Mining in Australia. Flickr Image

This article compares the coal sales volume of 3 major coal producers in the U.S. and they are Peabody Energy (BTU), Arch Resources (ARCH), and Alliance Resource Partners, LP (ARLP).

Aside from being the major coal producers in the U.S., they are also the largest companies by market capitalization within the coal industry.

As of November 2022, each one of these coal miners has a market capitalization exceeding $2 billion, with BTU being the largest at $5 billion.

As much as we may not like coal, we definitely like the stock of the coal miners as the stock price of each of them has appreciated by more than 1000% in the last 3 years, putting some of the hottest companies on Wall Street such as Tesla to shame.

The question is, are coals or coal miners making a comeback?

Coal may not be coming back but the coal miners are, and they are rolling back with a much stronger cycle than before, riding along the current commodity boom.

In this article, we are taking a look at the coal sales volume of these coal miners on an annual and trailing 12-month basis (TTM).

Aside from the historical trend, we are also getting into the 2022 outlooks for coal shipment volume provided by Peabody, Arch Resources, and Alliance Resource Partners.

So, let’s go take a look!

BTU, ARCH, And ARLP’s Coal Sales Topics

1. Thermal Coal Sales By Year

2. Metallurgical Coal Sales By Year

3. Thermal Coal Sales By TTM

4. Metallurgical Coal Sales By TTM

5. Summary

Thermal Coal Sales By Year

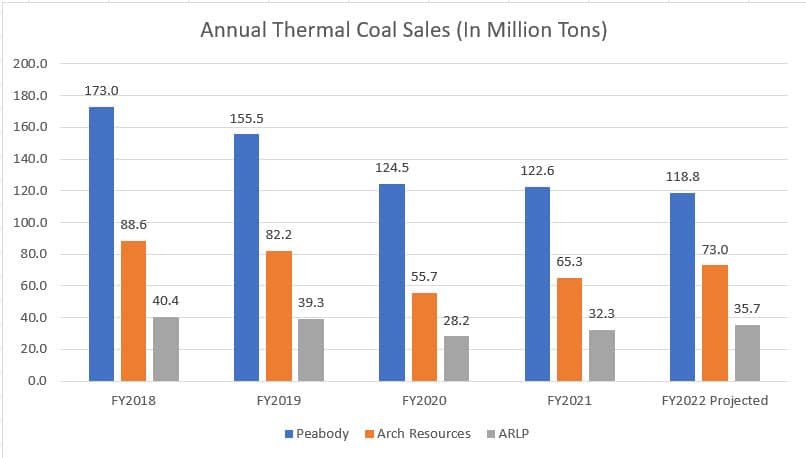

Thermal coal sales by year

Let’s first look at the miners’ thermal coal sales by year as shown in the chart above.

On a yearly basis, Peabody is by far the biggest thermal coal producer among the 3 miners at more than 100 million tons per year.

In fiscal 2021, Peabody sold 122.6 million tons of thermal coal compared to only 65.3 million tons and 32.3 million tons for Arch Resources and Alliance Resource Partners, respectively.

Despite being the largest thermal coal miner, Peabody guided for a lower coal sales volume in fiscal 2022, at only 119 million tons, a decline of about 3% year-over-year.

In contrast, both Arch Resources and Alliance Resource Partners LP (ARLP) have guided for a higher thermal coal sales volume in fiscal 2022 at 73 million tons and 35.7 million tons, respectively.

While these coal miners have been the largest thermal coal producers in America, their coal sales volume has been on a decline.

As seen from the chart, Peabody, Arch Resources and ARLP’s thermal coal sales have been declining since fiscal 2018, and the reported figures in fiscal 2021 were nearly the lowest in the last 3 years.

Despite guiding for a better outlook in fiscal 2022 for thermal coal sales, both Arch Resources and ARLP’s projected figures for 2022 are significantly down from their historical highs, thereby underscoring the long-term decline of thermal coal sales.

In short, thermal coal mining is likely a sun-setting industry going into the future, driven mainly by the world’s transition into green energy.

