Tesla Gigafactory Shanghai, China. Source: Tesla 3Q19 Update Letter.

This article presents Tesla’s services revenue and the respective gross margin.

Tesla’s services segment has often been overlooked because it contributes less than 10% of total revenue. However, the reality is that the services revenue is much larger than the energy segment.

Let’s take a look!

For other key statistics of Tesla, you may find more resources on these pages:

Sales

Revenue

Energy

Profit Margin

- Gross profit breakdown: automotive, energy, and services,

- Profit margin by segment: automotive, energy, and services,

- Gross profit and gross margin per car,

- Profit per employee,

R&D Comparison

Debt, Cash, and Liquidity

- Financial health: debt level, payment due, and liquidity,

- Cash flow and cash on hand analysis,

- Debt to equity, capital structure, and more,

- Liquidity check: current ratio, working capital, and quick ratio,

Comparison With Peers

- Marketing, advertising, and promotional spending,

- Tesla vs GM: profit margin comparison,

- Tesla vs Ford: vehicle profit and margin,

- Tesla vs BYD: profit margin comparison,

Other Statistics

- Interest expense and interest coverage ratio,

- Infrastructure expansion: supercharger stations, service fleets, and stores,

- Operating expenses breakdown analysis,

- Inventory breakdown analysis

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Overview Of Tesla Services Segment

O3. Tesla Services Revenue Breakdown

Consolidated Results

A1. Services Revenue

Growth Rates

B1. Services Revenue YoY Growth Rates

Gross Margin

C1. Services Segment Gross Margin

Ratios

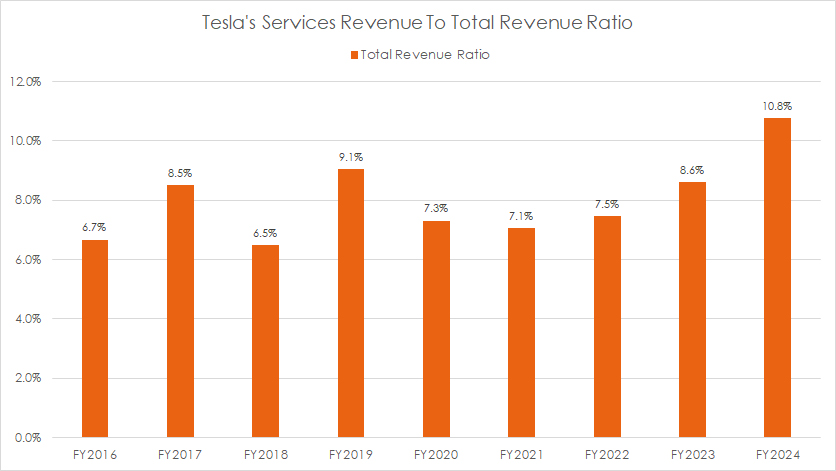

D1. Services Revenue to Total Revenue Ratio

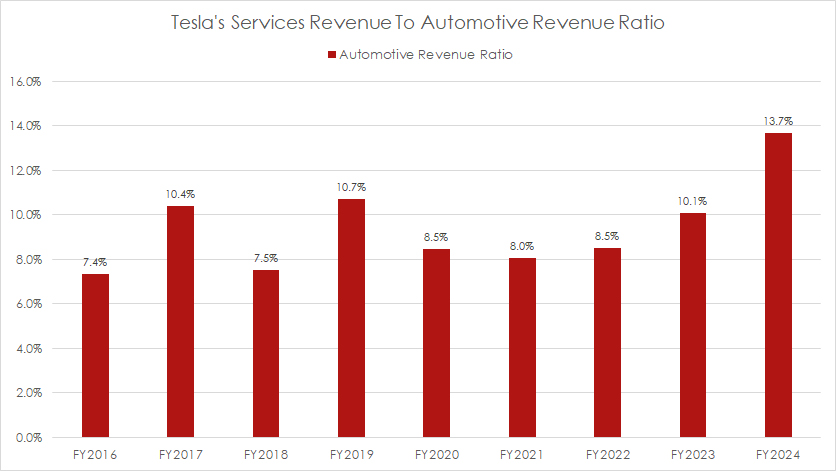

D2. Services Revenue to Automotive Revenue Ratio

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Tesla Insurance: Tesla Insurance is a unique product offering comprehensive coverage and claim management for Tesla vehicle owners in select U.S. states, with plans to expand to additional states. The insurance is designed to be competitively priced and tailored explicitly to Tesla vehicles, technology, safety, and repair costs, eliminating traditional insurance carriers’ additional charges.

