Financial District, Singapore. Flickr Image.

Twitter is one of the leading social media companies in the world.

The company completed its IPO or initial public offering in November 2013 and it is currently listed on the New York Stock Exchange under the symbol TWTR.

Therefore, Twitter has gone public for nearly 8 years.

However, the company has never declared or paid any cash dividends on its common stocks for the 8 years that the company has gone public.

The following excerpt extracted from the 2020 annual report shows what Twitter has said regarding its dividend policy:

-

Dividend Policy

We have never declared or paid any cash dividends on our capital stock. We intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future.Any future determination to declare cash dividends will be made at the discretion of our board of directors, subject to applicable laws, and will depend on a number of factors, including our financial condition, results of operations, capital requirements, contractual restrictions, general business conditions and other factors that our board of directors may deem relevant.

In addition, the credit facility contains restrictions on payments including cash payments of dividends.

Therefore, Twitter is a non-dividend-paying company and does not have a history of paying any cash dividends in the past.

Twitter’s shareholders who hold the company’s common stocks can only gain from the price appreciation of the stocks.

While Twitter is currently not paying any dividends on its common stocks, this does not rule out the possibility of the company paying out a dividend in the future.

For one, Twitter is not only a profitable company but its profits are growing too.

Additionally, the company has been having positive operating cash flow and free cash flow is also on the rise.

By the end of fiscal 2021, Twitter is expected to generate more than $1 billion of net cash from operations.

Therefore, Twitter definitely has the ability and can afford to pay out a dividend if it decided to do so.

In this article, we are going to explore whether Twitter can afford to pay out a dividend that yields 1% for a stock price of $60 USD per share for fiscal 2021.

Let’s take the ride!

Twitter’s Cash Dividend Topics

1. Estimated Dividend Payout

2. Earnings Growth

3. Projected Operating Cash Flow

4. Projected Free Cash Flow

5. Dividend Payout Ratio For 1% Yield

6. Dividend Payout Ratio For 0.5% Yield

7. Conclusion

Twitter’s Estimated Dividend Payout

Twitter’s estimated dividend payout

Twitter’s stock price has been trading between $50 and $80 USD per share in the last few months.

To simplify things, we will take a share price of $60 to calculate a dividend that yields 1%.

Therefore, for a 1% dividend yield, Twitter’s estimated cash dividend per share will come to $0.60 USD per share.

This figure is only the amount for 1 common stock.

To calculate how much cash Twitter is required to pay, we need to take the dividend per share and multiply it by the total shares outstanding.

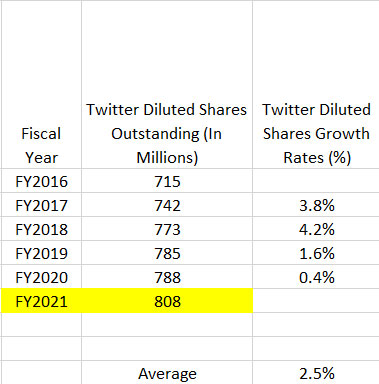

By the end of fiscal 2021, Twitter is estimated to have more than 800 million common stocks outstanding as shown in the following table.

Twitter’s estimated shares outstanding

In the last 5 years, Twitter’s common stock outstanding has been growing at a growth rate of about 2.5% per year.

Per the figures shown in the table above, Twitter is estimated to have a common stock outstanding totaling 808 million by the end of fiscal 2021.

With regard to the cash dividend, Twitter’s cash payout will total around $485 million (808 million X $0.60 USD per share).

This is the estimated total cash dividends that Twitter will pay to shareholders for all of the common stocks outstanding.

Twitter’s Earnings Growth

Twitter’s projected earnings per share from Yahoo Finance

Can Twitter pay out as much as $485 million as cash dividends?

This question boils down to Twitter’s estimated earnings for fiscal 2021.

To find out what the estimated earnings are like for Twitter, we go to Yahoo Finance which is shown in the snapshot above.

According to Yahoo Finance, Twitter is expected to earn an average of $0.79 USD per share in fiscal 2021 based on the estimates of 29 analysts.

Keep in mind that this earnings figure actually refers to the non-GAAP earnings per share.

All told, we can calculate Twitter’s non-GAAP net income by multiplying the non-GAAP earnings per share figure by the estimated total shares outstanding.

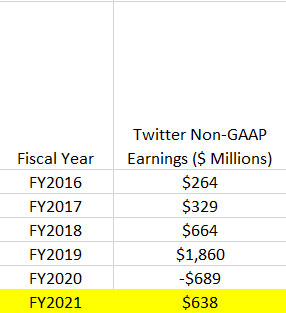

Twitter’s estimated earnings for fiscal 2021

Twitter’s estimated non-GAAP net income for fiscal 2021 will come to about $638 million (808 million X $0.79 USD per share) as shown in the table above.

