Tesla battery. Source: Flickr Image.

This article covers Tesla’s energy segment revenue, profit, and margins.

Tesla’s energy segment holds the potential to surpass its automotive segment in the future, driven by significant advancements and growing demand for sustainable energy solutions.

Tesla envisions a future where its entire network of supercharger stations will be fully powered by solar energy generation and storage systems.

Achieving this goal would significantly reduce the company’s carbon footprint and further its mission of promoting sustainable energy solutions.

You may find other related statistic of Tesla on these pages:

Sales

Revenue

Energy

Profit Margin

- Gross profit breakdown: automotive, energy, and services,

- Profit margin by segment: automotive, energy, and services,

- Gross profit and gross margin per car,

- Profit per employee,

R&D Comparison

Debt, Cash, and Liquidity

- Financial health: debt level, payment due, and liquidity,

- Cash flow and cash on hand analysis,

- Debt to equity, capital structure, and more,

- Liquidity check: current ratio, working capital, and quick ratio,

Comparison With Peers

- Marketing, advertising, and promotional spending,

- Tesla vs GM: profit margin comparison,

- Tesla vs Ford: vehicle profit and margin,

- Tesla vs BYD: profit margin comparison,

Other Statistics

- Interest expense and interest coverage ratio,

- Infrastructure expansion: supercharger stations, service fleets, and stores,

- Operating expenses breakdown analysis,

- Inventory breakdown analysis

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Tesla Energy Business Strategy

O3. How Does Tesla Energy Make Money

Insight & Summary of Observed Trends

Z1. Insight & Summary of Tesla’s Energy Revenue, Gross Margin, and Growth Rates

Energy Revenue Statistics

A1. Energy Generation And Storage Revenue

A2. Energy To Total Revenue Ratio

A3. YoY Growth Rates Of Energy Revenue

A4. Energy Revenue Gross Profit

A5. Energy Revenue Gross Margin

Reference, Credits, and Disclosure

S1. References and Credits

S2. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Power Purchase Agreement: A power purchase agreement (PPA) is a legal contract between an electricity generator and a buyer, typically a utility or a corporation.

In this agreement, the generator agrees to sell a certain amount of electricity at a pre-determined price over a specified period. PPAs are commonly used in the renewable energy industry to facilitate the financing and development of new renewable energy projects.

Tesla Energy Business Strategy

Tesla’s energy business strategy encompasses several key components aimed at reinventing and leading the global shift towards sustainable energy. The strategy can be dissected into the following critical aspects:

-

Integration of Energy Solutions: Tesla is not just an electric vehicle (EV) manufacturer; it’s also focused on creating a fully integrated clean energy ecosystem. This includes solar energy products, like solar panels and solar roofs, as well as energy storage solutions, such as the Powerwall, Powerpack, and Megapack. By offering a comprehensive range of products, Tesla aims to enable homes, businesses, and utilities to generate, store, and manage renewable energy efficiently.

-

Innovation in Energy Storage: A cornerstone of Tesla’s energy strategy is its emphasis on advanced battery technology. The company continuously innovates in this area, aiming to reduce energy storage costs and increase its batteries’ efficiency and reliability. This is crucial for the viability of renewable energy, as it addresses the issue of intermittency by storing excess energy generated during peak conditions for use when generation is low.

-

Scaling Production: Tesla’s Gigafactories are central to its strategy, enabling the mass production of batteries and electric vehicles. By scaling up production, Tesla aims to drive down costs through economies of scale, making sustainable energy products more affordable and accessible to a broader market.

-

Synergy Between Electric Vehicles and Energy Products: Tesla’s energy strategy is closely tied to its electric vehicle business. The company envisions a future where homes and businesses generate their own clean energy, store it, and use it to power their everyday needs and their Tesla vehicles. This holistic approach encourages the adoption of both EVs and renewable energy products.

-

Deployment of Software and Services: Beyond hardware, Tesla is leveraging software to enhance the value of its energy products. This includes smart management systems that optimize energy use and storage based on real-time data and user preferences. Additionally, Tesla aims to create a virtual power plant by linking distributed energy resources to provide grid services, further stabilizing the grid and reducing the need for fossil fuel-based peak power plants.

-

Market Expansion and Policy Advocacy: Tesla is actively working to expand into new markets around the world while also engaging in policy advocacy to support the transition to renewable energy. The company recognizes the importance of favorable regulations and incentives in accelerating the adoption of sustainable energy solutions.

In summary, Tesla’s energy business strategy is multifaceted, aiming to lead in the transition to sustainable transportation and fundamentally change how energy is generated, stored, and consumed. Tesla seeks to drive the world toward a cleaner, more sustainable energy future through innovation, integration, and advocacy.

