Tesla Gigafactory Shanghai. Source: Tesla Q3 2019 Update Letter.

Tesla’s automotive revenue refers to the income generated from its core business of designing, manufacturing, and selling electric vehicles.

This segment includes revenue from new vehicle sales, leasing, and automotive regulatory credits.

Additionally, it encompasses revenue from related services such as used vehicle sales, non-warranty after-sales services, paid supercharging, vehicle insurance, and retail merchandise.

However, in this article, we exclude the services income, focusing only on the automotive segment, which includes only vehicle sales and leasing, as well as automotive regulatory credits.

Let’s take a deeper look!

For other key statistics of Tesla, you may find more resources on these pages:

Sales

Revenue

Energy

Profit Margin

- Gross profit breakdown: automotive, energy, and services,

- Profit margin by segment: automotive, energy, and services,

- Gross profit and gross margin per car,

- Profit per employee,

R&D Comparison

Debt, Cash, and Liquidity

- Financial health: debt level, payment due, and liquidity,

- Cash flow and cash on hand analysis,

- Debt to equity, capital structure, and more,

- Liquidity check: current ratio, working capital, and quick ratio,

Comparison With Peers

- Marketing, advertising, and promotional spending,

- Tesla vs GM: profit margin comparison,

- Tesla vs Ford: vehicle profit and margin,

- Tesla vs BYD: profit margin comparison,

Other Statistics

- Interest expense and interest coverage ratio,

- Infrastructure expansion: supercharger stations, service fleets, and stores,

- Operating expenses breakdown analysis,

- Inventory breakdown analysis

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Automotive Segment Overview

O3. Number Of Vehicles Delivered

Consolidated Revenue

Revenue Per Car

B1. Automotive Revenue Per Car

Growth Rates

C1. Growth Rates Of Automotive Revenue

Automotive Revenue Ratio

D1. Automotive Revenue to Total Revenue Ratio

Gross Margin

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Automotive Revenue: Tesla’s automotive revenue refers to the financial income generated by the sales and leasing of Tesla’s electric vehicles. This includes revenue from selling and leasing their Model S, Model X, Model 3, and Model Y vehicles and any other automotive products or services the company offers.

Precisely, Tesla’s automotive revenue consists of two components: automotive sales and automotive leasing.

Investors interested in Tesla’s automotive sales revenue may find more information on this page: Tesla Car Sales Revenue.

Investors interested in Tesla’s leasing revenue may find more information on this page: Tesla Leasing Revenue And Leased Vehicle Sales.

Automtoive Revenue Per Car: Tesla’s automotive revenue per vehicle is calculated as:

Automotive Revenue Per Car = Total Revenue From The Automotive Segment / Total Car Deliveries

Automotive Segment Overview

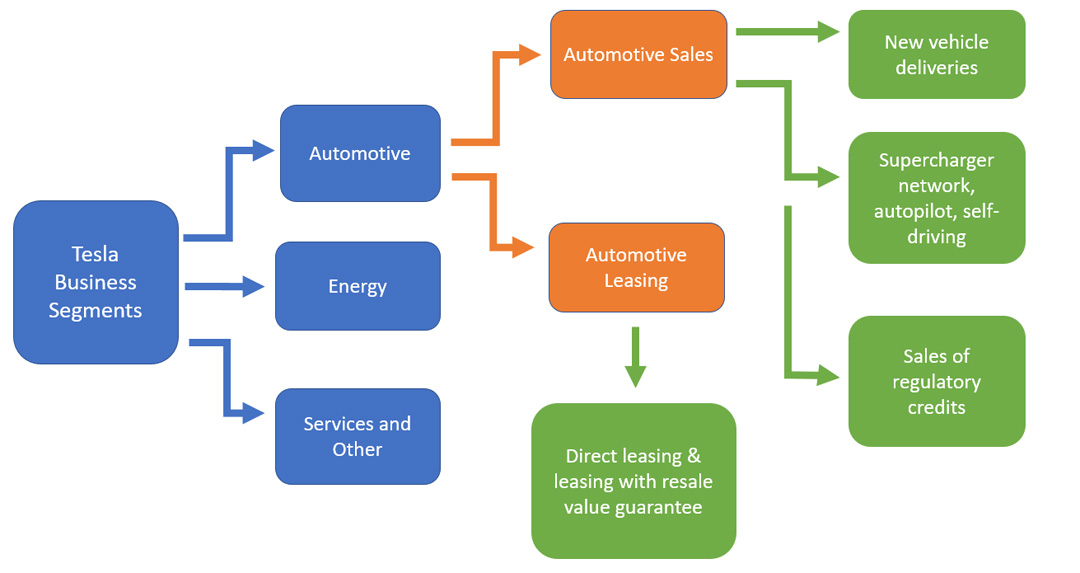

The following diagram sums up Tesla’s automotive business segment.

