Euro. Pixabay image.

Stellantis has a strong presence in Europe, operating under several well-known brands such as Peugeot, Citroën, Opel, Vauxhall, Fiat, Alfa Romeo, and Jeep.

This article covers Stellantis’ vehicle sales and market share in Europe, as well as its competitive position in Europe versus its competitors.

Keep in mind that the vehicle sales data presented is based on the retail sales data. Also, according to Stellantis, its European sales are divided into Europe 30 and Other Europe. The Enlarged Europe encompasses the Europe 30 and Other Europe regions.

Let’s look at the details!

Investors looking for other sales statistics of Stellantis may find more resources on these pages:

- Stellantis global sales,

- Stellantis North America,

- Stellantis South America,

- Stellantis China, India & Asia Pacific,

- Stellantis Middle East & Africa, and

- Stellantis Maserati.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Consolidated Sales

A1. Vehicle Sales In Enlarged Europe

A2. YoY Growth Rates Of Vehicle Sales In Enlarged Europe

Sales By Region

A3. Vehicle Sales In Europe30

A4. Vehicle Sales In Other Europe

Sales By Country

B1. Vehicle Sales In France, Italy, Germany, UK, And Spain

B2. Percentage Of Vehicle Sales In France, Italy, Germany, UK, And Spain

B3. YoY Growth Rates Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Consolidated Market Share

C1. Market Share In Enlarged Europe

C2. Market Share In Europe30

Market Share By Country

D1. Market Share In France, Italy, Germany, UK, And Spain

Market Share Vs Competitors

E1. Market Share In Europe30 Vs Competitors

E2. Market Share Before The Merger

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Enlarged Europe: Stellantis defines the Enlarged Europe as Europe30 plus Other Europe.

The definition of Europe30 can be found here: Europe30.

Other Europe includes Eurasia (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Moldova, Russia, Ukraine, Uzbekistan) and other Europe (Albania, Bosnia, Kosovo, Malta, Montenegro, North Macedonia and Serbia).

Basically, Enlarged Europe is defined in the following equation:

Enlarged Europe = Europe30 + Other Europe

Europe 30: Europe 30 includes the 27 members of the European Union excluding Malta and including Iceland, Norway, Switzerland and UK.

Basically, Europe 30 is defined in the following equation:

Europe 30 = Europe 27 (excluding Malta) + Iceland + Norway + Switzerland + UK

Other Europe: According to Stellantis’ 2023 annual report, Other Europe = Eurasia (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Moldova, Russia, Ukraine, Uzbekistan) and other Europe (Albania, Bosnia, Kosovo, Malta, Montenegro, North Macedonia, Serbia and Ukraine).

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants and vehicles manufactured by joint ventures and third-party contract manufacturers and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis vehicle wholesale.

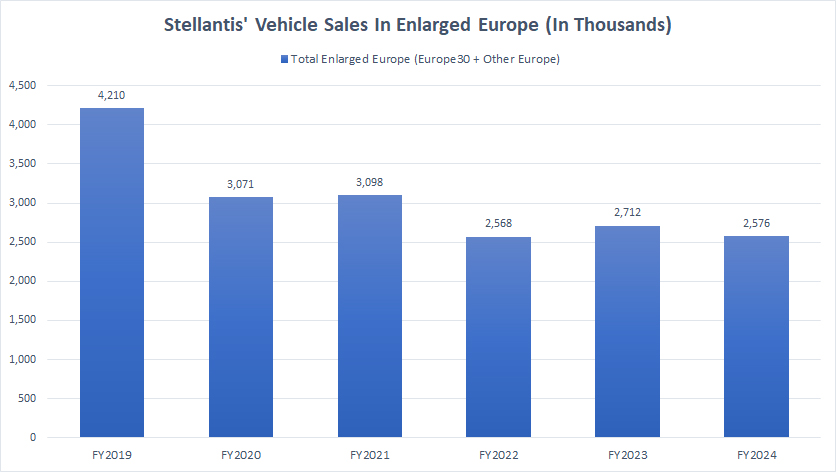

Vehicle Sales In Enlarged Europe

Stellantis-vehicle-sales-in-Enlarged-Europe

(click image to expand)

A definition of Stellantis’ Enlarged Europe and new vehicle sales can be found here: Enlarged Europe and vehicle sales.

