Charging a Tesla Model S. Flickr Image.

One of Tesla’s revenue streams that we have often overlooked is the automotive leasing.

While automotive leasing revenue comprises only 2% of the company’s total automotive revenue, it is one of the most profitable with the highest profit margin.

Let’s take a look.

For other key statistics of Tesla, you may find more resources on these pages:

Sales

Revenue

- Tesla revenue segments and profit margin breakdown,

- Tesla revenue by country: U.S., China, Norway, Netherlands, etc.,

- Tesla revenue per employee and revenue per car

Energy

Profit Margin

- Tesla profit margin breakdown: automotive, energy, and services,

- Tesla profit per employee plunges,

- Tesla vs BYD: profit margin comparison

R&D Budget

- Tesla vs GM,

- Tesla vs Ford,

- Tesla vs Chinese EV,

- Tesla vs BYD

Debt & Cash

- Tesla financial health: debt level, payment due, and liquidity,

- Tesla cash flow and cash on hand analysis

Other Statistics

Please use the table of contents to navigate this page.

Table Of Contents

Overview And Definitions

O2. Automotive Leasing Business

O3. Leased Vehicle Deliveries

Revenue Numbers

A1. Automotive Leasing Revenue

A2. Leasing Revenue Per Car

Revenue Growth Rates

B1. YoY Growth Rates Of Automotive Leasing Revenue

Revenue Share

C1. Automotive Leasing To Total Automotive Revenue Ratio

Gross Margin

D1. Automotive Leasing Gross Margin

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Automotive Leasing Revenue: Tesla’s automotive leasing revenue refers to the amount of money earned by Tesla through its leasing program for its electric vehicles.

This revenue includes the monthly lease payments made by customers and any fees associated with the lease. Tesla offers leasing options for many models, allowing customers to drive their electric vehicles without purchasing them outright.

Leasing Revenue Per Car: Tesla’s automotive leasing revenue per vehicle is calculated as:

Automotive Leasing Revenue Per Car = Automotive Leasing Revenue / Car Deliveries Subject To Leasing

Automotive Leasing Business

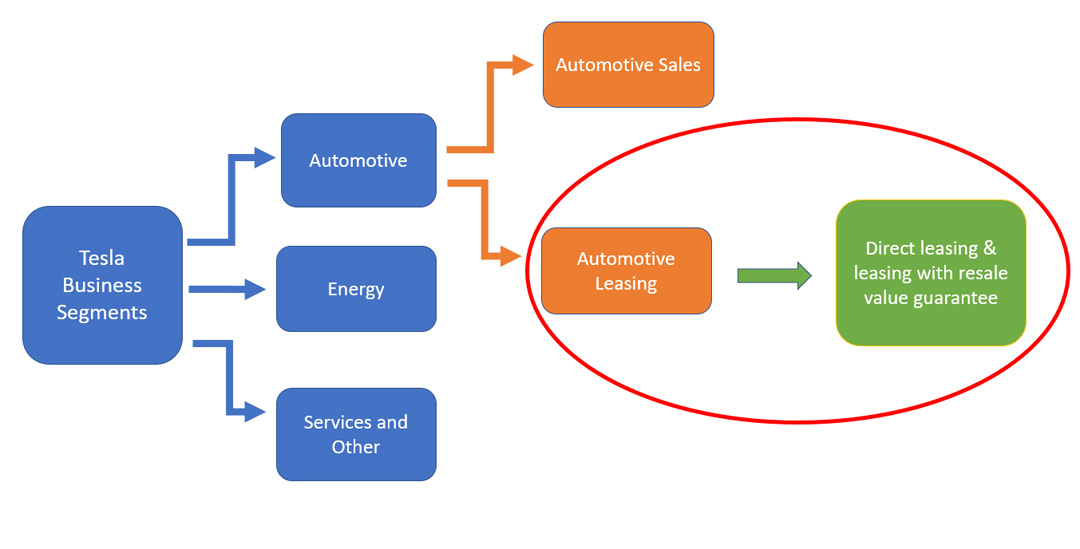

Tesla’s automotive leasing sector is clearly illustrated in the following diagram:

Tesla automotive leasing business

(click image to expand)

Tesla’s automotive leasing business falls under the automotive sector and is in the same hierarchy as the automotive sales.

