Automotive Products

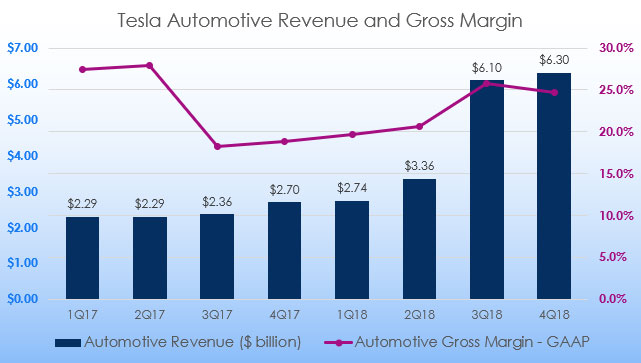

Tesla 4Q 2018 Automotive Revenue and Gross Margin

- In 4Q18, total vehicle deliveries were 90,966 units in which 27,607 deliveries were made up by Model S and Model X and 63,359 deliveries came from Model 3. This delivery result was a quarterly record for Tesla.

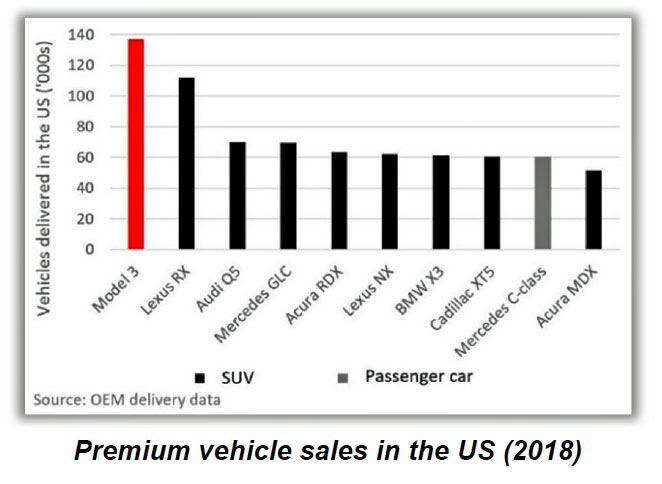

- Model 3 went on to become the best-selling passenger car in the US in terms of revenue in both Q3 and Q4 2018. In addition, Model 3 was also the best-selling premium vehicle (including SUVs) in the US for 2018, with nearly 140,000 units sold.

- Tesla expects to start producing Model 3 vehicles at the Shanghai Gigafactory using a complete vehicle production line by end of 2019. The company has already started construction of Gigafactory Shanghai in January 2019. The capital spend per unit of capacity at the Gigafactory Shanghai is expected to be less than half of that of the Model 3 line at Fremont factory.

- By end of 2019, Tesla expects a production rate of 7000 Model 3 vehicles per week on a sustained basis. As the company is improving the production rate of Model 3, the cost of production per vehicle will decline gradually. As a result, the company is able to main a stable gross margin of 20% for Model 3 at Q4 despite introducing a lower-priced range variant.

- On the logistic side, Tesla is continuing its effort to purchase its own car-hauling truck capacity for vehicle shipments in order to reduce vehicle transportation time and improve delivery schedule. Moreover, by having its own car-hauling trucks, Tesla has far better control while lowering costs and improving customer satisfaction.

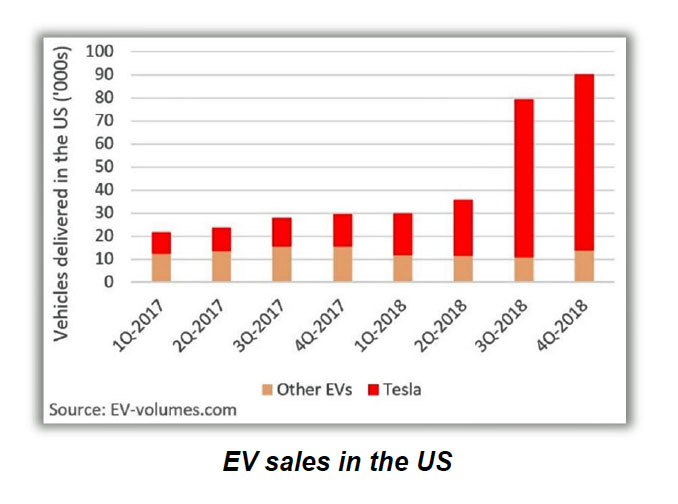

- As of Q4 2018, EVs (Electric Vehicles) still accounts for just 2% of the total US market despite the radical EV growth in 2018. As such, there is substantial opportunity for EVs to continue to gain market share in the US and globally. In Q4 2018, Electric Vehicles have outsold hybrid electric vehicles (HEVs) in the US for the first time in history.

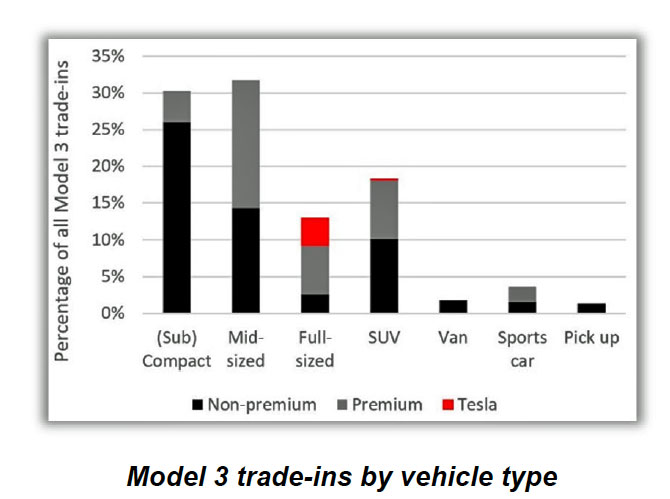

- Tesla trade-in data shows that the appeal of Model 3 goes far beyond the mid-sized premium sedan market. Based on the trade-in data for customers buying Model 3, only 17% are mid-sized premium sedans. Surprisingly, almost 60% of the trade-in are non-premium vehicles. In addition, there are increasing buyers of Model 3 trading down in size from a larger car or a SUV to a Model 3.

