Tesla Motors in Menlo Park. Source: Flickr

This article presents Tesla’s gross profit per car and gross margin per car.

For other key statistics of Tesla, you may find more resources on these pages:

Sales

Revenue

Energy

Profit Margin

R&D Comparison

Debt, Cash, and Liquidity

- Financial health: debt level, payment due, and liquidity,

- Cash flow and cash on hand analysis,

- Debt Ratios: debt to equity, capital structure, and more,

- Liquidity check: current ratio, working capital, and quick ratio,

Comparison With Peers

- Marketing, advertising, and promotional spending,

- Tesla vs GM: profit margin comparison,

- Tesla vs Ford: vehicle profit and margin,

- Tesla vs BYD: profit margin comparison,

Other Statistics

- Interest expense and interest coverage ratio,

- Infrastructure expansion: supercharger stations, service fleets, and stores,

- Operating expenses breakdown analysis,

- Inventory breakdown analysis

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Automotive Profit

Profit Per Car

Margin Per Car

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Automotive Gross Profit: Tesla’s automotive gross profit is defined as automotive sales revenue, excluding automotive leasing and regulatory credits revenue, minus automotive cost of revenue.

Here is the formula:

Automotive Gross Profit = Automotive Sales Revenue (Excluding Automotive Leasing And Regulatory Credits Revenue ) – Automotive Cost Of Revenue

Gross Profit Per Car Calculation: Tesla’s gross profit per car is defined as the automotive gross profit, which we saw earlier, divided by the number of vehicle deliveries, excluding vehicles subject to operating lease.

Here is the formula:

Gross Profit Per Car = Automotive Gross Profit / Total Number Of Vehicle Deliveries Not Subject To Operating Lease

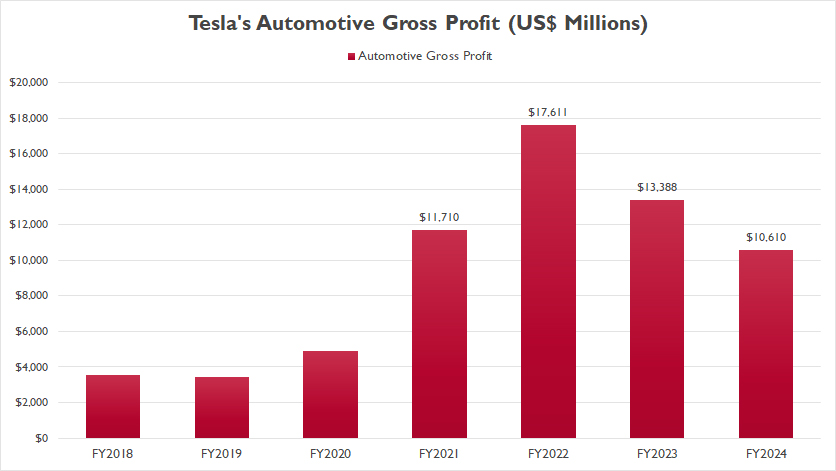

Automotive Gross Profit

tesla-automotive-gross-profit

(click image to expand)

The formula for calulating Tesla’s automotive gross profit is available here: automotive gross profit.

Tesla’s automotive gross profit represents only the gross profit generated from sale of vehicles, excluding other business segments such as vehicle leasing, energy, and services.

That said, In fiscal year 2024, Tesla reported an automotive gross profit of $10.6 billion, following $13.4 billion in fiscal year 2023 and a peak of $17.6 billion in fiscal year 2022.

Since fiscal year 2018, this figure has grown significantly, rising from less than $4 billion to its latest result of $10.6 billion, showcasing Tesla’s ability to scale production and enhance profitability despite recent fluctuations.

