Tesla Model S side panels, strong but light. Source: Flickr

For your information, Tesla is currently a non-dividend-paying stock, meaning shareholders will not receive any cash on the common stocks.

This is based on the company’s 2023 annual filings, which stated the following dividend policy:

Tesla Dividend Policy

“We have never declared or paid cash dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future.Any future determination to declare cash dividends will be made at the discretion of our board of directors, subject to applicable laws, and will depend on our financial condition, results of operations, capital requirements, general business conditions, and other factors that our board of directors may deem relevant.“

It’s not a surprise that many investors are expecting Tesla (NASDAQ: TSLA) to pay cash dividends as most automobile companies, including Toyota, Volkswagen, Ford Motor and General Motors, are decent dividend payers.

Moreover, Tesla is already profitable and generates a sizable cash flow.

While Tesla is currently a non-dividend payer, it’s still worth exploring to see if the case for a cash dividend from Tesla is possible.

This article will explore several reasons Tesla may or may not be a dividend-paying stock.

Let’s read on!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Factors That Support A Dividend

P1. All Automakers Are Dividend Payers

P2. Growing EV Sales And Market Share

P3. Rising Revenue Across All Segments

P4. Rising Profitability Across All Segments

P5. Growing Profit And Cash Flow

P6. Low Debt Level And Leverage

P7. Cash Rich Company

P8. Potential Dividends Rate And Yield

Factors That Do Not Support A Dividend

C1. Battery Scalability

C2. Rise Of Hydrogen Power

C3. Plummeting Revenue Per Car

C4. Elon Musk Is Not Keen On A Cash Dividend

Summary And References

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

EBITDA: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a measure of a company’s operating profitability. EBITDA is calculated by taking a company’s revenue and subtracting its operating expenses, excluding interest, taxes, depreciation, and amortization.

EBITDA is often used to measure a company’s financial performance because it eliminates the effects of financing and accounting decisions.

Revenue Per Car: Revenue per car is calculated as below:

Revenue per car = Total automotive revenue / Global vehicle delivered

Automotive revenue includes leasing revenue but excludes carbon credit sales.

All Automakers Are Dividend Payers

The first argument that Tesla should be paying cash dividends is that most, if not all, of its peers are doing so.

For example, General Motors, Ford Motor, Toyota, Porsche Automobil Holding SE, Volkswagen, and even BYD Company Limited from China, to name a few, are returning cash to shareholders. In other words, they are all dividend-paying auto manufacturers.

Therefore, why not Tesla?

Most automakers and car companies make huge profits and generate decent cash flows. Therefore, being an auto manufacturer can be an extremely profitable undertaking.

These companies are not only profitable but also cash-flow rich. The notion of a capital-intensive operation for an automaker is true, but only to a certain extent.

For example, in Tesla’s case, a sizeable capital outlay was only applied during the company’s initial setup.

Once that initial setup has passed, the company will benefit immensely from these investments in the following years and retain most of the profit produced by the businesses, just like what happens to Tesla now.

Here is a table that shows the 4-year retained earnings of Tesla from 2020 to 2023:

Tesla’s Retained Earnings As At The End Of The Financial Year

| As at 31 December | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Retained Earnings ($ Millions) | $19,954 | $12,885 | $329 | -$5,399 |

As shown in the table above, Tesla’s retained earnings soared to $20 billion as of 2023, a jump of 2X from the previous year and over 10X from 2021.

Therefore, the rising retained earnings prove that an automobile company can be extremely profitable, particularly for Tesla.

While it is also true that most automakers invest for expansion after years into the business, they do so, and at the same time, still being able to distribute cash to shareholders indicates that their businesses are profitable enough for both expansions and capital returns to shareholders.

Therefore, car-making is a profitable business and is no exception for Tesla. In short, the case for a cash dividend from Tesla should easily play out in the near future.

