GM Hummer H2

When I published this article in early April 2021, General Motors (NYSE:GM) stock price was traded close to $60 per share.

At this price, GM’s market cap was well over $80 billion, nearly 60% higher than the market cap of Ford (NYSE:F).

Additionally, at $60 per share, GM’s stock price was at an all-time high.

Year to date, GM’s stock has gained almost 50%, which is quite extraordinary considering that we are only 4 months into 2021.

So, is GM stock still worth buying at $60 per share?

Well, it depends on what you are looking for.

In this article, we will discuss General Motors’ stock investment based on 4 criteria, and they are as follows:

2. Growth

3. Income, and

4. Company fundamentals.

Let’s get started!

Valuation

First, we dive into General Motors’ valuation to see how stretched the stock valuation is compared to its historical values.

There are a few ratios that I used to evaluate GM’s stock valuation and they are price to sales, price to book value, price to net profit, price to EBIT, price to free cash flow, etc.

When this article was published, GM was having mixed results in terms of these valuation ratios.

For example, GM’s price to sales and price to book values were at an all-time high, pointing to a stretched valuation with respect to both revenue and equity.

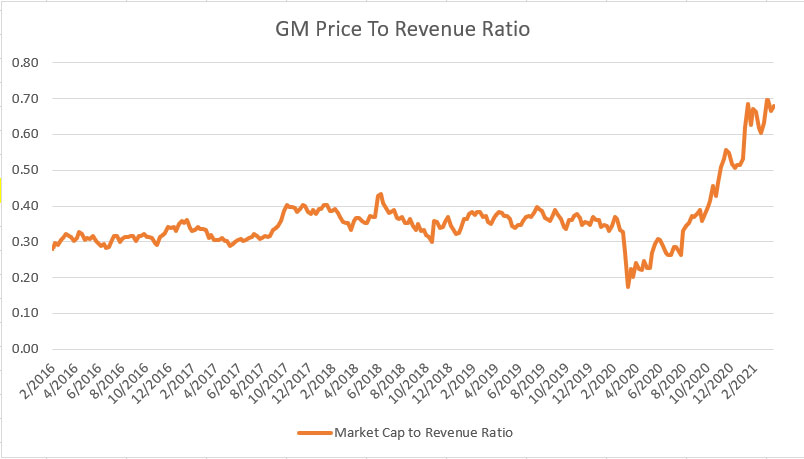

GM price to revenue ratio

As shown in the chart above, GM’s price to sales ratio was at 0.70 as of April 2021, which was nearly 100% above its historical value of 0.35.

GM’s recent surging stock price coupled with the declining TTM revenue has contributed to the record high price to sales ratio.

Additionally, GM’s stock was priced at about 1.7 times its book value or equity value as of April 2021, also a record high for the company.

While GM may have reached a sky-high valuation with respect to revenue and book value, it was a different case for net income and free cash flow as well as a couple more ratios.

For example, GM’s stock was traded at about 13 times its TTM net income and about 7 times its TTM free cash flow in April 2021.

These results were significantly below the peak values reported in Q4 2020, indicating that GM’s fundamentals have actually improved by leaps and bounds since the end of 2020.

So, on a valuation basis, GM’s stock is NOT a buy at $60, in my opinion, even though the company has improved significantly in terms of financial health and business prospects as shown in some of the declining valuation ratios, including the price to net income ratio, price to EBIT and the price to cash flow ratio.

In other words, GM’s stock has gained too much and too fast in a short period of time and it is not cheap enough to warrant a buy now.

At $60 per share or over $80 billion in market capitalization, GM’s stock price looks stretched and it will stumble dramatically if the company’s electrification ambition fails to play out as planned by the company.

Besides, GM’s stock price is definitely not on the cheap side at $60 per share and it’s even slightly expensive by all measures.

Also, we do not know yet whether GM’s recently launched battery electric vehicle models will outsell and gain market share against more established models including those that come from Tesla and Volkswagen.

Additionally, GM’s TTM sales were still way below its historical average based on its latest result in 4Q 2020 which means the company’s existing products have so far failed to gain any traction.

Other than the depressed revenue, GM and a host of other automakers are facing an unprecedented problem in which there is a shortage of microchips that go into their vehicles.

Currently, it’s hard to predict how the shortage of semiconductor chips will play out in the near term and how it will materially impact General Motors.

As of now, there are just too many uncertainties plaguing General Motors.

Therefore, I say that we wait out a little longer for a better entry point for GM’s stock.

Growth

Is General Motors a growth stock? Definitely a NO.

Over the past several years, GM has not been able to play out as a growth stock.

The investment into GM’s stock has been more on income as the company paid out quite a generous cash dividend.

A look into GM’s vehicle deliveries will explain why the company has not been a growth stock.

