Nikola One. Source: nikolamotor.com

Nikola Corporation (NASDAQ:NKLA) is an emerging automobile company that designs and manufactures state-of-the-art battery-electric and hydrogen fuel cell electric vehicles, electric vehicle drivetrains, energy storage systems and hydrogen fueling stations.

The company has only started trading its common stocks with the ticker NKLA in June 2020.

Nikola Corporation’s peers and competitors include automobile companies such as Tesla, Ford and General Motors.

According to the company’s latest quarterly filings dated March 31, 2021, it does not pay a dividend and has never done so.

Here is an excerpt extracted from the 1Q 2021 filings regarding Nikola’s dividend policy:

- Expected Dividend Yield – The dividend rate used is zero as the Company does not have a history of paying dividends on its common stock and does not anticipate doing so in the foreseeable future.

In other words, Nikola Corporation will retain all the profits and cash generated from business operations, if there are any.

As such, Nikola’s investors can only expect to make a gain from the price appreciation on the common stocks.

There are a number of reasons that the company does not pay dividends.

In this article, we are going to find out why Nikola Corporation does not pay a dividend while other automobile companies such as Ford and General Motors have a history of paying out dividends.

Without further ado, let’s dive in!

Nikola Corporation’s Stock Dividend Topics

1. Total Revenue

2. Gross Profit

3. Operating Income

4. Net Income

5. Earnings Per Share

6. Net Cash From Operations

7. Summary

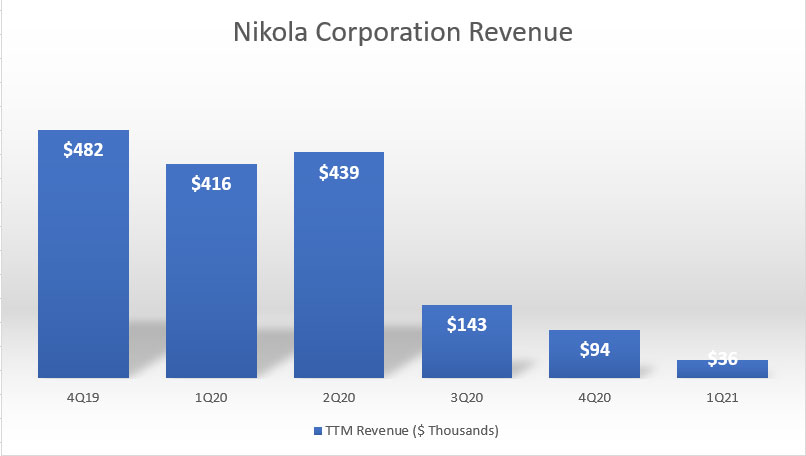

Nikola Corporation’s Total Revenue

Nikola’s revenue

Let’s first look at the company’s TTM revenue to find out about Nikola’s sales.

According to the chart above, Nikola’s TTM revenue totaled only $36,000 as of fiscal 1Q 2021, probably a little low for a company with a market cap of more than $6 billion, let alone for paying a cash dividend.

Keep in mind that this revenue did not come from Nikola’s primary operation of selling EVs.

Instead, it came from solar installation projects that will be phased out soon.

Besides, dividends are not paid out of revenue but from profits and cash flow which we are going to look at in the subsequent discussion.

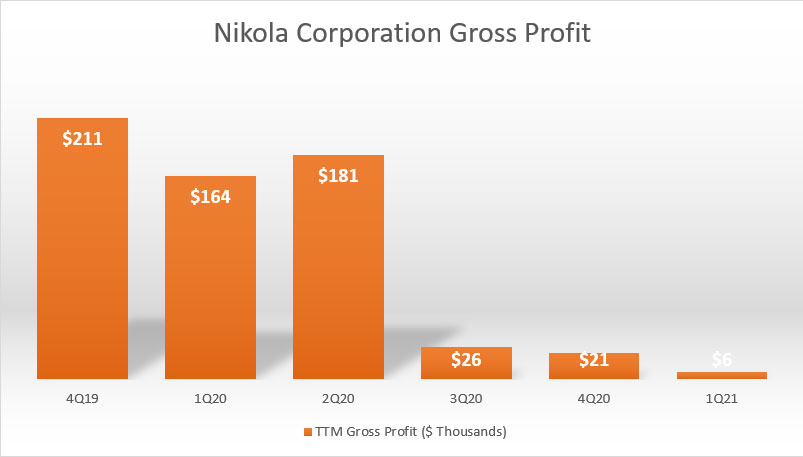

Nikola Corporation’s Gross Profit

Nikola’s gross profit

Accordingly, Nikola’s TTM gross profit totaled only $6,000 as of fiscal Q1 2021.