Stellantis’ new vehicle sales (retail volume) in Enlarged Europe reached 2.6 million units in fiscal year 2024, down slightly from 2.7 million in 2023, according to its 2024 annual report.

Stellantis used to deliver more than 4.0 million vehicles in Enlarged Europe. For example, the estimated vehicle sales in 2019 exceeded 4 million units, and roughly 3 million vehicles were sold in 2020 and 2021, respectively.

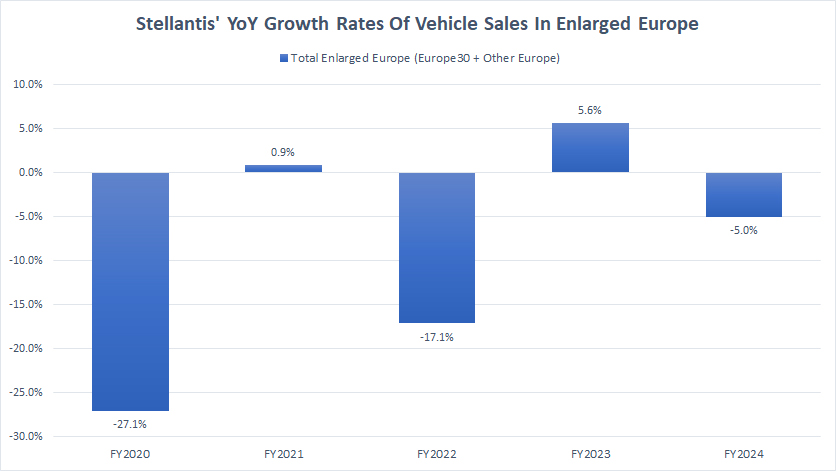

YoY Growth Rates Of Vehicle Sales In Enlarged Europe

Stellantis-yoy-growth-rates-of-vehicle-sales-in-Enlarged-Europe

(click image to expand)

A definition of Stellantis’ Enlarged Europe and new vehicle sales can be found here: Enlarged Europe and vehicle sales.

Stellantis’ new vehicle sales in Enlarged Europe in 2024 declined 5.0% from the previous year versus an increase of 6% in 2023.

On average, Stellantis’ YoY growth rates in Enlarged Europe has declined by 6% annually over the past three years since 2022.

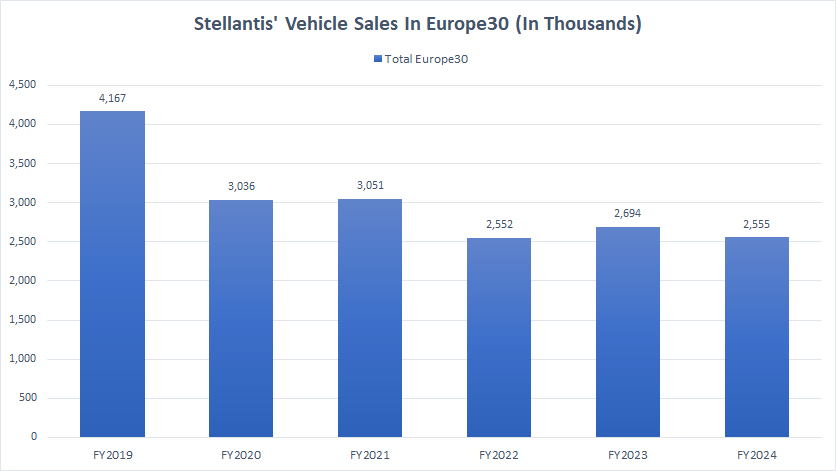

Vehicle Sales In Europe30

Stellantis-vehicle-sales-in-Europe-30

(click image to expand)

A definition of Stellantis’ Europe30 and new vehicle sales can be found here: Europe30 and vehicle sales.