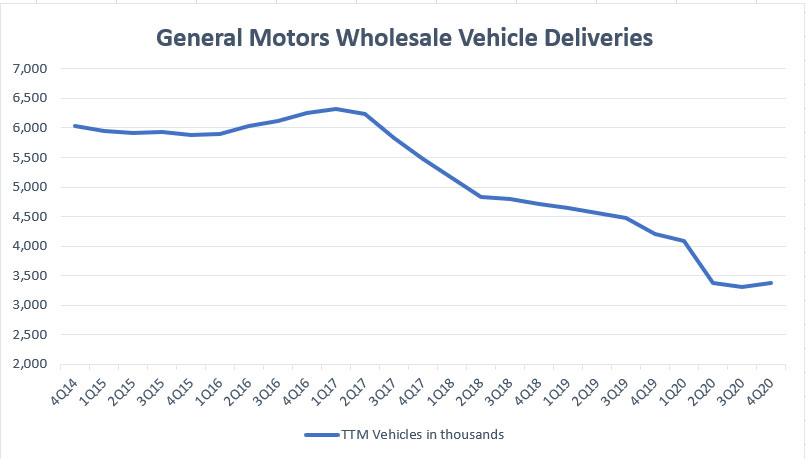

The following chart shows GM’s wholesale vehicle deliveries on a historical basis.

GM wholesale vehicle deliveries

Do you see any GM’s growth story in the plot above?

According to the chart, GM’s vehicle wholesale has been going downhill in the past 6 years and reached a record low of only 3.5 million vehicles as of 2020 Q4.

On a long-term basis, GM has not been able to lift the demand for its products as reflected in the continuous slide of the TTM plot in the chart.

If GM has persistently failed to make a breakthrough in the past, what makes you think the company will make it in the future?

GM may have hit the bottom in terms of wholesale vehicle deliveries but it’s still a big question mark going forward.

Yes, GM has rolled out several head-turning battery electric vehicles, including the super HUMMER EV SUV, in recent quarters and has even teamed up with Microsoft to commercialize self-driving vehicles, but all of these actions have so far failed to drive sales in a meaningful way.

As of 2020 4Q, GM’s TTM wholesale vehicle sales continued to dive to a record low while TTM revenue has reversed the dive and gone slightly higher for the 1st time when hitting rock bottom in 2Q 2020.

While GM’s TTM revenue may have reversed the plunge, it was still significantly below its historical average on a TTM basis.

Therefore, in my opinion, GM’s recent initiatives, including the introduction of new battery-electric vehicles as well as other joint ventures in the autonomous space, have yet to be seen as a growth driver.

Income

General Motors used to pay out a generous cash dividend that yields around 4%.

GM’s common stockholders have received quarterly dividend payments continuously since 2014.

Unfortunately, the company has suspended the dividend payout since 2Q 2020 due mainly to the COVID-19 pandemic.

As of April 2021, GM’s dividend suspension was still in effect.

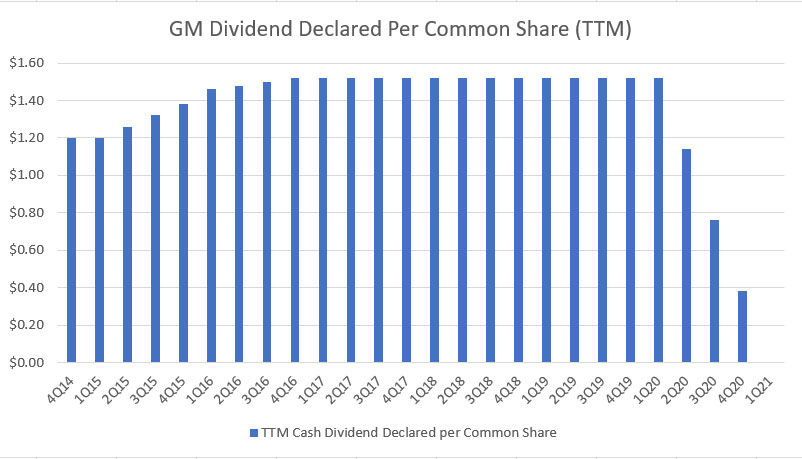

As a result, GM has become a non-dividend-paying stock now as shown in the following TTM plot:

GM TTM cash dividends

According to the chart above, GM’s dividend declared per common share has come to $0.00 as of 1Q 2020 on a TTM basis.

GM has failed to resume its cash dividends for more than 12 months or 4 quarters in a row and hence, the $0.00 payout as of 1Q 2020 on a TTM basis.

While GM has suspended its cash dividends consecutively in 4 quarters, GM may possibly resume its dividend in 2Q 2021.

The reason is that GM has fully paid back all amounts drawn under its revolving credit facilities as of Dec 2020 as shown in the following quote extracted from GM’s 4Q 2020 annual report:

-

In 2020, we borrowed $3.4 billion against our three-year, $4.0 billion facility, $2.0 billion against our three-year, $2.0 billion transformation facility and $10.5 billion against our five-year, $10.5 billion facility.

We repaid all amounts drawn under the revolving credit facilities as of December 31, 2020.

We had letters of credit outstanding under our sub-facility of $0.3 billion and $0.2 billion at December 31, 2020 and 2019.