Growing EV Sales And Market Share

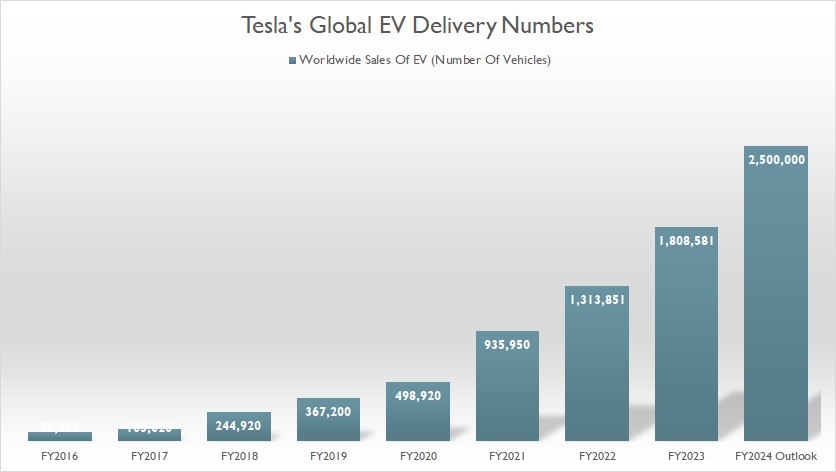

Tesla EV delivery numbers

Another reason Tesla may soon join the cash dividend-paying club is the consistent growth of the company’s EV sales and rising market share.

As shown in the chart above, Tesla’s EV sales have significantly grown and reached record milestones every year. In addition, Tesla’s delivery may rise to 2.5 million units in 2024, indicating the company’s potential growth.

While Tesla may deliver a sizable number of cars, this figure represents less than half of its peers’ vehicle sales, such as Ford Motor and GM.

You can check out Ford Motor and GM’s vehicle sales figures here: Ford Motor Vehicle Sales and GM Vehicle Sales.

Therefore, there are plenty of opportunities ahead for Tesla. More importantly, Tesla is already making so much money even before delivering the same level of sales as Ford Motor and GM.

Imagine what Tesla will be like when it sells a minimum of 5 million vehicles yearly, which Ford and GM have been selling for years.

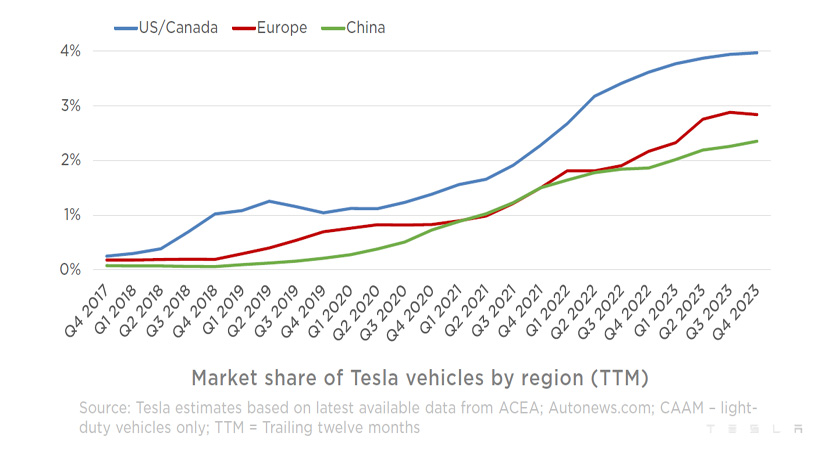

Apart from the growing vehicle sales, Tesla’s market share also has been on the rise, as shown in the snapshot below:

Tesla market share by region

While market share has steadily grown, it is still in the low single digits for most regions shown. Therefore, there will be plenty of market share to grab for Tesla, and it is likely coming from fossil fuel vehicles.

Moreover, the world is intensifying its efforts to curb climate change. This means there will be even more demand for EVs. Again, this is another opportunity for Tesla to expand its market share.

As Tesla is at the forefront of EV technology, its EV sales and market share will only increase.

Mind you, we have not even touched on Tesla’s energy segment, which is expected to grow due to the world’s transition to green energy.

Therefore, the case for a cash dividend from Tesla is getting even stronger, considering what lies ahead for the company.

