Longwall mining gears. Flickr Image

Arch Resources (NYSE:ARCH) is the 2nd largest coal producer in the U.S. by market capitalization.

As of Oct 2021, Arch Resources’s market cap clocked in at around $1.5 billion USD, only behind that of Peabody Energy.

Arch Resouces used to pay out a cash dividend that averaged around a 2% yield in 2018 and 2019.

However, the company has suspended the dividend in 2Q 2020 and the suspension is still being enforced as of now.

Aside from the dividends, Arch Resources also has indefinitely suspended the stock buyback, driven primarily by the COVID-19 impact.

The following excerpt extracted from ARCH’s 2020 annual report explains about the company’s dividend policy:

-

Dividend Policy

We paid a dividend of $0.50 per common share on March 13, 2020 to stockholders of record at the close of business on March 3, 2020.On April 23, 2020, we announced the suspension of our quarterly dividend due to the significant economic uncertainty surrounding the COVID-19 virus and the steps being taken to control the virus.

Since March 13, 2020, we have not paid any further dividends on shares of our stock.

Therefore, Arch Resources is currently a non-dividend-paying stock that does not declare or pay any cash dividend to shareholders who hold the company’s common shares.

While Arch Resources does not currently pay a dividend, it is likely to reinstate the cash dividend in the foreseeable future, at the end of 2021 in particular.

I believe there are several compelling reasons that Arch Resources will resume the cash dividend pretty soon considering the improving outlook and the guided strong financial position from several analysts for fiscal 2021 and 2022.

That said, in this article, we are going to find out why I think ARCH will reinstate the cash dividend in 2021.

Since ARCH may resume the dividend in 2021, we will estimate the forward dividend rate that the company can afford.

In addition, we will also look at several of ARCH’s dividend metrics, including the dividend history, trailing yield, forward dividend yield in 2021, projected dividend to earnings as well as free cash flow payout ratio.

Let’s go take a look.

ARCH’s Cash Dividend Topics

1. Dividend History And Yield

2. Higher Coal Volume In 2021

3. Lower Cash Cost In 2021

4. Projected Revenue And Earnings In 2021

5. Forward Dividends 2021

6. Dividends To Earnings Payout Ratio

7. Dividends To FCF Payout Ratio

8. Fordward Dividends Yield 2021

Arch Resources’s Dividend History And Yield

| Fiscal Year | ARCH’s Dividend Per Share Declared ($ USD) | ARCH’s Average Share Price ($ USD) | ARCH’s Dividend Yield (%) |

|---|---|---|---|

| 2018 | $1.60 | $88 | 1.8% |

| 2019 | $1.80 | $84 | 2.1% |

| 2020 | $0.50 | $38 | 1.3% |

Let’s first look at Arch Resources’ historical dividend rate and yield that dated back to fiscal 2018.

As seen, Arch Resources’ cash dividend came in at $1.60 USD per share in 2018 and $1.80 USD per share in 2019.

The trailing dividend yield was 1.8% and 2.1% in 2018 and 2019, respectively.

While Arch popped the dividend slightly higher in 2019, it cut the dividend to only $0.50 USD per share in 2020, driven primarily by the negative impact of the COVID-19 pandemic.

Despite the cut, Arch’s cash dividend in 2020 still yielded 1.3% on average thanks to the plummeted share price in the same year.

As of Oct 2021, Arch Resources has yet to reinstate the cash dividend suspended since 2020.

While Arch is a non-dividend stock, I think there are strong reasons that Arch will soon resume the dividend payment, possibly by the end of 2021 or early 2022 at the latest.

Arch’s Higher Coal Volume In 2021

| Fiscal Year | Coking Coal | Thermal Coal |

|---|---|---|

| 2018 Reported | 6.7 | 88.6 |

| 2019 Reported | 6.8 | 82.2 |

| 2020 Reported | 6.0 | 55.8 |

| 2021 Projected | 7.8 | 57.0 |

The 1st reason that Arch will reinstate the dividend in 2021 is the higher coal shipment in 2021 compared to that of 2020.