Tesla automotive business segment (click to enlarge)

Basically, Tesla’s automotive sector consists of two major segments: automotive sales and automotive leasing.

The automotive sales segment gets its revenue from new vehicle deliveries, charging and self-driving services, as well as the sale of carbon credits.

On the other hand, the automotive leasing segment gets its revenue from vehicle leasing, which is further divided into direct leasing and leasing with a resale value guarantee.

Number Of Vehicles Delivered

Tesla vehicle delivery figures as of 2024

| As at 31 Dec | |||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | |||

| Total Deliveries | 499,647 | 936,222 | 1,313,851 | 1,808,581 | 1,789,226 | ||

Tesla’s total vehicles delivered in 2024 topped 1.8 million units worldwide, helped significantly by Model 3 and Model Y.

Total Automotive Revenue

Tesla-automotive-revenue

(click image to expand)

More information about Tesla’s automotive revenue is available here: automotive revenue.

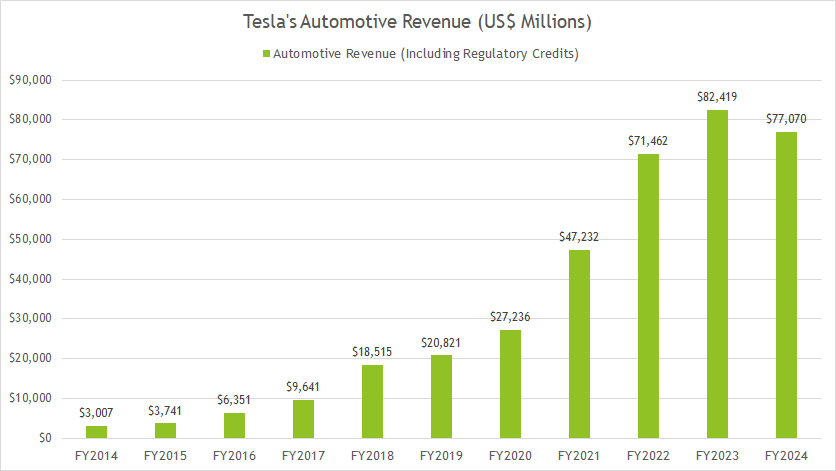

Tesla experienced the first decline in automotive revenue in fiscal year 2024, down by 6.5% year-over-year, as shown in the chart above.

The following table shows more detailed results:

Automotive Revenue in FY2024:

| Category | Revenue |

|---|---|

| (US$ Billions) | |

| Automotive | $77.1 |

3-Year Trend from FY2021 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Automotive | $47.2 to $77.1 | +63.2% |

5-Year Trend from FY2019 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Automotive | $20.8 to $77.1 | +270.2% |

10-Year Trend from FY2014 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$ Billions) | ||

| Automotive | $3.7 to $77.1 | +2463.0% |

Automotive Revenue Per Car

Tesla-automotive-revenue-per-car

(click image to expand)

More information about Tesla’s automotive revenue per car is available here: automotive revenue per car.

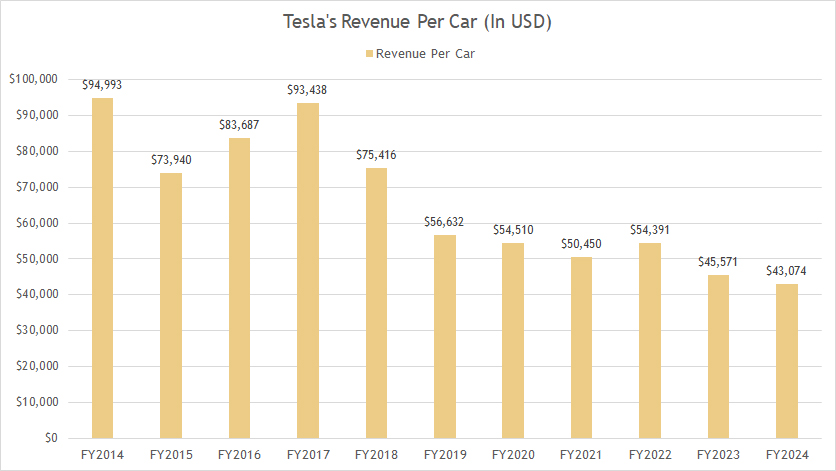

Tesla’s automotive revenue per vehicle has significantly been on the decline, even though the total sum of automotive revenue has considerably risen, as shown in the chart above.

