To Infinity… and Beyond! (Burger). Source: Flickr Image

A company’s liquidity is often one of the most discussed topics.

That’s because the life or death of a company is closely related to its liquidity.

That said, liquidity is not the same as profitability.

A company can still be profitable despite having a cash flow problem.

The same can be said for Beyond Meat. The company has been one of my favorites and it has also been on my radar for quite some time.

However, it has been trading at a very high market valuation and the stock price is still not within my buy zone yet.

Nonetheless, Beyond Meat is one of the most innovative food companies on earth and possibly the fastest growing too.

In this article, we will talk about a couple of Beyond Meat’s liquidity metrics which includes the current ratio, working capital and quick ratio.

Without further delay, let’s get started!

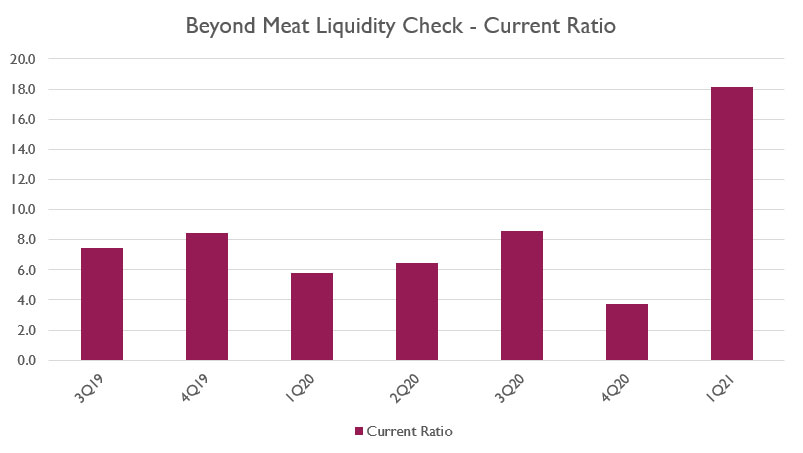

Beyond Meat’s Current Ratio

Beyond Meat’s current ratio

The chart above shows Beyond Meat’s current ratio for the period from fiscal 2019 to fiscal 2021.

Current ratio is derived from the following equation:

Current Ratio = Total Current Assets / Total Current Liabilities

The current ratio is one of the most used metrics when it comes to measuring a company’s short-term liquidity.

From the equation, the ratio compares the company’s existing current assets with the respective current liabilities that will come due within the next 12 months or 1 year.

As such, the current ratio measures the ability of a company to cover its short-term liabilities.

That said, Beyond Meat’s current ratio from fiscal 2019 to fiscal 2021 averages more than 8X, which is considered extraordinary.

As of fiscal 2021 1Q, Beyond Meat has the best liquidity ratio since fiscal 2019, as shown by the 18X current ratio.

At this level of current ratio, Beyond Meat’s current assets are 18 times the amount of current liabilities, suggesting that the company has enough short-term liquidity to deal with the coming liabilities.

As we all know, current assets equal highly liquid assets or the working capital of the company.

In Beyond Meat’s case, it means that the company’s liquid assets are more than enough to cover the coming liabilities that will come due in the next 12 months.

Despite being disrupted by the COVID-19 outbreak since fiscal 2020, Beyond Meat’s liquidity has been holding up, indicating that the company has been able to weather the COVID storm comfortably.

In short, Beyond Meat has more than enough liquid assets to pay for creditors for the next 12 months.

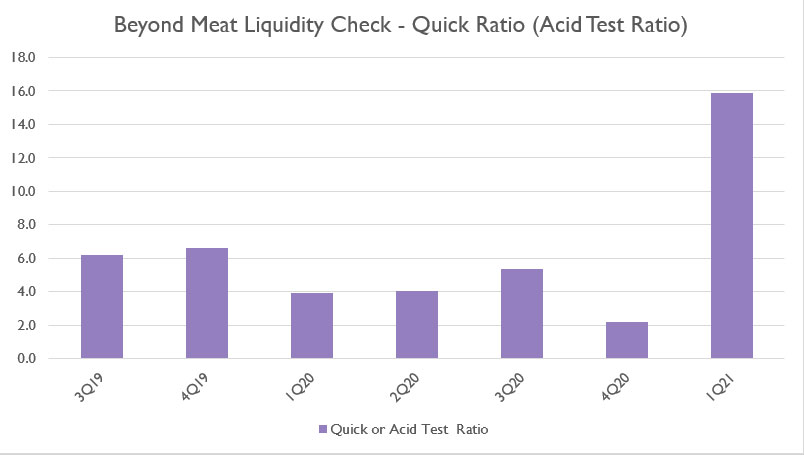

Beyond Meat’s Quick Ratio

Beyond Meat’s quick ratio or acid test ratio

To measure Beyond Meat’s liquidity under the most extreme condition, we can use the quick ratio or acid test ratio which measures the company’s adjusted current assets with respect to current liabilities.