Rising Revenue Across All Segments

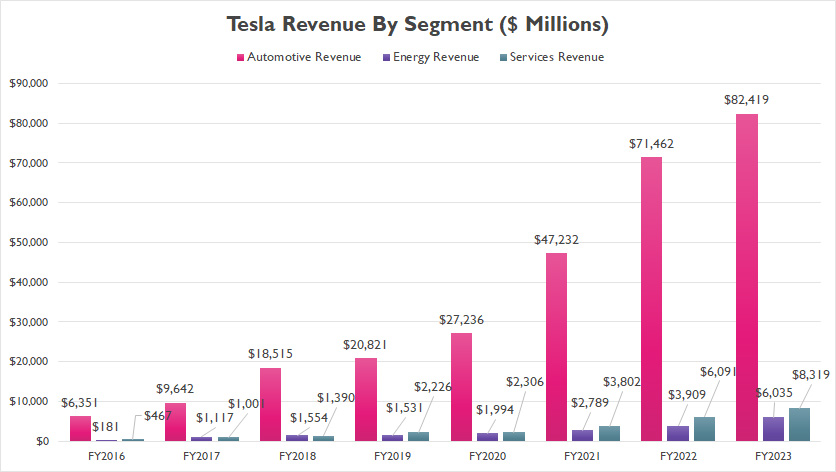

Tesla revenue by segment

The likelihood of Tesla distributing a cash dividend depends not only on the growth of its automotive sector but also on the growth of other business segments, including the energy sector.

As shown in the chart above, we are seeing very strong revenue growth in the automotive sector and other business segments.

Historically, the revenue of these segments had been on a tear, especially in the automotive segment.

While Tesla’s automotive sector has grown exponentially, its energy segment also has done fairly well.

Over five years, Tesla’s energy revenue has grown 250%, or 50% year-over-year on average over the last five years.

Going into the future, the revenue of all segments will only be rising, given all the factors that we mentioned in prior discussions.

More importantly, Tesla’s energy segment may still be in its infancy, considering that the energy revenue reported in 2022 represented only 5% of the automotive revenue.

As the world races towards a green future, the demand for solar and energy storage will skyrocket.

And Tesla is in a great position to capture the growing demand for solar and energy storage.

Again, Tesla’s growing revenue across all segments makes the case of a cash dividend extremely likely.

Rising Profitability Across All Segments

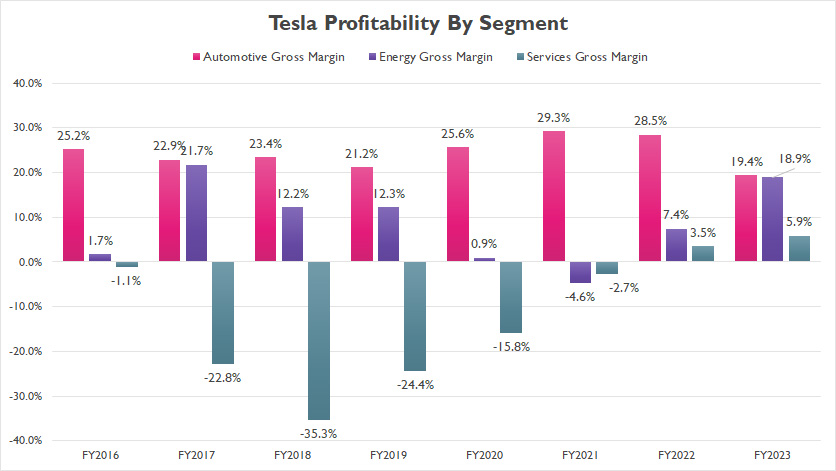

Tesla profit by segment

While revenue across all segments has considerably jumped, Tesla’s profitability in all segments also has been doing fairly well.

As shown in the chart above, Tesla’s automotive sector is by far the most profitable among all segments, with a gross margin coming in at 19% as of 2023.

While the automotive gross margin decreased to 19% as of 2023, it was still highly profitable.

Apart from the automotive segment, Tesla has also become profitable in other business segments, including the energy and services segments, as shown in the chart above. In other words, Tesla is making money in all its business sectors.

A noticeable trend is that Tesla’s services gross margin has steadily turned around from unprofitable to profitable.

