Time to go vegan during the grilling season. Flickr Image.

This article deals primarily with Beyond Meat’s margins.

That said, the margins that we are going to look at here include the gross margin, operating margin and net profit margin.

Margins are some of the most-used metrics that measure the profitability of a company.

For instance, gross margin measures the gross profitability of a company. Of course, the higher the gross margin, the better the gross profitability is.

Additionally, margins can also be compared across a list of companies that operate in the same industry.

The purpose of the comparison is to find out the performances of each business and how they fare with respect to the other.

In this article, we will look at the gross margin, operating margin and net profit margin of Beyond Meat (NASDAQ:BYND), and compare these margins with that of Beyond Meat’s peers or competitors such as Kellogg Company (NYSE:K) and Conagra Brands (NYSE:CAG) that also work on plant-based protein products.

Keep in mind that the comparison of such metrics may not be on an apple to apple basis in spite of the fact that these metrics are determined in accordance with the GAAP standard.

Additionally, Beyond Meat is a relatively new player in the food packaging industry whereas Kellogg and Conagra Brands are established players which have been operating for more than a decade.

Let’s hop on!

Beyond Meat’s Gross Margin

Beyond Meat’s gross margin

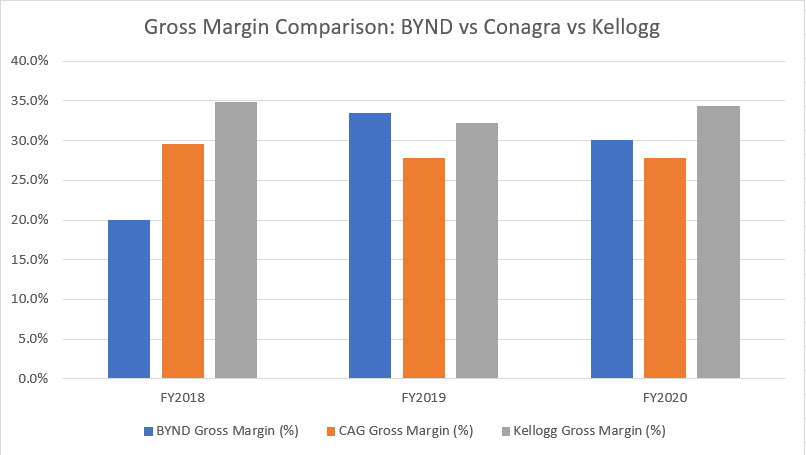

The chart above shows Beyond Meat’s gross margin and the respective comparison with that of competitors such as Kellogg and Conagra Brands.

For your information, gross margin refers to the mark-up of the products that the company sells.

The gross margin normally considers only the costs of goods sold while excluding other operating expenses such as selling, general and administrative (SGA) and interest expenses.

In Beyond Meat’s case, research and development costs are also excluded from the company’s costs of goods sold and are disclosed as part of the company’s operating expense.

That said, Beyond Meat’s gross margin is at the same level as that of its competitors such as Kellogg and Conagra Brands.

The company’s gross margin has been on a rise and even exceeded that of its competitors in some of the fiscal years.

For instance, from fiscal 2018 to 2020, Beyond Meat’s gross margin has gone from 20% to 30%, driven mainly by a higher volume of products sold, production efficiency and improvements, reduced materials and packaging costs as well as labor efficiency, according to the company’s 1Q20 earnings presentation.

While Beyond Meat managed to thrust its gross margin to as high as 34% in fiscal 2019, it suffered a minor setback in fiscal 2020.

As seen in the chart, Beyond Meat’s gross margin declined considerably to 30% in fiscal 2020, as much as a 4 percentage point lower compared to fiscal 2019.

The gross margin deterioration in fiscal 2020 was largely attributed to the disruption caused by the COVID-19 outbreak.

According to the 2Q 2020 earnings release, Beyond Meat has to spend extra costs on product repacking in an effort to re-purpose certain foodservice inventory into retail products as a result of the sudden shift in consumers’ demand related to COVID-19.

Understandably, Beyond Meat’s foodservice revenue in fiscal 2020 has been badly affected, largely driven by the temporary closure of bars and restaurants.

On the other hand, Beyond Meat’s competitors such as Kellogg and Conagra Brands’ gross margins in fiscal 2020 were largely unaffected and even slightly increased year over year.

Beyond Meat’s Operating Margin

Beyond Meat’s operating margin

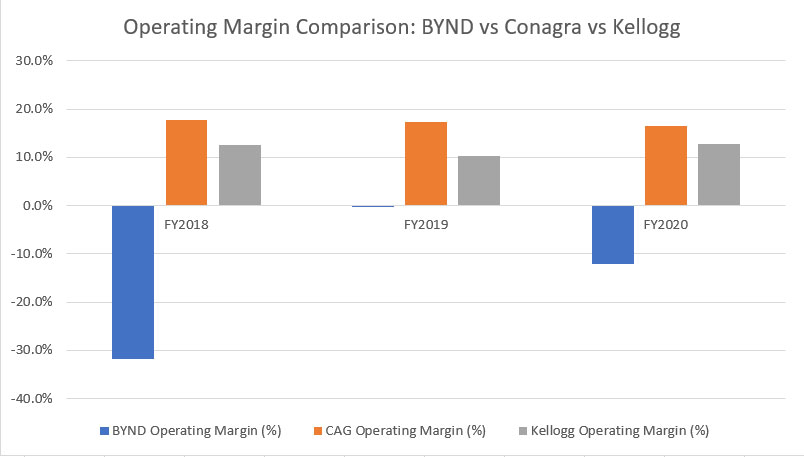

For your information, Beyond Meat’s operating margin takes into consideration of operating expenses such as R&D, SGA and restructuring costs.