- In 4Q18, 27 new stores and service locations were opened, resulting in 378 locations worldwide at the end of the quarter.

- Mobile Service fleet was expanded to 411 vehicles at the end of the quarter. In addition, 69 new Supercharger stations were opened in the same quarter, resulting in 1,421 stations worldwide.

- Tesla engineering team is working on finalizing the rollout of V3 Supercharger technology in 2019. The V3 Supercharger is significantly faster in terms of charging times compared to the current Supercharger technology.

Tesla premium vehicles sales in US (2018). Source: Tesla 4Q18 Update Letter

Tesla electric vehicles sales in US (4Q 2018). Source: Tesla 4Q18 Update Letter

Tesla Model 3 trade-in by vehicle type. Source: Tesla 4Q18 Update Letter

Energy Products

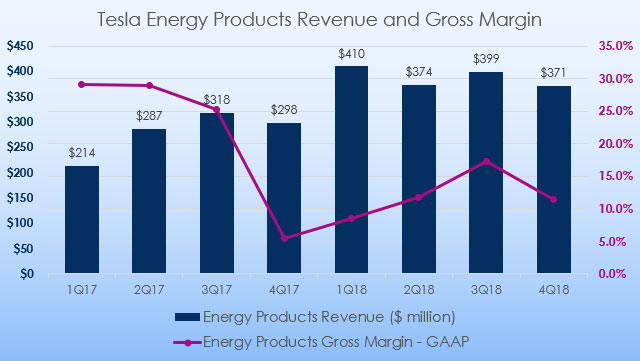

Tesla Energy Product Revenue and Gross Margin 4Q18

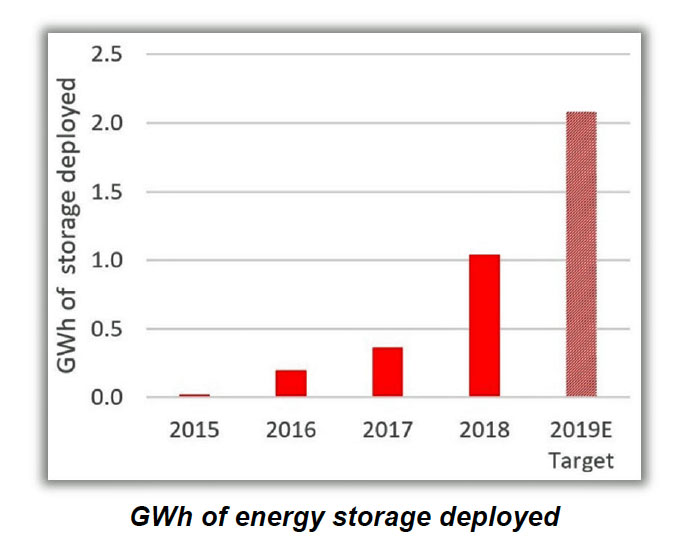

- For the full year of 2018, the total energy storage deployment was 1.04GWh, which is tripling the total energy storage deployment of 358MWh in 2017.

- In Q4 2018 alone, the total energy storage deployment has reached 225MWh, a decrease of 6% sequentially but up 57% year on year compared to Q4 2017.

- Q4 total solar energy generation systems deployment was 73 MW, a 21% decrease sequentially. The decrease was primarily due to the transitioning of the company sales channel from former partner to Tesla stores and training the sales team to sell solar system in addition to vehicles.

- Tesla goal is to increase the total energy storage deployment to over 2GWh in 2019 with the introduction of a new manufacturing line made by Tesla Grohmann. The new Powerwall and Powerpack manufacturing line will further increase the production of these energy storage products at Gigafactory 1.

- There are vast opportunities in Australia and Europe for Tesla energy storage where electricity rates are high in these regions. The reason is that the combination of solar panels and Powerwall will help to drive electricity bills lower.

- The Powerwall storage energy unit is just like the Tesla electric vehicle, delivering vast amount of data through the internet to the company. Tesla will use these data to introduce new functionality and improvement over time.

- The Powerpack energy storage project in Hornsdale, South Australia has generated a lot of attentions from governments and municipalities from around the world that are interested to invest in large battery storage projects.

- The reason is that these large battery storage projects can generate substantial savings over conventional peak energy generation and the savings will pay off the cost of the project in just a few years. As of 4Q 2018, Powerpack units are used in over 100 microgrid projects across 32 countries.

- Solar Roof deployment remains a challenge for Tesla due to the complexity of the product and the difficult installation process. Tesla is continuously working on improving Solar Roof through intensive reliability testing and refinement of the installation process. The company is installing Solar Roof at a slow pace to gather more information on design changes and viability of the installation process in areas that are experiencing inclement weather.

Tesla energy storage deployment. Source: Tesla 4Q18 Update Letter

References:

1. Financial figures were obtained from Tesla Update Letter.