Stellantis’ retail sales in Europe30 topped 2.6 million vehicles in fiscal year 2024, slightly lower from 2.7 million sales in 2023 and at the same level as in 2022, according to its 2024 annual report.

Stellantis’ vehicle sales in Europe30 in 2019 were estimated at over 4 million units, while roughly 3 million vehicles were sold in 2020 and 2021, respectively, which were much higher than the figure in 2024.

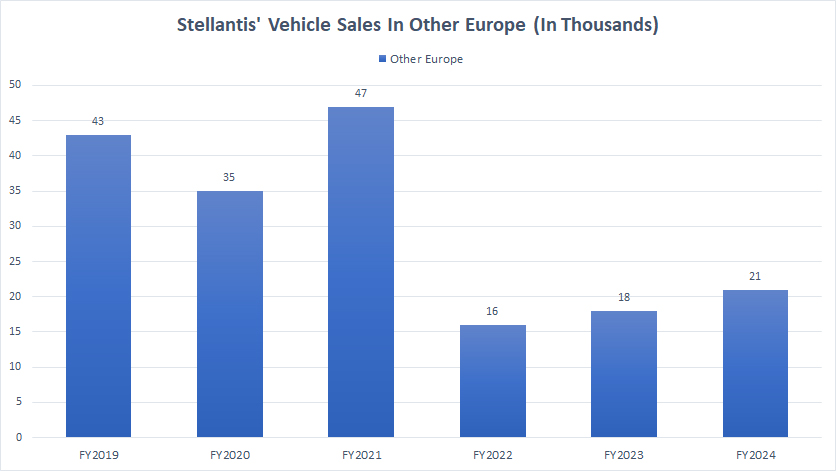

Vehicle Sales In Other Europe

Stellantis-vehicle-sales-in-Other-Europe

(click image to expand)

A definition of Stellantis’ Other Europe and new vehicle sales can be found here: Other Europe and vehicle sales.

Stellantis delivered just 21 thousand vehicles in European countries in Other Europe. This figure was higher than the 18 thousand sales in 2023 and was massively down from the 47 thousand units sold in 2021.

In fact, Stellantis’ new vehicle sales in countries in Other Europe in 2024 was less than half of the vehicles sold in 2021.

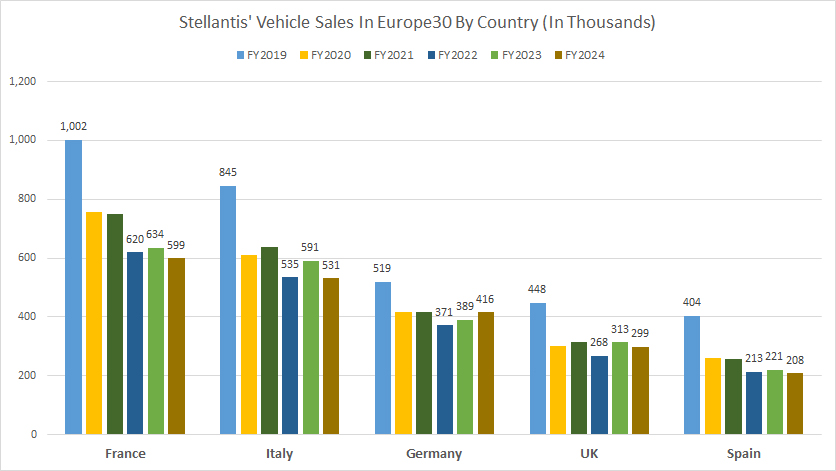

Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-vehicle-sales-in-Europe-30-by-country

(click image to expand)

The countries presented in the graph above represent Stellantis’ biggest markets in Europe. That said, Stellantis’ biggest market in Europe30 is France, with vehicle sales reaching 600 thousand units in fiscal year 2024. The automaker sold 634 thousand vehicles in France in 2023.