As shown in the table above, Arch Resources has guided for a much higher coking coal volume in fiscal 2021 than all prior-year results.

Notably, Arch will ship approximately 7.8 million tons of coking coal in fiscal 2021, the highest volume the company has ever seen since 2018.

For your information, coking coal makes up the majority of Arch’s profits, reportedly at 70% and 67% of the company’s adjusted segment EBITDA in fiscal 2020 and 2019, respectively.

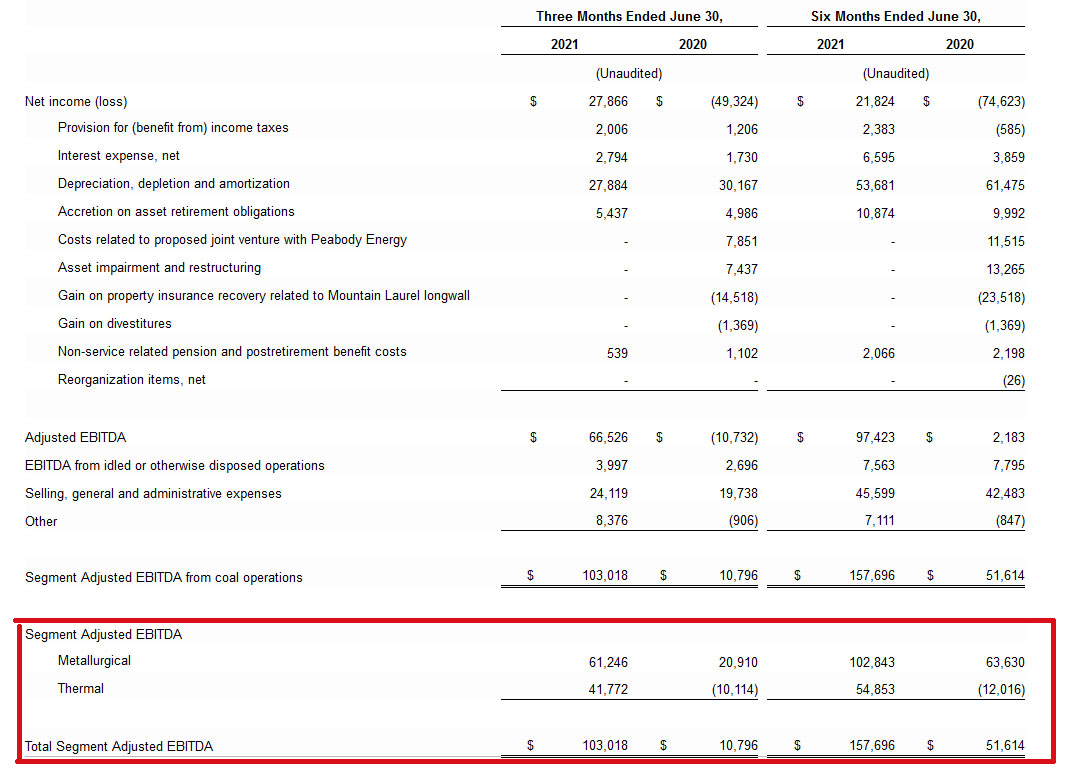

This ratio remains the same in the first 6-months of 2021 as shown in the following snapshot extracted from Arch’s 2Q 2021 quarterly release.

ARCH’s adjusted EBITDA by segment

Similarly, Arch Resources also will ship approximately 57.0 million tons of thermal coal in fiscal 2021, a much higher figure compared to that of 2020.

While the projected 2021 thermal coal volume is still down significantly compared to its historical highs, it is higher than that of 2020.

More importantly, the overall higher coal volume projected in 2021 indicates a recovery is in place, and the result may lead to a stronger financial position in the same fiscal year.