Metallurgical Coal Sales By Year

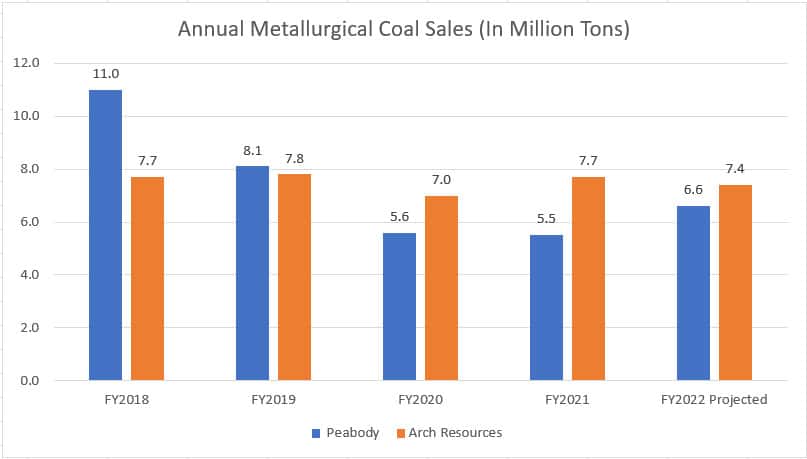

Metallurgical coal sales by year

In terms of metallurgical coal sales, Peabody used to be a bigger player than Arch Resources.

For example, in fiscal 2018, Peabody sold 11 million tons of metallurgical coal compared to only 7.7 million tons sold by Arch Resources.

However, Peabody’s metallurgical coal sales have since dwindled and reached only 5.5 million tons in fiscal 2021 while projecting a slightly higher sales volume in fiscal 2022 at 6.6 million tons.

On the other hand, Arch Resources has aimed to become a major metallurgical coal player due to the commodity potential in a seemingly warming world.

For your information, metallurgical coal is used primarily as the main ingredient in steel-making.

According to Arch Resources, a de-carbonizing world will require a lot of steel for urbanization, infrastructure replacement, and the construction of essential de-carbonization tools such as mass transit systems, wind turbines, and electric vehicles.

Given the importance of steel and the role that metallurgical coal will play in a de-carbonization world, Arch Resources has stepped up its effort to produce more high-quality metallurgical coal with the aim of reaching 7.4 million tons of sales in fiscal 2022, one of the highest figures in the last 3 years.

In short, Arch Resources has overtaken Peabody as the major player in the metallurgical coal market with the aim of shipping as much as 7.4 million tons in fiscal 2022 compared to only 6.6 million tons projected by Peabody in the same fiscal year.

Thermal Coal Sales By TTM

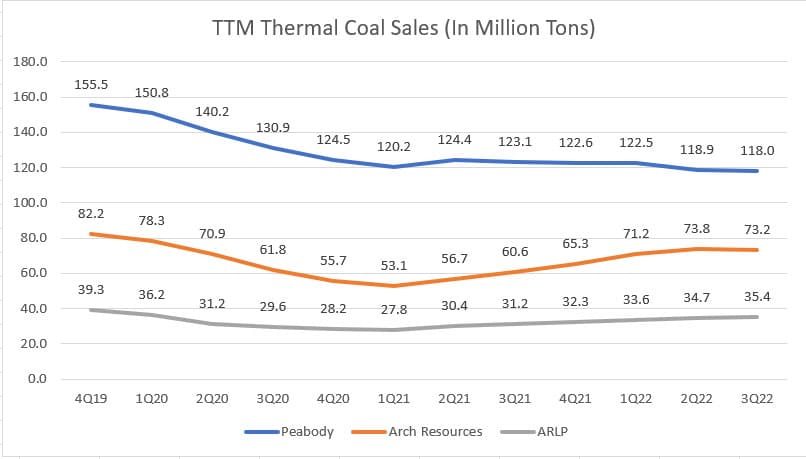

Thermal coal sales by TTM

From a TTM perspective, all coal miners, including Peabody, Arch Resources, and Alliance Resource Partners have been experiencing a decline in thermal coal sales volume in the last 3 years.

However, the miners’ thermal coal sales seem to have reached the bottom in 1Q 2021 and a turnaround has started to appear in 2Q 2021.

As of 3Q 2022, Peabody delivered 118 million tons of thermal coal on a TTM basis, a record low since 2019 while Arch Resources shipped 73.2 million tons of thermal coal, nearly less than half of what Peabody sold in the same fiscal quarter.

Of all 3 miners, Alliance Resource Partners sold the least at only 35.4 million tons of thermal coal as of 2022 3Q.