Stellantis’ second biggest market in Europe30 is Italy. The company’s retail volume in this country topped slightly over half a million vehicles in fiscal year 2022, and it sold nearly 600 thousand vehicle in Italy in 2023. In fiscal year 2024, the sales figure in Italy declined to 531 thousand vehicles.

Germany contributed about 389 thousand vehicles to Stellantis in fiscal 2023 versus 371 thousand units in 2022, making this country the third-largest market for the company in Europe. In fiscal year 2024, Stellantis’ retail volume in Germany increased to 416 thousand vehicles.

The UK and Spain were Stellantis’ fourth and fifth largest markets in Europe, contributing sales of about 300 thousand and 208 thousand vehicles to the company in 2024.

A noticeable trend is that Stellantis vehicle sales decreased in most European countries in 2024, following an increase in sales in 2023.

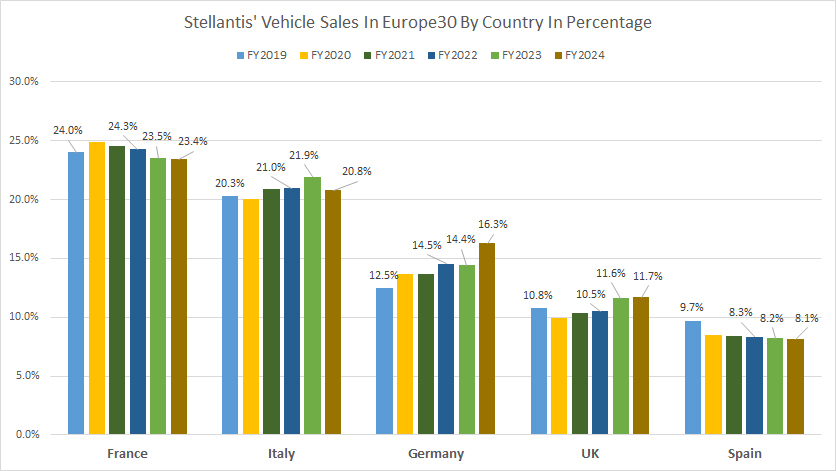

Percentage Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-vehicle-sales-in-Europe-30-by-country-in-percentage

(click image to expand)

The countries presented in the graph above represent Stellantis’ biggest sales contributors in Europe.

That said, France contributed about 23% of sales to Stellantis in fiscal year 2024, while Italy contributed 21% of sales to the company during the same period. These two countries have contributed the biggest number of vehicle volumes to the company in most fiscal years.

On the other hand, new vehicle sales from Germany made up just 16% of Stellantis’ total retail volume in Europe in fiscal year 2024. More importantly, this ratio has significantly grown over time, reaching a record figure in the latest result, and illustrate the growing importance of Germany in Stellantios’ sales portfolio.

Stellantis’ sales in the UK represented only 12% of its total volume in Europe in fiscal year 2024, while Spain came in at 8% in the same period. Like Germany, the sales contribution from the U.K. also has increased over time, marking this country one of the fastest growing for the company.

On a broader perspective, most European countries have seen their sales contributions steadily decreasing since 2019. For example, France and Spain have experienced a decrease in sales contribution, while Italy has been flat.

In this regard, France’s ratio has decreased from nearly 25% in 2020 to 23% as of 2024, while Spain’s ratio has decreased from 10% to 8% during the same period.