Despite having a comparable gross margin with that of its peers, Beyond Meat’s operating margin has been considerably lower than that of its peers, and even downright negative in most of the fiscal years, indicating that the company’s generated gross income has failed to sufficiently cover the operating costs.

As shown in the chart, Beyond Meat’s operating margin was the worst in fiscal 2018 at -30% and improved considerably to 0% in fiscal 2019.

While Beyond Meat may seem to be on track to a positive operating margin in fiscal 2020, its plan was derailed by the COVID-19 pandemic which appeared in the same fiscal year.

Accordingly, Beyond Meat’s operating margin was back to the negative region at -12% in fiscal 2020.

On the contrary, companies such as Kellogg and Conagra Brands have managed to maintain their operating margins at relatively the same level in the last 3 years and even edged slightly higher as of fiscal 2020, illustrating the resilience of their food businesses to the pandemic.

Beyond Meat’s Net Profit Margin

Beyond Meat’s net profit margin

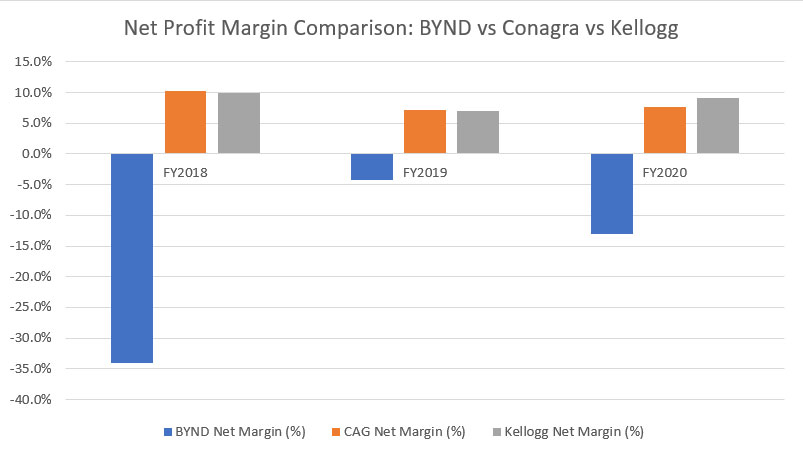

For your information, net margin takes into account all costs of doing business, including taxes and interest expenses.

All told, Beyond Meat’s net profit margin also falls considerably behind that of Kellogg and Conagra Brands.

Similar to the operating margin, Beyond Meat’s net profit margin has also been negative throughout the last 3 fiscal years, indicating the net losses that the company has incurred all these years.

While Beyond Meat’s net profit margin improved significantly to less than -5% in fiscal 2019, it worsened again in fiscal 2020 to nearly -15%, driven primarily by the COVID-19 outbreak.

On the contrary, Beyond Meat’s peers such as Kellogg and Conagra Brands have been profitable between fiscal 2018 and 2020, achieving a net profit margin of around 9% and 8%, respectively, in fiscal 2020.

For Kellogg and Conagra Brands, their net profit margins even edged slightly higher in fiscal 2020 compared to a year ago, suggesting the immersed earnings power that lies within these companies.

In this aspect, Beyond Meat’s worsened net profit margin in fiscal 2020 illustrates the earnings power that the company lacked compared to its peers.

Conclusion

Of all the margins reported by Beyond Meat, only the gross margin was seen being positive.

The rest of Beyond Meat’s margins such as the operating margin and net profit margin have all been in the red.

Additionally, most of Beyond Meat’s margins are considerably lower than that of its competitors such as Kellogg and Conagra Brands.

The only margin that is nearly on the same level as that of its peers is the gross margin.

As Beyond Meat is a new player in the industry and the plant-based protein is still relatively new to the market, it is natural for the company to incur losses in the early stage of its expansion.

In this aspect, Beyond Meat is seen dealing with tonnes of operating expenses that have put the company in the red.

As its sales volume grows over time, Beyond Meat may one day generate sufficient gross profit that will cover the operating expenses.

For your information, operating costs are usually fixed costs that do not grow proportionately with sales volumes.

At that time, Beyond Meat will definitely be making a profit not only at the operating level but also at the net level.

As of now, investors just have to be a little patient with the company.

References and Credits

1. All financial figures in this article were obtained and referenced from companies’s quarterly and annual filings which can be found in the following websites:

a. Bynd earnings releases

b. CAG earnings releases

c. Kellogg earnings releases

2. Featured images in this article are used under the creative commons license and sourced from the following websites: marcus eubanks and Ashbridge Studios.

Other Stock Analysis That You May Find Helpful

Disclosure

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.