This article analyzes and reviews the Public Indonesia Select Fund (PINDOSF).

The PINDOSF is a unit trust fund managed by Public Mutual Malaysia.

The fund invests primarily in equities or stocks of companies based in Indonesia.

The PINDOSF is a small fund estimated at only MYR273 million as of 31 Oct 2023 or US$61 million, based on an exchange rate of USD1 to MYR4.50.

Please use the table of contents to navigate this page.

Table Of Contents

Overview

A1. Fund Summary

Performance

B1. Annual Total Return

B2. Average Annual Return

B3. Total Return

B4. Capital And Income Growth

B5. Other Performance Data

Distribution And Income Received

C1. Cash Distribution And Unit Split

C2. Income And Yield

Asset Allocation

D1. Indonesian Equities

D2. Foreign Equities

D3. Total Assets

Liquidity

Top Holdings

F1. Top 10 Equities – Indonesia

F2. Top 10 Equities– Foreign

Tracking Number Of Shares Held

G1. Indonesia Equities

G2. Foreign Equities

Correlation With Benchmark

H1. Unit Price Vs Benchmark

H2. Positive Correlation With Benchmark

H3. Negative Correlation With Benchmark

Conclusion And Reference

S1. Review Summary

– S11. Advantages

– S12. Disadvantages

S2. References and Credits

S3. Disclosure

Fund Summary

The following summary is obtained from the annual report for the financial year ending 31 August 2023.

Category

Equity

Investment Objective

To achieve capital growth over the medium to long-term period by investing in a portfolio of investments primarily in the Indonesian market.

Launch Date

1st Sept 2010

Distribution Policy

Incidental

Risk Level

Very High – 5 (on a scale of 1 – 5)

3-Year Volatility

Very High – 16.1 By Lipper Analytics

Size

MYR273 million (USD61 million based on an exchange rate of USD1 = MYR4.5) as of 31 Oct 2023.

Shariah Compliant

No

Sales Charge

Up To 5%

Expenses

1.80% Of Fund NAV On Average From 2020 To 2023

Performance

Annual Total Return

Annual total return for the financial year ended 31 August.

| Years | PINDOSF Return (%) | Jakarta LQ-45 Index (%) |

|---|---|---|

| 2023 | 5.02 | -4.74 |

| 2022 | 19.49 | 22.85 |

| 2021 | 4.54 | 3.87 |

| 2020 | -12.83 | -18.21 |

| 2019 | 9.20 | 10.78 |

| 2018 | -15.23 | -15.01 |

The volatility of the unit trust PINDOSF is reflected by the return figures shown in the performance table above.

The Public Indonesia Select Fund (PINDOSF) registered a massive annualized return of 19% in 2022 but performed poorly in 2021, with an annualized return of only 4.54%.

In fiscal 2020, the Public Indonesia Select Fund (PINDOSF) performed even worse, having an annualized return of -12.83%.

For the fiscal year ended on 31 Aug 2023, the Public Indonesia Select Fund (PINDOSF) generated a return of 5.02% compared to its benchmark’s return of -4.74%.

The 5.02% return recorded in fiscal 2023 was made possible by a 7.59% return from its equity portfolio, while its money market portfolio returned 2.82%.

After adjusting for average equity and money market exposure and an expense ratio of 2.33%, the fund’s final return was 5.02%.

PINDOSF’s better performance than its benchmark Jakarta LQ45 index was attributed to the fund’s selected investments within the financial, basic materials, and consumer sectors outperforming the broader market during the financial year under review.

Average Annual Return

Average annual return for the following years ended 27 Nov 2023.

| Years | PINDOSF Average Return (%) |

|---|---|

| 1 Year | 0.19 |

| 3 Years | 3.30 |

| 5 Years | 1.86 |

| 10 Years | 3.92 |

| Since Commencement | 3.56 |

The PINDOSF unit trust appears to perform better on a long-term basis.

For example, the PINDOSF generated a return of only 0.19% for one year, ending on 27 Nov 2023.

The return figure performed much better for three years ended on 27 Nov 2023, averaging around 3.30% per year.

Since its commencement, the PINDOSF unit trust has generated an average annualized return of 3.56%.