Tesla Insurance is available in several states, including Arizona, California (excluding real-time driving behavior), Colorado, Illinois, Maryland, Minnesota, Nevada, Ohio, Oregon, Texas, Utah, and Virginia.

Tesla Insurance also offers coverage for non-Tesla vehicles, which can be added to a policy by contacting Tesla directly or using the Tesla app. In California, non-Tesla vehicle owners can add their vehicles when purchasing a policy by inputting their driver’s license information, address, and date of birth, with options to add additional drivers or vehicles to their policy.

One unique feature of Tesla Insurance is that it offers insurance using real-time driving behavior, which is currently available to all Model S, Model 3, Model X, and Model Y owners in select U.S. states. This feature allows Tesla Insurance to determine a driver’s premium using several factors, such as the type of vehicle, location, driving habits, coverage selection, and the vehicle’s monthly Safety Score. The safer a driver drives, the higher their Safety Score and the lower their insurance premium.

Unlike other telematics or usage-based insurance products, Tesla Insurance does not require an additional device to be installed in the vehicle. Instead, it uses specific features within the vehicle to evaluate a driver’s premium based on their actual driving behavior. This allows drivers to make monthly payments based on their driving behavior instead of traditional factors like credit, age, gender, claim history, and driving records used by other insurance providers.

Overall, Tesla Insurance is designed to be a comprehensive, competitive, and tailored insurance product for Tesla vehicle owners, with unique features that make it stand out from traditional insurance providers.

Overview Of Tesla Services Segment

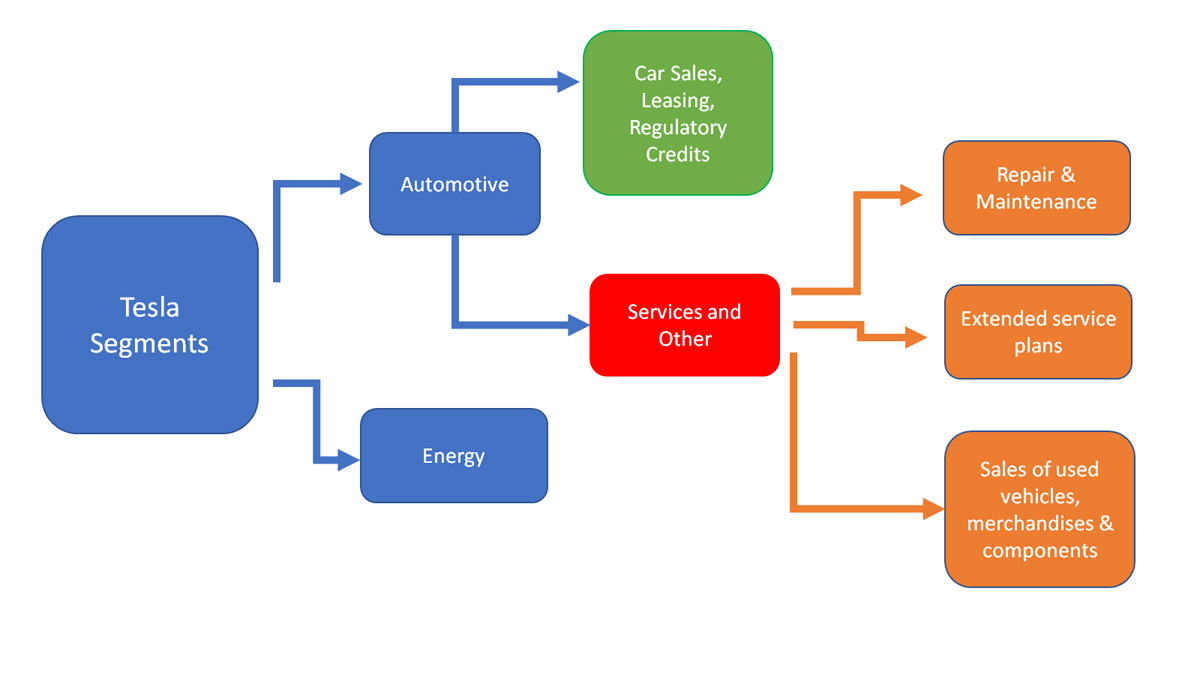

tesla-services-segment

The diagram above gives an overview of Tesla’s services segments and the respective revenue sources.

Tesla’s services segment falls under the automotive sector and generates revenue from multiple sources, including repair and maintenance, warranty services, used vehicle sales, merchandise and components, insurance, etc.