Tesla’s automotive leasing gets its revenue from 2 leasing methods, and they are

(2) leasing with a resale value guarantee.

Direct leasing is where Tesla gets more of its leasing revenue.

On the other hand, leasing with a resale guarantee is similar to direct leasing but comes with a guarantee that Tesla will buy back the vehicle at the end of the leased terms.

However, the company has done less leasing with a resale value guarantee.

In addition, I believe leasing with a resale value guarantee is only available in North America.

Leased Vehicle Deliveries

Tesla deliveries attributed to leasing sales

| As at 31 Dec | |||||

|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Total Deliveries | 499,647 | 936,222 | 1,313,851 | 1,808,581 | 1,789,226 |

| Of Which Subject To Lease Accounting | 34,470 | 60,912 | 47,582 | 72,226 | 60,003 |

| % Of Leased Vehicles To Total Deliveries | 6.9% | 6.5% | 3.6% | 4.0% | 3.3% |

Since fiscal 2018, Tesla’s number of vehicles delivered subject to leasing revenue has been on the rise, growing from 34,500 units reported in 2020 to 60,000 units as of 2024, a rise of nearly 100% for the past five years.

Tesla’s leased vehicle deliveries for fiscal 2024 came in at 60,000 units, a decrease of 17% over 2023. The result made up 3% of the total vehicle sales in 2024.

Automotive Leasing Revenue

Tesla-automotive-leasing-revenue-by-year

(click image to expand)

The definition of Tesla’s automotive leasing revenue is available here: automotive leasing revenue.

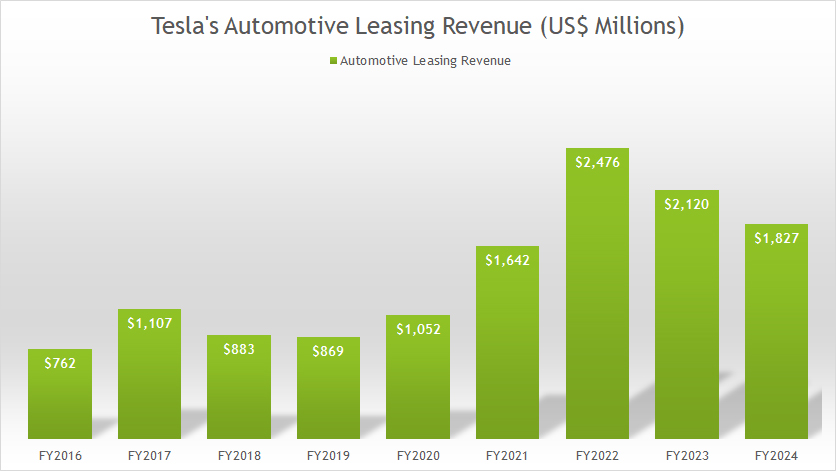

Tesla generated $1.8 billion in automotive leasing revenue during fiscal year 2024, representing a decline of approximately 14% from the $2.1 billion reported in fiscal year 2023. This reduction highlights a continued downward trend in leasing revenue for the company.

Tesla’s automotive leasing revenue reached its peak at $2.5 billion in fiscal year 2022. However, since that peak, the segment has experienced a steady decline.

From 2022 to 2024, Tesla’s leasing revenue has decreased by 28%, indicating potential challenges in sustaining growth within the vehicle leasing business.

Leasing Revenue Per Car

Tesla-leasing-revenue-per-car

(click image to expand)

The definition of Tesla’s automotive leasing revenue per car is available here: leasing revenue per vehicle.