Total Return

Total return for the following years ended 27 Nov 2023.

| Years | PINDOSF Total Return (%) |

|---|---|

| 1 Year | 0.19 |

| 3 Years | 10.23 |

| 5 Years | 9.66 |

| 10 Years | 46.98 |

| Since Commencement | 58.66 |

The PINDOSF unit trust generated a total return of 10.23% for three years, ending on 27 Nov 2023, while the total return for five years was slightly lower at 9.66%.

The 10-year total return amounted to 46.98% for the Public Indonesia Select Fund (PINDOSF) unit trust.

Since commencement, the PINDOSF unit trust generated a total return of 58.66% for the period ended on 27 Nov 2023.

Capital And Income Growth

Capital And Income Growth

| As at 31 August | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Capital Growth (%) | 2.42 | 18.59 | 4.27 | -13.50 |

| Income Growth (%) | 2.54 | 0.76 | 0.26 | 0.78 |

Another performance metric to keep an eye on for the PINDOSF unit trust is the capital and income growth of the fund.

The PINDOSF had poor capital growth, which averaged only +2.95% per annum between fiscal 2020 and 2023, as presented in the table above.

The income growth of the PINDOSF was even worse, averaging only +1.1% annually over the past four years.

The Public Indonesia Select Fund (PINDOSF) has underperformed since 2020 due to the weak Indonesian economy, further exacerbated by the COVID-19 pandemic.

Other Performance Data

Other performance data for the financial year ended 31 August.

Unit Prices (MYR) => prices quoted are ex-distribution

| As at 31 August | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Highest NAV per unit for the year | 0.2905 | 0.3080 | 0.2809 | 0.2669 |

| Lowest NAV per unit for the year | 0.2442 | 0.2427 | 0.1985 | 0.1484 |

Net Asset Value (NAV) and Units In Circulation (UIC) as at the end of the financial year

| As at 31 August | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total NAV (MYR’000) | 304,666 | 284,942 | 337,754 | 348,851 |

| UIC (in ’000) | 1,061,266 | 1,033,229 | 1,376,551 | 1,537,972 |

| NAV per unit (MYR) | 0.2871 | 0.2758 | 0.2454 | 0.2268 |

An important feature to look at when buying a unit trust such as the Public Indonesia Select Fund (PINDOSF) is the size of the fund, i.e., the fund’s NAV or net asset value.

The NAV per unit may not be an accurate indicator of the fund’s performance due to cash distribution and unit split, which can significantly affect the value of the NAV per unit.

That said, the NAV of the fund should always be on the rise on a long-term basis.

However, the PINDOSF has barely grown in its NAV since 2020.

In fact, the fund has decreased in size since 2020, raising a red flag for investors.

The decreasing NAV may indicate poor fund performance, lack of interest from new investors, or the exit of existing unit holders.

Total Expense Ratio

| As at 31 August | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total Expense Ratio (%) | 1.81 | 1.83 | 1.77 | 1.75 |

A lower ratio is preferable as it indicates lower expenses of the unit trust fund.

The PINDOSF has a slightly higher expense ratio compared to other funds.

Portfolio Turnover Ratio

| As at 31 August | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Portfolio Turnover Ratio (time) | 0.65 | 0.88 | 0.71 | 0.74 |

A lower ratio is preferred as it indicates lower trading activities and, thus, lower expenses and more money for unit holders.

Cash Distribution And Unit Split

| Declaration Date | |||||

|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| 08-30 | 08-30 | 08-30 | 08-30 | 08-30 | |

| Net Distribution Per Unit (Cent In MYR) | – | 1.50 | – | – | 1.00 |

| Distribution In Cash Amount (MYR In Millions) | – | 15.5 | – | – | – |

| Yield (%) | – | 4.9 – 6.2 | – | – | – |

| Unit Split | – | – | – | – | – |

Between 2019 and 2023, the Public Indonesia Select Fund (PINDOSF) declared a cash distribution in only two of five years.

For example, the PINDOSF declared a cash distribution per unit of 1.00 MYR and 1.50 MYR in 2019 and 2022, respectively.

From the perspective of cash amount, the cash distribution declared in 2022 amounted to MYR15.5 million and provided an income yield of between 4.9% and 6.2%, which was reasonably good compared to a fixed-rate deposit.

The unit trust has never initiated a unit split in the last five years, from 2019 to 2023.

In brief, the unit trust’s inconsistent cash distribution may disappoint dividend investors.