The amount of gross profit was way too little for Nikola to initiate a dividend payout.

Similar to the revenue trend, Nikola’s TTM gross profit has also been on a decline and will soon be phased out as the company does not intend to make solar installation a long-term operation.

By then, Nikola will not have any profit to support itself, let alone a dividend payment.

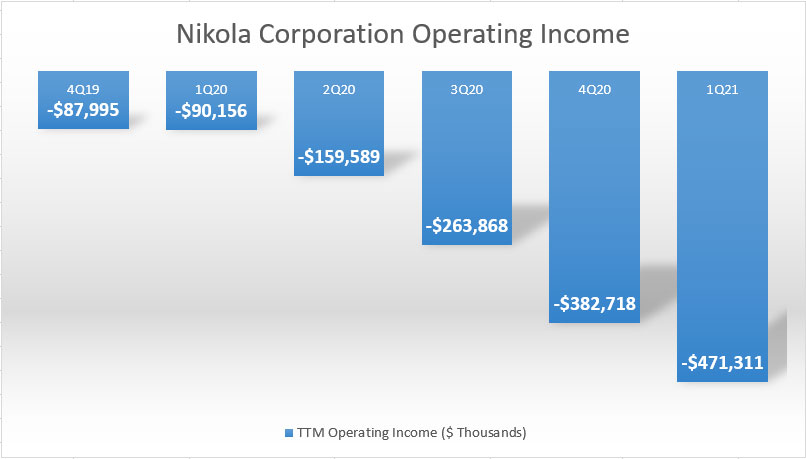

Nikola Corporation’s Operating Income

Nikola’s operating income

In terms of operating income, we can see that Nikola has been having operating losses since fiscal 2019 according to the chart.

To make matter worse, Nikola’s operating losses have been getting larger and totaled as much as $471 million as of fiscal 2021 Q1 on a TTM basis.

In other words, Nikola Corporation has incurred nearly half a billion operating losses as of fiscal 2021 Q1 for the past 12 months.

Since Nikola has not made any money in the past and does not expect to make any soon, the company certainly can’t pay out a dividend out of losses.

Additionally, Nikola will probably be making losses in the foreseeable future considering that its 1st battery-electric truck will only be available by the end of 2021 and the production of fuel cell EV trucks will only start in 2023.

Here is an excerpt extracted from the 2Q 2020 quarterly filings regarding Nikola’s production and delivery pipeline:

-

FCEV Trucks

Approximately twelve months from commercial production in second half of 2023, we plan to require existing and

new FCEV reservations to become binding with deposits. As of June 30, 2020, we had approximately 14,000 reservations for FCEV trucks, of which up to 800 trucks are subject to a binding commitment with Anheuser Busch LLC. These reservations are cancellable until the customer enters into a lease agreement, or in the case of Anheuser Busch, to the extent our trucks do not meet the vehicle specifications and delivery timelines specified in the contract.BEV Trucks

We only accept binding orders with deposits on BEV trucks, which are negotiated on a case by case basis since the expected delivery is in the late 2021.

The latest forward-looking statement announced by Nikola in fiscal 1Q 2021:

-

=> Start of vehicle trial production at the JV manufacturing facility at IVECO’s industrial complex in Ulm, Germany in

June 2021;=> Start of vehicle trial production at the greenfield manufacturing facility in Coolidge, Arizona in July 2021;

=> Deliver the first Nikola Tre BEVs to customers during the fourth quarter of 2021.

Therefore, Nikola is expected to only deliver its 1st vehicle to customers by the end of 2021 according to the forward-looking statements above.

In short, Nikola does not currently have any profit to pay out a dividend, and may probably do so when its 1st vehicle is available by the end of 2021.

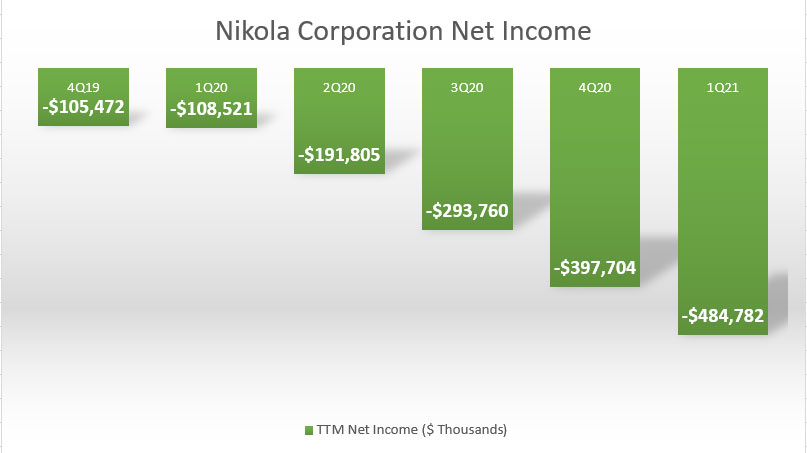

Nikola Corporation’s Net Income

Nikola’s net income

In terms of net profit, Nikola suffered an even greater loss as of fiscal Q1 2021.