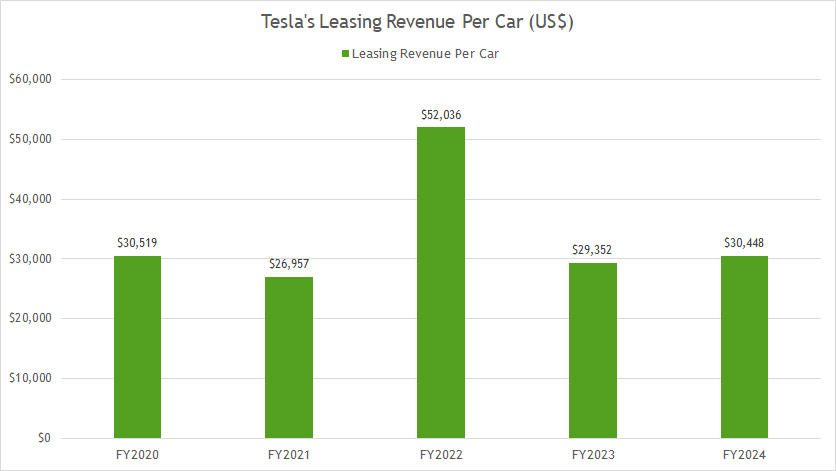

Tesla made about $30,500 in leasing revenue per vehicle in fiscal year 2024, roughly inline with the figure measured a year ago. This figure peaked at $52,000 in fiscal year 2022.

On average, Tesla’s automotive leasing revenue per car amounted to $37,000 for the previous three fiscal years.

YoY Growth Rates Of Automotive Leasing Revenue

Tesla’s automotive leasing revenue YoY growth rates

(click image to expand)

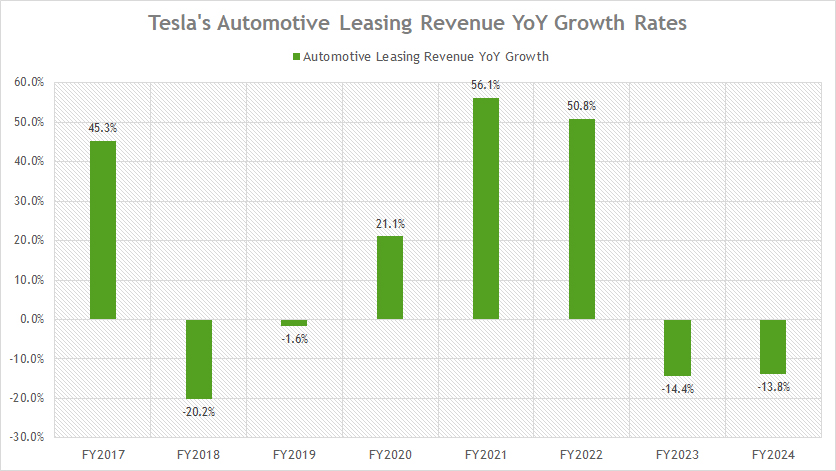

Tesla’s automotive leasing revenue has faced consecutive year-over-year (YoY) declines for two years, with a notable reduction of 14% in fiscal year 2023, followed by an identical 14% decrease in fiscal year 2024. This downward trend highlights ongoing challenges in sustaining growth in this segment.

Looking back, Tesla’s YoY growth rates in automotive leasing revenue reached a peak of 56% in fiscal year 2021, representing a period of exceptional growth fueled by increasing consumer interest and market expansion.

Since then, the segment has entered a phase of decline, reflecting shifting dynamics within the automotive leasing market and Tesla’s broader business strategy.

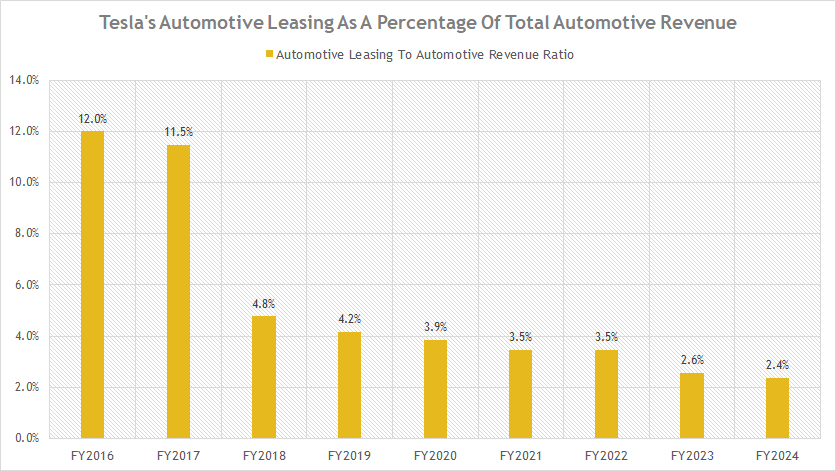

Automotive Leasing To Total Automotive Revenue Ratio

Tesla-automotive-leasing-revenue-to-automotive-revenue-ratio

(click image to expand)