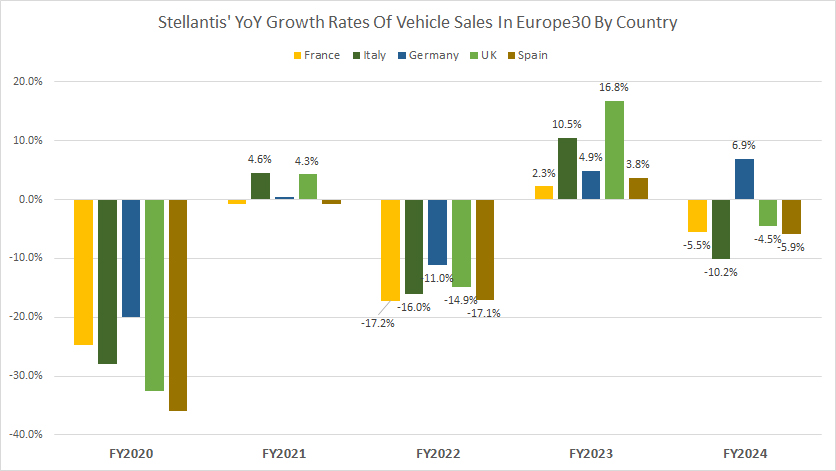

YoY Growth Rates Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-yoy-growth-rates-of-vehicle-sales-in-Europe-30-by-country

(click image to expand)

Stellantis’ sales growth in the biggest European markets were in the red in fiscal year 2024, as depicted in the chart above. However, Stellantis recorded significant growth in most European countries in fiscal year 2023.

For example, Stellantis’ sales in France was 6% lower in fiscal year 2024, while Italy was down by 10%. Germany was the only European country in the list registered sales growth of 7% in fiscal year 2024.

Both the U.K. and Spain saw sales lower by 5% and 6% in fiscal year 2024, respectively.

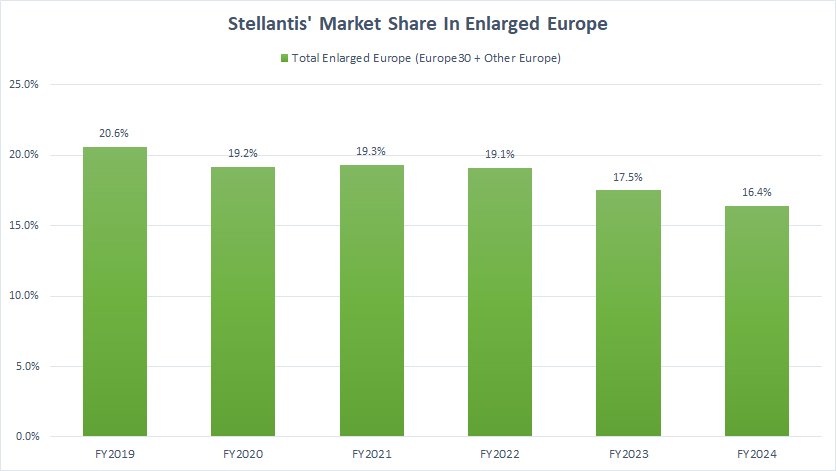

Market Share In Enlarged Europe

Stellantis-market-share-in-Enlarged-Europe

(click image to expand)

Stellantis had a total market share of 16.4% in Enlarged Europe in fiscal year 2024, down slightly from 17.5% in 2023, according to the company’s 2024 annual report.

Since 2019, Stellantis’ market share in Enlarged Europe has been on the decline, down from 20.6% in 2019 to 16.4% in the latest result.

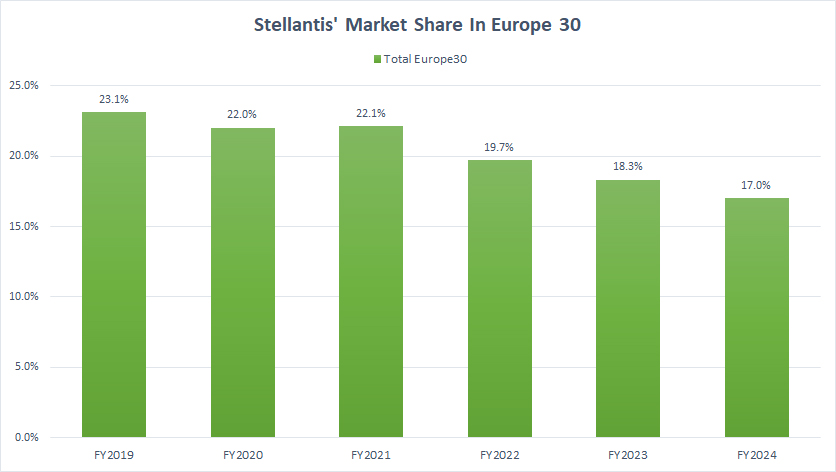

Market Share In Europe30

Stellantis-market-share-in-Europe-30

(click image to expand)

The definition of Stellantis’ Europe30 is available here: Europe30.

