Automotive Products

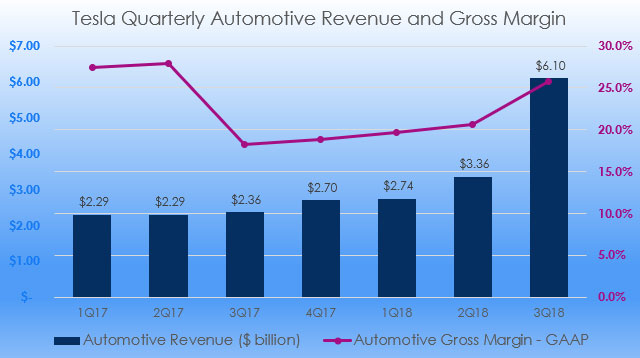

Tesla 3Q 2018 Automotive Revenue and Gross Margin

- In Q3 2018, Tesla did not disclose the exact vehicle production units in the 3Q18 quarterly report. The only number that the company provided was an average of 4,300 Model 3 per week. Based on this number, we can estimate the total production units for Model 3 in 3Q18. There were 13 weeks in 3Q18. Therefore, total production units for Model 3 was 4,300 x 13 = 55,900 units of Model 3.

- Based on the 2Q18 quarterly result, the average vehicles produced per week for Model S and Model X was 2,000 units. Assuming the same number was produced in 3Q18, total production units for Model S and Mode X combined was 2,000 x 13 = 26,000 units.

- Based on the above numbers, we can roughly estimate that the total productions units for all vehicles in third quarter 2018 was 55,900 + 26,000 = 81,900 units.

- In the same quarter, total vehicle deliveries were 83,000 units in which 27,710 deliveries were made up by Model S and Model X and 56,000 deliveries were that of Model 3. This delivery result was a quarterly record for Tesla.

- Total vehicle deliveries in US alone was as many as 70,000 in 3Q18. Even though only Model 3, Model S and Model X were sold in US, the deliveries were on par with those of premium competitors which have far more models and a vast network of dealerships.

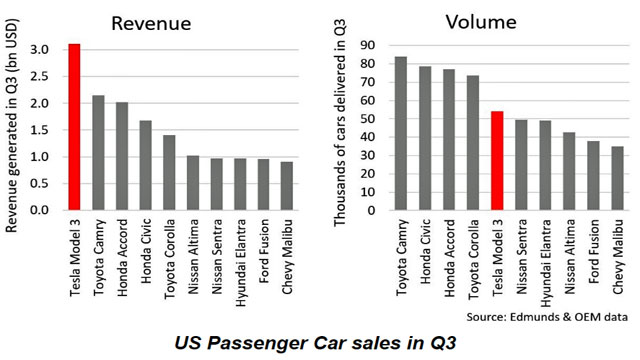

- Tesla has achieved a historic quarter in Q3 2018 as Model 3 was the best-selling car in the US in terms of revenue and the 5th best-selling car in terms of volume.

- The average weekly production of 4300 units of Model 3 vehicles has led Tesla to achieve profitability with a GAAP net income of $312 million. In addition, cash reserved had increased by $731 million with free cash flow (operating cash minus capital expenditure) of $881 million.

- Tesla started the quarter with production of Rear-Wheel Drive (RWD) version of Model 3 and ended the quarter with full production of All-Wheel Drive (AWD) version of Model 3. AWD vehicles are more complex to build but Tesla managed to produce 5,300 Model 3 in the last week of Q3.

- Since both the demand and production of Model 3 has ramped in 3Q18, vehicle delivery has posed a challenge in this quarter. To solve the logistic challenge, Tesla has expanded direct deliveries where employees are delivering cars to wherever customers have requested.

- At the end of 3Q18, Tesla inventory is at the lowest level compared to that of automotive industry and its own level when measured in terms of days of sales.

- Tesla believes that the total market potential for Model 3 is larger than just the premium sedan market as more than half of the trade-in vehicles for Model 3 were priced below $35,000 when new. The market potential for Model 3 is huge as customers are trading up their relatively cheaper vehicles for Model 3 even though Model 3 is not yet available for leasing and the 3Q18 starting price tag is $49,000.

- Tesla’s goal is to bring the cost down to $35,000 for Model 3 and had recently introduced a cheaper version of Model 3 which is priced around $46,000 with a medium range of 260 mile.