Therefore, a stronger financial position will definitely compel Arch to resume the suspended cash dividends.

Arch’s Lower Cash Cost In 2021

| Fiscal Year | Metallurgical Cash Cost Per Ton ($ USD) | Thermal Cash Cost Per Ton ($ USD) |

|---|---|---|

| 2018 Reported | $66.85 | $10.45 |

| 2019 Reported | $66.07 | $10.63 |

| 2020 Reported | $61.13 | $11.48 |

| 2021 Projected | $58.50 | $11.75 |

Another valid reason that Arch Resource may resume the dividends in 2021 is the guided lower cash cost per ton for metallurgical coal as depicted in the table above.

According to the table, Arch Resources’ metallurgical cash cost per ton is expected to come in at only $58.50 USD in fiscal 2021 on average, one of the lowest figures Arch has ever reported since 2018.

The lower cash cost per ton for metallurgical operation is primarily driven by the new mining operation in the Leer South longwall mine which is expected to become fully operational in 3Q 2021.

The Leer South longwall operation will provide Arch with millions of tons of low cost, high quality, High-Vol A coking coal for years to come.

The guided lower cash cost per ton for metallurgical or coking coal in 2021 will have a huge impact on Arch’s profitability.

As mentioned, Arch’s metallurgical operation accounts for more than 70% of the adjusted EBITDA in fiscal 2020 and 67% in 2019.

That said, Arch Resources’ profitability is projected to go up because of the lower cash cost per ton for coking coal.

While thermal coal cash cost per ton will rise slightly to $11.75 USD per ton in fiscal 2021, the impact will not be as profound as that of the coking coal as the thermal segment accounts for less than half of the company’s adjusted EBITDA in 2020 and 2019.

What’s even more important in 2021 is that Arch’s coking coal is expected to account for a significantly higher portion of EBITDA due to the guided higher shipment volume as seen in prior discussions.

In short, Arch’s projected higher profit in 2021 is another strong reason that the company will reinstate the dividend.

Arch’s Projected Revenue And Earnings 2021

| Fiscal Year | Arch’s Revenue ($ Millions) | Arch’s Earnings Per Share ($ USD) |

|---|---|---|

| 2018 Reported | $2,452 | $15.15 |

| 2019 Reported | $2,294 | $13.52 |

| 2020 Reported | $1,468 | -$22.74 |

| 2021 Projected | $1,890 | $13.27 |

| 2022 Projected | $1,850 | $19.24 |

The 3rd reason that Arch Resource will resume the dividends in 2021 is the higher revenue and earnings estimate from analysts for fiscal 2021 and 2022 as depicted in the table above.

Based on the estimate, Arch will earn approximately $1.9 billion in revenue in fiscal 2021 and roughly the same amount in fiscal 2022.

While revenue is expected to go higher in fiscal 2021 compared to 2020 and moderates in 2022, it is still lower than the figures reported in fiscal 2019 and 2018.

On the other hand, analysts expect Arch to report significant earnings growth in fiscal 2021 and 2022.

As shown, Arch Resources’ earnings per share (GAAP) will come in at $13.27 USD per share in fiscal 2021 and a massive $19.24 USD per share in 2022.

These earnings results are comparable to those reported in fiscal 2019 and 2018.

Moreover, the 2022 estimated earnings result even exceeds all prior-year results despite the moderating revenue growth.

As such, analysts are expecting Arch to generate significant profits in 2021 and 2022 while revenue to grow only moderately.

Therefore, higher profitability is definitely one of the compelling factors for Arch Resources to resume not only the cash dividends but also the suspended stock buyback.

Arch’s Forward Dividends In 2021

| Fiscal Year | Arch’s Dividends Per Share ($ USD) | Arch’s Shares Outstanding (In Millions) | Arch’s Cash Payment For Dividends ($ Millions) |

|---|---|---|---|

| 2021 | $1.80 | 16.6 | $30 |

Since Arch may reinstate the cash dividends in 2021 or 2022, what will be the amount that the company can afford?

