market. For example, if General Motors sold 2 million vehicles in a year in the U.S., and the total U.S. vehicle sales were 15 million, GM’s market share would be:

GM’s Market Share = {{2,000,000} / {15,000,000}) * 100% = 13.33%

This calculation gives a snapshot of General Motors’ competitive position within the automotive market for the period in question. Market share is a crucial metric for assessing a company’s size, health, and competitiveness within its industry.

Why is GM selling fewer sedan cars now?

General Motors (GM) has reduced its focus on sedan cars due to shifting consumer preferences and broader market trends. In recent years, there has been a significant increase in demand for SUVs, crossovers, and trucks, which offer more space, versatility, and perceived value compared to traditional sedans.

Additionally, GM and other automakers have been adjusting their lineups to align with these preferences, prioritizing vehicles that generate higher profit margins. Sedans, which have seen declining sales, are less profitable compared to larger vehicles.

GM’s pivot toward electric vehicles (EVs) has also influenced its strategy, as the company invests heavily in EV development and production.

This shift reflects a broader trend across the automotive industry, where sedans are becoming less prominent in favor of vehicles that cater to evolving consumer needs and preferences.

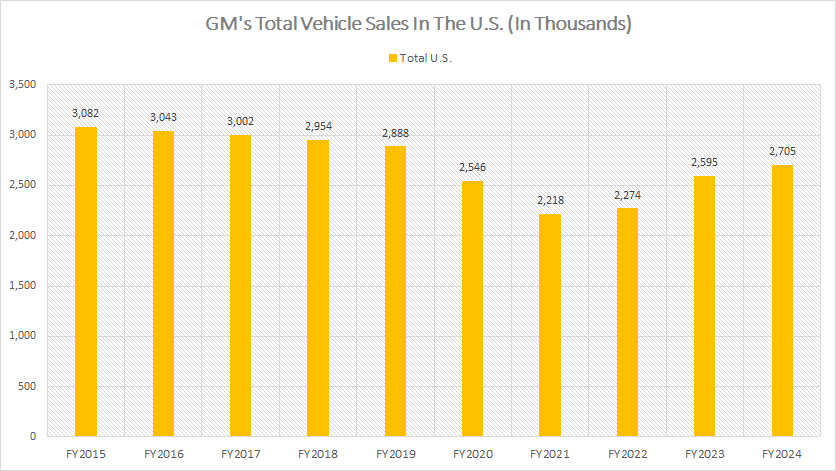

GM’s Total U.S. Sales

GM total U.S. vehicle sales

(click image to enlarge)

The definition of GM’s retail vehicle sales is available here: retail sales.

GM’s U.S. retail vehicle sales reached 2.7 million units by the end of 2024, reflecting a modest growth of approximately 100,000 vehicles compared to 2023 and an increase of over 400,000 units relative to 2022.

However, when examining a broader timeline from 2015 to 2024, GM’s overall retail volume in the U.S. has experienced a decline, despite the notable recovery in recent years.

After peaking at more than three million units in 2015, GM’s retail vehicle sales have been on a downward trajectory, decreasing by 15% over the past decade. This long-term trend highlights a significant shift in the company’s U.S. market performance.

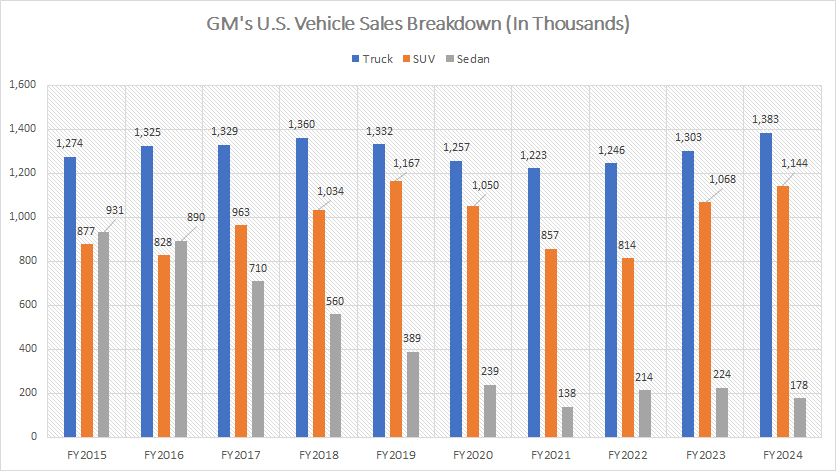

Truck, SUV, and Sedan Sales

GM truck, SUV, sedan sales in the U.S.