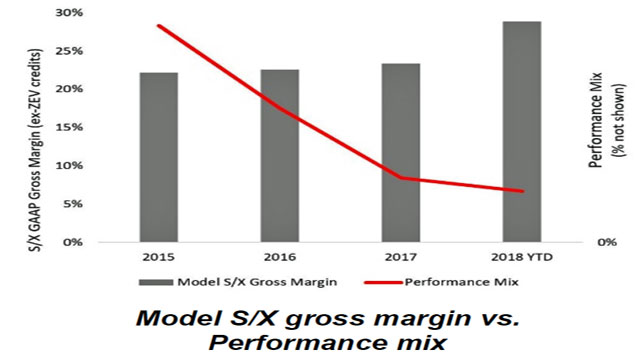

- As Tesla is gradually introducing lower priced Model 3 variants, the company does not expect a lower average selling price to affect profitability. Based on the data for Model S and Model X, the performance has declined over 4-fold since 2015 and yet the gross margin for these models continue to improve by roughly 6%.

- Margin improvement was achieved from cost improvement driven by lowering labor hours per vehicles, reduced cost of raw materials and various other cost efficiency.

- Tesla plans to introduce the Model 3 to the European market in 2019 in view of the size of the mid-sized premium sedan market in Europe is twice as big as the same segment in the US.

- To target the Chinese market, Tesla will accelerate its manufacturing timeline in hope of bringing a portion of Model 3 production to China in 2019. Demand in China remains a challenge due to the 40% import duty for Model S and X. Tesla offset the drop in China demand with growth in North America and Europe.

- Model 3 received a 5-star rating from NHTSA in every category and sub-category as the electric vehicle are designed from the ground up and this has made the vehicle structurally safer than equivalent combustion engine vehicles.

- In addition, Model 3 is the most efficient of any electric vehicles ever produced on earth. The rating for Model 3 by the Environmental Protection Agency (EPA) is 4.1 miles per kWh. Besides being energy efficient, Model 3 is superior in terms of performance where it can achieve an acceleration from 0-60mph in just 3.3 seconds and a top speed of 155mph.

- In 3Q18, 4 new stores and service locations were opened, resulting in 351 locations worldwide at the end of the quarter.

- Mobile Service fleet was expanded to 373 vehicles at the end of the quarter. In addition, 44 new Supercharger stations were open in the same quarter, resulting in 1,352 stations worldwide.

- In view of the complexity of body repairs for its electric vehicles, the company has opened its own several body shops in the highest density areas and is planning to open more stores in the future.

Passenger car sales in US. . Source: Tesla 3Q18 Update Letter

Tesla 3Q18 Days of Sales. Source: Tesla 3Q18 Update Letter

Tesla Model S and Model X Gross Margin. Source: Tesla 3Q18 Update Letter

Energy Products

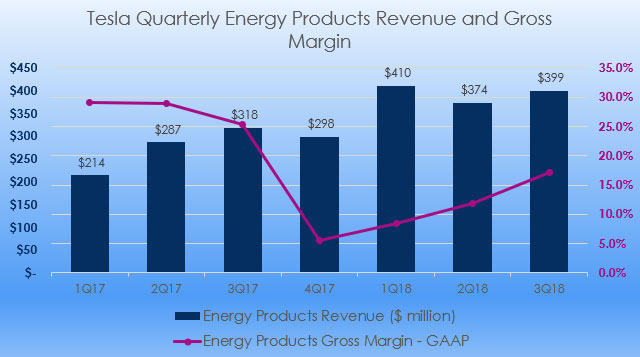

Tesla 3Q 2018 Energy Product Revenue and Gross Margin

- In Q3 2018, energy storage products (Powerpack and Powerwall combined) deployment grew 118% from Q2 2017 to 239 MWh.

- Q3 total energy generation systems deployment was 93 MW, an 11% increase sequentially.

- Solar Roof deployment remains a challenge for Tesla due to the complexity of the product and the difficult installation process. Tesla is continuously working on improving Solar Roof through intensive reliability testing and refinement of the installation process. The company expects to ramp Solar Roof production in first half of 2019.

- Tesla is prioritizing residential solar installation that are combined with energy storage products because the combination provides better customer experience and improve revenue and profit.

- Tesla is banking on its customer base of 450,000 vehicle owners around the world to drive the demand for its residential solar energy generator system and energy storage products.

References:

1. Financial figures were obtained from Tesla Quarterly Update Letters.

2. Featured image was obtained from National Renewable Energy Lab.