How Does Tesla Energy Make Money

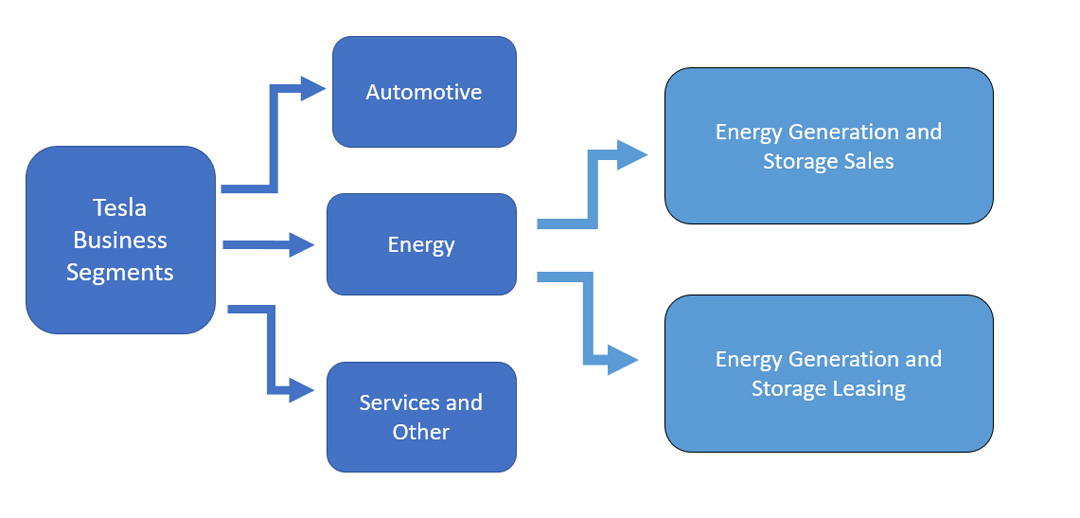

Tesla energy

(click image to expand)

Tesla’s energy gets its revenue primarily from two sources:

- 1. Energy generation and storage sales

- 2. Energy generation and storage leasing

Tesla’s energy generation and storage sales revenue is derived from sales of solar energy systems and energy storage products to residential, small commercial, and large commercial and utility grade customers.

On the other hand, Tesla’s energy generation and storage leasing revenue is derived from leasing solar energy systems and electricity to commercial and retail customers.

In the case of leasing, Tesla is the lessor who owns the assets, while its customers are the lessees.

Apart from leasing the entire solar energy generation systems, Tesla also leases electricity to retail and commercial customers under a power purchase agreement (PPA).

Tesla earns recurring income from customers leasing electricity under a power purchase arrangement.

Insight & Summary of Tesla’s Energy Revenue, Gross Margin, and Growth Rates

The following analysis consolidates the trends observed for Tesla’s energy revenue, gross margin, and YoY growth rates for the 2016–2025 period.

-

Tesla’s Energy Generation and Storage segment has fundamentally transformed from a volatile, supplementary business line into a substantial, highly profitable pillar of the company’s overall ecosystem.

-

While its early years (2016–2021) were characterized by fluctuating profitability — even dipping to a negative 4.6% gross margin in 2021 —the segment hit a massive inflection point starting in 2022.

-

During the latest three-year window, revenue scaled exponentially, driven by blistering year-over-year growth that averaged nearly 49.4%. As a result, the segment’s strategic footprint expanded significantly, accounting for 13.5% of Tesla’s total top-line revenue by 2025.

-

Most notably, this aggressive scaling unlocked tremendous operating leverage; gross profit skyrocketed alongside a rapidly expanding gross margin, which peaked at a highly lucrative 29.8% in 2025, effectively offsetting some of the recent margin compression observed in the core automotive business.

The table below combines all key revenue metrics, gross margin, and growth rates into a single view for the latest three fiscal years.

Consolidated Energy Revenue Metrics 3-Year Averages (2023–2025)

| Metric | 3-Year Avg. Value |

|---|---|

| Energy Generation and Storage Revenue ($ Millions) | $9,630.67 |

| Energy To Total Revenue Ratio (%) | 10.00% |

| Energy Revenue YoY Growth Rates (%) | 49.37% |

| Energy Revenue Gross Profit ($ Millions) | $2,527.67 |

| Energy Revenue Gross Margin (%) | 24.97% |

Energy Generation And Storage Revenue

Tesla’s energy generation and storage revenue reached an unprecedented $12.8 billion in fiscal year 2025, setting a new all-time high. This remarkable figure represents a 27% increase from the $10 billion recorded in fiscal year 2024.

Energy Generation and Storage Revenue ($M) – 3-Year Avg.

| Metric | 3-Year Avg. Value |

|---|---|

| Energy Generation and Storage Revenue | $9,630.67 |

Energy to Total Revenue Ratio

Over the past several years, Tesla’s energy revenue has increasingly contributed a significant portion of the company’s total revenue, as depicted in the graph above.

Energy To Total Revenue Ratio (%) – 3-Year Avg.

| Metric | 3-Year Avg. Value |

|---|---|

| Energy To Total Revenue Ratio | 10.00% |

YoY Growth Rates Of Energy Revenue

Tesla has consistently maintained steady growth in its energy revenue over the past eight years since fiscal year 2018, as illustrated in the chart above. The company has hardly recorded any dips in this segment, showcasing its resilience and strategic focus on expanding its energy solutions.

Energy Revenue YoY Growth Rates (%) – 3-Year Avg.

| Metric | 3-Year Avg. Value |

|---|---|

| Energy Revenue YoY Growth Rates | 49.37% |

Energy Revenue Gross Profit

In fiscal year 2025, Tesla achieved a record gross profit of $3.8 billion from its energy segment, marking a substantial increase from the $2.6 billion recorded in fiscal year 2024. This remarkable growth underscores the successful expansion and profitability of Tesla’s energy business.

Energy Revenue Gross Profit ($M) – 3-Year Avg.

| Metric | 3-Year Avg. Value |

|---|---|

| Energy Revenue Gross Profit | $2,527.67 |

Energy Revenue Gross Margin

Tesla’s energy gross margin has shown remarkable improvement over the past several years, reaching an all-time high of 30% in fiscal year 2025. This milestone marks a significant achievement for the company, reflecting its growing efficiency and profitability in the energy segment.

Energy Revenue Gross Margin (%) – 3-Year Avg.

| Metric | 3-Year Avg. Value |

|---|---|

| Energy Revenue Gross Margin | 24.97% |

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s annual reports published on the company’s investor relations page: Tesla Update Letters and Presentations.

2. Flickr Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.