Within Tesla’s automotive segment, automotive leasing revenue accounted for approximately 2.4% of the total automotive revenue in fiscal year 2024.

This represents a significant decline from 2016, when leasing revenue constituted over 12% of the segment’s total income. The consistent reduction in this ratio over the years reflects the diminishing importance of Tesla’s leasing business within its broader automotive operations.

This trend highlights the strategic shift in Tesla’s focus toward direct vehicle sales and other high-growth areas, including energy products and autonomous driving technologies.

Tesla’s leasing business, while still contributing to revenue, now plays a relatively minor role in the company’s overall financial performance.

However, this decline may not necessarily indicate weakness; rather, it underscores Tesla’s ability to adapt to market dynamics and allocate resources to more lucrative and strategically aligned segments.

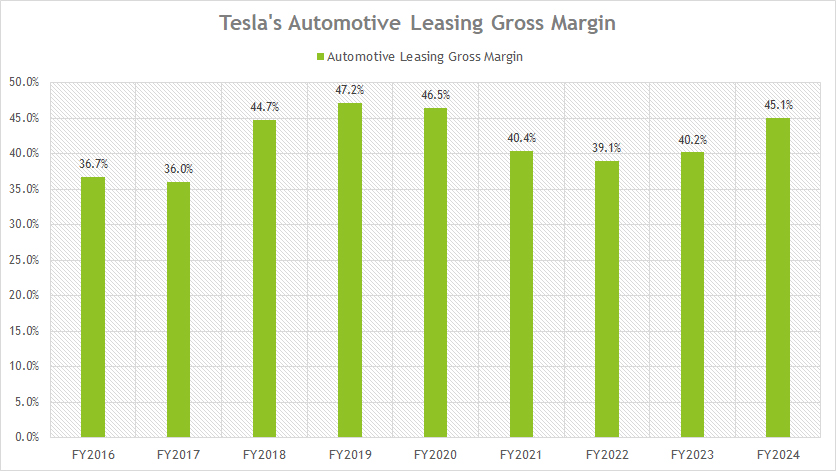

Automotive Leasing Gross Margin

Tesla’s automotive leasing gross margin

(click image to expand)

Tesla’s automotive leasing gross margin rose to 45% by the end of fiscal year 2024, reflecting a modest improvement from the 40% reported in fiscal year 2023. This performance underscores the segment’s strong profitability, which remains one of the highest among all of Tesla’s operational segments.

Tesla has consistently achieved a gross margin exceeding 40% in its automotive leasing business, demonstrating the operational efficiency and favorable cost structure of this revenue stream.

The consistent high profitability is likely driven by factors such as effective pricing strategies, relatively lower variable costs, and strong residual values of Tesla vehicles, which enhance the appeal of leasing options.

Despite contributing a smaller proportion to Tesla’s total automotive revenue, the leasing business stands out as a lucrative segment with stable returns.

This high gross margin reflects the segment’s strategic significance, even as Tesla increasingly focuses on direct vehicle sales, energy solutions, and autonomous driving technologies.

It also suggests that the leasing business plays a valuable role in enhancing overall profitability, even amid shifts in the company’s broader financial priorities.

Insight

Tesla’s automotive leasing business, though a smaller component of its overall automotive segment, stands out for its exceptional profitability and consistent gross margins.

Despite contributing only 2.4% of the company’s total automotive revenue in fiscal year 2024, it remains one of Tesla’s most lucrative operations, with gross margins exceeding 40% annually, peaking at 45% in 2024.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s quarterly and annual reports published on the company’s investor relations page: Tesla SEC Filings.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.