Twitter’s Projected Operating Cash Flow

Twitter’s projected operating cash flow for fiscal 2021

Since dividends are paid out of cash, it is necessary to figure out what Twitter’s free cash flow is like for fiscal 2021.

To estimate Twitter’s free cash flow, we start from the company’s operating cash flow.

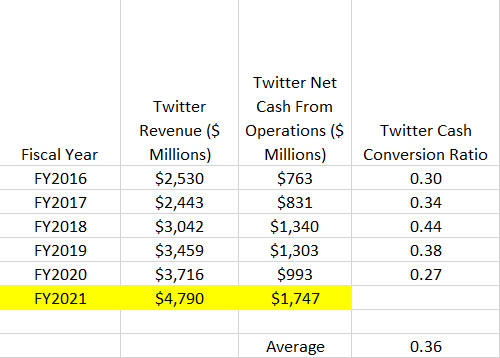

The table above shows the cash conversion ratio for Twitter between fiscal 2016 and fiscal 2020.

The cash conversion ratio shows the relationship between net cash from operations and revenue.

It gives an estimate of how much cash is retained from sales.

In Twitter’s case, its cash conversion ratio averaged around 0.36X for the last 5 years.

Therefore, applying the same cash conversion ratio for fiscal 2021, Twitter’s net cash from operations is estimated to arrive at $1.7 billion as shown in the table above.

Keep in mind that the revenue of $4.79 billion for fiscal 2021 is an average estimate that came from 37 analysts according to Yahoo Finance.

Twitter’s projected revenue from Yahoo Finance

At this figure, Twitter’s net cash from operations for fiscal 2021 will nearly double the amount reported in fiscal 2020.

Twitter’s Projected Free Cash Flow

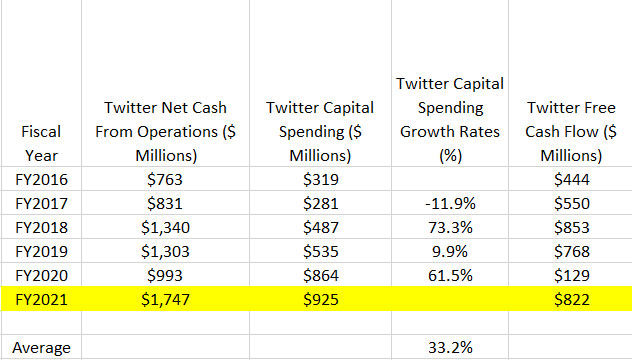

Twitter’s projected free cash flow for fiscal 2021

As mentioned, dividends are paid out of cash.

While dividends can be paid out of net cash from operations, it is the free cash flow that actually matters.

Free cash flow is the cash left from operations after accounting for capital spending.

As shown in the table above, Twitter’s free cash flow for fiscal 2021 is projected to arrive at more than $800 million.

This figure is calculated based on Twitter’s own capital spending projection for fiscal 2021.

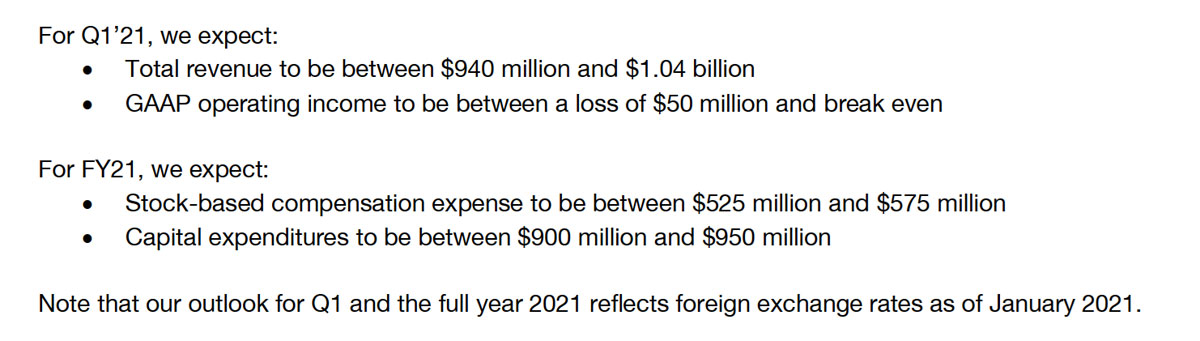

Twitter’s projected capital spending for fiscal 2021

As shown in the snapshot above, Twitter projected its capital expenditures to be between $900 and $950 million for fiscal 2021.

Taking the middle between the two figures, Twitter’s capital expenditures are estimated to be $925 million for fiscal 2021.