The turnaround in thermal coal shipment in fiscal 2022 3Q for all 3 miners may or may not last, depending largely on the volume that will be shipped in the 2nd half of 2022 and 2023.

All in all, Peabody is a much larger player in the thermal coal market at more than the combined volume of Arch Resources and Alliance Resource Partners.

Metallurgical Coal Sales By TTM

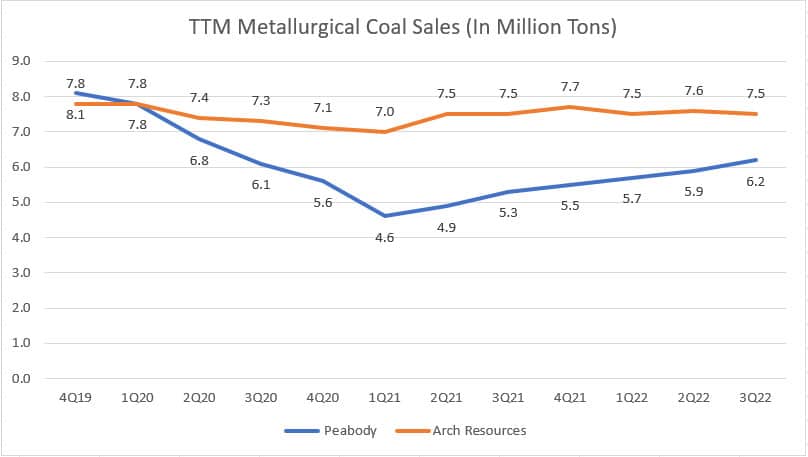

Metallurgical coal sales by TTM

While Peabody has largely dominated the thermal coal market, it loses to Arch Resources when it comes to the metallurgical coal market.

As shown in the chart above, Peabody’s metallurgical coal sales have been on a decline on a TTM basis and reached only 4.9 million tons in fiscal 2Q 2021, one of the lowest figures ever reported.

However, this figure has since been on a soaring trend and reached as much as 6.2 million tons as of 3Q 2022.

In contrast, Arch Resources is a much bigger player in the metallurgical coal market.

While Arch Resources’ metallurgical coal sales have slightly declined since 2019, the sales figures have rebounded significantly in 2021, reporting a much higher TTM figure compared to the same quarter a year ago.

As of 2022 Q3, Arch Resouces shipped 7.5 million tons of metallurgical coal on a TTM basis, roughly flat compared to the same quarter a year ago.

Despite the moderate result in 2022, Arch Resources shipped significantly higher metallurgical coal than Peabody did on a TTM basis, due primarily to the company’s ambitious plan of turning itself into a bigger player in the metallurgical coal market.

Conclusion

In conclusion, Peabody is a major player in the thermal coal market, with coal sales volume reaching as much as 118 million tons in fiscal 2021.

On the other hand, both Arch Resources and Alliance Resource Partners are much smaller players in the thermal coal market, and their combined sales volume was only slightly more than half of what Peabody reported in 2021.

For the metallurgical coal market, Arch Resource is a bigger player at 7.7 million tons of coal sales in fiscal 2021 while Peabody reported only 6.6 million tons of coal sales in the same fiscal year.

Similar to Peabody, Alliance Resource Partners (ARLP) also is a thermal coal player, with sales volume reaching 32.3 million tons in fiscal 2021, a significantly small figure compared to that of Peabody.

All 3 coal miners, Peabody, Arch Resources, and Alliance Resource Partners, saw a turnaround in coal sales since 2021.

However, on a long-term basis, total coal sales volume, be it thermal or metallurgical, is still on a declining trend, underscoring the waning demand for coal in a de-carbonizing world.

References and Credits

1. All financial information in this article was obtained and referenced from the annual and quarterly reports which are available in the following links:

a) BTU Investors Relation

b) ARCH Earnings Call Results

c) ARLP’s Quarterly Results

2. Featured images in this article are used under Creative Commons Licenses and obtained from Mining in Australia and Colorful stones.

Useful Statistics For Other Companies

- GM forward dividend rate and yield in 2022

- Xpeng, Li Auto, and Nio’s vehicle sales comparison with that of Tesla

- Can Pinterest afford a dividend with 1% yield in 2022?

- Explore Tesla’s revenue from regulatory credits sales

- Which social media company has better margin and profit? Facebook, Twitter, Pinterest or Snapchat?

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!