The following table shows more detailed results:

Automotive Revenue Per Car in FY2024:

| Category | Revenue |

|---|---|

| (US$) | |

| Automotive Revenue Per car | $43,074 |

3-Year Trend from FY2021 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$) | ||

| Automotive Revenue Per Car | $50,450 to $43,074 | -14.6% |

5-Year Trend from FY2019 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$) | ||

| Automotive Revenue Per Car | $56,632 to $43,074 | -23.9% |

10-Year Trend from FY2014 to FY2024:

| Category | Revenue | % Changes |

|---|---|---|

| (US$) | ||

| Automotive Revenue Per Car | $94,993 to $43,074 | -54.7% |

Growth Rates of Automotive Revenue

Tesla-automotive-revenue-YoY-growth-rates

(click image to expand)

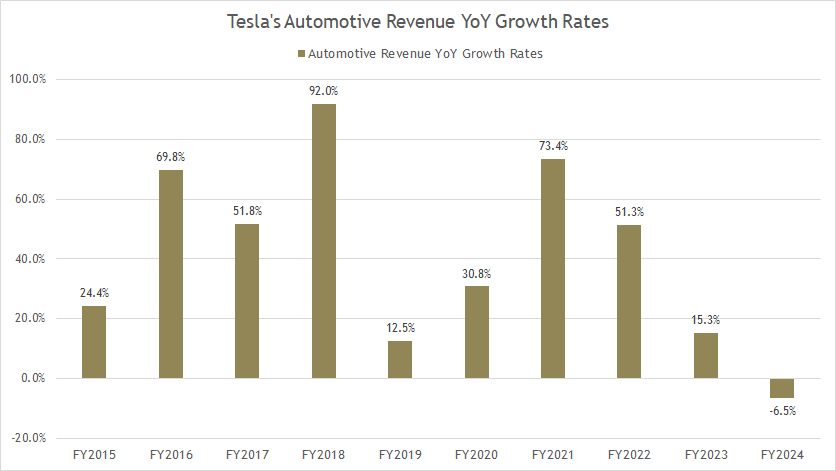

Tesla recorded its first automotive revenue decline in a decade during fiscal year 2024, as illustrated in the chart above.

The following table shows more detailed results:

Automotive Revenue Growth in FY2024:

| Category | Growth Rate (%) |

|---|---|

| Automotive Revenue | -6.5% |

3-Year Average from FY2022 to FY2024:

| Category | Growth Rate (%) |

|---|---|

| Automotive Revenue | +20.0% |

5-Year Average from FY2020 to FY2024:

| Category | Growth Rate (%) |

|---|---|

| Automotive Revenue | +32.9% |

10-Year Average from FY2015 to FY2024:

| Category | Growth Rate (%) |

|---|---|

| Automotive Revenue | +41.5% |

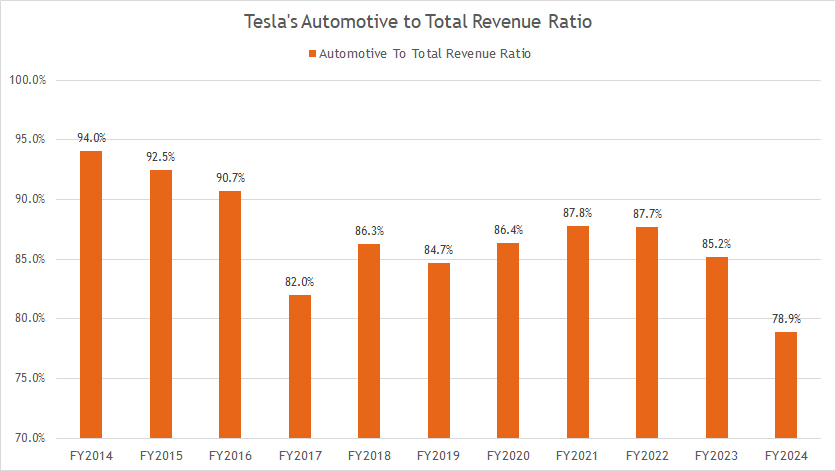

Automotive Revenue to Total Revenue Ratio

Tesla’s automotive revenue to total revenue ratio

(click image to expand)

With respect to the total revenue, Tesla’s automotive revenue represents a considerable amount of sales, as shown in the chart above.