Similarly, we are seeing a very successful turnaround of Tesla’s energy. The energy gross margin surged to 19% as of 2023.

In short, Tesla’s growing profitability in all segments bodes well for the company and makes the case of a cash dividend coming from the company highly possible.

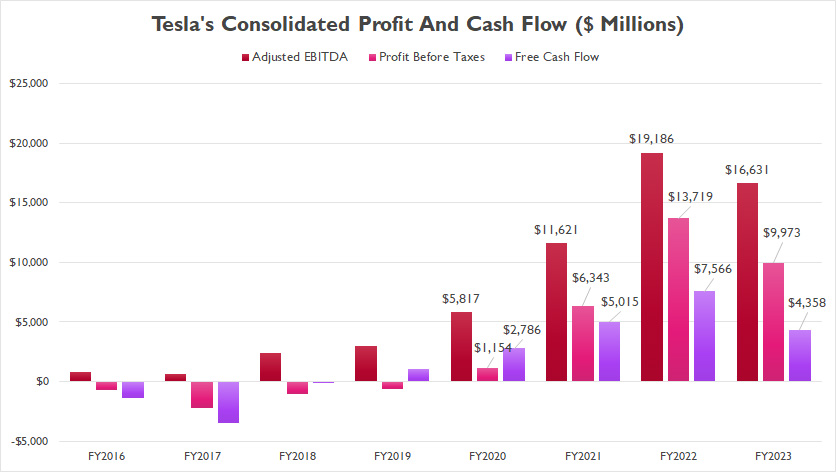

Growing Profitability And Cash Flow

Tesla profit and cash flow

The definition of EBITDA can be read here: EBITDA.

On a consolidated basis, Tesla is highly profitable and generates tonnes of free cash flow, as shown in the chart above.

As seen, Tesla is profitable and generates billions of dollars of free cash flow for the periods shown in the chart.

In the last several years, Tesla’s profitability across all business segments has translated to a huge upside in EBITDA, profit before taxes, and free cash flow.

Given the rising demand for EVs, energy storage, and solar products worldwide, Tesla’s growing profitability and free cash flow will likely continue in the foreseeable future.

As Tesla is at the forefront of the green energy revolution, it is in a great position to capture the rising demand for its products.

In return, Tesla’s rising profit and free cash flow will likely translate to decent capital returns for shareholders.

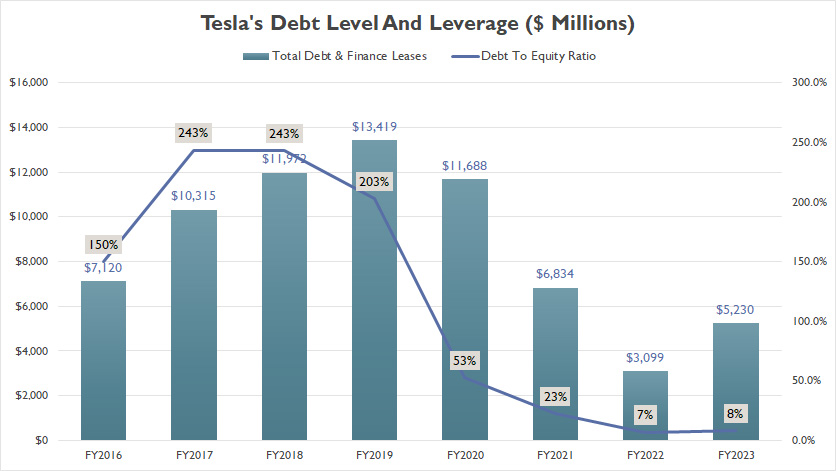

Low Debt Level And Leverage

Tesla debt level and leverage

Other than being profitable, Tesla also is low in debt and leverage. As shown in the chart above, Tesla’s debt level has declined after reaching $13 billion in 2019.

As of 2023, Tesla’s debt level totaled only $5 billion, one of the lowest levels in the last eight years.

Tesla’s low debt level is driven by the company’s aggressive debt extinguishment in the last couple of years. Tesla’s ability to repay its debt indicates the company’s responsible usage of debt and the highly profitable nature of its business.