With the capital spending estimate available, Twitter’s free cash flow is projected to be $822 million for fiscal 2021.

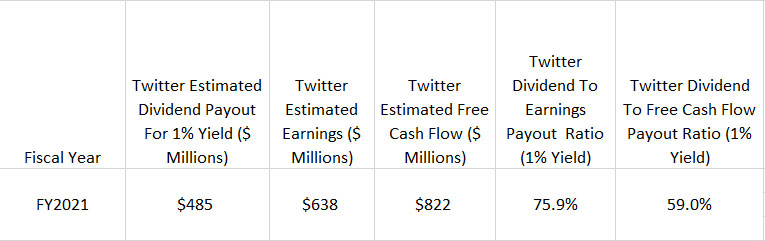

Twitter’s Dividend Payout Ratio For 1% Yield

Twitter’s estimated dividend payout ratio for 1% yield

Once the earnings and free cash flow estimates are available, we can calculate the dividend payout ratio with respect to these metrics.

As shown in the table above, Twitter’s dividend-to-earnings payout ratio comes to about 76% for a 1% dividend yield based on a $60 USD per share stock price.

Similarly, Twitter’s dividend-to-free-cash-flow payout ratio comes to about 60% for the same dividend payout.

At these levels of payout ratio, Twitter will be hard-pressed to pay out this much of cash dividends that will consume up to 76% of earnings and 60% of free cash flow in fiscal 2021.

While Twitter has sufficient earnings and free cash flow to cover the said dividend, the company will be left with only a small amount of cash for fiscal 2022.

Keep in mind that the free cash flow has yet to account for other investments, including debt repayments, business acquisition, purchases of intangible assets, etc.

These steps might be optional but they are critical for the future success of the company.

Also, Twitter carried quite a significant amount of debt and was the second most leveraged social media company in fiscal 2020 according to this article: Twitter’s Debt And Cash Comparison With Peers.

In short, Twitter needs the cash to repay the debt outstanding and for investment for future growth.

As such, Twitter will probably be reluctant to return this huge amount of capital to shareholders.

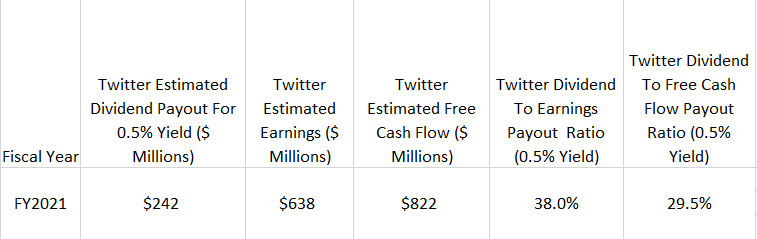

Twitter’s Dividend Payout Ratio For 0.5% Yield

Twitter’s estimated dividend payout ratio for 0.5% yield

So what would be a comfortable amount for Twitter to initiate a cash dividend?

My best guess would be a 0.5% dividend yield based on a stock price of $60 USD per share.

According to the table above, Twitter will be paying just $242 million as cash dividend for a 0.5% dividend yield.

At this amount of cash dividend, Twitter’s payout ratio will amount to only 38% and 30% with respect to earnings and free cash flow, respectively.

These levels of payout ratio are reasonably low and eat up only a small amount of earnings as well as free cash flow for Twitter.

Besides, Twitter also will be left with plenty of cash that can be used for other purposes.

I think this is a win-win situation for both shareholders and the company if Twitter were to initiate a cash dividend payout.

Conclusion

While Twitter certainly can afford a cash dividend that yields 1%, the company will be left with nothing after returning such massive capital to shareholders.

This is so because the dividend will consume up to 76% and 60% of Twitter’s earnings and free cash flow.

Since Twitter is a growing company and still a relatively young player in the social media space, the company needs to retain the majority of cash for investments to remain competitive.

These investments can range from buying up companies to intangible asset acquisitions that may provide future success for Twitter.

Additionally, Twitter has got a huge debt outstanding to be paid back.

Therefore, a more reasonable figure for Twitter’s cash dividend will be $242 million that yields 0.5% based on a stock price of $60.

At this amount of cash dividend, Twitter’s estimated dividend to earnings and free cash flow payout ratio will come to only 38% and 30%, respectively, a much reasonable figure.

Twitter can definitely afford such a dividend payout and still be left with plenty of cash.

References and Credits

1. Twitter’s financial figures were obtained and referenced from the respective financial statements which can be obtained from the following links:

a) Twitter Investor Relations

b) Yahoo Finance

2. Featured images in this article are used under creative commons license and sourced from the following websites: Thick as Thieves and Financial district, Singapore.

Other Statistics That May Help You

Disclosure

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.