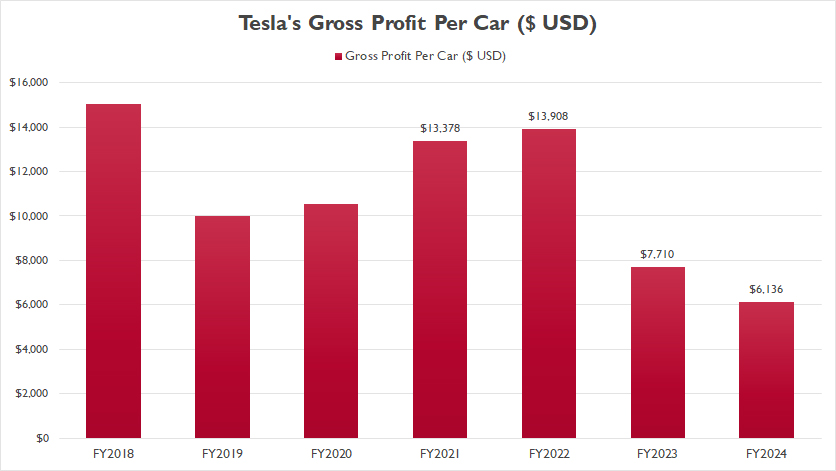

Gross Profit Per Car

tesla-profit-per-car

(click image to expand)

The formula for calulating Tesla’s gross profit per car is available here: gross profit per car.

I have to restate again that the gross profit per vehicle calculated here comes from only automotive sales, excluding leasing, regulatory credits, services, and energy.

Tesla’s gross profit per vehicle fell sharply to $6,100 in fiscal year 2024, marking a substantial decline from its peak of $13,900 in fiscal year 2022 — a drop of more than 50% over two years.

Before 2023, Tesla’s gross profit per car had been on a steady upward trajectory, fueled by consistent growth in its automotive gross profit.

However, following its peak in 2022, the figure began to decline, largely reflecting the broader downturn in Tesla’s automotive gross profit, as previously discussed.

Despite the decrease, Tesla’s gross profit per car averaged $9,250 between fiscal years 2022 and 2024.

While lower than previous highs, this still represents a significant profitability level, with the company generating over $9,000 in gross profit per vehicle.

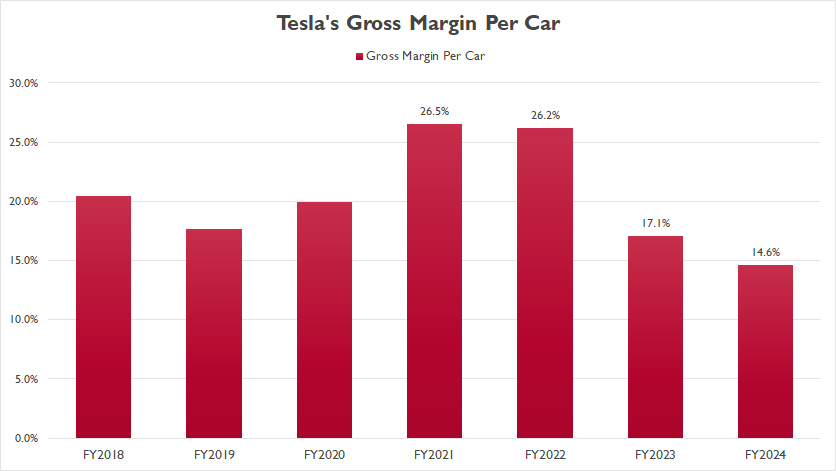

Gross Margin Per Car

tesla-gross-margin-per-car

(click image to expand)

The formula for calulating Tesla’s gross profit per car is available here: gross profit per car.

I have to restate again that the gross margin per vehicle calculated here comes from only automotive sales, excluding leasing, regulatory credits, services, and energy.

Tesla’s gross margin per vehicle peaked at 26.5% in 2021 before plunging to 14.6% in 2024, reflecting a significant decline.

Over the period from 2022 to 2024, the average gross margin per car was 19%, highlighting the shift in profitability dynamics within Tesla’s automotive business.

Insight

Several factors have contributed to these declining profitability trends. Increased raw material costs, aggressive vehicle pricing adjustments, and heightened competition in the EV market have likely impacted Tesla’s ability to maintain higher margins.

Additionally, the scaling of new Gigafactories and investments in emerging technologies introduced temporary cost pressures before achieving full operational efficiency.

Despite these challenges, Tesla continues to generate substantial profit from the automotive segment, and its ability to balance innovation and cost efficiency will play a crucial role in shaping its future profitability.

References and Credits

1. All financial figures presented were obtained and referenced from the company’s quarterly and annual reports published on the company’s investor relations page: Tesla Annual and Quarterly Results.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.

Great write up. Why not also discuss the gains from bitcoin sales and ev-credits? That would help address all the nay-sayers and negative articles claiming that Tesla loses money on every car they sell. thanks!