According to the chart above, Nikola’s TTM net income totaled as much as -$485 million, an increase of nearly $100 million of net loss compared to the prior quarter.

In other words, Nikola has lost close to half a billion in fiscal Q1 2021 on a TTM basis.

There is no way for Nikola to initiate a dividend-paying policy now when its net loss has been worsening and will continue for the foreseeable future.

Nikola Corporation’s Earnings Per Share (EPS)

Nikola’s earnings per share

On a per-share basis, Nikola’s EPS totaled -$1.35 as of fiscal 2021 Q1, illustrating the extent of the loss that the company is having now.

Since fiscal 2019, Nikola’s loss per share has been worsening and reached the largest figure in fiscal 1Q 2021.

Therefore, from the earnings per share perspective, Nikola is fundamentally incapable of starting a dividend policy now.

Nikola Corporation’s Operating Cash Flow

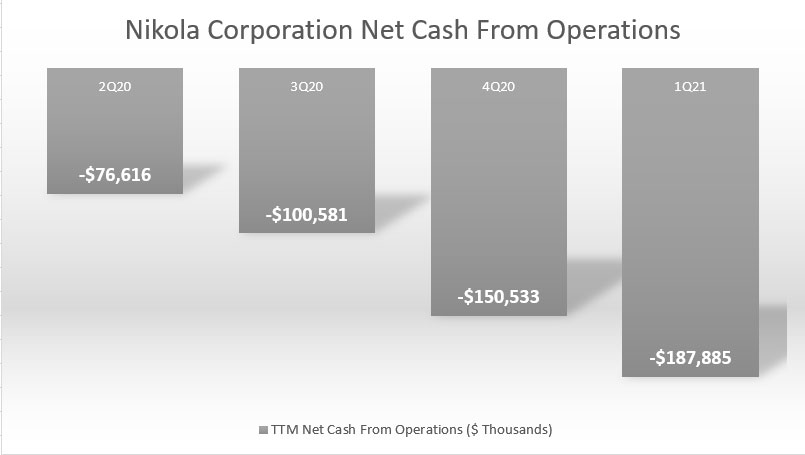

Nikola’s net cash from operations

Cash is the most important factor for a dividend-paying company.

Particularly, operating cash flow is the metric that most investors use to gauge the amount of cash generated by a company’s core operation.

That said, according to the chart above, Nikola’s TTM net cash from operations has been worsening and reached as low as -$188 million as of fiscal Q1 2021.

At this level of cash flow, Nikola’s core operation was consuming cash instead of producing it.

Since dividends are paid out of cash, Nikola has no cash to spare for dividends as its business alone is consuming more cash than it can produce.

Therefore, Nikola’s business operation has not been able to produce any extra cash that can be used to pay a dividend.

Additionally, Nikola is surviving on whatever cash on hand that the company has at the moment since its business is not producing any extra cash.

Any spare cash that the company has now is extremely valuable for its survival.

Therefore, Nikola should not use its existing cash on hand to pay dividends.

Doing so will only put the company at risk of going into bankruptcy.

Summary

From all of the analysis that covers from revenue to net profit and to cash flow, Nikola Corporation has neither profit nor the necessary operating cash flow to initiate a dividend payout.

Nikola does not even have any revenue generated from EV sales as of fiscal 2021 Q1.

So far, all of the revenue generated came entirely from solar installations.

Besides, Nikola’s losses will most likely persist, if not worsen, in the foreseeable future, judging from the fact that its 1st BEV truck will only be available by the end of 2021.

In short, investors of Nikola’s common stocks can only hope for a price appreciation.

For now, investors should not expect Nikola to pay a dividend, not until when the company has its 1st BEV truck delivered in 2021.

Until then, we will look at the company’s fundamentals again to see how it performs in terms of profitability and cash flow.

References and Credits

1. Financial figures in this article were obtained and referenced from Nikola’s annual and quarterly filings available in NKLA Earnings Presentations.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Nikola One and Money.

Other Statistics That May Help You

Disclosure

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.