(click image to enlarge)

Sales in FY2024:

| Vehicle Type | FY2024 |

|---|---|

| (Vehicles In Thousands) | |

| Truck | 1,383 |

| SUV | 1,144 |

| Sedan/Car | 178 |

3-Year Sales Trend from FY2022 to FY2024:

| Vehicle Type | FY2022 to FY2024 |

|---|---|

| (Vehicles In Thousands) | |

| Truck | 1,246 to 1,383 |

| SUV | 814 to 1,144 |

| Sedan/Car | 214 to 178 |

5-Year Sales Trend from FY2020 to FY2024:

| Vehicle Type | FY2020 to FY2024 |

|---|---|

| (Vehicles In Thousands) | |

| Truck | 1,257 to 1,383 |

| SUV | 1,050 to 1,144 |

| Sedan/Car | 239 to 178 |

10-Year Sales Trend from FY2015 to FY2024:

| Vehicle Type | FY2015 to FY2024 |

|---|---|

| (Vehicles In Thousands) | |

| Truck | 1,274 to 1,383 |

| SUV | 877 to 1,144 |

| Sedan/Car | 931 to 178 |

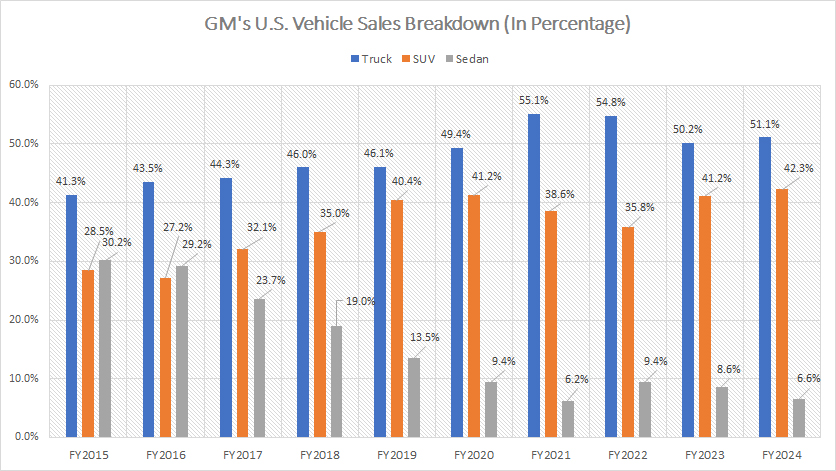

Truck, SUV, and Sedan Sales In Percentage

GM truck, SUV, sedan sales in the U.S. by percentage

(click image to enlarge)

Sales Percentage in FY2024:

| Vehicle Type | FY2024 |

|---|---|

| Truck | 51.1% |

| SUV | 42.3% |

| Sedan/Car | 6.6% |

Sales Percentage 3-Year Trend from FY2022 to FY2024:

| Vehicle Type | FY2022 to FY2024 |

|---|---|

| Truck | 54.8% to 51.1% |

| SUV | 35.8% to 42.3% |

| Sedan/Car | 9.4% to 6.6% |

Sales Percentage 5-Year Trend from FY2020 to FY2024:

| Vehicle Type | FY2020 to FY2024 |

|---|---|

| Truck | 49.4% to 51.1% |

| SUV | 41.2% to 42.3% |

| Sedan/Car | 9.4% to 6.6% |

Sales Percentage 10-Year Trend from FY2015 to FY2024:

| Vehicle Type | FY2015 to FY2024 |

|---|---|

| Truck | 41.3% to 51.1% |

| SUV | 28.5% to 42.3% |

| Sedan/Car | 30.2% to 6.6% |

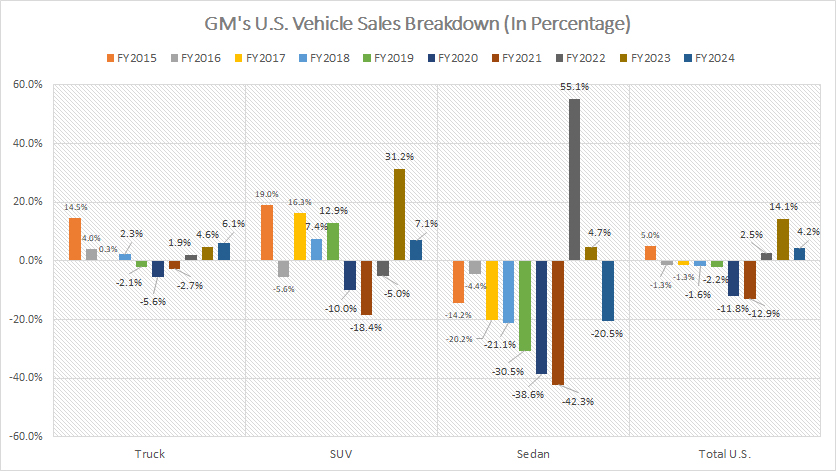

Truck, SUV, and Sedan Sales Growth

GM truck, SUV, sedan sales in the U.S. growth rates

(click image to enlarge)

Sales Growth In FY2024

| Vehicle Type | FY2024 |

|---|---|

| Truck | 6.1% |

| SUV | 7.1% |

| Sedan/Car | -20.5% |

| Total U.S. | 4.2% |

Sales Growth 3-Year Average from FY2022 to FY2024:

| Vehicle Type | FY2022 to FY2024 |

|---|---|

| Truck | 4.2% |

| SUV | 11.1% |

| Sedan/Car | 13.1% |

| Total U.S. | 7.0% |

Sales Growth 5-Year Average from FY2020 to FY2024:

| Vehicle Type | FY2020 to FY2024 |

|---|---|

| Truck | 0.9% |

| SUV | 1.0% |

| Sedan/Car | -8.3% |

| Total U.S. | -0.8% |

Sales Growth 10-Year Average from FY2015 to FY2024:

| Vehicle Type | FY2015 to FY2024 |

|---|---|

| Truck | 2.3% |

| SUV | 5.5% |

| Sedan/Car | -13.2% |

| Total U.S. | -0.5% |

Insight

Essentially, multiple trends highlight the growing dominance of GM’s truck and SUV sales in the U.S., while sedan sales continue to decline significantly.

In fiscal year 2024, trucks accounted for over 51% of GM’s U.S. retail volume, with SUV sales contributing 42%. Meanwhile, sedans made up just 6.6%, reflecting a steep decline from their earlier prominence, when GM sold close to a million sedans annually.

This shift underscores how consumer preferences have evolved, favoring larger and more versatile vehicles like trucks and SUVs over traditional sedans.

It also highlights GM’s ability to adapt its vehicle lineup to meet market demands while investing heavily in SUVs and crossovers, which saw an impressive 40% growth between 2022 and 2024.

This strategic focus has bolstered GM’s overall sales recovery, despite long-term declines in total U.S. retail volume over the past decade.

References and Credits

1. All sales figures presented were obtained and referenced from General Motors’ quarterly and annual statements published on the company’s investor relations page: GM Investor Relations.

2. Hummer EV image was obtained from GMC Hummer EV.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

I currently drive a 2019 Volt. This leased vehicle comes due in August 2022. We had an Equinox before it was downsized and the moon roof removed. I thought it should have been produced as a hybrid and a plug-in. My wife currently owns a KIA Niro hybrid. It seems that the sedan void is being filled by foreign companies and the Tesla. The Tesla is something new and exciting. There is really nothing new and exciting yet from anyone. I like the Toyota approach. They are the leaders of electric motor vehicles in the world and are making money on the Prius. I have owned (3). When I visited Berlin I noticed the taxi cabs there were mostly Prius.

Thanks for the data on GM/Ford/Tesla.