Moreover, Tesla’s debt leverage was at the lowest level as of 2023, topping only 8% with respect to equity.

As Tesla’s debt decreases, its interest expenses also follow suit. Total interest payments fell to the lowest level as of 2023, as shown in this article – Tesla Interest Expense.

The decrease in interest expense will translate to more profit for Tesla. Tesla will be paying less interest expenses going forward.

As a result, Tesla’s case of paying cash dividends is extremely likely when its debt, leverage, and interest expense are all declining.

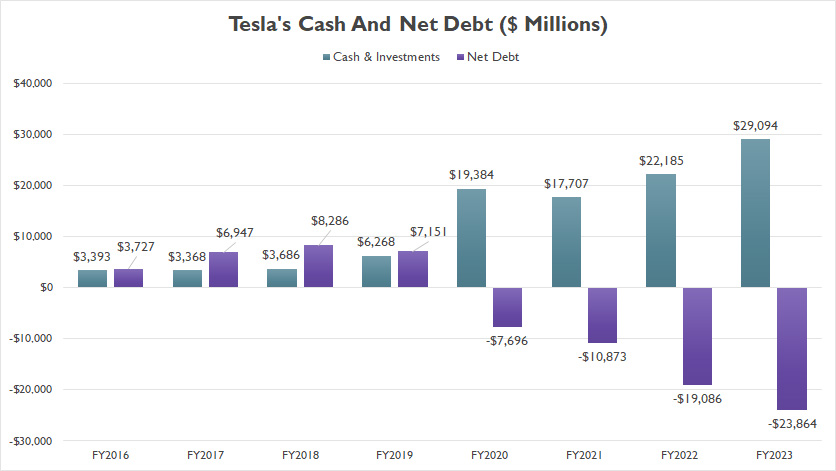

Cash Rich Company

Tesla cash and net debt

Tesla is profitable and cash-rich, as shown in the chart above. Tesla’s cash and investments ballooned to a massive $29 billion as of 2023, which was more than enough to pay off its total debt multiple times.

As a result, Tesla’s net debt came in at -$24 billion as of 2023, as cash was much higher than its debt level.

With $29 billion in cash or $24 billion after accounting for debt, Tesla is not only cash-rich but also liquidity rich as cash and investments alone accounts for 58% of the company’s current assets.

With this amount of cash on hand, Tesla can afford to return some cash to shareholders as dividends.

Potential Dividend Rate And Yield

Tesla’s 2024 Dividend Rate And Yield

| Estimate And Actual Results | |||

|---|---|---|---|

| 2024 Estimate | 2023 Actual | 2022 Actual | |

| Annual Revenue ($ Billions) | $118 | $97 | $81 |

| Adjusted EBITDA ($ Billions) | $19 | $17 | $19 |

| Free Cash Flow ($ Billions) | $8 | $4 | $8 |

| Dividends Declared ($ Billions) | $2 | – | – |

| Dividend To EBITDA Payout Ratio (%) | 10% | – | – |

| Dividend To FCF Payout Ratio (%) | 25% | – | – |

| Dividend Rate (US$) | $0.60 | – | – |

| Dividend Yield (%) | 0.3% | – | – |

Suppose Tesla returns $2 billion of cash to shareholders as dividends in 2024.

This particular cash dividend represents only 10% and 25% of 2024 EBITDA and free cash flow estimates, respectively. These ratios are reasonably low.

In terms of the dividend rate, shareholders will get roughly USD 0.60 per share annually based on 3.2 billion shares outstanding.

For dividend yield, if you have bought Tesla’s stock at USD 180 per share, the yield will come to about 0.3%, which is quite low.

While $2 billion of cash dividends may be small, Tesla can certainly afford to raise the dividend to a higher amount, say $6 billion, which will consume 32% and 75% of 2024 EBITDA and free cash flow estimates.

Your dividend yield will be about 1% based on a stock price of $180.

Tesla may not be willing to return $6 billion of cash to shareholders, considering it will consume over half of the free cash flow. However, Tesla can certainly afford a $2 billion cash dividend payout.