Income And Yield

| As at 31 Aug (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Interest Income | 233 | 163 | 164 |

| Dividend Income | 14,461 | 8,637 | 7,390 |

| Total Income | 14,694 | 8,800 | 7,554 |

| Average NAV | 294,804 | 311,348 | – |

| Average Yield % | 5.0 | 2.8 | – |

The table above shows the breakdown of income earned by the fund.

The PINDOSF earned income from various streams, such as interest income and income from dividends.

The PINDOSF earned a total income of MYR14.7 million in 2023 compared to MYR8.8 million in 2022, representing a year-on-year growth of 67%.

The average income yield for the financial year 2023 reached 5.0%, nearly double the yield in 2022.

This yield is good, considering the fund’s focus on long-term capital appreciation, not income.

The earned income can potentially cover expenses and contribute to cash distributions for unit holders.

Indonesian Equities

| As at 31 August (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Sectors | ||||

| Basic Materials | 10.4 | 9.7 | 15.2 | 4.3 |

| Communications | 11.0 | 10.5 | 12.0 | 9.1 |

| Consumer, Cyclical | 21.9 | 14.7 | 19.0 | 15.5 |

| Consumer, Non-Cyclical | 9.4 | 6.1 | 2.1 | 14.4 |

| Energy | 1.2 | 5.1 | 2.7 | 1.3 |

| Financial | 37.7 | 42.4 | 29.1 | 36.3 |

| Industrial | 3.2 | 5.2 | 8.7 | 9.2 |

| Total | 94.8 | 93.7 | 88.8 | 90.1 |

The Public Indonesia Select Fund (PINDOSF) allocated a much higher percentage of assets to the Consumer, Cyclical sector in fiscal 2023 compared to 2022.

At the same time, the PINDOSF significantly cut its exposure to the Financial and Energy sectors.

As presented in the table, the PINDOSF’s equity holdings within the Financial and Energy sectors reduced to 37.7% and 1.2%, respectively, as of the end of the financial year 2023.

The PINDOSF’s exposure to the Consumer, Cyclical sector stood at 21.9% as of 2023, a significant increase over 2022.

Overall, the PINDOSF’s holdings of Indonesian equities remained relatively unchanged in 2023 compared to 2022 but have significantly grown since 2020, possibly indicating a favorable Indonesian equity market.

Foreign Equities

| As at 31 August (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Countries | ||||

| Hong Kong | 1.3 | 4.8 | 1.7 | 2.2 |

| Korea | – | – | 0.9 | – |

| Singapore | – | – | 0.2 | – |

| Thailand | – | – | 0.4 | – |

| United States | – | – | 5.6 | 3.8 |

| Total | 1.3 | 4.8 | 8.8 | 6.0 |

As of 2023, the PINDOSF held only 1.3% of NAV in Hong Kong equities for equities outside of Indonesia.

PINDOSF’s holdings of non-Indonesian equities have significantly decreased since 2020, from 6% in 2020 to 1.3% in 2023.

In addition, the PINDOSF completely exited positions in Korea, Singapore, Thailand, and the United States.

Total Assets

Asset allocation for the past financial years

| As at 31 August (% Of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Investment Type | ||||

| Equity and equity-related securities | 96.1 | 98.5 | 97.6 | 96.1 |

| Deposits With Financial Institutions | 2.1 | 3.7 | 2.4 | 2.1 |

| Other Assets And Liabilities | 1.8 | -2.2 | – | 1.8 |

The Public Indonesia Select Fund (PINDOSF)’s equity portfolio has remained relatively the same between 2020 and 2023.

Similarly, the PINDOSF’s money market or deposit portfolio has remained relatively unchanged since 2020.

Cash And Deposits

| As at 31 August (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Deposits And Cash | |||

| Deposits With Financial Institutions | 6,425 | 10,680 | 8,096 |

| Cash At Banks | 9,964 | 10,368 | 94 |

| Total Deposit And Cash | 16,389 | 21,048 | 8,190 |

| Net Assets | |||

| Net Asset Value (“NAV”) | 304,666 | 284,942 | 337,754 |

| Ratio Of Total Deposit And Cash To NAV (%) | 5.4 | 7.4 | 2.4 |

The Public Indonesia Select Fund (PINDOSF)’s total deposit and cash position remained relatively the same between 2023 and 2022, but had significantly increased since 2021.