A good estimate is to look at what Arch Resources had paid in fiscal 2019 as this was the last dividend that the company paid before the suspension and also, was the highest dividend rate that the company had paid in the last 3 years.

Assuming that Arch is going to pay out the same dividend rate in 2021 as that of fiscal 2019 which is $1.80 USD per share, the company’s cash payment will come to about $30 million on the back of 16.6 million shares outstanding.

While Arch had paid this dividend rate back in fiscal 2019, can the company afford the same dividend rate in 2021 or in 2022?

Let’s take a look.

Arch’s Dividends To Earnings Payout Ratio

| Fiscal Year | Arch’s Dividends Per Share ($ USD) | Arch’s EPS ($ USD) | Dividends To EPS Payout Ratio (%) |

|---|---|---|---|

| 2018 Reported | $1.60 | $15.15 | 10.6% |

| 2019 Reported | $1.80 | $13.52 | 13.3% |

| 2020 Reported | $1.50 | -$22.74 | -2.2% |

| 2021 Estimated | $1.80 | $13.27 | 13.6% |

Assuming Arch will reinstate the dividends in 2021 and the payout is the same as that in 2019 which is $1.80 USD per share, Arch’s dividend to earnings payout ratio will amount to only 13.6% on the back of the guided $13.27 EPS in fiscal 2021 as shown in the table above.

At this level of payout ratio, Arch can definitely afford to resume the cash dividends because the company’s dividend paid in fiscal 2019 came in exactly at the same payout ratio.

Therefore, if Arch could afford this dividend back in fiscal 2019, the company can certainly afford the same amount of dividend in fiscal 2021 given the better outlook in 2021 and 2022 than in 2019.

As seen in prior discussions, Arch’s EPS is estimated to come in at $19.24 in fiscal 2022, a much better result than that of 2021 and a massive figure that the company has ever seen since fiscal 2018.

That’s a huge profit boost despite a guided revenue of only $1.85 billion for fiscal 2022 thanks to its Leer South longwall mine commencement in fiscal 3Q 2021.

In short, the affordability of the dividend with respect to earnings coupled with the better outlook in fiscal 2022 are solid reasons that Arch will resume the suspended dividends in 2021 or 2022.

Arch’s Dividends To Free Cash Flow Payout Ratio

| Fiscal Year | Arch’s Dividends Paid ($ Millions) | Arch’s Free Cash Flow ($ Millions) | Dividends To FCF Payout Ratio (%) |

|---|---|---|---|

| 2018 Reported | $31 | $323 | 9.6% |

| 2019 Reported | $30 | $154 | 19.5% |

| 2020 Reported | $8 | -$225 | -3.6% |

| 2021 Estimated | $30 | $113 | 26.5% |

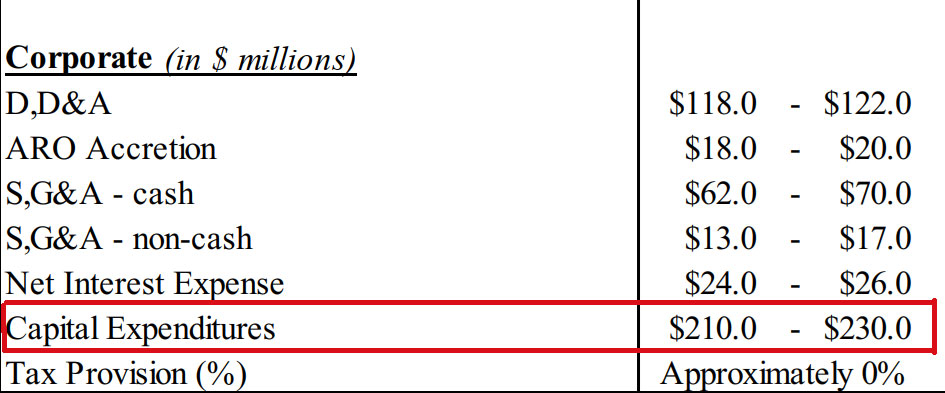

Arch has guided for lower capital expenditure for fiscal 2021 compared to fiscal 2020 and 2019 according to its 2Q 2021 quarterly releases, notably between $210 and $230 million.