The following table shows more detailed results:

Automotive Revenue Share in FY2024:

| Category | Revenue Share (%) |

|---|---|

| Automotive Revenue | 78.9% |

3-Year Trend from FY2021 to FY2024:

| Category | Revenue Share (%) | % Point Changes |

|---|---|---|

| Automotive Revenue | 87.8% to 78.9% | -8.9% |

5-Year Trend from FY2019 to FY2024:

| Category | Revenue Share (%) | % Point Changes |

|---|---|---|

| Automotive Revenue | 84.7% to 78.9% | -5.8% |

10-Year Trend from FY2014 to FY2024:

| Category | Revenue Share (%) | % Point Changes |

|---|---|---|

| Automotive Revenue | 94.0% to 78.9% | -15.1% |

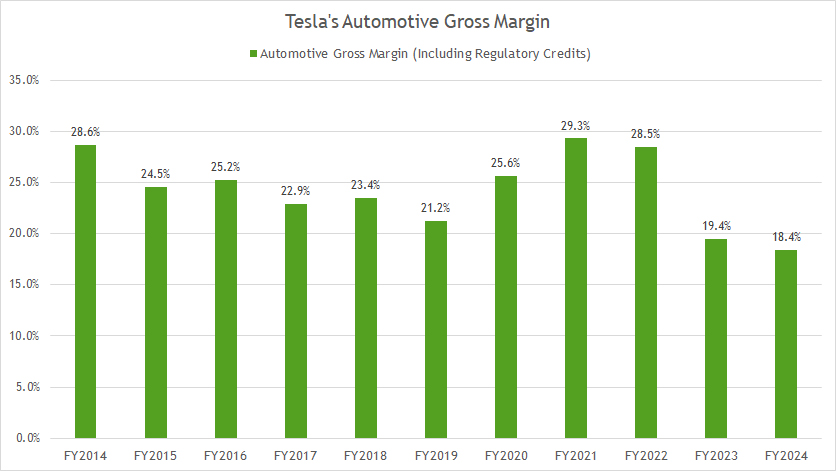

Automotive Gross Margin

Tesla-automotive-gross-margin

(click image to expand)

Tesla’s automotive gross margin reached its lowest level of 18.4% as of fiscal year 2024, down significantly from its peak level of over 29% measured in fiscal year 2021.

The following table shows more detailed results:

Automotive Gross Margin in FY2024:

| Category | Gross Margin (%) |

|---|---|

| Automotive | 18.4% |

3-Year Trend from FY2021 to FY2024:

| Category | Gross Margin (%) | % Point Changes |

|---|---|---|

| Automotive | 29.3% to 18.4% | -10.9% |

5-Year Trend from FY2019 to FY2024:

| Category | Gross Margin (%) | % Point Changes |

|---|---|---|

| Automotive | 21.2% to 18.4% | -2.8% |

10-Year Trend from FY2014 to FY2024:

| Category | Gross Margin (%) | % Point Changes |

|---|---|---|

| Automotive | 28.6% to 18.4% | -10.2% |

Insight

Tesla’s automotive revenue, which has long been a key driver of the company’s financial success, experienced its first decline in a decade in fiscal year 2024, falling by 6.5% year-over-year. This marks a significant shift for the company, signaling potential headwinds in its core business.

The decline in revenue coincided with a drop in vehicle deliveries, which fell slightly to 1.79 million units, reflecting intensified competition, pricing pressures, and macroeconomic challenges affecting consumer demand.

A deeper look into Tesla’s revenue trends shows that, while its total automotive revenue has grown substantially over the years, reaching $77.1 billion in fiscal year 2024, the company’s revenue per vehicle has steadily declined. Tesla’s average revenue per car dropped to $43,074 in fiscal year 2024, down by nearly 15% over the last three years.

This trend indicates a shift toward more affordable models and price cuts aimed at sustaining demand amid increasing global competition. The company’s gross margin also saw a sharp decline, dropping to 18.4%, its lowest level in years, further underscoring profitability concerns

One contributing factor to this slowdown is the growing presence of rival automakers in the electric vehicle (EV) market. Companies such as BYD, Hyundai, and legacy automakers like Ford and GM have aggressively expanded their EV offerings, resulting in greater price competition. Additionally, Tesla’s recent price reductions—while driving sales volume—have squeezed margins, reducing overall profitability.

Despite these challenges, Tesla continues to push forward with global expansion efforts, particularly in China and Europe, where demand for EVs remains strong. The company is also focusing on innovations such as autonomous driving technology and energy storage solutions to diversify its revenue streams beyond automotive sales. However, the decline in revenue growth raises concerns about Tesla’s ability to maintain its dominant position in the EV market without sacrificing profitability

Tesla’s strategic response to these financial pressures will be critical in determining its long-term trajectory. The company may need to rethink its pricing strategy, improve cost efficiencies, and further develop alternative revenue sources such as energy products and software-based services. As the global EV market continues to mature, Tesla faces the challenge of balancing growth and profitability while navigating an increasingly competitive landscape.

References and Credits

1. All financial figures presented were obtained and referenced from Tesla’s quarterly and annual reports, and update letters published on the company’s investor relations page: Tesla Investor Overview.

2. Flickr Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.