According to GM, the company is restricted from paying dividends on common shares if outstanding borrowings under the revolving credit facilities exceed $5 billion.

Since GM has fully paid back its debt under the revolving credit facilities, the restriction on paying a dividend has now been lifted.

Therefore, it’s only a matter of time before GM resumes the cash dividends again in the near future.

Income seekers may want to consider GM’s stock again when the company resumes its dividends.

However, GM is still a non-dividend-paying stock as of April 2021.

If you are seeking income from GM, the stock is definitely not a buy now when it’s trading at $60 per share, a rather expensive valuation according to several valuation metrics that we discussed.

Fundamentals

From a fundamental perspective, GM’s results have improved quite significantly as of 2020 Q4 compared to when the COVID-19 first struck the automotive sector in 1Q 2020.

For example, GM’s automotive debt has gone significantly lower in 4Q 2020 compared to 1Q 2020 when the company started to incur short-term borrowings in preparation for a looming liquidity crisis.

That said, GM has repaid all short-term borrowings under its revolving credit facilities as of 2020 Q4.

Additionally, GM’s debt leverage has gone significantly lower in the 4th quarter of 2020 as shown in the total debt to equity ratio.

In particular, GM’s automotive debt leverage has already reverted to its pre-COVID level as of 2020 4Q.

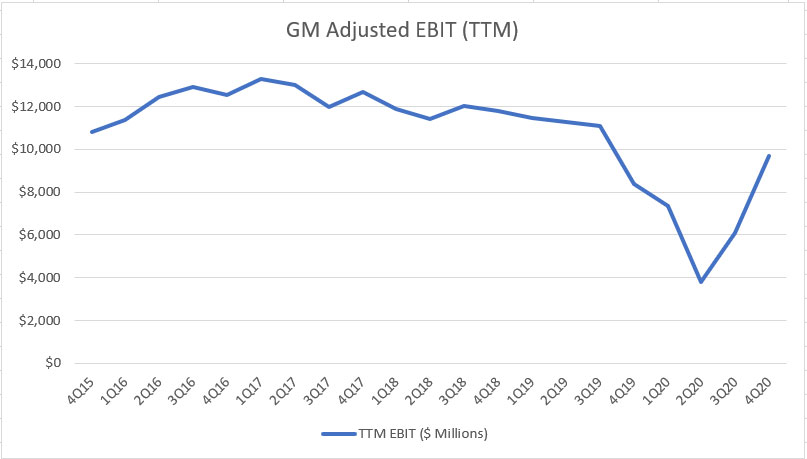

In terms of profitability, GM experienced a V-shape recovery for its adjusted EBIT as shown in the following chart.

GM TTM adjusted EBIT

According to the chart above, GM’s TTM adjusted EBIT bottomed out in 2Q 2020 and the plot continued to surge in subsequent quarters and reached nearly $10 billion as of 2020 Q4.

While GM’s adjusted EBIT has surged in the past 2 quarters, it was still significantly below its historical average.

Therefore, there is still quite a lot of catching up to do for the company.

Additionally, GM has been generating lots of cash, especially in the midst of the pandemic.

As of Q4 2020, GM’s free cash flow reached an all-time high at slightly more than $11 billion on a TTM basis, beating all its prior records.

Fundamentally speaking, GM is slowly recovering and may even surpass its pre-COVID results in terms of profitability and cash flow generation going forward if the company’s electrification plan does play out as expected.

Therefore, from a fundamental point of view, I believe GM’s stock is a buy even at more than $60 per share, considering that the company has only started to be slightly profitable and free cash flow positive in its latest fiscal period.

GM may even gain larger profits and free cash flow in the near future on the back of improved fundamentals.

If the company can continue to generate positive fundamental results in the coming quarters, GM’s stock price would definitely soar beyond $60 per share.

Conclusion

In summary, is General Motors’ stock a buy at $60 per share?

1. Valuation

No, GM is definitely not cheap at $60 per share by all measures.

2. Growth

No, GM has not been a growth stock for the past 6 years and there are quite a number of uncertainties lingering around the company in the near term, including its electrification ambition.

3. Income

No, GM used to pay out a dividend that yields around 4% but not now as the company has suspended its dividends for more than 4 consecutive quarters.

4. Fundamentals

Yes, GM may be on track to larger profitability and free cash flow in the coming quarters on the back of improved fundamentals.

References and Credits

1. All financial data in this article were referenced and obtained directly from General Motors’ annual and quarterly reports which can be found in GM Investor Relations.

2. Some figures came from the author’s own calculations.

3. Featured images in this article are used under Creative Commons License and sourced from the following websites: Marc Wellekötter and Rog b.

Articles That You Might Find Related

Disclosure

Readers, investors, analysts, bloggers, visitors, researchers, writers, or academicians are highly encouraged to use, copy, quote, distribute, duplicate, modify, edit, upload, download, share and link any materials on this webpage such as the charts, snapshots, texts, paragraphs, etc. in your websites, research papers, essays and so on.

You can credit back to this page by a link or a mention of the website. Thanks for sharing!