How Tesla Services Make Money

Tesla’s services segment derives its revenue from several activities, which include the following:

- 1. Repair and maintenance services

- 2. Extended service plans

- 3. Sales of merchandises

- 4. Sales of used Tesla vehicles

- 5. Sales of non-Tesla vehicle trade-ins

- 6. Sales of electric vehicle components to other manufacturers

- 7. Non-warranty after-sales vehicle services

- 8. Sales of Supercharging

- 9. Sales of insurance

A detailed definition of Tesla’s insurance is available here: Tesla insurance.

Repair and maintenance services

Revenue recognition for repair and maintenance services is done as soon as the services are provided to customers.

Extended service plans

Revenues for extended service plans are recognized over the performance period of the service contracts as the obligation represents a stand-ready obligation to the customers.

Sales of merchandise, used vehicles, components, and trade-in vehicles

Revenues are recognized when payments for merchandise, used vehicles, components, and vehicle trade-ins are received at the point when control is transferred to the customers or in accordance with payment terms customary to the business.

Sales of insurance

Based on the 1Q22 filings, Tesla’s insurance business continues to expand, with recent launches in Colorado, Oregon, and Virginia. As an insurance carrier, Tesla is the underwriter and bears all financial risks.

Services Revenue

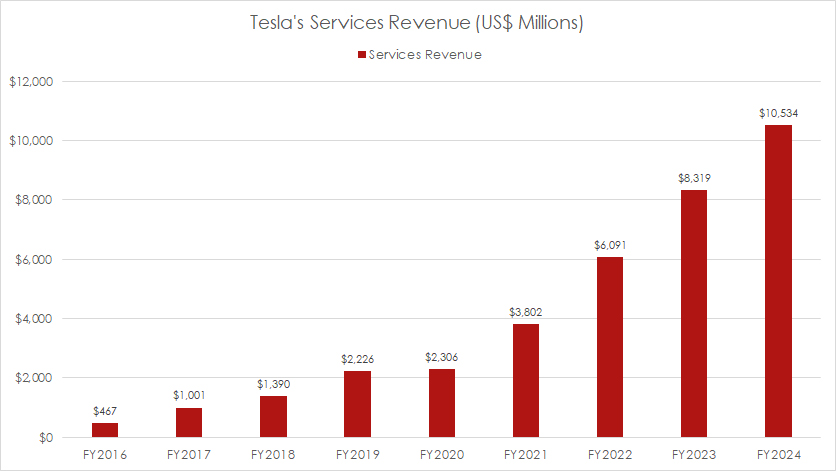

Tesla-services-revenue-by-year

(click image to expand)

Tesla earned $10.5 billion, $8.3 billion, and $6.1 billion in services and other revenue in fiscal years 2024, 2023, and 2022, respectively.

The following shows a detailed result:

Revenue in FY2024:

| Category | Revenue |

|---|---|

| (US$ Billions) | |

| Services | $10.5 |

3-Year Trend from FY2021 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Services | $3.8 to $10.5 | +177.1% |

5-Year Trend from FY2019 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Services | $2.2 to $10.5 | +373.2% |

Services Revenue YoY Growth Rates

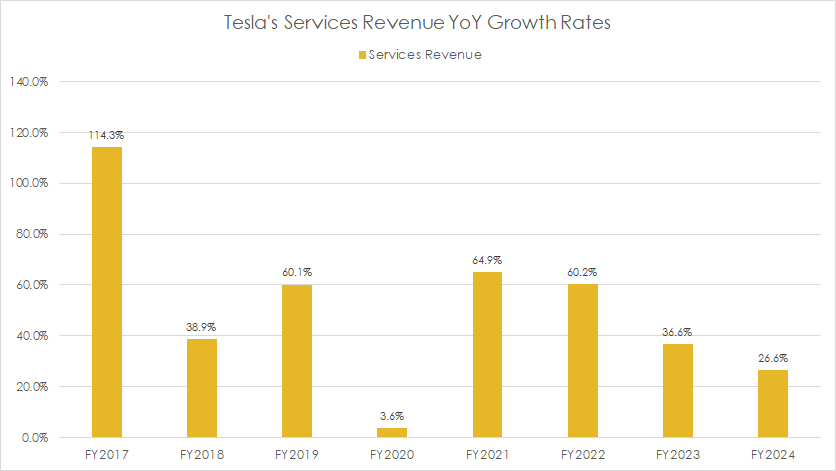

Tesla’s services revenue year-on-year growth rates

Tesla has experienced strong service revenue growth for the past few years, consistently reaching mid-double digits.

The success of Tesla’s services segment is heavily reliant on the strong momentum of vehicle sales. Without new vehicle sales, Tesla’s services segment may not achieve the same level of success.