Nevertheless, I bet that Tesla’s shareholders will be more than happy to have any cash dividend declared as they get not only capital appreciation from the stock but also a little bit of cash, which is a plus to them.

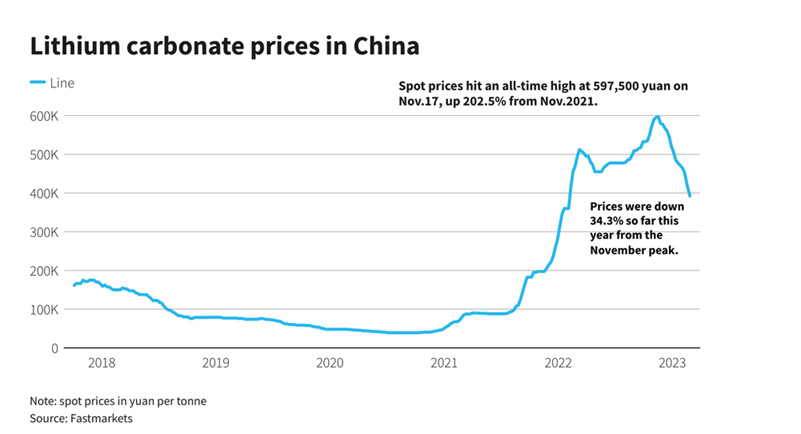

Tesla May Be Held Back By Battery

Lithium Carbonate Spot Prices

Tesla may be at the top of the world now, but it may soon face a shortage of batteries that will put the company’s expansion on hold.

Tesla or its suppliers may not be getting enough lithium, the main component used in an electric battery, to power millions of electric vehicles sold yearly, soon.

While there is enough lithium in the world to power the electric vehicle revolution, there is only a small quantity that is economically viable to mine as reserves, according to this analysis from Substack.

The worrying part is that the supply of the world’s lithium could face a shortage by 2025.

While the production of lithium will increase over time when new technology is available, it still takes roughly a decade to put a new mine ready for production, according to World Economic Forum.

Besides, the IEA predicted that the world could face lithium shortages as soon as 2025.

Therefore, there is not enough lithium on the face of the planet to power all the EVs.

If this is the case in the foreseeable future, Tesla’s growth in the EV space may face a bottleneck. It may have to switch to a new energy source, i.e., hydrogen, to power its vehicles or design a battery that uses other materials instead of lithium.

This scenario can derail Tesla’s plan of distributing a cash dividend to shareholders because margins and profitability may shrink.

The Rise Of Hydrogen Power

Lately, hydrogen-powered vehicles are getting a lot of attention, and this technology may seem capable of replacing battery-electric vehicles.

There are a few advantages of hydrogen-powered vehicles to battery electric vehicles.

The biggest advantage is that hydrogen is an infinite resource compared to lithium, as hydrogen is abundant around us. Take water, for example.

Therefore, there is no restriction regarding materials used in a vehicle, as in the case of lithium. However, this advantage applies only to vehicles directly powered by hydrogen instead of a hydrogen fuel cell.

A hydrogen fuel cell vehicle is quite similar to a battery electric vehicle in which an onboard electric battery is still required.

A second advantage is that you can refuel a hydrogen-powered vehicle as quickly as a fossil-fuel vehicle.

And a hydrogen-powered vehicle has a much longer range than a battery-electric vehicle. However, hydrogen-powered vehicles have been struggling to take off due to several limitations.

First, a hydrogen vehicle is inefficient compared to a battery-electric vehicle due to high energy loss. Second, the infrastructure to refuel hydrogen-powered vehicles is non-existent.

Third, based on today’s technology, hydrogen-powered vehicles are too costly to make and maintain. However, if the technology behind the hydrogen revolution can one day solve these limitations, then it may become viable and will threaten the existence of Tesla.

If this day comes, Tesla’s investment thesis can be thrown out, and the question of cash dividends from Tesla is no longer relevant.