Stellantis’s market share in Europe30 topped 17% as of fiscal year 2024, down slightly from 18.3% in 2023, according to the company’s 2024 annual report.

Since 2019, Stellantis’s market share in Europe30 has decreased from 23.1% in 2019 to 17.0% as of 2024.

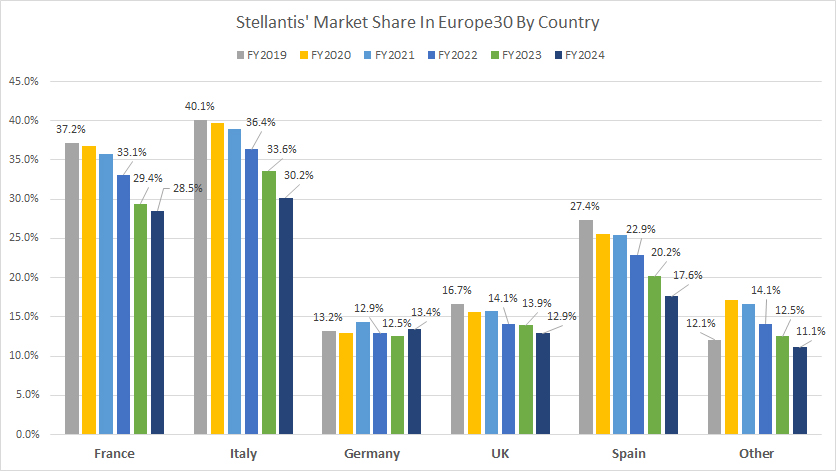

Market Share In France, Italy, Germany, UK, And Spain

Stellantis-market-share-in-Europe-30-by-country

(click image to expand)

The definition of Stellantis’ Europe30 is available here: Europe30.

Stellantis’ market share in Europe30 by country shows that its market share in Italy is among the highest for all European countries compared. In fiscal year 2024, the market share figure for Italy declined to 30% from 33.6% in 2023.

Stellantis registered a market share of 28.5% in France in 2024, the second-highest after Italy although France was the automaker’s biggest market by sales volume in Europe in the same year.

Stellantis had substantial market share in Spain, which reached nearly 18% as of 2024. On the other hand, Stellantis’ market share in Germany and the U.K. came in at 13.4% and 12.9%, respectively, in fiscal year 2024, one of the lowest among all European countries under comparison.

A key observation is Stellantis’ decreasing market share in most European countries since fiscal year 2019. For example, Stellantis’ market share in Italy has considerably decreased from 40% in 2019 to 30% as of 2024, while a similar decline is observed in France whose number has decreased from 37% to just 28.5% during the same period.

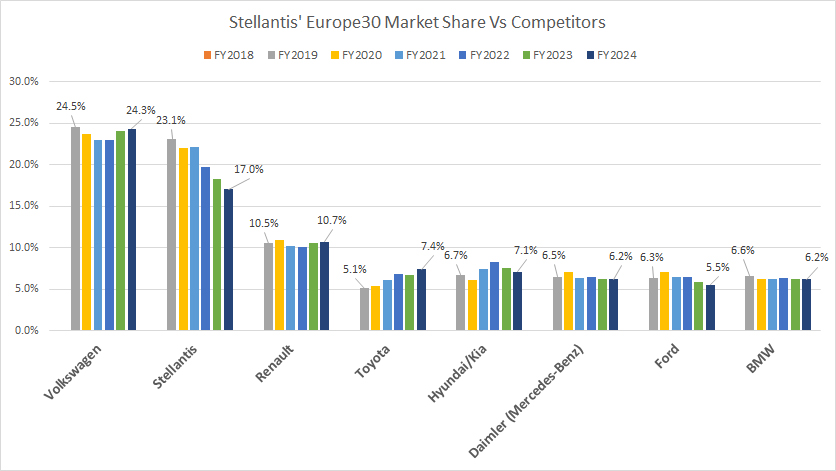

Market Share In Europe30 Vs Competitors

Stellantis-Europe-30-market-share-vs-competitors

(click image to expand)