With respect to the NAV, the unit trust’s total liquidity came in at 5.4% of NAV as of 2023, slightly lower than the ratio in 2022 but double the figure in 2021.

In short, the PINDOSF’s total liquidity is reasonably modest at a ratio of 5.4% of NAV as of the end of the financial year 2023.

Top 10 Equities – Indonesia

| As at 31 August 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | ||

| Bank Mandiri | Financial | 34,446 | 11.3 |

| Bank Central Asia | Financial | 29,697 | 9.7 |

| Bank Rakyat Indonesia | Financial | 29,275 | 9.6 |

| Astra International | Consumer Cyclical | 23,979 | 7.9 |

| Bank Negara Indonesia | Financial | 17,006 | 5.6 |

| Telkom Indonesia | Communications | 16,566 | 5.4 |

| Sumber Alfaria Trijaya | Consumer Non-Cyclical | 15,063 | 4.9 |

| Erajaya Swasembada | Consumer Cyclical | 14,706 | 4.8 |

| Mitra Adiperkasa | Consumer Cyclical | 14,511 | 4.7 |

| AKR Corporindo | Consumer Cyclical | 13,651 | 4.5 |

| Total | – | 208,900 | 68.4 |

Upon initial review, the PINDOSF unit trust’s top 10 holdings consisted mainly of defensive stocks in large-cap companies within the financial, communications, and non-cyclical consumer sectors.

Equity holdings in Bank Mandiri claimed the top spot at 11.3% of NAV or MYR34.5 million, while Bank Central Asia made up 9.7% of NAV or MYR29.7 million.

At 9.6% of NAV or MYR29.3 million, Bank Rakyat Indonesia became the third largest holding in the fund.

The top 10 equity holdings in the Indonesian market alone made up 68% of the unit trust’s NAV or MYR209 million.

As a result, the performance of the Public Indonesia Select Fund (PINDOSF) will heavily rely on the return of its top 10 equities, especially those in the financial sector.

Top 10 Equities – Foreign

| As at 31 August 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | ||

| Meituan | Communications | 3,831 | 1.3 |

| Grab Holdings Limited | Communications | 105 | 0.0 |

| Total | – | 3,936 | 1.3 |

In terms of foreign equity, the Public Indonesia Select Fund (PINDOSF) held equities in Hong Kong and the U.S.

For the U.S. equities, the amount is insignificant at only MYR105,000.

Therefore, the PINDOSF’s foreign equity portfolio is mainly concentrated in Hong Kong, but only at 1.4% of the fund’s NAV or MYR3.9 million.

In short, the Public Indonesia Select Fund (PINDOSF) has limited exposure to foreign equity.