ARCH’s capital expenditures 2021

As such, Arch Resources will have approximately more than $100 million of free cash flow at its disposal in the entire year in 2021.

That said, Arch’s free cash flow can certainly cover the dividend payment of only $30 million for fiscal 2021 if the company decides to reinstate the suspended dividend at $1.80 USD per share.

From a cash flow perspective, Arch’s free cash flow is more than enough for the cash payment for dividends as the payout ratio amounts to only 26.5%.

Keep in mind that this payout ratio will definitely be less in fiscal 2022 considering a much better outlook for the same fiscal year.

Despite a considerably higher payout ratio in fiscal 2021 compared to that of 2019, it is reasonably within the reach of Arch Resources and the company can absolutely afford this amount at less than 30% of free cash flow.

In fact, Arch Resources can even resume its share buyback after reinstating the cash dividends and have both capital returns being executed at the same time without running into any financial distress provided the company can meet the guided financial outlook.

For example, if Arch decides to use as much as 50% of its 2021 guided free cash flow as shares buyback, the company will still be left with plenty of cash around, notably at more than $20 million USD.

Again, from a cash flow perspective, Arch Resources can afford the $30 million cash payment as dividends in fiscal 2021.

In short, cash flow is another reason that Arch will resume the 2021 dividends.

Arch’s Fordward Dividends Yield 2021

| Fiscal Year | Arch’s Dividends Per Share ($ USD) | Arch’s Average Share Price ($ USD) | Dividends Yield (%) |

|---|---|---|---|

| 2018 Reported | $1.60 | $88 | 1.8% |

| 2019 Reported | $1.80 | $84 | 2.1% |

| 2020 Reported | $0.50 | $38 | 1.3% |

| 2021 Estimated | $1.80 | $90 | 2.0% |

While Arch Resources is currently not a dividend payer, we have seen that there are many valid reasons for the company to reinstate the suspended dividends in 2021, including a better outlook and stronger financial positions in years to come.

Therefore, if you own Arch’s stock today at a share price of roughly $90 USD per share, your forward dividend yield may come to as much as 2% if Arch were to declare a dividend that amounts to $1.80 USD per share in 2021 or 2022.

In addition to the cash dividend, you may also get price appreciation in Arch’s stock.

For your information, Arch’s stock has appreciated by more than 1000% in the last 3 years and there is certainly room for more upsides given the better outlook and stronger profitability in the coming years.

Moreover, if Arch Resources reinstates the dividends, the company will likely reinstate the suspended stock buybacks.

Therefore, investors will get not only a dividend yield but also the yield as a result of stock buybacks in addition to the huge upside in stock price.

In short, I am long Arch Resources.

Credits and References

1. Arch Resources’ financial figures were obtained and referenced from the company’s financial statements which are available at the following links:

a) ARCH Investors Relation

b) Arch Resources’s historical closed price – Yahoo Finance

c) ARCH – Zacks Consensus Estimate

2. Featured images in this article are used under creative commons license and sourced from the following websites: Longwall coal mining equipment and coal workers.

Statistics For Other Companies

- Comparison of average vehicle sales price among Tesla, Nio, Xpeng and Li Auto

- R&D spending comparison between Tesla and Ford Motor

- Explore GM’s leverage from the debt to equity ratio

- Altria’s price to sales and price to book ratio

- Tesla’s vehicle production and deliveries as well as growth rates in 2021

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!