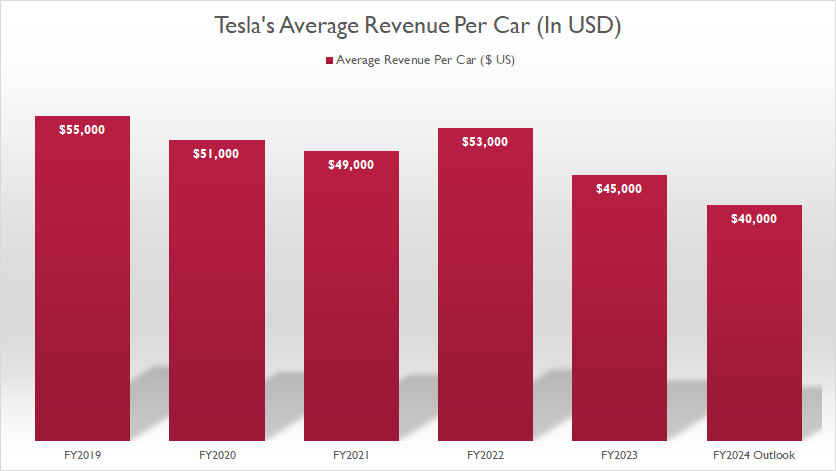

Plummeting Revenue Per Car

tesla-revenue-per-car

(click image to expand)

The definition and calculation of revenue per car can be found here: revenue per car.

Another problem Tesla faces is the plummeting revenue per car. As shown in the chart above, Tesla’s revenue per car has significantly decreased from US$55,000 in 2019 to US$45,000 as of 2023.

Tesla’s revenue per car may decrease to US$40,000 by the end of fiscal 2024 if the rate of decline remains the same.

Tesla’s decreasing revenue per car is caused by growing competition in the EV race, China in particular. Tesla is cutting pricing to boost sales.

This practice can dent the company’s profitability and margins. As seen in the profitability section, Tesla’s automotive margin declined to 19.4% as of 2023, down significantly over 28.5% in 2022.

If Tesla’s revenue per vehicle continues to decrease, the possibility of a dividend from the company looks unlikely.

Elon Musk May Not Be Keen On A Dividend

One of Tesla’s largest shareholders cum CEO, Elon Musk, may not be keen on returning capital to shareholders in the form of cash dividends. Tesla’s other shareholders may share the same thoughts as the CEO.

The reasons? Tesla is still a relatively young company, and taking cash out of the company now may threaten its growth in the future.

Tesla needs the cash for reinvestment to expand and develop new technology. There are many areas where Tesla desperately needs cash to improve and resolve.

For example, Tesla’s full-self-driving (FSD) technology is one area that needs significant investment. As of 2024, it is still pending regulatory approval and not ready for real-world deployment, according to Reuters.

Authorities say that the technology is still not good enough without a driver, as self-driving is a complex task requiring human interaction. Therefore, Tesla’s full self-driving technology is an area that needs improvement and requires a sizable investment to make it practical.

Another area that requires investment includes Tesla’s charging infrastructure and mobile service fleet.

Tesla needs to expand its Supercharger infrastructure as quickly as possible to make electric vehicles more viable. The limited range of electric vehicles may still hinder consumers from choosing fossil-fuel vehicles over battery-electric vehicles.

In addition, Tesla’s solar and energy is one area that needs investment as this segment may have been overlooked all these years when the company aggressively expanded its automotive sector.

Other areas where Tesla needs to spend cash include buying a piece of land, if not a country rich in lithium where Tesla can mine the heck out of it to keep its battery cost down.

In addition, Tesla may consider buying out an EV startup such as Rivian or Nikola.

Therefore, it is probably better for Tesla to spend its cash on reinvestment rather than returning it to shareholders, as the company is still growing.

Conclusion

As Tesla does not pay a dividend, investors can only gain from the stock price appreciation.

Since more reasons support a cash dividend from Tesla, should Tesla declare a dividend?

What do you say?

References and Credits

1. All financial figures presented in this article were obtained and referenced from Tesla’s quarterly and annual reports, SEC filings, investor letters, press releases, presentations, etc., which are available in the following link: Tesla Financial Results.

2. Featured images in this article are used under the Creative Commons license and sourced from the following websites: Steve Jurvetson and Automotive Rhythms

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!