Indonesia Equities

| Number Of Shares Held As At 31 Aug (In ‘000) | ||

|---|---|---|

| 2023 | 2022 | |

| Basic Materials | ||

| Aneka Tambang | 14,487 | 5,487 |

| Barito Pacific | 100 | 21,301 |

| Indah Kiat Pulp & Paper | 110 | 300 |

| Merdeka Copper Gold | 13,218 | 6,166 |

| Vale Indonesia | 1,943 | 2,450 |

| United Tractors | 711 | 570 |

| Communications | ||

| Bukalapak.com | 120,500 | 1,000 |

| GoTo Gojek Tokopedia | 286,100 | 100 |

| Telkom Indonesia | 14,609 | 16,084 |

| XL Axiata | – | 9,600 |

| Consumer, Cyclical | ||

| AKR Corporindo | 32,075 | 10,125 |

| Mitra Adiperkasa | 24,669 | 100 |

| Astra International | 12,229 | 12,379 |

| Erajaya Swasembada | 99,535 | 83,535 |

| Consumer, Non-Cyclical | ||

| Indofood CBP Sukses Makmur | 1,660 | 1,085 |

| Indofood Sukses Makmur | 1,405 | 1,800 |

| Mitra Keluarga Karyasehat | 5,513 | – |

| Sumber Alfaria Trijaya | 17,086 | 16,886 |

| Unilever Indonesia | – | 200 |

| Energy | ||

| Adaro Energy | 4,442 | 13,642 |

| Financial | ||

| Bank Central Asia | 10,647 | 12,122 |

| Bank Rakyat Indonesia | 17,351 | 21,951 |

| Ciputra Development | 12,180 | 11,296 |

| Pakuwon Jati | 1,427 | 12,523 |

| Bank BTPN Syariah | – | 3,289 |

| Bank Jago | – | 4,443 |

| Bank Mandiri | 18,806 | 10,473 |

| Bank Negara Indonesia | 6,097 | 5,920 |

| Industrial | ||

| Indocement Tunggal Prakarsa | 50 | – |

| Semen Indonesia | 4,632 | 3,791 |

| Jasa Marga | – | 2,135 |

| Sarana Menara Nusantara | – | 1,000 |

| Wijaya Karya | – | 14,500 |

The table above tracks the numbers of equities held for Indonesian companies between 2023 and 2022 within the PINDOSF unit trust.

The most significant change is the number of shares held has significantly increased for Bukalapak.com and GoTo Gojek Tokopedia in 2023 compared to 2022.

As seen in the table, the PINDOSF held 120.5 million and 286.1 million shares in Bukalapak.com and GoTo Gojek Tokopedia as of 2023, a significant rise over 2022.

The PINDOSF has significantly cut its positions in Barito Pacific, Adaro Energy, and Pakuwon Jati.

The fund closed its position in several companies, including XL Axiata, Bank BTPN Syariah, Bank Jago, Jasa Marga, Sarana Menara Nusantara, and Wijaya Karya, as of 2023.

The fund initiated a new position in Mitra Keluarga Karyasehat as of 2023 by holding 5.5 million shares.

Foreign Equities

| Number Of Shares Held As At 31 Aug (In ‘000) | ||

|---|---|---|

| 2023 | 2022 | |

| Communications | ||

| Alibaba Group Holding Ltd (HK) | – | 184 |

| JD.com, Inc (HK) | – | 23 |

| Meituan (HK) | 50 | – |

| Grab Holdings Limited (U.S.) | 6 | 1 |

| Industrial | ||

| Sunny Optical Technology (Group) Co. Ltd (HK) | – | 7 |

The table above tracks the number of shares held for foreign equities within the PINDOSF unit trust.

As seen, the PINDOSF closed its position in Alibaba Group Holding and JD.com in 2023 but initiated a new position in Meituan in the same period.

Although the unit trust’s position in Grab Holdings Limited is small, it has significantly increased since 2022.

Unit Price Vs Benchmark

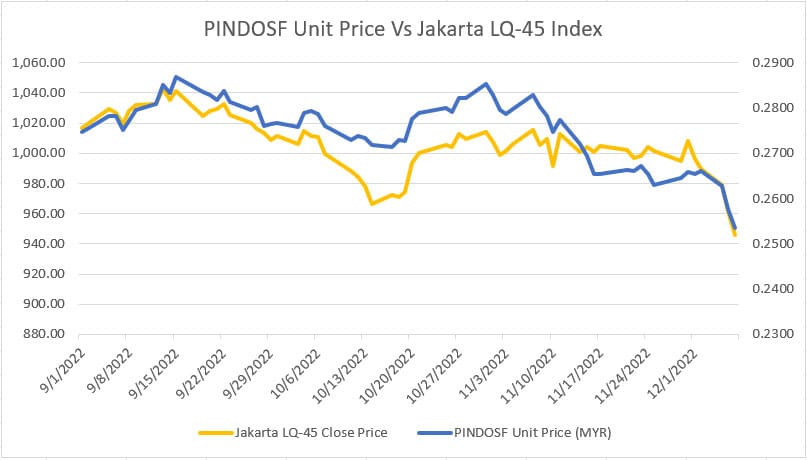

PINDOSF Unit Price Vs JKLQ45 Index

(click image to expand)

The chart above shows the plots of the Public Indonesia Select Fund (PINDOSF) unit price and the Jakarta LQ45 index.

The correlation was performed back in 2022 over three months.

The results above show that the unit price of the Public Indonesia Select Fund (PINDOSF) closely tracks the volatility of the JKLQ45 index.