The following shows a detailed result:

Revenue Growth in FY2024

| Category | Growth Rates |

|---|---|

| Services | +26.6% |

3-Year Average Revenue Growth from FY2022 to FY2024:

| Category | Growth Rates |

|---|---|

| Service | +41.1% |

5-Year Average Revenue Growth from FY2020 to FY2024:

| Category | Growth Rates |

|---|---|

| Service | +38.4% |

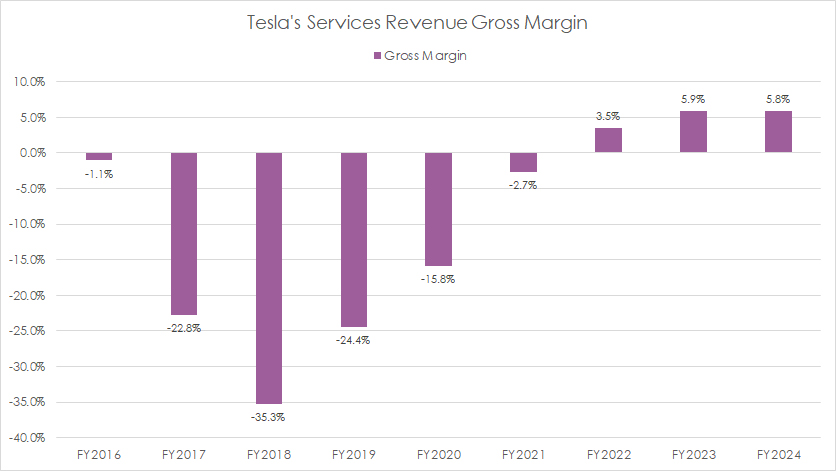

Services Segment Gross Margin

Tesla’s services revenue gross margin

Tesla’s services segment gross margin has significantly improved from unprofitable to profitable. Tesla’s services segment has turned a profit after achieving a positive gross margin since 2022.

The following shows a detailed result:

Gross Margin in FY2024:

| Category | Gross Margin (%) |

|---|---|

| Services | +5.8% |

3-Year Average Gross Margin from FY2022 to FY2024:

| Category | Gross Margin (%) |

|---|---|

| Service | +5.1% |

5-Year Average Gross Margin from FY2020 to FY2024:

| Category | Gross Margin (%) |

|---|---|

| Service | -0.7% |

Services Revenue to Total Revenue Ratio

Tesla’s services revenue to total revenue ratio

Tesla’s services revenue accounted for a modest portion of its total revenue.

Here is the breakdown:

Revenue Share in FY2024:

| Category | Total Revenue Share (%) |

|---|---|

| Services | 10.5% |

3-Year Trend from FY2021 to FY2024:

| Category | Total Revenue Share (%) | % Point Changes |

|---|---|---|

| Services | 7.1% to 10.6% | +3.7% |

5-Year Trend from FY2019 to FY2024:

| Category | Total Revenue Share (%) | % Point Changes |

|---|---|---|

| Services | 9.1% to 10.6% | +1.7% |

Services Revenue to Automotive Revenue Ratio

tesla-services-revenue-to-automotive-revenue-ratio

(click image to expand)

Tesla’s services revenue accounted for a modest portion of its automotive revenue.

Here is the breakdown:

Revenue Share in FY2024:

| Category | Automotive Revenue Share (%) |

|---|---|

| Services | 13.7% |

3-Year Trend from FY2021 to FY2024:

| Category | Automotive Revenue Share (%) | % Point Changes |

|---|---|---|

| Services | 8.0% to 13.7% | +5.6% |

5-Year Trend from FY2019 to FY2024:

| Category | Automotive Revenue Share (%) | % Point Changes |

|---|---|---|

| Services | 10.7% to 13.7% | +3.0% |

Insight

Tesla’s services segment has undergone a remarkable transformation, shifting from a low-margin, overlooked revenue stream to a profitable and increasingly substantial contributor. Despite its modest share of total revenue, services have grown at a rapid pace, driven by rising vehicle sales and expanding offerings such as repairs, used car sales, insurance, and component sales.

The most notable shift is profitability — Tesla’s services segment, once a financial drag, now consistently delivers positive gross margins. In FY2024, it reached 5.8%, marking a sustained improvement from prior losses. This suggests Tesla has optimized pricing and cost structures across its service offerings.

While services still pale in comparison to automotive sales, their revenue has nearly quadrupled over five years. If Tesla continues enhancing efficiency and scaling its services — especially insurance and used car sales — it could further stabilize earnings, reducing reliance on vehicle sales growth alone.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s quarterly and annual statements published on the company’s investor relations page: Tesla Investor Relations.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.