Stellantis has become the second largest automobile company in Europe30 after the merger in 2021, only behind Volkswagen.

Compared to most competitors in Europe30, Stellantis’ market share in this region has led by a wide margin.

For example, Stellantis’ market share of 17% in 2024 was much higher than the rest of its competitors. For example, Renault, Stellantis’ next closest competitor, had a market share of 10.7% in the same year. In this context, Stellantis’ market share was nearly double Renault’s figure.

A noticeable trend is the solid market share of Hyundai/Kia and Toyota in Europe30. Their market shares have remained relatively firm in this region over the last several years.

On the other hand, Stellantis’ market share in Europe30 has significantly decreased since 2021, down from 23% in 2018 to 17% as of 2024.

Daimler ((Mercedes-Benz), Ford Motor, and BWM had market shares of 6.2%, 5.5%, and 6.2%, respectively, in Europe as of 2024. Their results were far behind Stellantis.

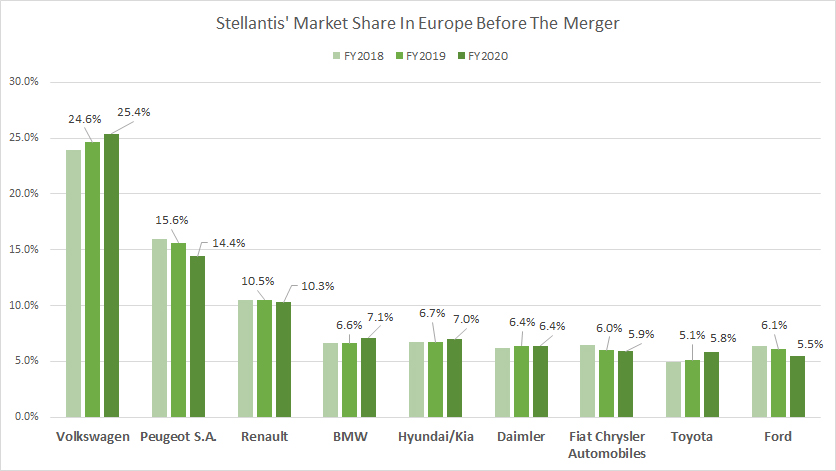

Market Share Before The Merger

Stellantis-market-share-in-Europe-before-the-merger

(click image to expand)

Before the merger of PSA Group (Peugeot S.A) and FCA (Fiat Chrysler Automobiles), Stellantis’s market share in Europe was much smaller.

For example, PSA Group had a market share of just 14.4% in 2020 in Europe, while FCA’s market share in the European region came in at only 5.9% during the same period.

Although PSA Group’s market share in Europe was nowhere near Volkswagen’s market share of 25.4%, it was second only to Volkswagen. Moreover, PSA Group was literally the second-largest automobile company by market share in Europe in that period.

On the other hand, FCA was a much smaller player in Europe as its market share in this region was only 5.9% in fiscal year 2020, the seventh largest in the European continent at that time.

Insight

Stellantis’ declining vehicle sales and market share in Europe over the years across regions and countries could reflect shifting consumer preferences, intensifying competition, or broader economic challenges.

Stellantis’ growing reliance on Germany and the UK as rising contributors in the portfolio is promising, signaling potential areas for growth and stabilization.

References and Credits

1. All financial figures presented were obtained and referenced from Stellantis’ quarterly and annual reports (Form 20-F) published on the company’s investor relations page: Stellantis Investor Relatio.

2. Pixabay images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.