Positive Correlation With Benchmark

Positive Correlation

| Positive Correlation | |||

|---|---|---|---|

| JKLQ45 Index Changes | PINDOSF Unit Price Changes In MYR | Positive Ratio | |

| Date | |||

| 11/30/2022 | 13.06006 | 0.00130 | 0.000100 |

| 11/23/2022 | 1.63000 | 0.00120 | 0.000736 |

| 11/17/2022 | 3.95996 | 0.00010 | 0.000025 |

| 11/11/2022 | 21.28998 | 0.00260 | 0.000122 |

| 11/07/2022 | 9.30005 | 0.00310 | 0.000333 |

| 11/04/2022 | 4.66998 | 0.00100 | 0.000214 |

| 10/31/2022 | 4.41998 | 0.00310 | 0.000701 |

| Average | – | – | 0.000392 |

The table above shows the correlation between the JKLQ45 index and the PINDOSF unit prices in an upward direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000392.

At this ratio, a 1-point index increment in the JKLQ45 will result in an MYR0.000392 increase in the PINDOSF unit price.

For a 10-point index increment, the PINDOSF unit trust fund will increase by MYR0.00392 or MYR0.4 cents on average.

Negative Correlation With Benchmark

Negative Correlation

| Negative Correlation | |||

|---|---|---|---|

| JKLQ45 Index Changes | PINDOSF Unit Price Changes In MYR | Negative Ratio | |

| Date | |||

| 12/07/2022 | -16.26001 | -0.00400 | 0.000246 |

| 12/06/2022 | -17.31000 | -0.00510 | 0.000295 |

| 12/05/2022 | -10.44000 | -0.00350 | 0.000335 |

| 12/01/2022 | -12.32001 | -0.00030 | 0.000024 |

| 11/25/2022 | -2.58002 | -0.00250 | 0.000969 |

| 11/22/2022 | -5.53003 | -0.00030 | 0.000054 |

| 11/16/2022 | -3.39996 | -0.00410 | 0.001206 |

| Average | – | – | 0.000385 |

The table above shows the correlation between the JKLQ45 index and PINDOSF unit prices in a downward direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000385.

The average ratio indicates that when the JKLQ45 falls by one index point, the PINDOSF unit price will fall by about MYR0.000385.

From a 10-point perspective, the PINDOSF unit price will fall by about MYR0.00385 or MYR0.4 cents on average.

Therefore, the Public Indonesia Select Fund (PINDOSF) unit price has quite a balanced sensitivity to both market rise and fall based on the average ratio of 0.000392 and 0.000385, respectively.

As a result, the PINDOSF unit trust will react nearly the same way to both a market rise and fall.

Review Summary

Advantages (Results Were Up To 31 Aug 2023, unless stated otherwise)

1. The Public Indonesia Select Fund (PINDOSF) invests in large-cap Indonesian companies with growth potential, providing investors solid returns in a developing economy.

2. The PINDOSF offers better returns on a long-term basis, averaging around 3.92% annually for ten years ended 27 Nov 2023, while the return since commencement came in at 3.56% annually.

3. The fund does not intend to provide income consistently, but it may declare a cash distribution incidentally. More importantly, the yield was quite good in the past, as seen in the table above.

Disadvantages (Results Were Up To 31 Aug 2023, unless stated otherwise)

1. The PINDOSF unit trust is concentrated on the Indonesian equity market, with an NAV ratio of 95% as of 2023, while foreign equity made up only 1.3% of NAV. Therefore, the fund had minimal foreign equity exposure.

2. The PINDOSF unit trust heavily relies on a selected number of companies, with the top 10 Indonesian equity holdings alone accounting for 68% of the fund’s NAV in 2023. This means that if the growth of the Indonesian economy or the performance of these particular companies slows down or stops, the PINDOSF is likely to suffer negative consequences.

3. The unit trust does not distribute cash dividends regularly. For example, it only declared a cash distribution in 2 of the five years between 2019 and 2023.

4. The net asset value (NAV) of PINDOSF has remained stagnant since 2020, potentially due to poor performance, overpayment of cash distribution, lack of interest from new investors, and the departure of unit holders.

References and Credits

1. All financial figures presented in this article were obtained and referenced from the following web pages:

a) Public Mutual Unit Trust Fund

b) JKLQ45 index

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor advice to purchase a security. The Public Indonesia Select Fund (PINDOSF) is not in any way sponsored, endorsed, sold, or promoted by StockDividendScreener.com.

Therefore, StockDividendScreener.com shall not be liable (whether in negligence or otherwise) to any person for any error in this article.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website so that more articles like this can be created. Thank you!