The formula for calculating the quick ratio is the same as the one used for the current ratio, except for the portion where current assets have been adjusted to use only highly liquid assets such as cash or near-cash assets.

In Beyond Meat’s case, highly liquid assets are cash and cash equivalents as well as accounts receivable.

Other current assets that are not as liquid as cash such as inventories and prepaid expenses are excluded in the quick ratio or acid test ratio calculation.

As such, the quick ratio or acid test ratio measures Beyond Meat’s short-term liquidity under the most extreme condition when only highly liquid assets are used to cover short-term liabilities that will come due in the next 12 months or 1 year.

According to the chart above, Beyond Meat’s quick ratio or acid test ratio averages around 6X, which is slightly below the average current ratio of 8X.

The lower quick ratio is expected since a portion of Beyond Meat’s current assets has been excluded during the measurement of the ratio.

Despite having a lower average quick ratio, Beyond Meat’s liquidity is still considered to be outstanding given that the company’s highly liquid assets, mostly cash and cash equivalents, are 6 times more than the respective total current liabilities.

Additionally, Beyond Meat’s liquidity increased significantly in fiscal 2021 1Q, as reflected by the 16X quick ratio.

In this case, Beyond Meat’s cash and cash equivalents were 16X more than the total current liabilities.

All in all, Beyond Meat has enough highly liquid assets, cash, in particular, to deal with the coming liabilities for the next 12 months.

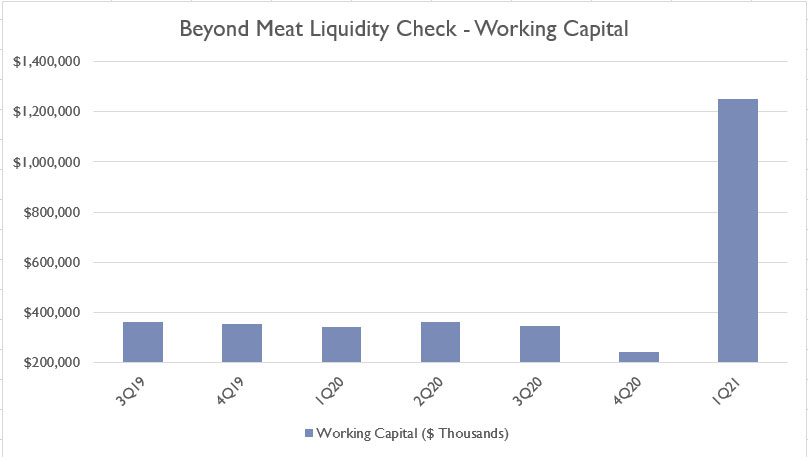

Beyond Meat’s Working Capital

Beyond Meat’s working capital

For your information, working capital is calculated using the following formula:

Working Capital = Current Assets – Current Liabilities

Therefore, working capital is the excess of current assets after accounting for the respective current liabilities.

For Beyond Meat, the company has positive working capital in most fiscal quarters, with the latest one having the highest figure, notably at more than $1.2 billion even after accounting for the respective current liabilities.

Prior to fiscal 2021 1Q, Beyond Meat’s working capital was seen dipping significantly to slightly more than $200 million, a 30% decline compared to the figure reported a year ago.

To make matter worse, Beyond Meat also has been having negative operating cash flow as far as the company has existed, meaning that the business operation has been consuming cash rather than producing it.

Therefore, the declining working capital was not an option for Beyond Meat as the company may face a liquidity crunch if it ran out of working capital.

With working capital running low, Beyond Meat went to the capital market to raise cash through a $1 billion debt offering in fiscal 2021 1Q.

As a result, Beyond Meat’s working capital significantly increased in fiscal 2021 1Q to more than $1.2 billion as a result of the capital raise.

In short, Beyond Meat will have enough working capital going forward given that its cash and cash equivalents alone total more than $1 billion in the latest quarter.

Summary

In summary, Beyond Meat should not have any liquidity issues in the near term, judging from the higher than average current ratio, quick ratio and working capital.

In fact, Beyond Meat’s liquidity has been mostly in highly liquid assets such as cash and cash equivalents and accounts receivable throughout most of the financial periods, suggesting that the company has no issue in covering all short-term debt even under the most extreme condition when only cash is available.

This said, Beyond Meat’s investors should be able to sleep sound upon knowing about the company’s abundant liquidity.

Nonetheless, investors still need to keep a watchful eye on the company’s cash flow such as operating and free cash flow since the company has been cash-flow negative all the while.

References and Credits

1. All financial figures in this article were obtained and referenced from Beyond Meat’s financial statements which are available in BYND Annual and Quarterly Reports.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Frans de Wit and Jo.

Other Stock Analysis That You May Find Helpful

- What makes up General Motors’ capital structure?

- Explore Tesla’s liquidity from the current ratio and working capital

- Are Ford’s truck and SUV sales in the U.S. heading lower?

- Jack In The Box’s sales and profits are doing much better during the COVID age

- Tesla’s improving return on equity and return on assets ratio will drive stock price higher

Disclosure

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.